Is New Hvac Tax Deductible Does a New HVAC System Qualify for Tax Credits Yes a new HVAC system can qualify for a federal energy efficiency tax credit as long as it s installed into an existing home Newly built homes however do not qualify

The HVAC related tax credits in particular increased dramatically compared to previous years For example installing an eligible air source heat pump can qualify for a 30 tax credit worth up to 2 000 for systems installed from 2023 2032 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work More information about reliance is available

Is New Hvac Tax Deductible

Is New Hvac Tax Deductible

https://www.christiansonco.com/wp-content/uploads/2021/07/accountant-working-with-us-tax-forms-1024x684.jpg

New Tax Law Provides Big Changes To Expensing HVAC Equipment

https://files.constantcontact.com/ba1bc8ab001/964e053f-d14c-4535-a1c2-be3334941e81.jpg

Is A New HVAC Unit Tax Deductible Christiansonco

https://www.christiansonco.com/wp-content/uploads/2021/07/ac-air-appliance-change-checking-clean-condition-768x461.jpg

In August 2022 the Inflation Reduction Act amended two credits available for energy efficient home improvements and residential clean energy equipment so that they last longer and have a greater financial impact The new federal rebates for HVAC systems run through 2032 and include 8 8 billion for the Home Energy Rebates according to the U S Department of Energy Inflation Reduction Act tax credits are benefits from the government when taxpayers make energy efficient upgrades to

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to claim them on your taxes when you file for 2022 Energy Efficient Upgrades That Qualify for Federal Tax Credits For qualified HVAC improvements homeowners might be able to claim 25c tax credits equal to 10 of the install costs up to a maximum of 500 If you re unsure of how to get the tax credit you might be eligible for don t worry

Download Is New Hvac Tax Deductible

More picture related to Is New Hvac Tax Deductible

Is Your HVAC Replacement Tax Deductible Champion Home Services

https://www.championac.com/wp-content/uploads/2018/07/reviews-1-670x448-c-default.png

Commercial Building Owners Did You Know Your HVAC Upgrades May Be Tax

https://www.airtro.com/wp-content/uploads/2018/05/tax-incentive-for-web.jpg

Arkansas Air Flow Inc What The NEW HVAC Tax Incentive Means For YOU

https://i0.wp.com/arairflow.com/wp-content/uploads/2022/08/pexels-photo-3964341.jpeg?fit=1200%2C802&ssl=1

Heating ventilation and air conditioning HVAC replacement costs can be significant expenses for businesses that own or lease real estate Find out about how to distinguish between deductible repairs and more extensive work that must be capitalized Q Is a new HVAC system tax deductible 2023 Yep A new energy efficient HVAC system could be tax deductible for you based on your financial situation tax liability and the type of HVAC system you install

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air conditioners New Resources The Tax Credit Product Lookup Tool can help determine if new heating air conditioning or water heating equipment may be eligible for the Energy Efficient Home Improvement Credit Contractors or even homeowners can enter information about a particular product to determine if it meets tax credit eligibility criteria and

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

https://i0.wp.com/alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png?ssl=1

Tips For Maximizing Your Home s HVAC Efficiency Lions HVAC

https://lionshvac.com/wp-content/uploads/2023/01/2-Is-Energy-Efficient-HVAC-Tax-Deductible.jpg

https://airconditionerlab.com › what-hvac-systems...

