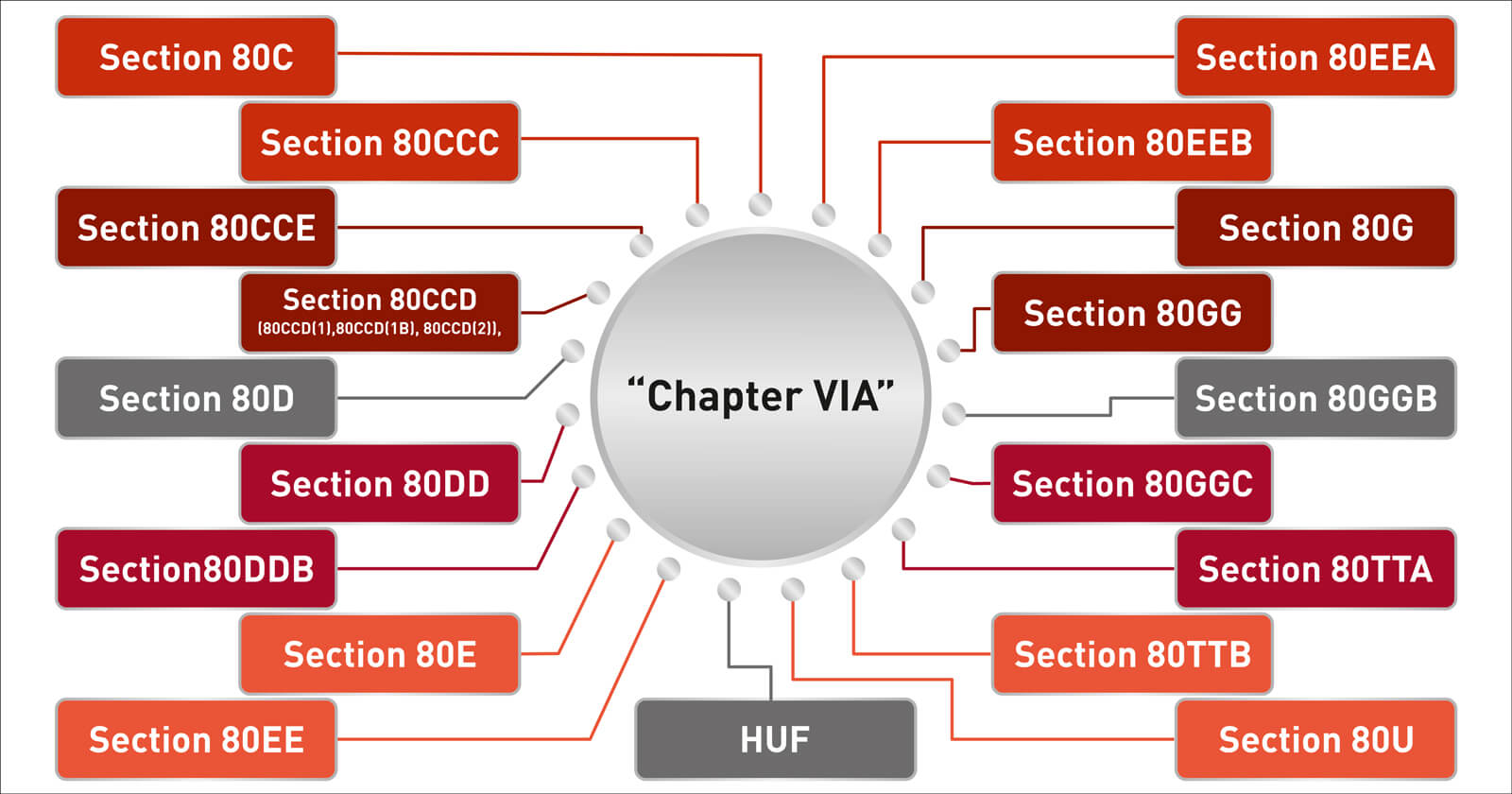

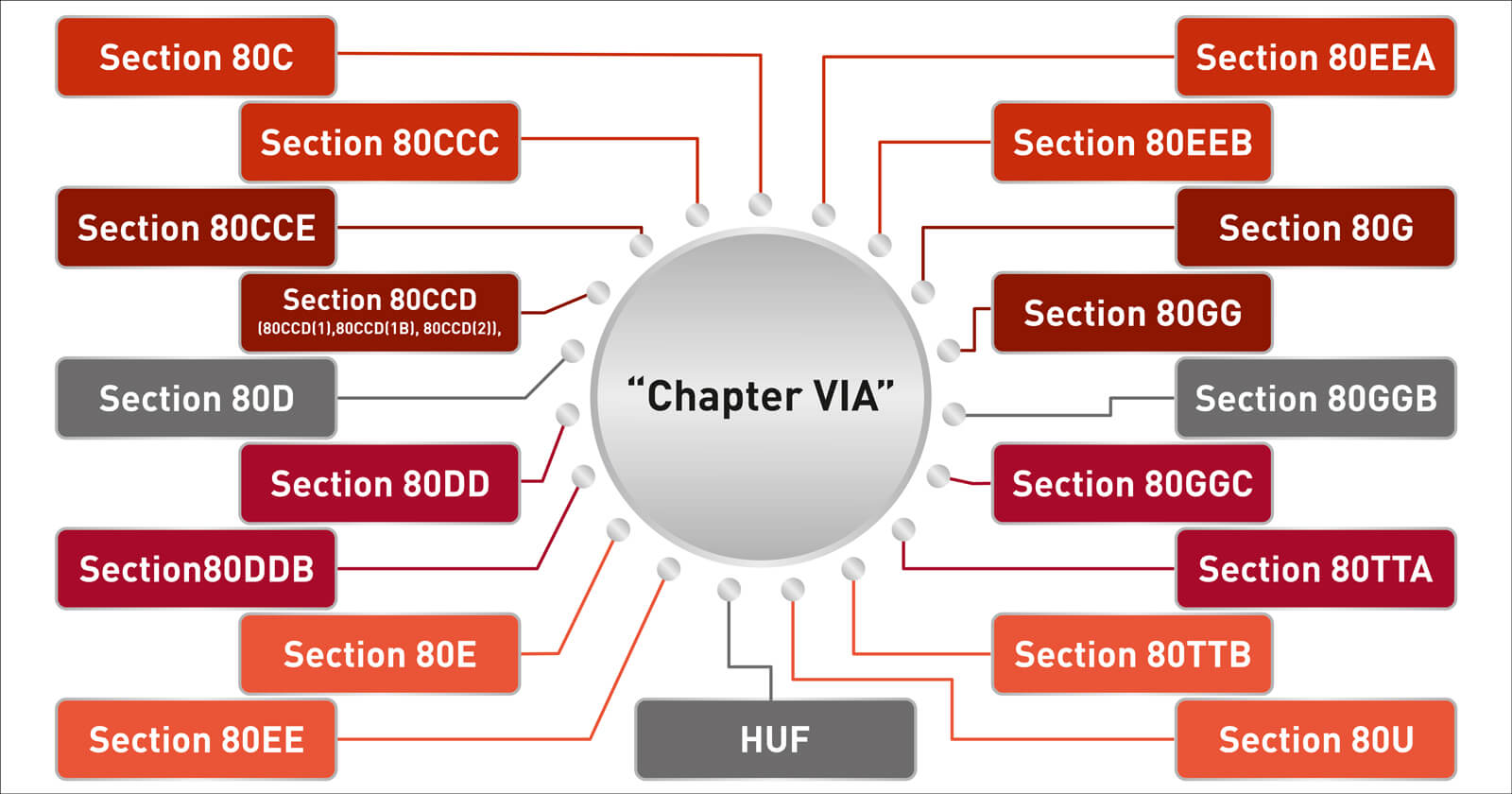

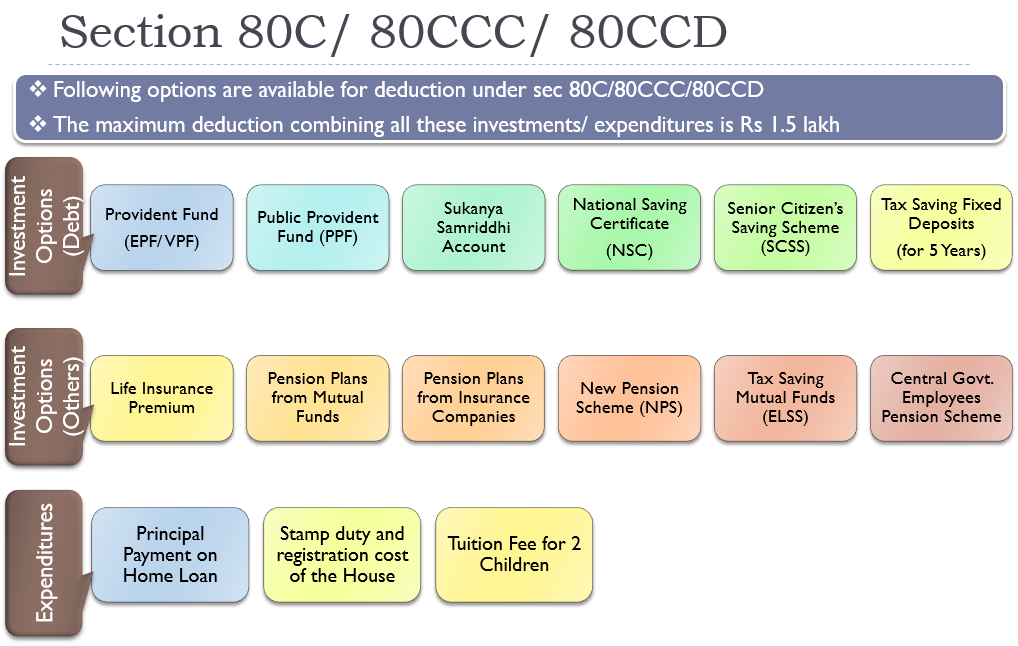

Is Nps Under 80c The maximum deduction under Section 80C 80CCC and 80CCD 1 put together is Rs 1 5 lakhs However you may claim an additional deduction of Rs 50 000

