Is Mortgage Tax Deductible Learn how to deduct home mortgage interest on your tax return and what factors affect the amount of deduction Find out the limits exceptions and requirements for different types of mortgages and

Up to 750 000 in interest is deductible for mortgages originating after December 15 2017 The total limit is 375 000 for The interest portion of your mortgage payment is tax deductible The deduction doesn t apply to the mortgage principal

Is Mortgage Tax Deductible

Is Mortgage Tax Deductible

https://www.kitces.com/wp-content/uploads/2018/01/Graphic_1-3.png

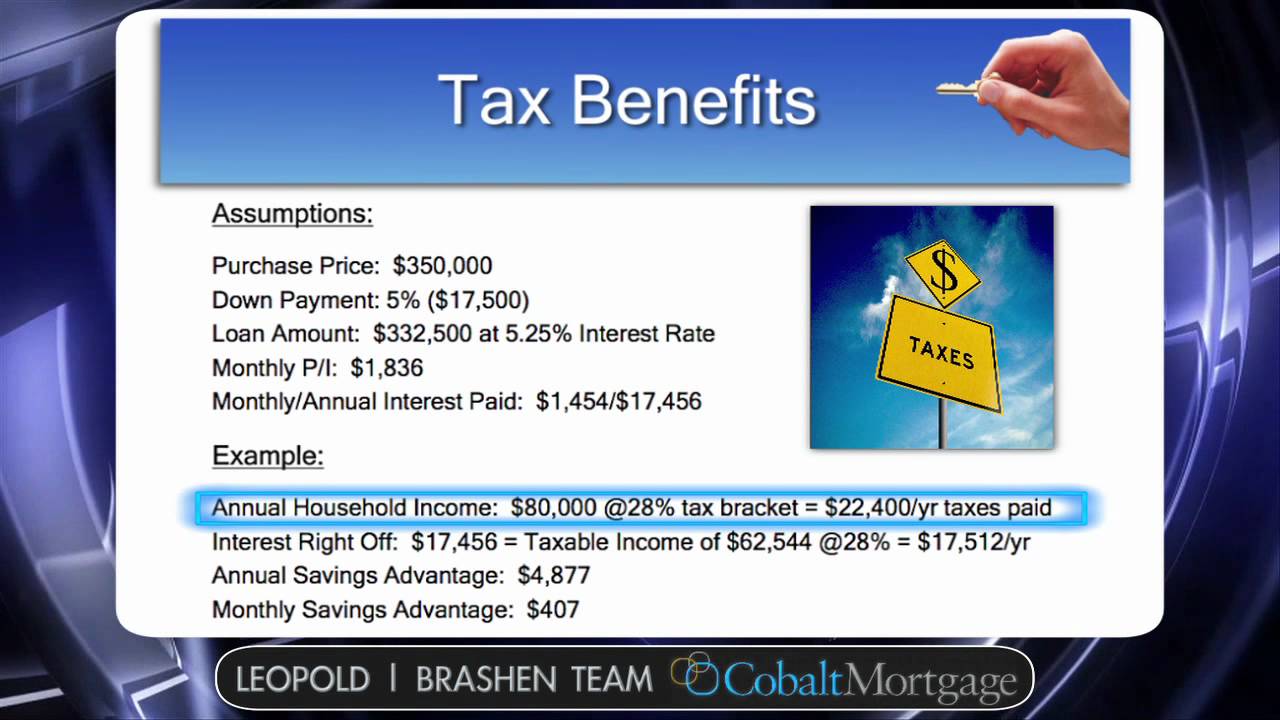

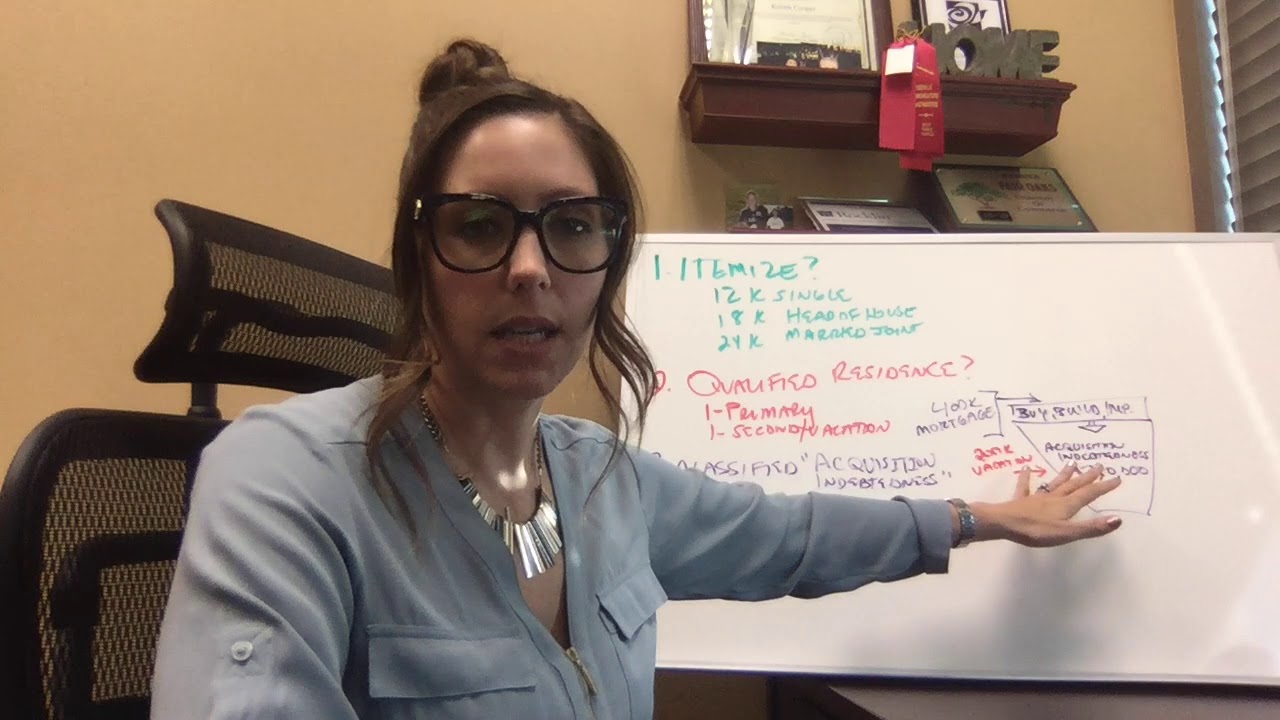

Mortgage Interest Tax Deduction YouTube

https://i.ytimg.com/vi/1Y6dQ5IeQE8/maxresdefault.jpg

Tax Deductible Mortgage Strategy How To Pay Off Your Mortgage Up To

https://i.ytimg.com/vi/-8eN_HMnHt0/maxresdefault.jpg

Under the Tax Cuts and Jobs Act TCJA of 2017 the mortgage interest deduction is available for up to 750 000 in mortgage You can deduct the interest from your mortgage payments when you file a tax return but only if the loan is secured by your home Also the loan proceeds must have been used to buy build or improve

A mortgage interest deduction allows homeowners to deduct mortgage interest from taxable income Read who benefits from a mortgage interest deduction The mortgage interest tax deduction allows taxpayers to deduct from their taxable income the amount of interest they paid for the year on up to 750 000 of their home loan debt To use this

Download Is Mortgage Tax Deductible

More picture related to Is Mortgage Tax Deductible

Mortgage Interest Tax Deduction Calculator MLS Mortgage

https://www.mlsmortgage.com/wp-content/uploads/Mortgage-Interest-Tax-Deduction-Calculator-Featured.jpg

Is Mortgage Interest Tax Deductible In Canada Ratehub ca

https://www.ratehub.ca/blog/files/2021/07/is-mortgage-interest-tax-deductible-couple-on-couch-looking-at-laptop.jpg

Is Interest On Mortgage Tax Deductible A Primer