Does a New HVAC System Qualify for Tax Credits Yes a new HVAC system can qualify for a federal energy efficiency tax credit as long as it s installed into an existing home Newly built homes however do not qualify

https://todayshomeowner.com › hvac › guides › hvac-tax-credit

The HVAC related tax credits in particular increased dramatically compared to previous years For example installing an eligible air source heat pump can qualify for a 30 tax credit worth up to 2 000 for systems installed from 2023 2032

Are HVAC Repairs Tax Deductible In Los Angeles

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Is Energy Efficiency HVAC Worth It

New HVAC Tax Credit authorSTREAM

Commercial HVAC Tax Changes In Section 179 For Business Owners Energy

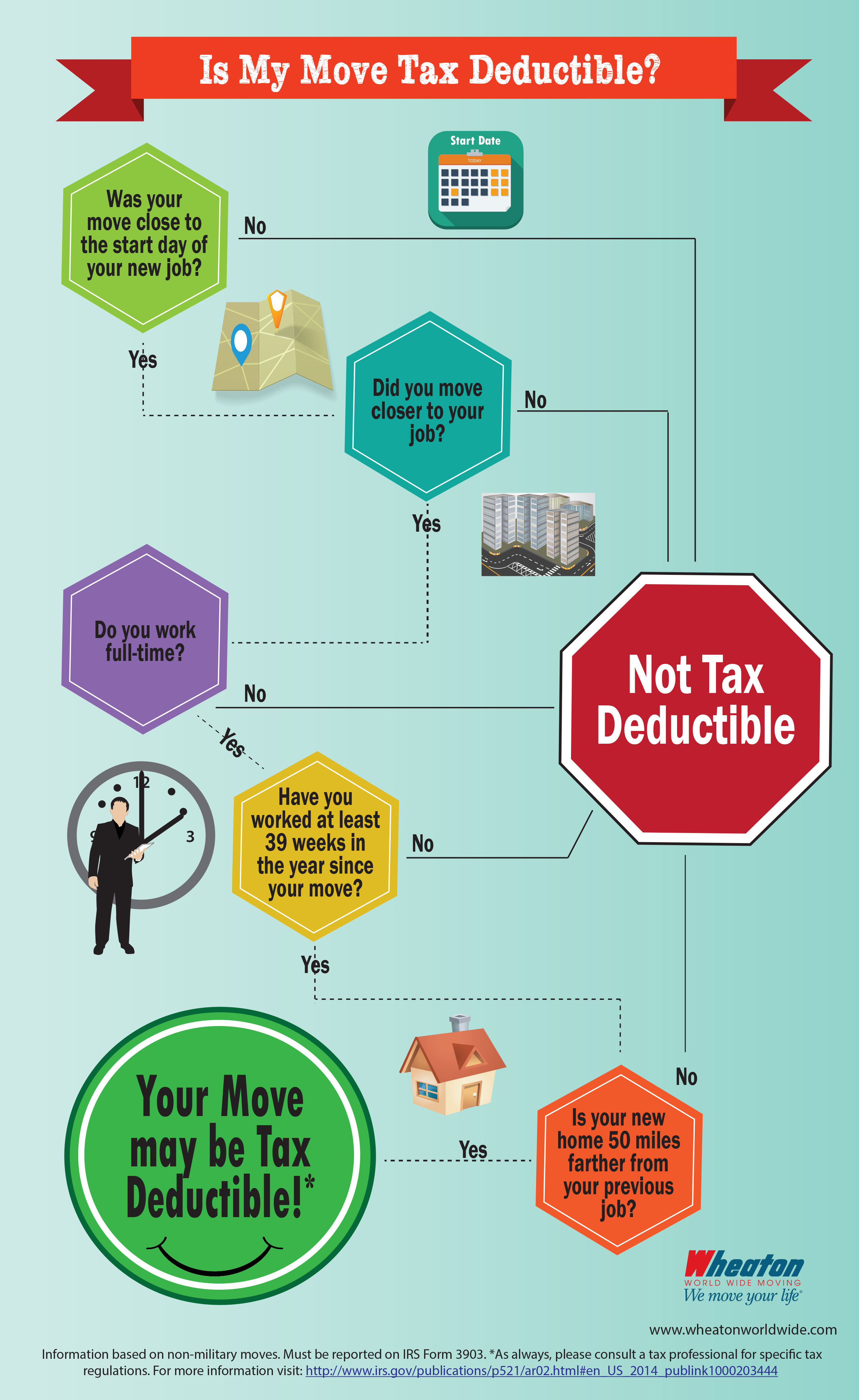

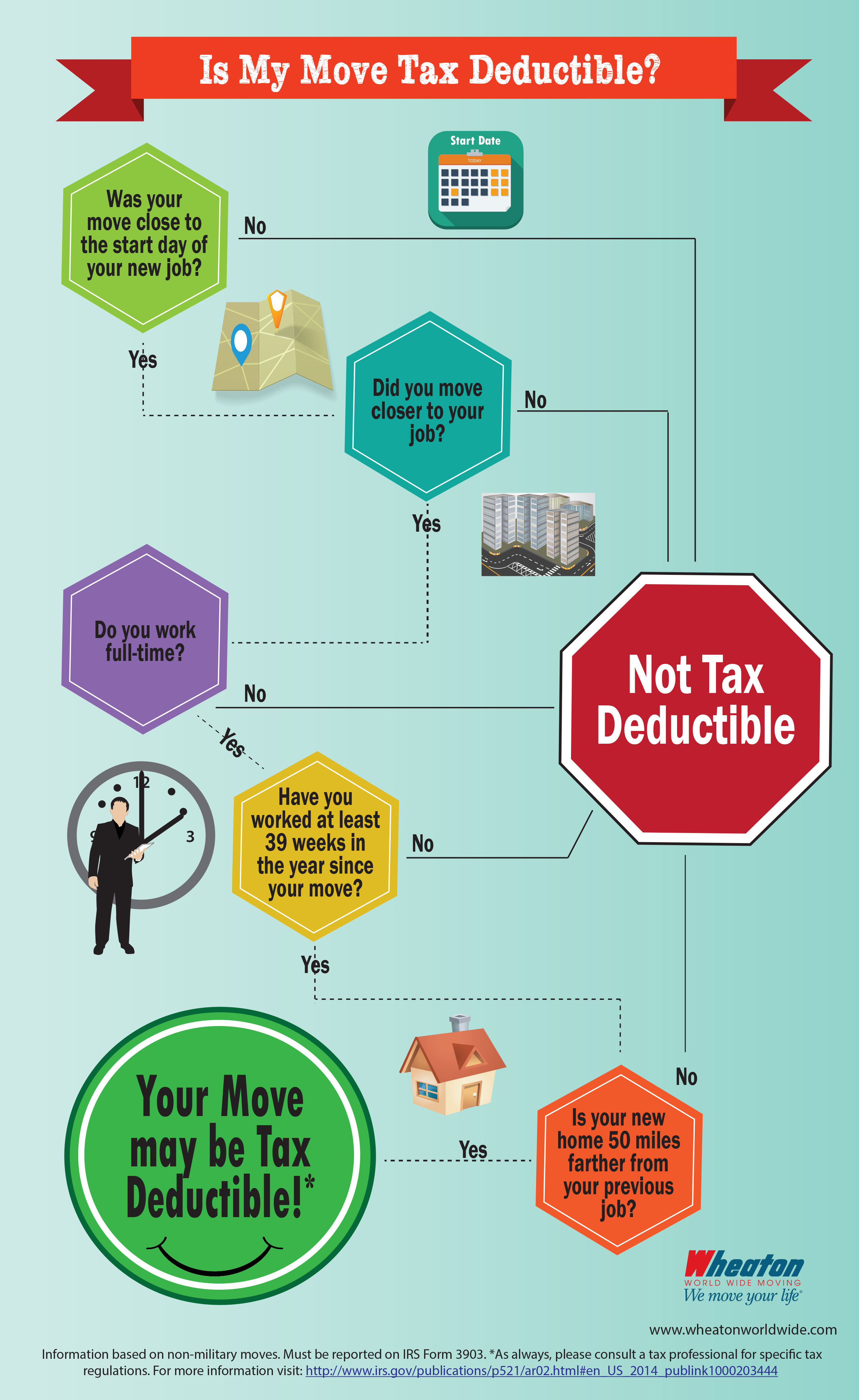

Infographic Is My Move Tax Deductible Wheaton

Infographic Is My Move Tax Deductible Wheaton

Stay Cool And Avoid A Big Unanticipated HVAC Repair Bill With A Home

