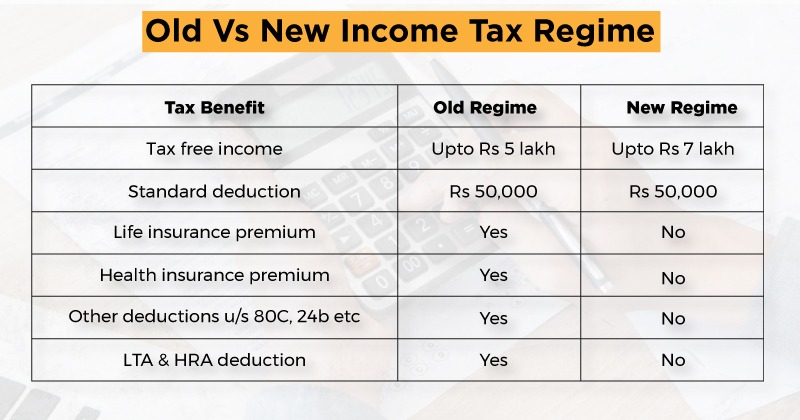

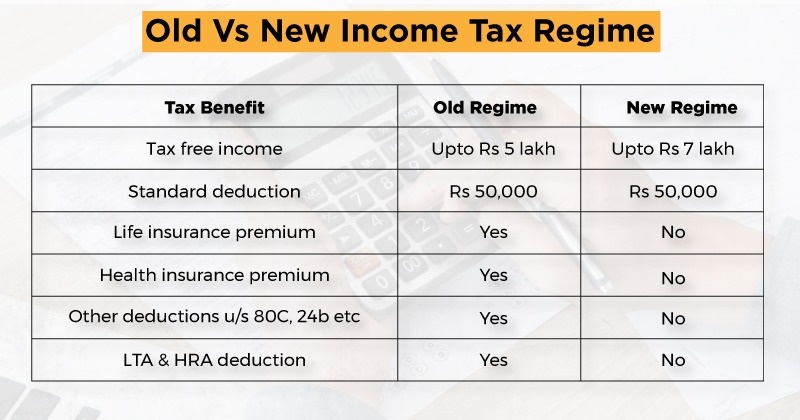

Is Nps 50000 Deduction Allowed In New Tax Regime Under Old Tax Regime If you are opting old tax regime then you can continue claiming income tax deduction of Rs 50 000 u s 80CCD 1b New Tax

Section 80CCD 1B provides an additional deduction of up to Rs 50 000 for contributions made to NPS The additional deduction of Rs 50 000 under Section 80CCD 1B is available over and above the Currently this deduction benefit is restricted to taxpayers opting for the old tax regime and taxpayers under the new tax regime cannot avail it As the new tax

Is Nps 50000 Deduction Allowed In New Tax Regime

Is Nps 50000 Deduction Allowed In New Tax Regime

https://im.indiatimes.in/content/2023/Feb/Old-Vs-New-Tax-Regime-Which-One-To-Pick-After-Budget-2023_63db747264d86.jpg

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com

https://studycafe.in/wp-content/uploads/2020/02/List-of-ExemptionsDeductions-available-under-new-tax-regime-Budget-2020-1.jpg

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

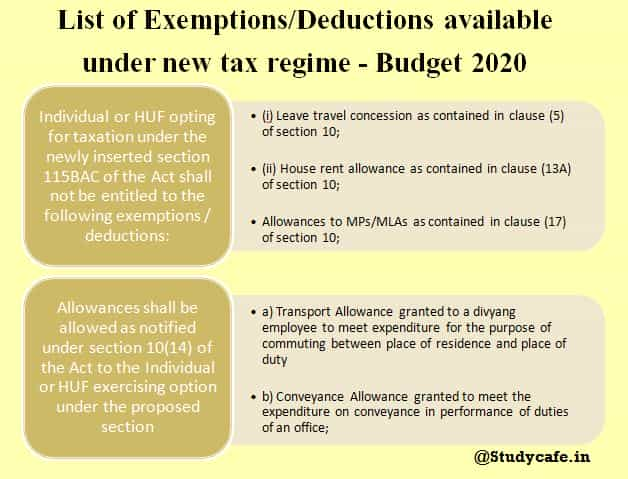

It is to be noted that salaried individuals can claim two deductions under the new tax regime Standard Deduction and deduction under section 80CCD 2 for Employer s NPS contribution for the benefit of employee up to 10 per cent of salary Basic DA is deductible from taxable income up to 7 5 Lakh the NPS

