Is My Hsa Account Taxable Besides being able to set aside money tax free HSAs have other tax benefits Interest earned by HSAs is not taxable There s no use it or lose it rule like with an FSA If you don t use all the money in the year it rolls over from year to year and continues earning interest

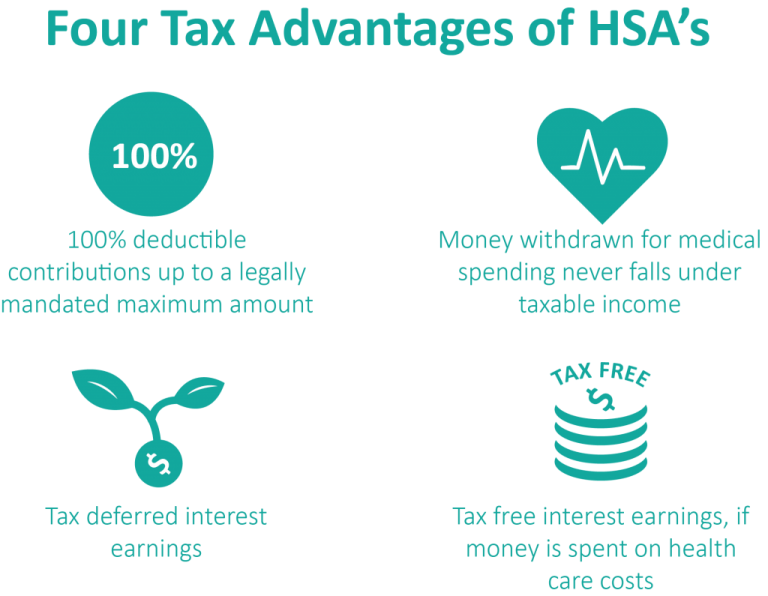

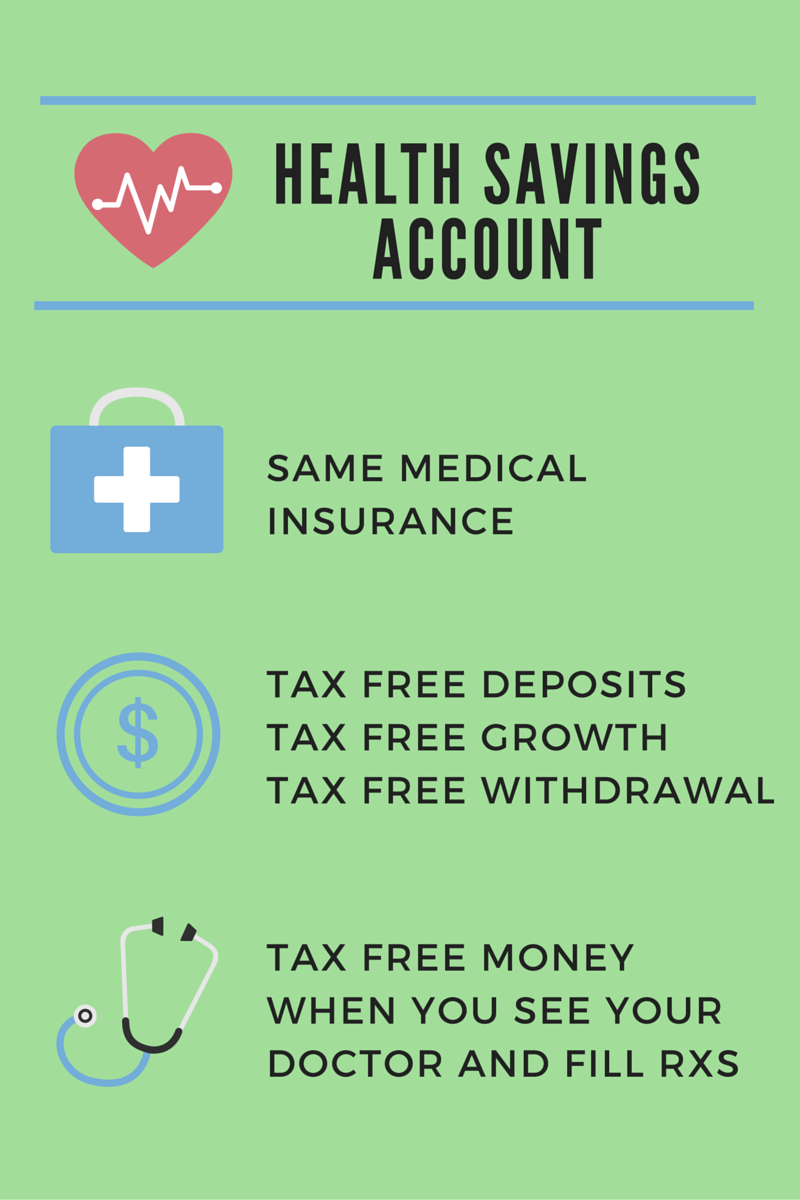

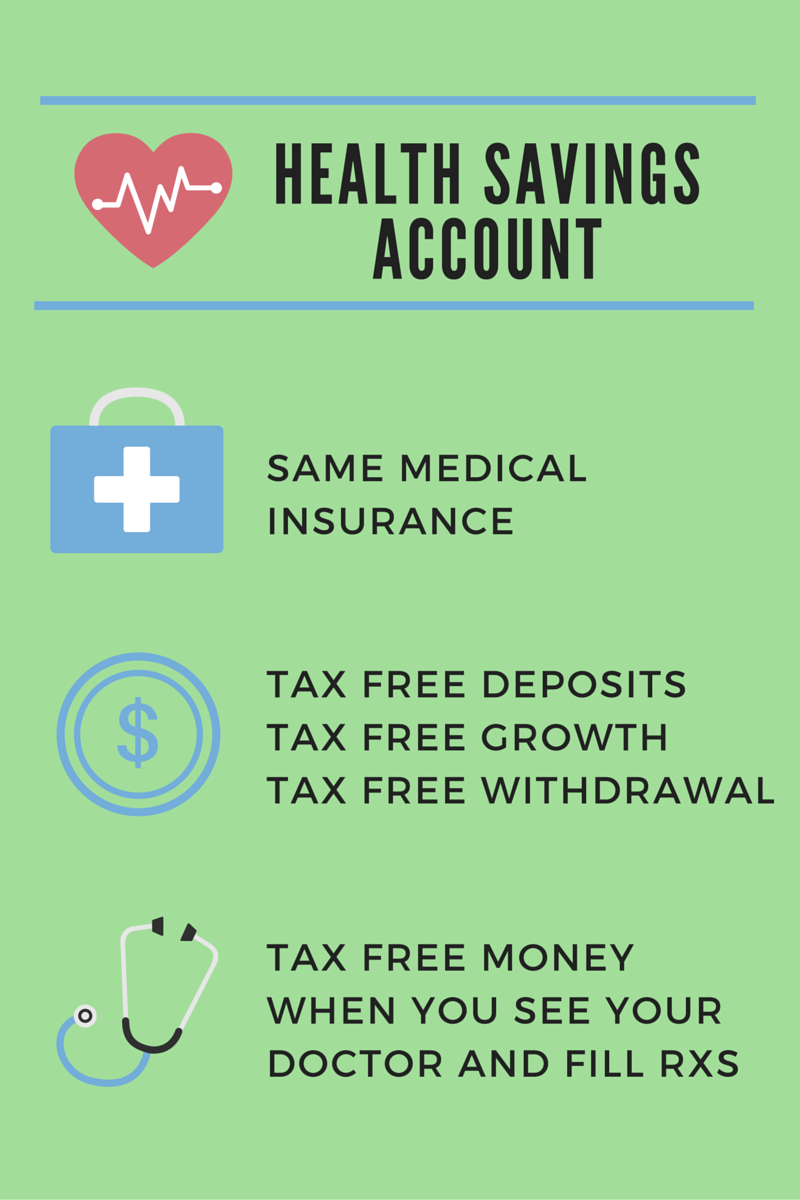

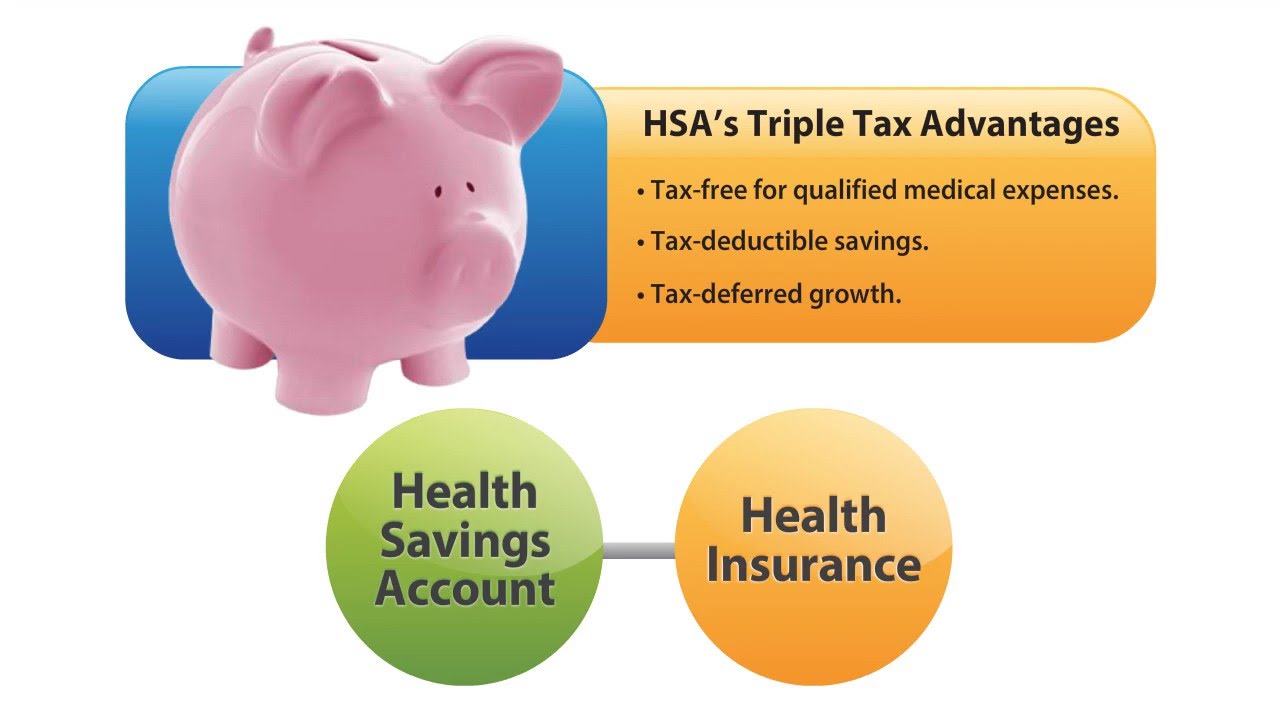

