Is New Jersey Disability Taxable New Jersey disability income and unemployment benefits are not taxed on the state level However Social Security disability benefits may be taxable depending on whether or not you

The following items of income are not subject to New Jersey tax However if you file a resident return you must report the total amount of nontaxable interest on the Tax exempt interest Line of your return The portion of a distribution from New Jersey Qualified Investment Funds and If you re single and file an individual return you d pay taxes on Up to 50 of your benefits if your income is between 25 000 and 34 000 Up to 85 of your benefits if your income is

Is New Jersey Disability Taxable

Is New Jersey Disability Taxable

https://www.hillandponton.com/wp-content/uploads/2021/03/DISABILITY20TAX20THUMBNAIL-1280x720.png

Is Long Term Disability Taxable J Price McNamara ERISA Insurance

https://jpricemcnamara.com/wp-content/uploads/2022/03/Long-Term-Disability-Taxable.jpg

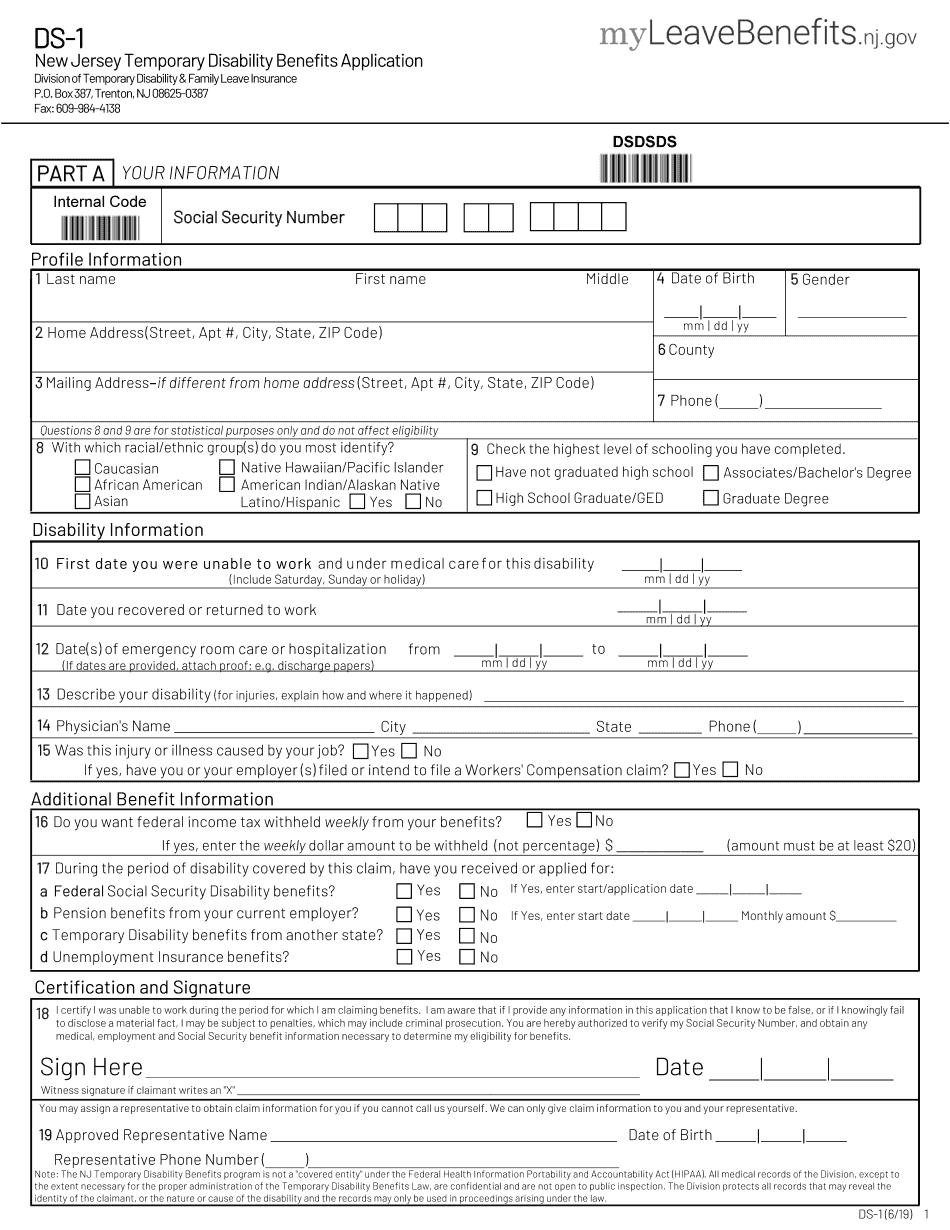

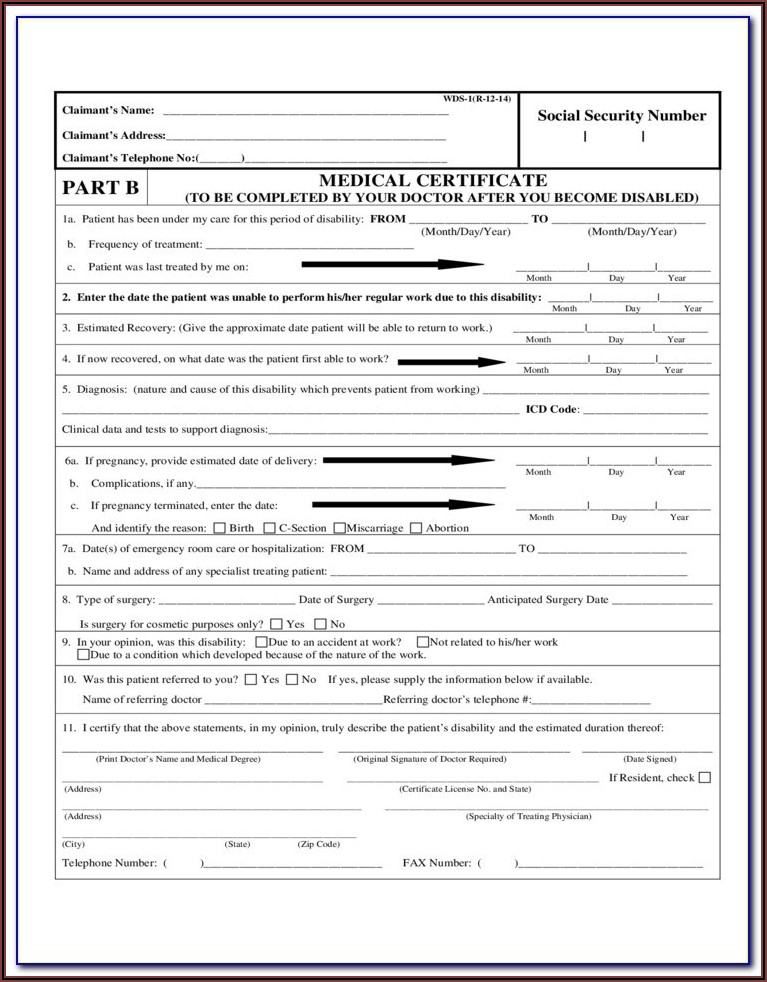

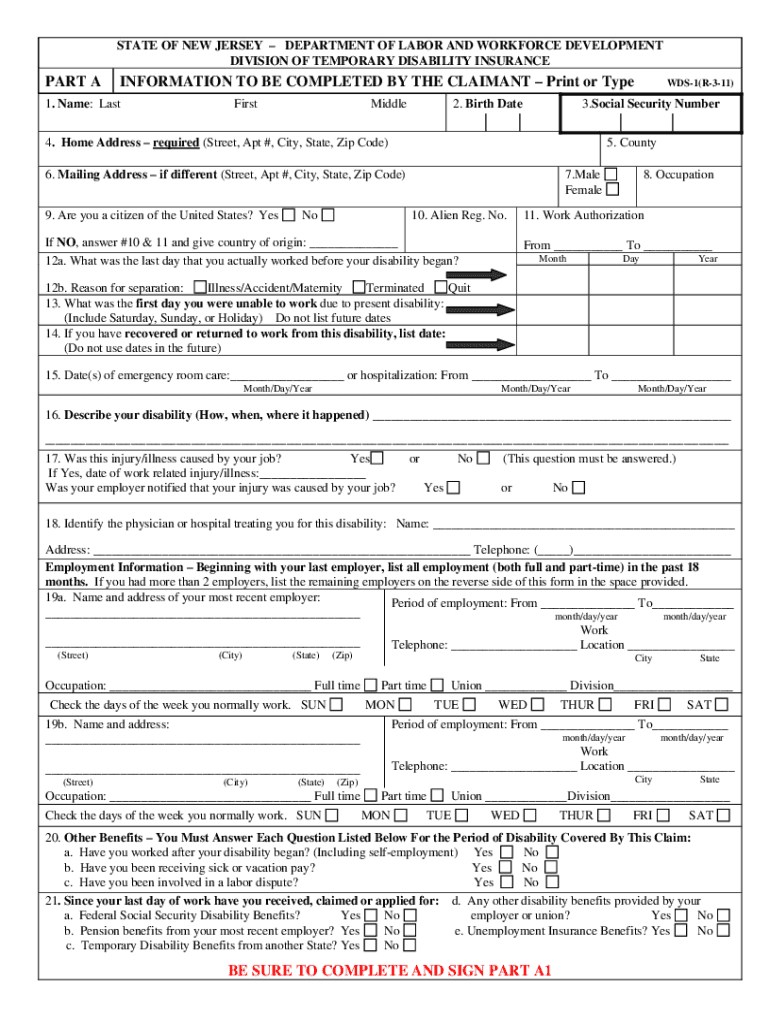

Apply For Temporary Disability Nj Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/478/748/478748167/big.png

New Jersey residents with disability benefits are most likely to qualify for SSDI or SSI so the rest of this guide will explain how to apply for either program You can also reference our guide to the types of disability benefits The following benefits are not taxable and should not be reported as pension income Social Security and Railroad Retirement benefits Pension payments received because of permanent and total disability before age 65

