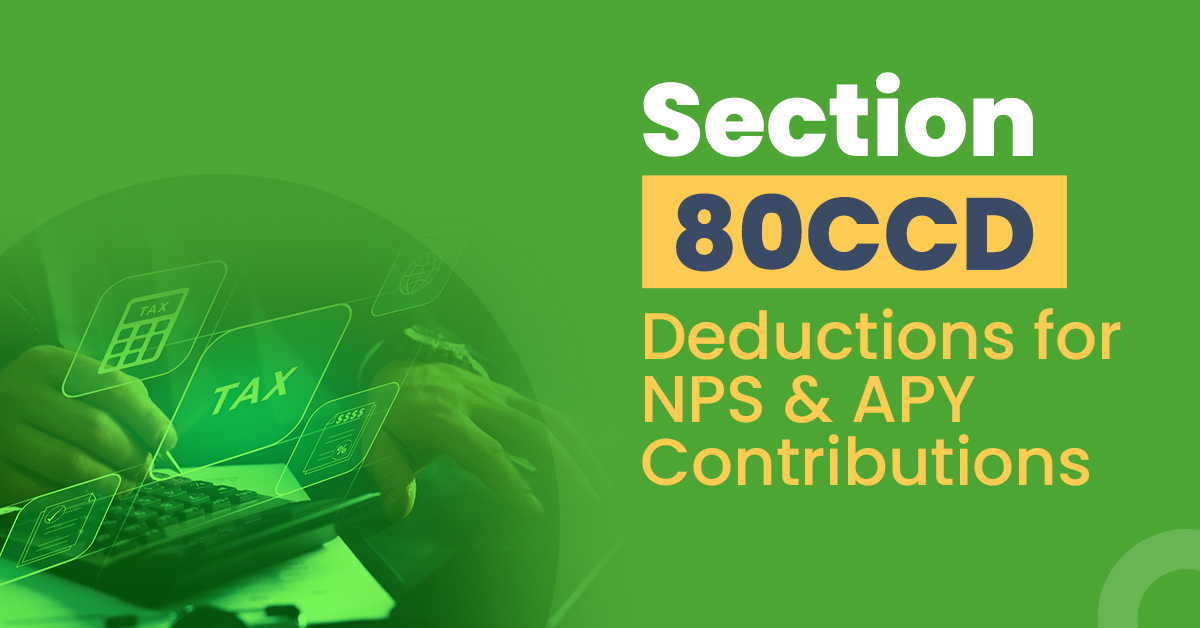

Is Nps Comes Under 80ccc Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section

Existing NPS subscribers can benefit from the deduction under Section 80CCD for their NPS contribution Section 80CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic The maximum deduction under Section 80C 80CCC and 80CCD 1 put together is Rs 1 5 lakhs However you may claim an additional deduction of Rs 50 000

Is Nps Comes Under 80ccc

Is Nps Comes Under 80ccc

https://userpeek.com/wp-content/uploads/2020/09/Net-Promoter-Score-NPS.png

Why Should You Invest In NPS By BFC CAPITAL On Dribbble

https://cdn.dribbble.com/userupload/8873558/file/original-eab950c204f48c4db13e6827419ff7c4.png?resize=1200x800

Section 80CCD Deductions For NPS And APY Contributions

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Section-80CCD-Deductions-For-NPS-And-APY-Contributions.jpg

Under Section 80CCC of the Income Tax Act 1961 a taxpayer can claim tax deductions against the monetary contributions made towards specified pension funds which has been offered by an approved Employer s contribution to NPS is allowed as a deduction under section 80CCD 2 while computing the employee s total income However the amount of deduction cannot

So a government employee a private sector employee self employed or an ordinary citizen can claim benefit of Rs 50 000 under Section 80CCD 1B Therefore the total tax benefits that can be Is the tax benefit available for contributions made to NPS or APY covered under section 80CCC No you cannot claim tax deduction under section 80CCC for

Download Is Nps Comes Under 80ccc

More picture related to Is Nps Comes Under 80ccc

NPS Miar Sukcesu Blog Bluerank

https://www.bluerank.pl/wp-content/uploads/2018/07/NPS_4.jpg

NPS Vs PPF Which Is Better Personal Finance Plan

https://www.personalfinanceplan.in/wp-content/uploads/2019/04/20190415_NPS-vs-PPF-vs-NPS-or-PPF-which-is-good.png

How To Turn Your NPS Detractors Into Promoters The Essential Guide

https://www.smartkarrot.com/wp-content/uploads/2021/01/NPS-Detractors.jpg

Tax exemptions under Section 80 CCD are applicable to contributions made under the government s pension plan The National Pension Scheme NPS and NPS tax benefits apart from Section 80CCD include Partial withdrawals made under the NPS account are fully exempt Lumpsum withdrawal at age 60 is fully exempt 40 of the total NPS

But remember the total amount of deduction under sections 80C 80CCC investment in pension plan offered by an insurer and Section 80CCD 1 for NPS cannot exceed 1 5 lakh Section 80CCC lets you claim a deduction of Rs 1 5 lakh Section 80CCC deduction limit is combined with sections 80C and 80CCD That is by combining all

Tom Haws NPS Global 1 0 My First Explanation Of Where NPS Came From

https://4.bp.blogspot.com/-ZFt85jRJm10/WePVlOKIOgI/AAAAAAAACdc/iGdd9QP_AzUJ_vRoK-yh4E9A-yXzVvzFgCLcBGAs/s1600/nps-t-shirt-pkd.png

NPS Lojala Kunder r N jda Kunder Webropol se

https://webropol.se/wp-content/uploads/2020/01/NPS_Higher_Image.png

https://www.etmoney.com/learn/income-tax/section-80ccd-deductions

Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section

https://cleartax.in/s/section-80-ccd-1b

Existing NPS subscribers can benefit from the deduction under Section 80CCD for their NPS contribution Section 80CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B BasuNivesh

Tom Haws NPS Global 1 0 My First Explanation Of Where NPS Came From

SNP Comes Under Attack For Centralising Power

NPS Builders Consultants And Engineers Muzaffarpur

REMIX ER NPS Music

SCVNews NPS Director Addresses Environmental Societal Changes

SCVNews NPS Director Addresses Environmental Societal Changes

Maintenance Of Clinical Remission In Early Axial Spondyloarthritis

Enabling Aadhaar Based Offline Paperless KYC Verification Process For NPS

Income Tax Deduction U s 80C 80CCC 80CCD 80D MyEfilings

Is Nps Comes Under 80ccc - Is the tax benefit available for contributions made to NPS or APY covered under section 80CCC No you cannot claim tax deduction under section 80CCC for