Is Nps Rebate In New Tax Regime The budget has encouraged retirement planning by increasing the tax benefit on NPS payments and adding a new option to the pension system for minor children The deduction under Section 80CCD 2 is planned to be

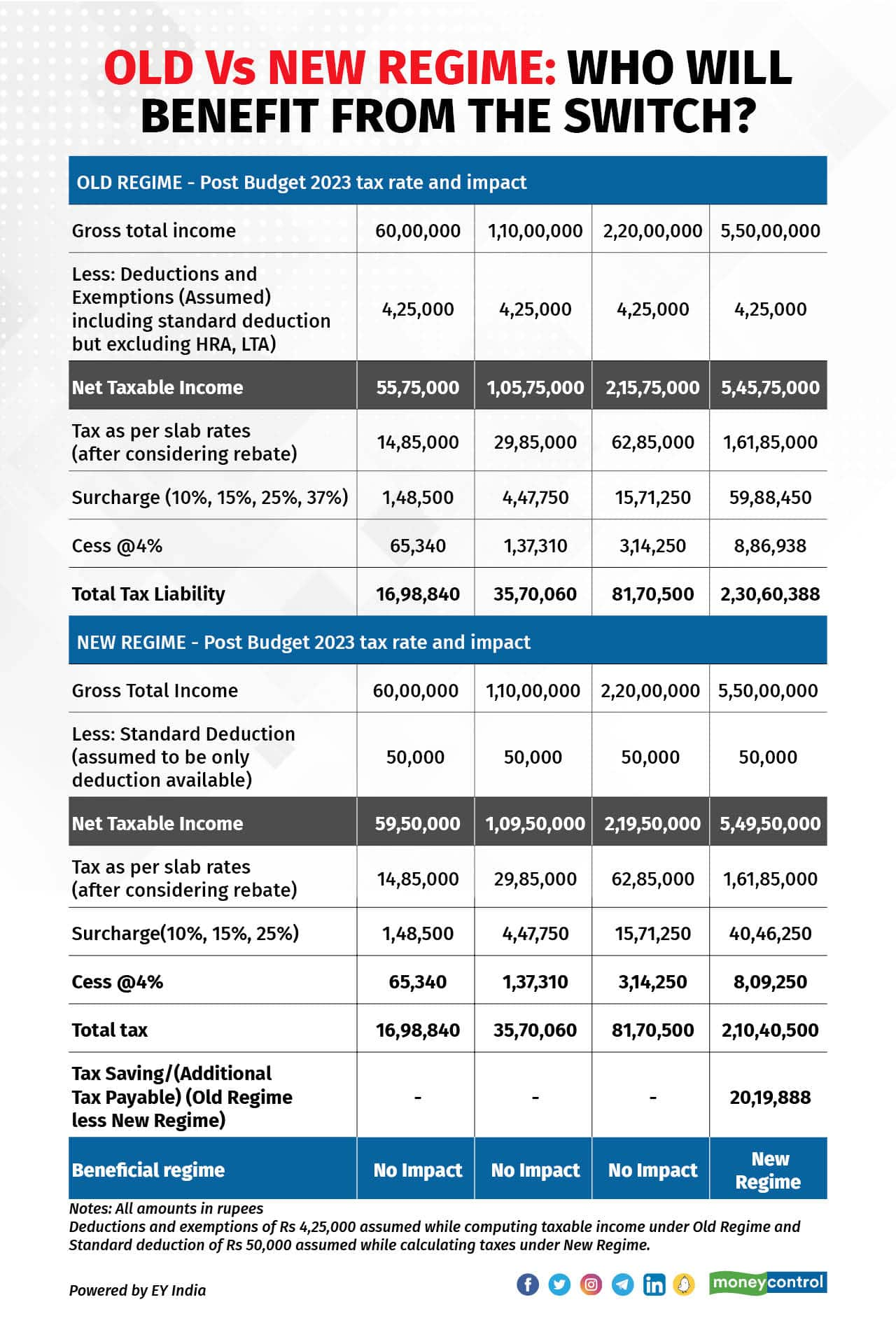