https://www.freshbooks.com/wp-content/uploads/2022/03/tax-deductible-interest-on-mortgage.jpg

Learn how to deduct mortgage interest on your tax return if you itemize deductions Find out the eligibility criteria deduction limits qualified expenses and exceptions for homeowners Yes mortgage interest is tax deductible in 2024 up to a loan limit of 750 000 for individuals filing as single married filing jointly or head of household

What counts as mortgage interest Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the home Find out if you can deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage related expenses Answer questions

Mortgage Minute Making Mortgage Interest Tax Deductible YouTube

https://i.ytimg.com/vi/vlLTI8XKn8E/maxresdefault.jpg

Mortgage Interest Tax Deductible 2023

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/shutterstock_1613352049-1280x720.jpg

https://www.irs.gov/publications/p936

Learn how to deduct home mortgage interest on your tax return and what factors affect the amount of deduction Find out the limits exceptions and requirements for different types of mortgages and

https://www.forbes.com/advisor/mortgage…

Up to 750 000 in interest is deductible for mortgages originating after December 15 2017 The total limit is 375 000 for

Contrary To Popular Belief Mortgage Interest Is Not Always Tax

Mortgage Minute Making Mortgage Interest Tax Deductible YouTube

Mortgage Interest Tax Deduction What Is It How Is It Used

Is Mortgage Interest Tax Deductible In 2023 Orchard

Is Mortgage Interest Tax Deductible In Canada Nesto ca

Your Separation Agreement Impacts Whether Spousal Support Payments Are

Your Separation Agreement Impacts Whether Spousal Support Payments Are

Is PMI Tax Deductible The Insurance Bulletin

When Is Mortgage Interest Tax Deductible YouTube

How To Claim The Student Loan Interest Deduction Tomcaligist

Is Mortgage Tax Deductible - Let s take a closer look at which of your household expenses are deductible as a homeowner and consider whether you should take the standard deductible instead