California New Jersey and Rhode Island do not tax state paid short term disability benefits but New York and Hawaii partially tax these benefits depending on how much your employer contributed to the cost of the insurance and how much you contributed to the cost of insurance Only a portion of the Temporary Disability Insurance benefits paid are taxable by the federal government they are not taxed by the State of New Jersey They are considered third party sick pay or other wages

Download Is New Jersey Disability Taxable

More picture related to Is New Jersey Disability Taxable

Spotlight On Need For Disability Strategy Bailiwick Express Jersey

https://www.bailiwickexpress.com/files/7714/1140/1230/jersey_disability_awareness_showcase.jpg

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

https://apprisewealth.com/wp-content/uploads/2021/08/6078d22e880cc80157173540_Provisional-Income-Table.png

New Jersey Disability Insurance Attorneys Free Consultation

https://callagylaw.com/wp-content/uploads/2020/08/New-Jersey-Disability-Insurance-Attorneys-T.jpg

Temporary Disability benefits including family leave insurance benefits are not subject to the New Jersey state income tax according to NJ Dept of Taxation FAQs In New Jersey temporary disability benefits are treated in 3 New Jersey Legislation A 3975 effective January 1 2020 separated the computation of the temporary disability and family leave insurance taxable wage base from that of the state unemployment insurance taxable wage base

Most states do not tax Social Security benefits including those for disability As of 2020 however a total of 13 states tax benefits to some degree Those states are Colorado 2024 state disability paid family and medical leave and long term care insurance wage base and rates Six jurisdictions California Hawaii New Jersey New York Puerto Rico and Rhode Island operate state disability insurance SDI programs