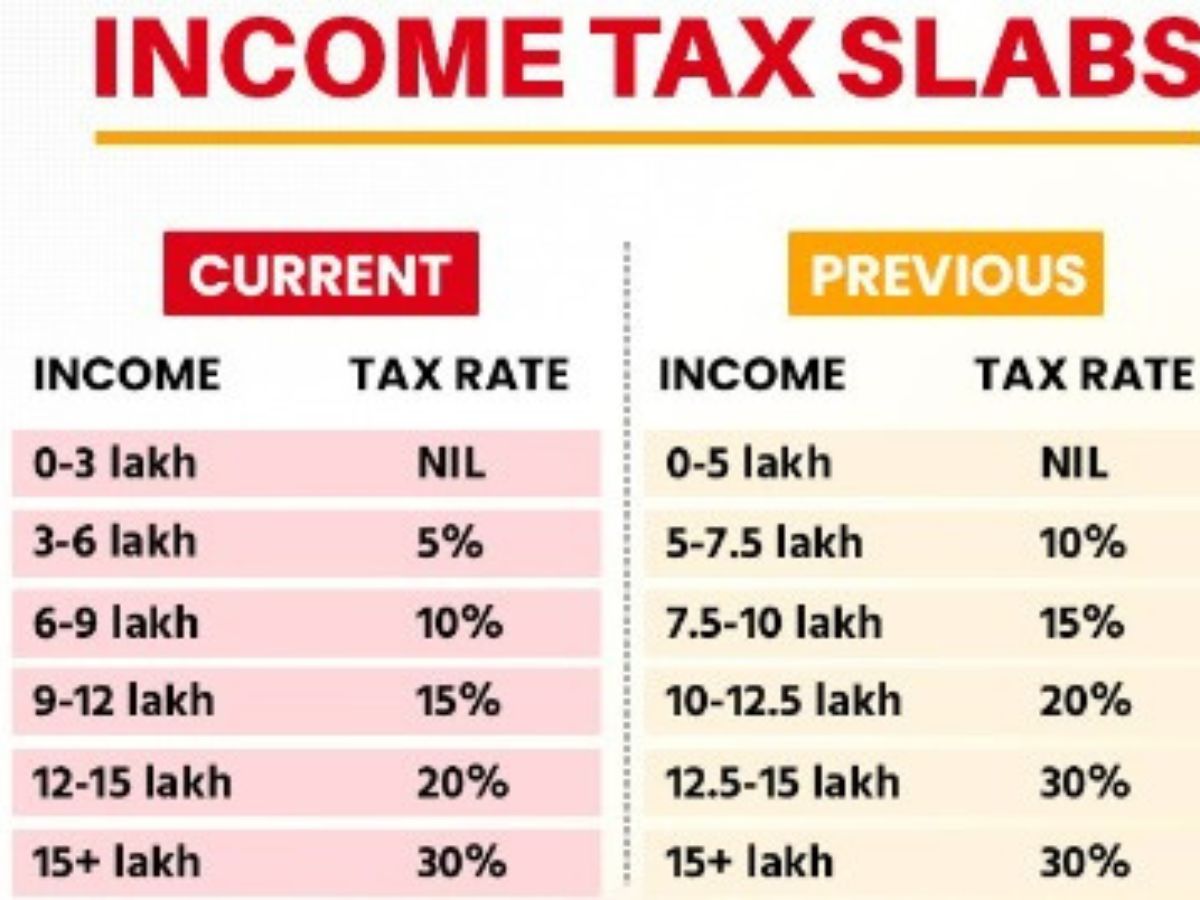

In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to pay any tax at all if they opt for the new tax regime NPS additions under New Tax Regime Budget 2024 25 1 Employees choosing the New Tax Regime are now eligible for a higher deduction of up to 14 of their basic salary for the