Health savings accounts HSAs offer triple tax advantages 1 tax deductible contributions tax deferred growth and tax free withdrawals for qualified medical expenses You can use an HSA account for a wide variety of qualified medical expenses including dental and vision care as well as over the counter medications Generally contributions made by an employer to the health savings account HSA of an eligible employee are excludable from an employee s income and are not subject to federal income

Is My Hsa Account Taxable

Is My Hsa Account Taxable

https://millennialmoney.com/wp-content/uploads/2019/12/health-savings-account.jpg

HSA And FSA Accounts What You Need To Know Readers

https://www.readers.com/blog/wp-content/uploads/2018/10/[email protected]

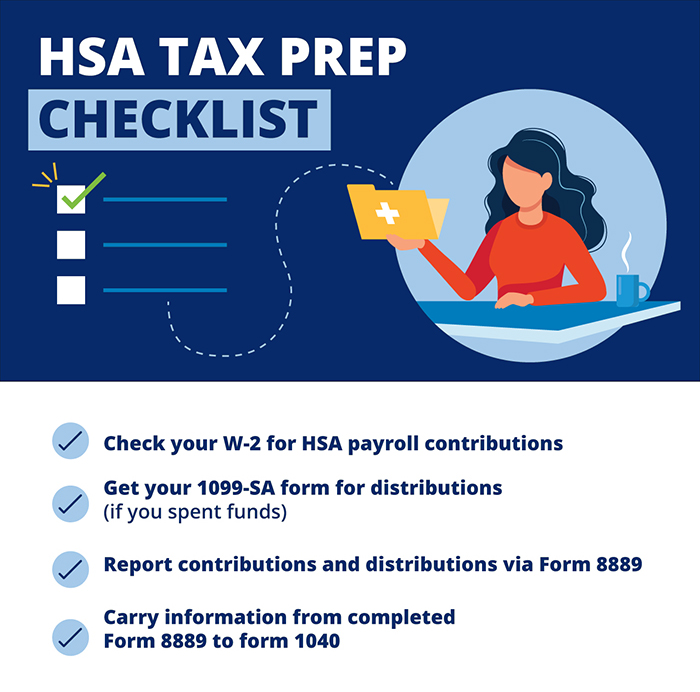

Your HSA And Your Tax Return 4 Tips For Filing First American Bank

https://www.firstambank.com/getattachment/392bb1a4-e19a-4517-9a33-bd674543472c/HSA-Tax-Prep-Checklist.jpg

Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However employer contributions are already excluded from your income on your Form W 2 So the HSA deduction rules don t allow an additional deduction for those contributions An HSA is a tax exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur You must be an eligible individual to contribute to an HSA

This form allows you to claim a tax deduction for any HSA contributions you made outside of payroll deductions and ensures money withdrawn from your account was spent on qualified health care expenses A health savings account HSA is a tax free savings account you can use to pay for medical expenses if you have a high deductible health plan HDHP If you spend your HSA on non medical expenses the money will be taxed and you ll receive a 20 penalty if you re not disabled or under the age of 65

Download Is My Hsa Account Taxable

More picture related to Is My Hsa Account Taxable

Health Savings Accounts How HSAs Work And The Tax Advantages

http://www.ilhealthagents.com/wp-content/uploads/2018/04/Tax-Advantages-of-an-HSA-1024x795-1024x795-768x596.png

What Is A Health Savings Account HSA HSA Search

https://www.hsasearch.com/wp-content/uploads/hsavsretirementaccounts-1024x660.png

What Is A Health Savings Account HSA

https://fsastore.com/dw/image/v2/BFKW_PRD/on/demandware.static/-/Library-Sites-fsaStoreLibrary/default/dwa719ce45/blog_images_3/filing-income-taxes-and-your-HSA.jpg

An HSA distribution money spent from your HSA account is nontaxable as long as it s used to pay for qualified medical expenses However if you answer No the portion that wasn t used for qualified medical expenses becomes taxable income Any growth within the account is tax free And when used for eligible medical expenses withdrawals are also tax free This article aims to demystify the HSA tax deduction We ll explore how to claim it what expenses are eligible and how to maximize its benefits

Interest and investment gains in an HSA grow tax free allowing your account balance to compound over time Tax Free Withdrawals Funds used for qualified medical expenses are withdrawn tax free Contributions to a health savings account HSA can be made by or on behalf of for example by a family member any eligible individual and are deductible by the eligible individual above the line in arriving at adjusted gross income AGI Sec 62 a 19

Health Savings Account How It Works And How To Benefit In 2020

https://www.moneypeach.com/wp-content/uploads/2019/05/Health-Savings-Account.png

Health Savings Account HSA A Triple Tax Advantage Account

https://static.wixstatic.com/media/aa3def_54c3eecc24364afe8278aebd213c742f~mv2.jpg/v1/fit/w_1000%2Ch_713%2Cal_c%2Cq_80/file.jpg

https://1040.com › ... › hsas-and-your-tax-return

Besides being able to set aside money tax free HSAs have other tax benefits Interest earned by HSAs is not taxable There s no use it or lose it rule like with an FSA If you don t use all the money in the year it rolls over from year to year and continues earning interest

https://www.fidelity.com › learning-center › smart...

Health savings accounts HSAs offer triple tax advantages 1 tax deductible contributions tax deferred growth and tax free withdrawals for qualified medical expenses You can use an HSA account for a wide variety of qualified medical expenses including dental and vision care as well as over the counter medications

5 Things To Know About Health Savings Accounts ThinkHealth

Health Savings Account How It Works And How To Benefit In 2020

How To Set Up Get The Most From A Health Savings Account HSA

How Does An HSA Work The Ultimate HSA Guide Personal Finance Club

:max_bytes(150000):strip_icc()/hra-vs-hsa-5190731_final-eec8d019c0a545009e049f4a96861d85.png)

Health Reimbursement Arrangement HRA Vs Health Savings Account HSA

Health Savings Account FAQ HSA Basics

Health Savings Account FAQ HSA Basics

HSA Basics Qualifications Contributions And More Lively Lively

What Is A Health Savings Account HSA YouTube

Health Savings Account HSA A Powerful Investment Family And FI

Is My Hsa Account Taxable - HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses Also most states recognize HSA funds as tax deductible with very few exceptions Please consult a tax advisor regarding your state s specific rules