Is My State Pension Taxable In Massachusetts Residents Report the government pension income on MA Form 1 Line 4 as pensions Depending on the other state s tax treatment of Massachusetts

Overview If you move to Massachusetts and receive pension payments from your former states public employee retirement plans you can deduct those from 52 rowsThe following taxability information was obtained from each

Is My State Pension Taxable In Massachusetts

Is My State Pension Taxable In Massachusetts

https://media.product.which.co.uk/prod/images/original/12b4afe2cd76-statepensiongraphicforgareth1.jpg

Is My Pension Taxable

https://taxsaversonline.com/wp-content/uploads/2022/07/Is-My-Pension-Taxable-768x512.jpg

Advice About Purchasing Additional Years For My State Pension

https://www.litrg.org.uk/sites/default/files/files/Do not miss out on your state pension 2454 Your State Pension summary.PNG

Income from most private pensions or annuity plans is taxable in Massachusetts Certain government pensions however are exempt under Massachusetts law In general Is Massachusetts tax friendly for retirees Massachusetts is moderately tax friendly for retirees It fully exempts Social Security retirement benefits and income from most public pension funds from taxation On the other

Approximately 95 98 will be taxable at the federal level depending on how much after tax money you have in your MTRS annuity account at the time of your retirement as explained below Upon your retirement you Massachusetts allows for an exclusion of certain government pensions annuities These qualified pensions include contributory pensions from the U S Government or the

Download Is My State Pension Taxable In Massachusetts

More picture related to Is My State Pension Taxable In Massachusetts

Law Web Supreme Court Court Can Not Attach Pension And Gratuity

https://4.bp.blogspot.com/-W3nM8MdtpIU/V_jqLAc14qI/AAAAAAAAKb8/5yZERgVutdcOzwbIiDNgLu3k5eUogyoRQCLcB/w1200-h630-p-k-no-nu/pensions.jpg

Is My Pension Income Taxable Middle Life Money

https://www.middlelifemoney.com/wp-content/uploads/2022/09/image-3-1024x454.png

State Pension MbarakDaeney

https://files.taxfoundation.org/20210602144601/2021-State-Pension-Funding-Gap-and-State-Pension-Plan-State-Public-Pension-Funding-Finances.png

Effective for retirement income received after December 31 1995 federal law prohibits any state from taxing certain retirement income mainly pension income When you input your pension into the federal area of the return did you indicate that it was from a tax exempt source for the state of Massachusetts To do this Verify your 1099 R entry under Federal

While there is nothing from MA state that directly references OPM pensions they do remark All retirement plan contributions and distributions that are Retirement allowances from a Massachusetts retirement system are not subject to the Massachusetts state income tax laws Superannuation retirement allowances and non

State Pension Forecast Check MoneySavingExpert Forum

https://us-noi.v-cdn.net/6031891/uploads/editor/f8/qn4repz2arwp.jpeg

INPRS PERF Pension Payment Dates

https://www.in.gov/inprs/images/2023PERF-TRFPaymentDateCalendar.jpg

https://www.mass.gov/info-details/tax-treatment-of...

Residents Report the government pension income on MA Form 1 Line 4 as pensions Depending on the other state s tax treatment of Massachusetts

https://www.mass.gov/info-details/tax-treatment-of...

Overview If you move to Massachusetts and receive pension payments from your former states public employee retirement plans you can deduct those from