Is Nps Rebate In New Tax Regime

Is Nps Rebate In New Tax Regime

https://blog.freetaxfiler.com/wp-content/uploads/2022/09/Tax-Rebate-1.jpg

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Individuals opting for the new tax regime in the current financial year can get a deduction under Section 80CCD 2 of the Income Tax Act by investing in NPS This deduction from gross total income can be claimed if the employer makes a contribution to NPS account on behalf of the employee Can you claim Income Tax Deduction on NPS contribution under New Tax Regime Are there any tax deductions under NPS Tier 2 account Under what sections of the IT act NPS investments can be claimed as tax deductions What is the investment proof to avail the tax benefit under NPS for FY 2023 24

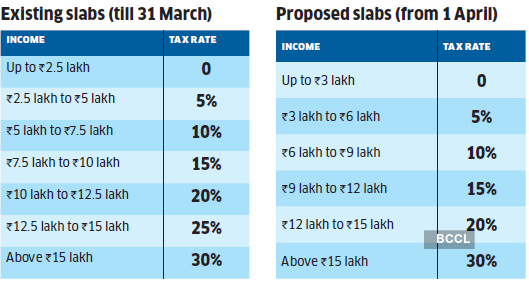

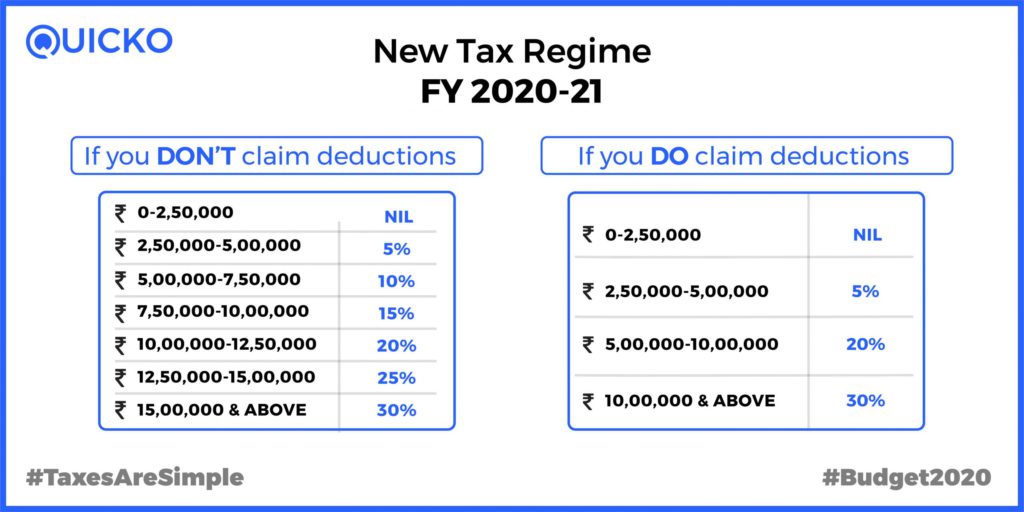

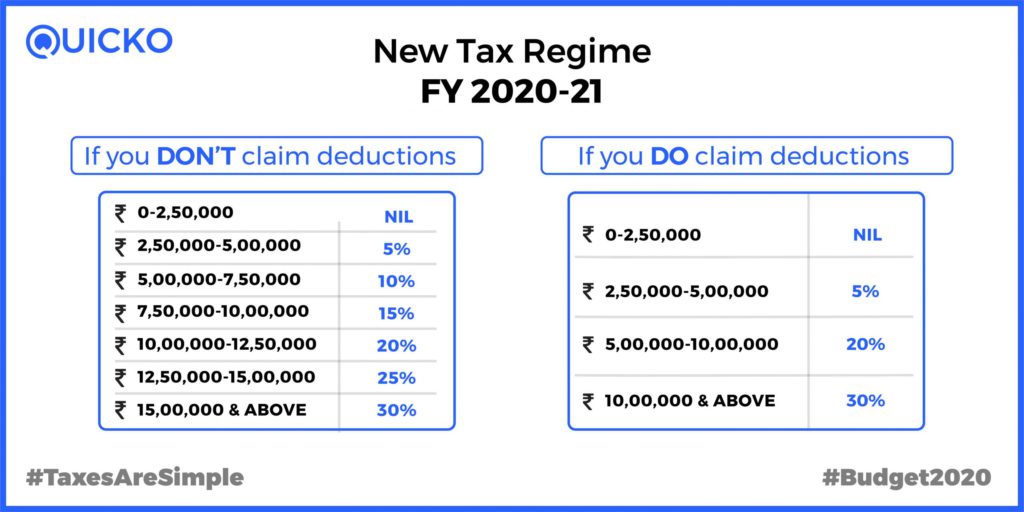

As of now for the financial year 2020 21 the new tax regime is only an option and one may stick to old tax regime while filing income tax returns for the assessment year 2021 22 NPS additions under New Tax Regime Budget 2024 25 Employees opting for the New Tax Regime are now entitled to a larger deduction of up to 14 of their basic salary for the contributions made by