If you have exhausted the Rs 1 5 lakh limit under Section 80C then additional tax can be saved by investing Rs 50 000 in NPS This deduction claimed will be over and above Section 80C deduction of Rs 1 5 lakh Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such contribution

Is Nps Under 80c

Is Nps Under 80c

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

NPS Take off pressed ETS NORD

https://www.etsnord.fi/content/uploads/NPS-4.png

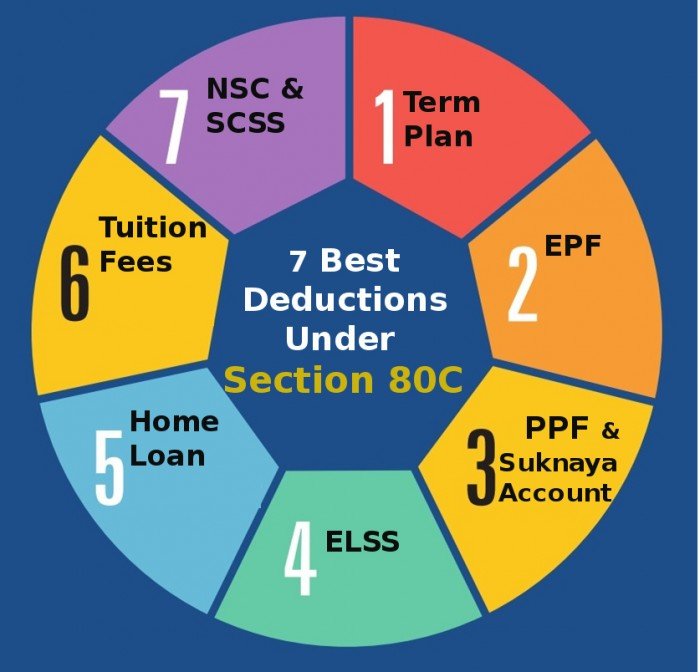

Section 80C Deduction Tax Saving Investment Options Under Section 80C

https://cdnblog.etmoney.com/wp-content/uploads/2019/12/Section-80C-768x319.jpg

Investments of up to Rs 1 5 lakh can be used to avail tax deductions under Section 80C Additional Rs 50 000 deduction is available for NPS contribution over and above Section 80C limit of Rs 1 5 lakh NPS National Pension Scheme tax benefits available only in Tier 1 NPS accounts NPS tax saving comes under Sec 80CCD 1 80CCD 1B 80CCD 2 deduction

Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction under sec 80 CCD What are the tax benefits under NPS Tax Benefit available to Individual Any individual who is Subscriber of NPS can claim tax benefit under Sec 80 CCD 1 with in the overall

Download Is Nps Under 80c

More picture related to Is Nps Under 80c

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/01/section-80c.jpg

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

Why Should You Invest In NPS By BFC CAPITAL On Dribbble

https://cdn.dribbble.com/userupload/8873558/file/original-eab950c204f48c4db13e6827419ff7c4.png?resize=1200x800

NPS is one of the listed investment options in which you can invest and save tax under Section 80C The deduction limit for this section is Rs 1 5 lakhs and you can invest the Yes that is correct Also no matter whether you are self employed or working with a Corporate NPS offers you can still invest in NPS to avail tax benefits under 80C This

The NPS investment provides retirement benefits along with tax benefits You can also voluntarily contribute to the NPS account The tax benefit is available for investment in NPS Tier I accounts The deduction of NPS is So a government employee a private sector employee self employed or an ordinary citizen can claim benefit of Rs 50 000 under Section 80CCD 1B Therefore the total

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

https://i.ytimg.com/vi/Q6z6wI7m9Eo/maxresdefault.jpg

https://cleartax.in

The maximum deduction under Section 80C 80CCC and 80CCD 1 put together is Rs 1 5 lakhs However you may claim an additional deduction of Rs 50 000

https://economictimes.indiatimes.com › we…

If you have exhausted the Rs 1 5 lakh limit under Section 80C then additional tax can be saved by investing Rs 50 000 in NPS This deduction claimed will be over and above Section 80C deduction of Rs 1 5 lakh

Section 80C Deduction Under Section 80C In India Paisabazaar

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Why Is 80C The Best Tax Saving Instrument

Section 80C Deduction FAQs Finwisdom

NPS Vs PPF Which Is Better Personal Finance Plan

Section 80c Everything You Should Know Deduction Under 80c Tax

Section 80c Everything You Should Know Deduction Under 80c Tax

NPS Miar Sukcesu Blog Bluerank

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

Here A List Of Types Of Deductions Covered Under Section 80C

Is Nps Under 80c - NPS National Pension Scheme tax benefits available only in Tier 1 NPS accounts NPS tax saving comes under Sec 80CCD 1 80CCD 1B 80CCD 2 deduction