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

State Pension Forecast Check MoneySavingExpert Forum

Will The State Pension Age Increase To 75 How Old You Will Be When You

States That Tax Social Security Benefits Tax Foundation

UK State Pension Age Forecast How Much Will You Get YouTube

Pensions More Than Just A Tax efficient Way To Save For Retirement

Pensions More Than Just A Tax efficient Way To Save For Retirement

What Is The State Pension Age How Much Is It And How To Check Yours

INCOME TAX ON PENSION HOW TO CALCULATE TAX ON PENSION IS PENSION

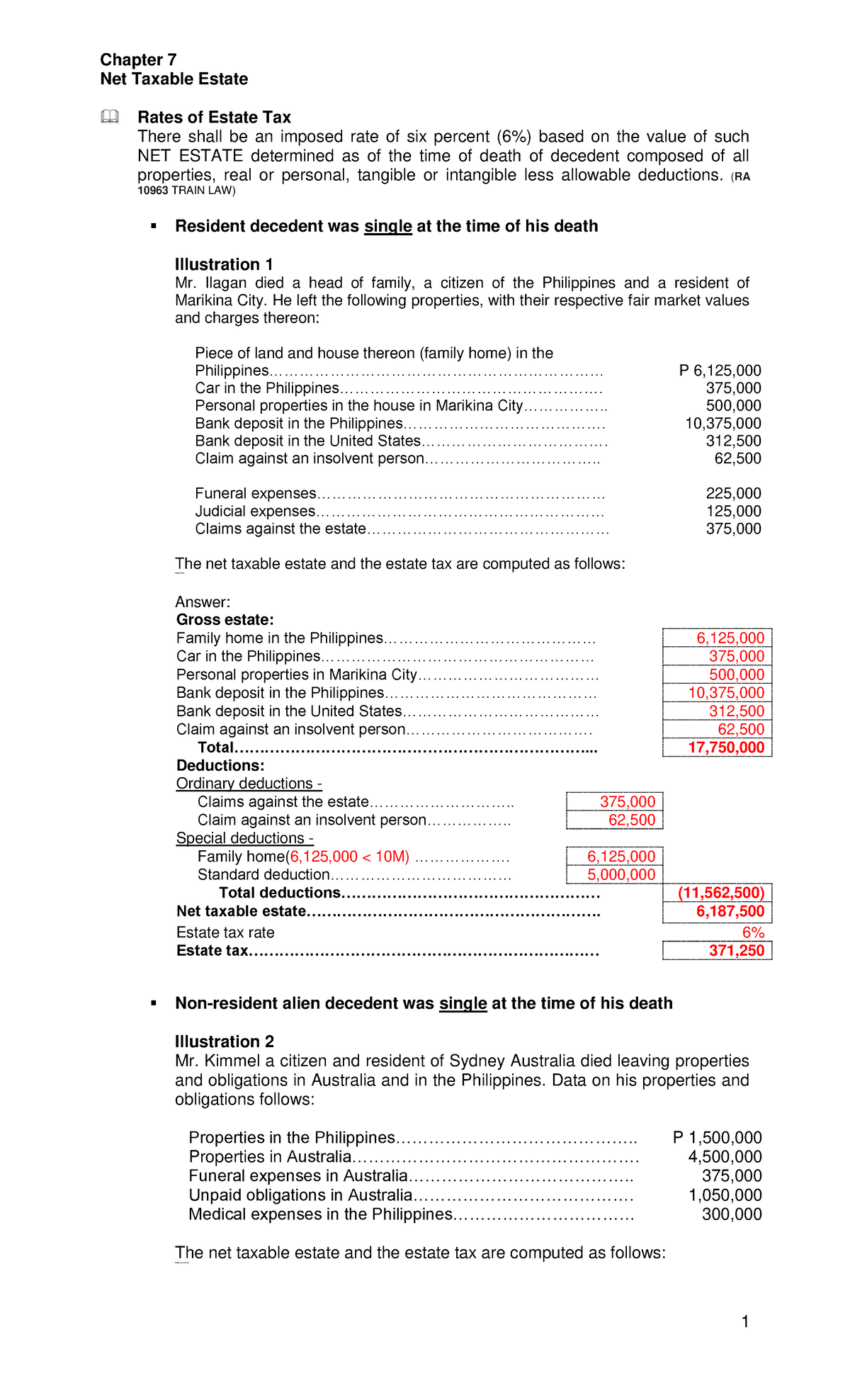

Chapter 7 Net Taxable Estate Net Taxable Estate Rates Of Estate Tax

Is My State Pension Taxable In Massachusetts - Is Massachusetts tax friendly for retirees Massachusetts is moderately tax friendly for retirees It fully exempts Social Security retirement benefits and income from most public pension funds from taxation On the other