Download Is Nps Rebate In New Tax Regime

More picture related to Is Nps Rebate In New Tax Regime

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

The New Tax Regime Offers A Higher Tax Exemption Raises The Threshold

https://img.etimg.com/photo/msid-97597074/image-1.jpg

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

https://static.tnn.in/photo/msid-101208384/101208384.jpg

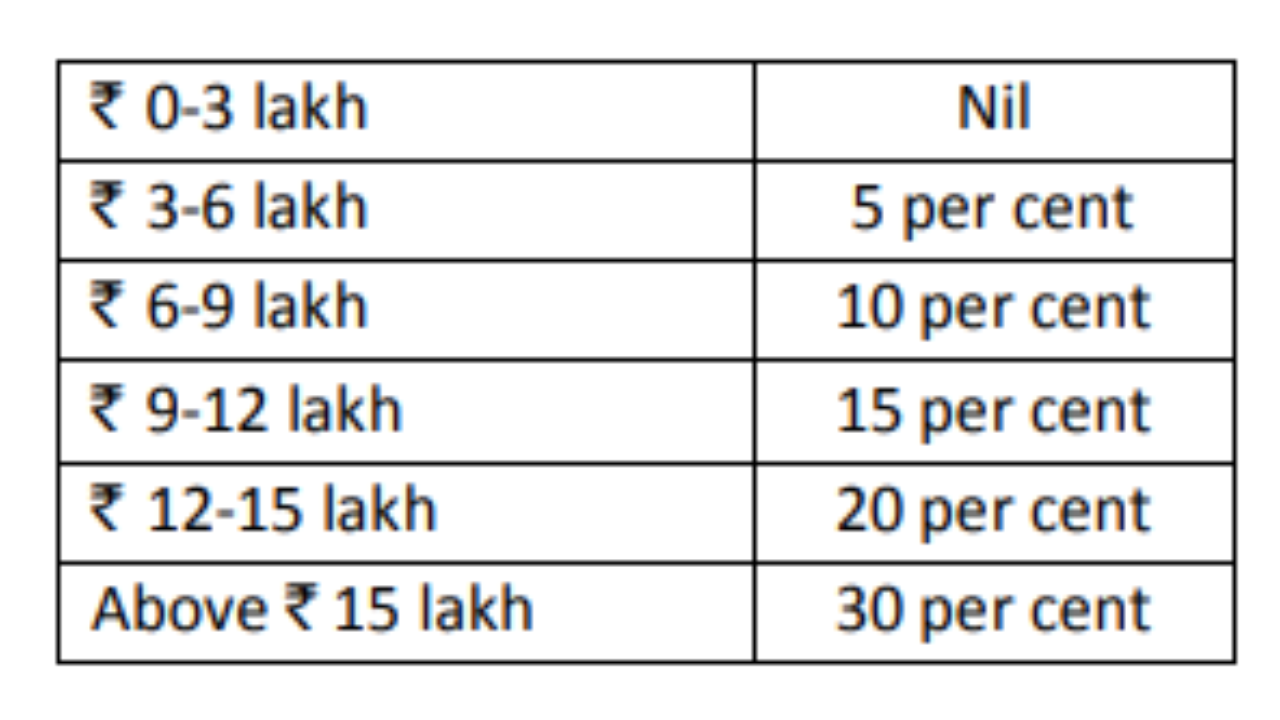

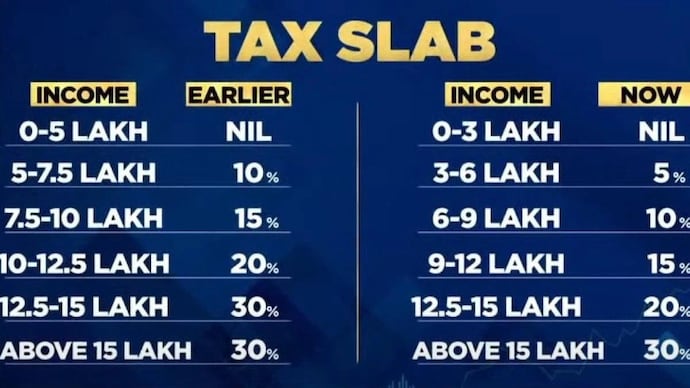

Under the new tax regime the contribution made by employer towards Tier 1 NPS account is eligible for tax deduction under section 80CCD 2 of Income Tax Act 1961 without any limit Under the old tax regime a maximum Rs 12 500 rebate was given if the taxable income did not exceed Rs 5 lakh However beginning April 1 2023 the new tax regime would provide a Rs 25 000 rebate if taxable income does not exceed Rs 7 lakh Under the old tax regime rebate of Rs 12 500 will continue for incomes up to Rs 5 lakh

An individual taxpayer is eligible to claim deduction under Section 80CCD 1B by filing the income tax return under the old tax regime However there is an age restriction for opening an NPS account The following individuals can open NPS Resident individuals between 18 70 years NPS subscribers can also claim deductions for contributions to the pension scheme under the new tax regime However the deductions are only allowed for the employer s part up to 10 per cent of

Union Budget 2023 24 Why Old Tax Regime Is Still Better Than New Tax