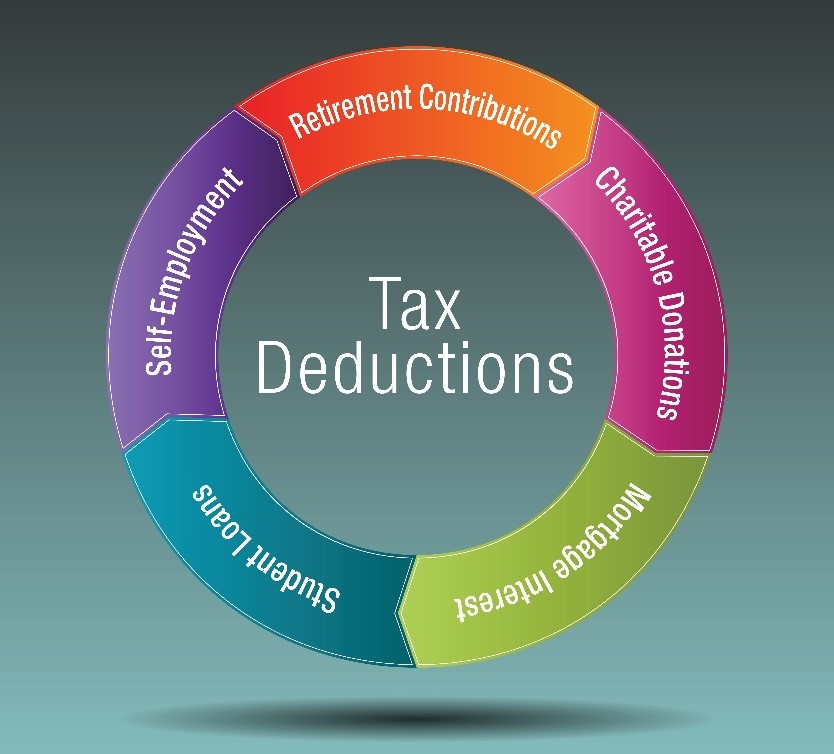

Section 115BAC of Income Tax Act New Tax Regime Deductions Allowed Updated on 27 Mar 2024 04 12 PM The Finance Act of 2020 introduced Section Additional deduction of up to Rs 50 000 under Section 80CCD 1B of the Income Tax Act exclusively available through NPS investment The third deduction is in

Download Is Nps 50000 Deduction Allowed In New Tax Regime

More picture related to Is Nps 50000 Deduction Allowed In New Tax Regime

Union Budget 2023 24 Why Old Tax Regime Is Still Better Than New Tax

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202302/tax-graphic-1.jpg?itok=AFs3rjIf

INTRODUCTION OF SECTION 115BAC TO INCOME TAX ACT 1961 Onfiling Blog

https://blog.onfiling.com/wp-content/uploads/2021/04/49134-1940x1455-1.jpg

Itemized Deductions Still Exist For 2018 Tax Return BMP CPA

https://www.bmp-cpa.com/wp-content/uploads/2019/01/tax-deductions.jpg

So if the annual basic salary of the employee is Rs 5 lakh one can avail a deduction of up to Rs 50 000 if the employer contributes towards employees NPS Thus salaried individuals and pensioners can claim the standard deduction of Rs 50 000 only from their salary pension income Getty Images 3 6 For family

Under the old tax regime this extra Rs 50 000 tax deduction is in addition to the Rs 1 5 lakh allowed under Section 80CCD 1 for investment towards NPS This Rs In accordance with Section 80C of the Income Tax Act NPS Tier 1 accounts are eligible for a deduction of up to 1 5 lakh from taxable income and an additional

Opt New Tax Regime If Deduction Exemption Claims Less Than Rs 3 75

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202302/ezgif.com-gif-maker_78-sixteen_nine.jpg?VersionId=xUwpmYRrPS0rtimFBRBauVHLpBCu3Uq9

Rebate Limit New Income Slabs Standard Deduction Understanding What

https://feeds.abplive.com/onecms/images/uploaded-images/2023/02/01/a7b773f5d25d441b1f70bb4e5af7e14f1675251759563314_original.jpg

https://www.relakhs.com/nps-income-tax-benefits-fy...

