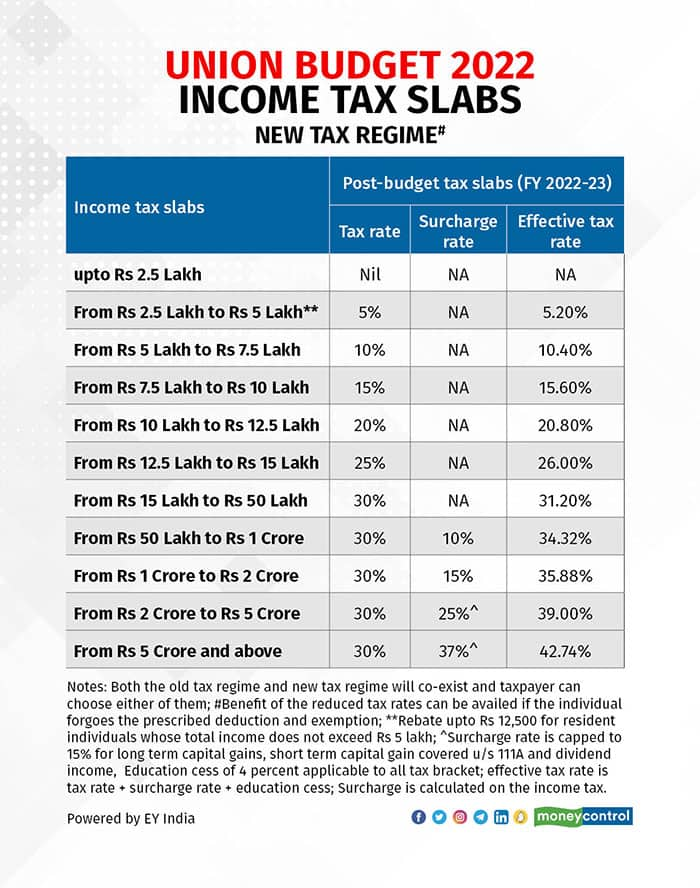

Is Nps Eligible For Tax Deduction In New Tax Regime The deduction of employer s contribution to NPS account i e under Section 80CCD 2 is allowed under New Regime There was a limit of 10 of employer s contribution that has been increased to 14 in new Budget in

While the new tax regime offers the NPS benefit only under Section 80CCD 2 the old tax regime allows three deductions under Sections 80CCD 1 1 5 lakh 80CCD 1B Under the new tax regime a deduction under Section 80CCD 2 of the Income Tax Act by investing in NPS can be availed This deduction from gross total income can be claimed if the

Is Nps Eligible For Tax Deduction In New Tax Regime

Is Nps Eligible For Tax Deduction In New Tax Regime

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

Exemptions Allowances And Deductions Under Old New Tax Regime

https://www.taxhelpdesk.in/wp-content/uploads/2023/06/EXEMPTIONS-ALLOWANCES-DEDUCTIONS-AVAILABLE-UNDER-THE-OLD-NEW-TAX-REGIME-1.jpg

Old Income Tax Regime Vs New Regime Filing Of Return After Due Date

https://cachandanagarwal.com/wp-content/uploads/2022/03/Income-Tax-3-1024x576.jpeg

If individuals choose the new tax regime they can avail of a deduction under Section 80CCD 2 of the Income Tax Act by investing in NPS This deduction from the gross Deduction Availability In the new tax regime deductions under Section 80CCD 1 up to 1 5 lakh and Section 80CCD 1B an additional 50 000 are not available for self

The following deductions under New Tax Regime are still available for tax payers The Standard Deduction of Rs 50 000 for salaried individuals and pensioners The deduction Latest NPS benefits under new tax regime after Budget 2024 If your basic salary is Rs 1 lakh your employer can contribute Rs 10 000 10 of basic pay to the NPS on your