NJ Disability Population Conditions Not Among Best In US

https://www.gannett-cdn.com/presto/2021/03/27/PNJM/7f972222-9ad2-4172-9e78-b69d5f331e60-032621_Clifton_0329.JPG?width=1320&height=880&fit=crop&format=pjpg&auto=webp

Disability Resources In New Jersey Hoboken Girl

https://www.hobokengirl.com/wp-content/uploads/2020/12/disability-resources-new-jersey.png

https://finance.zacks.com

New Jersey disability income and unemployment benefits are not taxed on the state level However Social Security disability benefits may be taxable depending on whether or not you

https://www.nj.gov › treasury › taxation

The following items of income are not subject to New Jersey tax However if you file a resident return you must report the total amount of nontaxable interest on the Tax exempt interest Line of your return The portion of a distribution from New Jersey Qualified Investment Funds and

How Long Can You Collect Temporary Disability In Nj Disability Talk

NJ Disability Population Conditions Not Among Best In US

Nj Permanent Disability Chart

Nj Disability Forms Printable Free Printable Disability Forms

Permanent Disability Chart

State Of New Jersey Disability Support Services

State Of New Jersey Disability Support Services

Social Security Disability Missoula Workers Compensation And Social

What Conditions Qualify For Disability In New Jersey Disability

2024 Va Disability Pay Chart Smc

Is New Jersey Disability Taxable - If you re 65 and older or have a disability and have been a New Jersey resident for at least a year you may be eligible for a 250 property tax deduction Surviving spouses 55 or older may also qualify