Under Old Tax Regime If you are opting old tax regime then you can continue claiming income tax deduction of Rs 50 000 u s 80CCD 1b New Tax

https://cleartax.in/s/section-80-ccd-1b

Section 80CCD 1B provides an additional deduction of up to Rs 50 000 for contributions made to NPS The additional deduction of Rs 50 000 under Section 80CCD 1B is available over and above the

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

Opt New Tax Regime If Deduction Exemption Claims Less Than Rs 3 75

Section 80C Deductions List To Save Income Tax FinCalC Blog

Budget 2023 Tax Saving Under New Tax Regime Vs Old Tax Regime For Rs 7

Old Vs New Tax Regime Make Sure Which One To Opt For With These 4 Tips

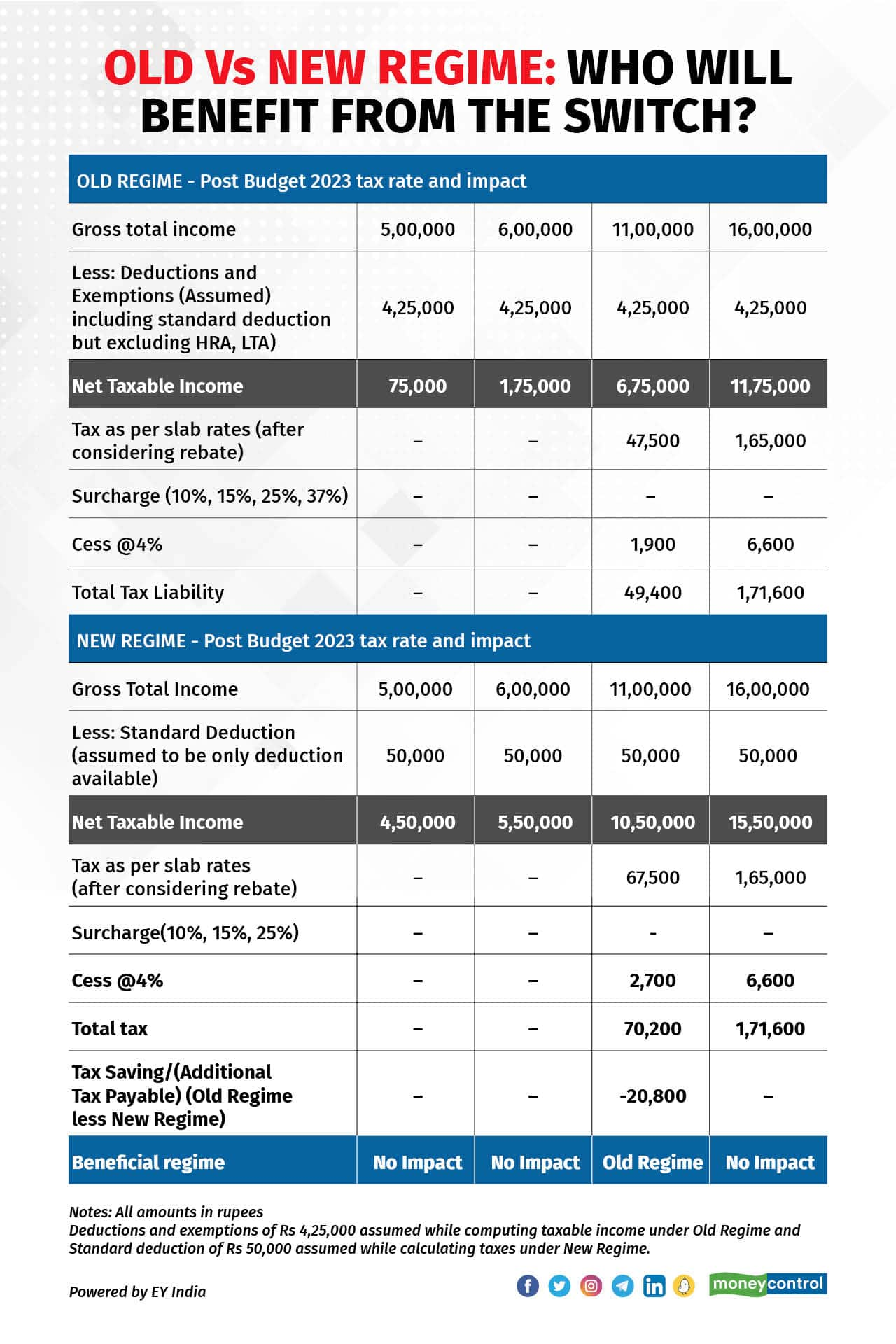

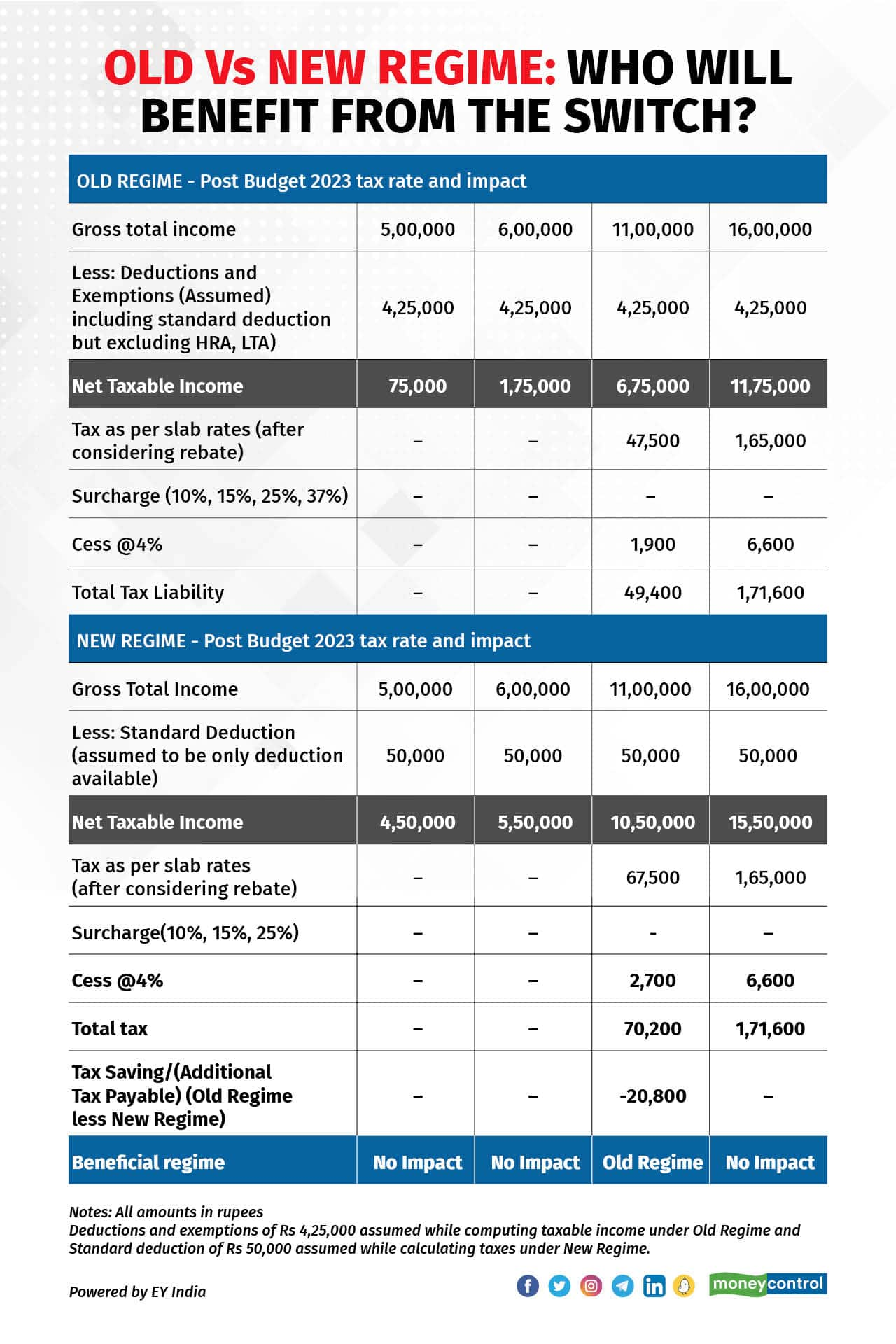

Budget 2023 Old Vs New Tax Regimes Who Should Make The Switch

Budget 2023 Old Vs New Tax Regimes Who Should Make The Switch

Brief Comparison Between New Tax Regime And Old Tax Regime FY 2023 24

New Tax Regime Vs Old Which Is Better For You Rupiko Peoplesoft

Income Tax Deductions Financial Year 2022 2023 WealthTech Speaks

Is Nps 50000 Deduction Allowed In New Tax Regime - Employer s NPS contribution for the benefit of employee up to 10 per cent of salary Basic DA is deductible from taxable income up to 7 5 Lakh the NPS