Download Is Nps Eligible For Tax Deduction In New Tax Regime

More picture related to Is Nps Eligible For Tax Deduction In New Tax Regime

The New Tax Regime FY 2020 21 VS The Old Tax Regime Quick Tax Help

https://mkrk.co.in/wp-content/uploads/2021/03/Blog18-Old-Versus-New-Tax-Regime-33.png

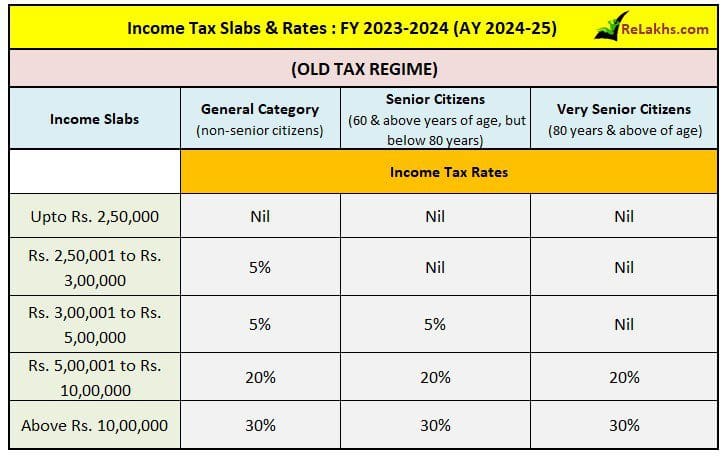

Earnings Tax Deductions Checklist FY 2023 24 MoreFinancialNews

https://www.relakhs.com/wp-content/uploads/2023/08/Latest-income-tax-slabs-rates-old-tax-regime-for-fy-2023-24-ay-2024-25-.jpg

E calculator Launched By The Income Tax Department For Individuals To

https://ask.careers/wp-content/uploads/2020/02/income-tax-dept-launches-e-calculator-to-compare-due-tax-under-new-old-regime-03.jpg

NPS subscribers can also claim deductions for contributions to the pension scheme under the new tax regime However the deductions are only allowed for the employer s part Is NPS deduction allowed under New Tax Regime In the new tax regime taxpayers will have to forgo most of the income tax exemptions and deductions to avail the lower tax rates

Under the new tax regime the contribution made by employer towards Tier 1 NPS account is eligible for tax deduction under section 80CCD 2 of Income Tax Act 1961 without New Tax Regime The NPS related deduction under Section 80CCD 2 of the Income tax Act 1961 was allowed under the New Tax Regime Under this regime the

Old Tax Regime And New Tax Regime Explained In 3 Scenarios Forum

https://c.ndtvimg.com/2023-02/hfvfqj2o_income-tax-slab_625x300_02_February_23.jpg

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

https://assets.blog.quicko.com/wp-content/uploads/2020/02/New-Tax-Regime-coverage-scaled-1-1024x512.jpg

https://taxguru.in › income-tax

The deduction of employer s contribution to NPS account i e under Section 80CCD 2 is allowed under New Regime There was a limit of 10 of employer s contribution that has been increased to 14 in new Budget in

https://economictimes.indiatimes.com › wealth › tax › ...

While the new tax regime offers the NPS benefit only under Section 80CCD 2 the old tax regime allows three deductions under Sections 80CCD 1 1 5 lakh 80CCD 1B