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202302/tax-graphic-1.jpg?itok=AFs3rjIf

Share

https://investinkenya.co.ke/wp-content/uploads/2024/03/c783e14b-0e27-4b10-a784-40bd925acdda-768x464.png

https://economictimes.indiatimes.com/wealth/tax/...

The budget has encouraged retirement planning by increasing the tax benefit on NPS payments and adding a new option to the pension system for minor children The deduction under Section 80CCD 2 is planned to be

https://cleartax.in/s/new-tax-regime-frequently-asked-questions

In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to pay any tax at all if they opt for the new tax regime

Opt New Tax Regime If Deduction Exemption Claims Less Than Rs 3 75

Union Budget 2023 24 Why Old Tax Regime Is Still Better Than New Tax

INTRODUCTION OF SECTION 115BAC TO INCOME TAX ACT 1961 Onfiling Blog

Budget 2023 Old Vs New Tax Regimes Who Should Make The Switch

Incomes That Are Exempted Under The Proposed New Tax Regime India

Income Tax Clarification Opting For The New Income Tax Regime U s

Income Tax Clarification Opting For The New Income Tax Regime U s

Budget 2023 Tax Saving Under New Tax Regime Vs Old Tax Regime For Rs 7

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Rebate Limit New Income Slabs Standard Deduction Understanding What

Is Nps Rebate In New Tax Regime - As of now for the financial year 2020 21 the new tax regime is only an option and one may stick to old tax regime while filing income tax returns for the assessment year 2021 22