Your Guide To HVAC Tax Credits J W Heating And Air

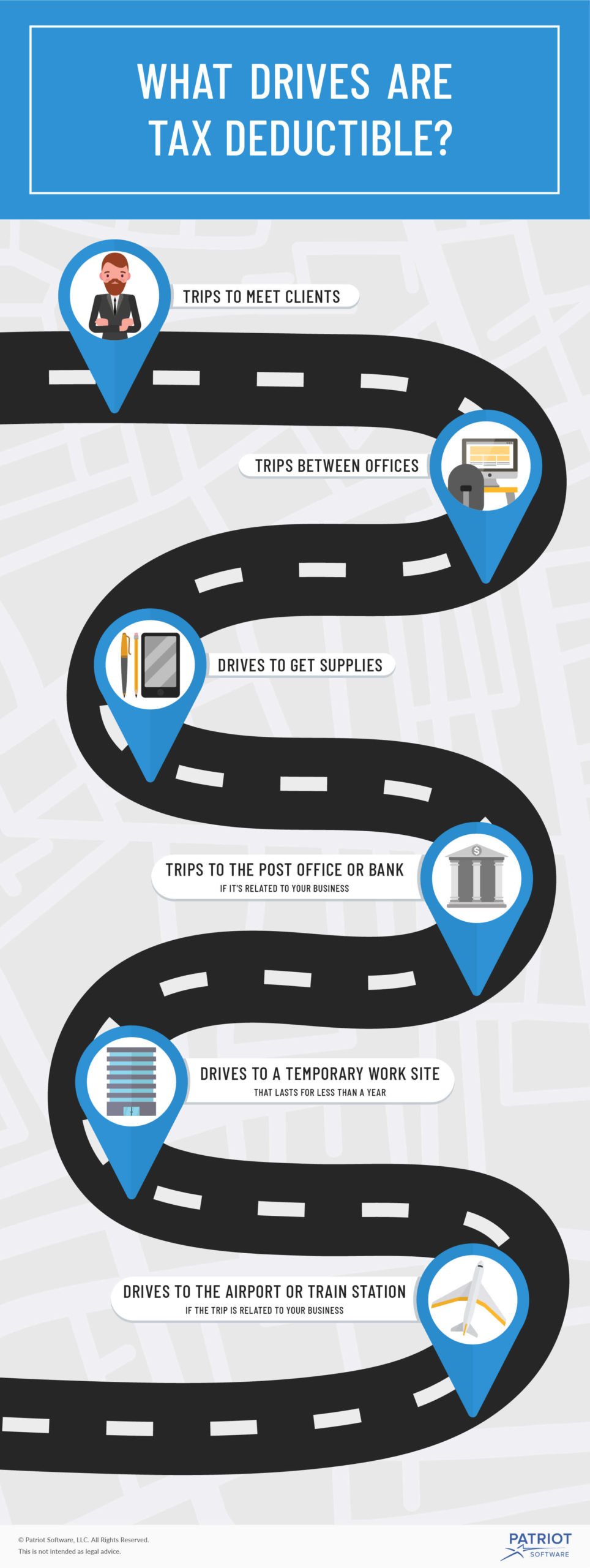

What Drives Are Tax Deductible Claiming Tax Deductions For Mileage

Is New Hvac Tax Deductible - Is Your HVAC Replacement Tax Deductible Private residential home improvements are considered nondeductible personal expenses by the IRS meaning your HVAC replacement isn t tax deductible However new AC installation is considered a home improvement that increases your home s basis