Old Vs New Income Tax Slabs After Budget Which Is Better Mint

Old Tax Regime And New Tax Regime Explained In 3 Scenarios Forum

Rebate Limit New Income Slabs Standard Deduction Understanding What

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

Tax Deductions You Can Deduct What Napkin Finance

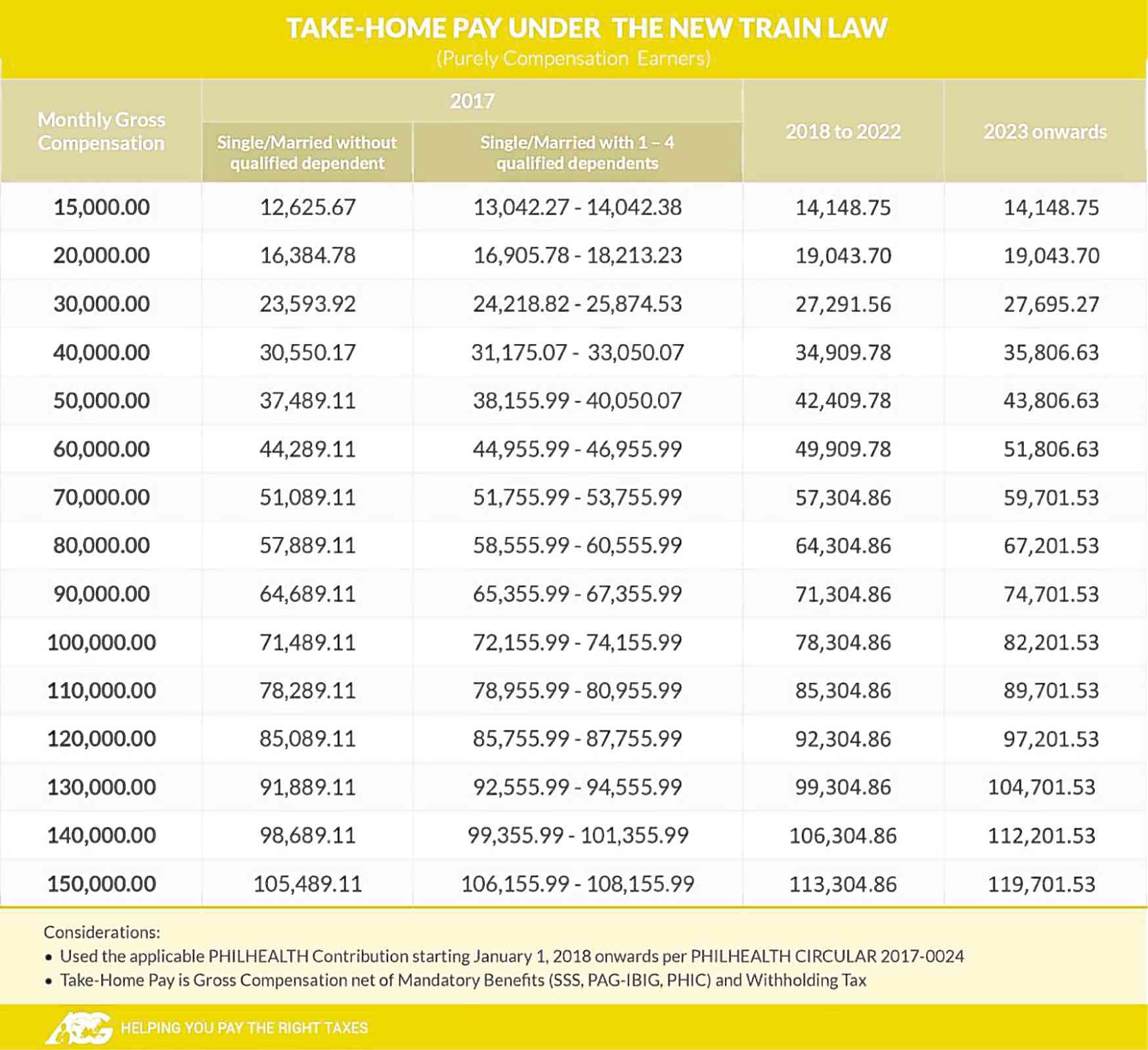

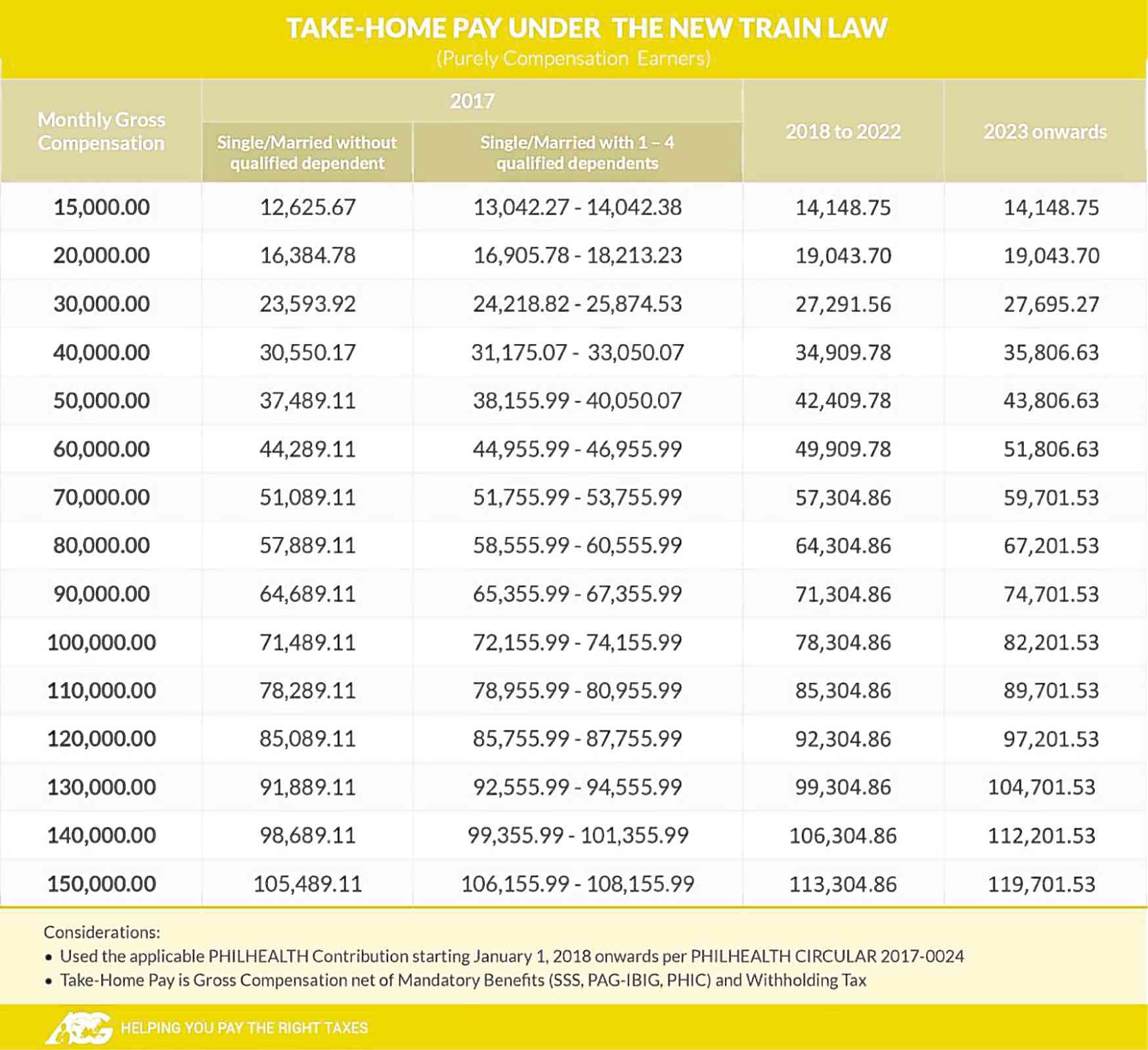

New Tax Regime For The New Year Inquirer Business

New Tax Regime For The New Year Inquirer Business

How To Choose Between The New And Old Income Tax Regimes

Old Tax Regime Vs New Tax Regime YouTube

Request Letter For Tax Certificate For Income Tax SemiOffice Com

Is Nps Eligible For Tax Deduction In New Tax Regime - If individuals choose the new tax regime they can avail of a deduction under Section 80CCD 2 of the Income Tax Act by investing in NPS This deduction from the gross