Is Nps Withdrawal Taxable As per the provisions of section 10 12A of the Income tax Act 1961 any withdrawal from the NPS Trust is exempt up to 60 of the total amount payable at the

The NPS can earn higher returns than the PPF or FDs but it is not as tax efficient upon maturity For instance you can withdraw up to 60 of your accumulated Withdrawal 1 How Exit is defined under NPS An exit is defined as closure of individual pension account of the subscriber under National Pension System 2 When can a

Is Nps Withdrawal Taxable

Is Nps Withdrawal Taxable

https://geod.in/wp-content/uploads/2021/08/NPS-Withdrawal-Form.jpg

When Is EPF Withdrawal Taxable Here s Everything You Need To Know News18

https://images.news18.com/ibnlive/uploads/2023/09/image-1200x900-2023-09-26t050601.219-2023-09-e69c8c0dc58f3134985edeed20dc7984-16x9.png?impolicy=website&width=1200&height=675

NPS Withdrawal Rules For Premature Withdrawal Max Life Insurance

https://www.maxlifeinsurance.com/content/dam/corporate/images/shutterstock_1530453095.jpg

Tax Treatment on partial withdrawal from NPS 25 of the permissible withdrawal from the NPS account is tax free The contribution made to the Tier I With the balance you have to buy an annuity with taxable returns 25 of the withdrawn amount is tax free in cases of partial withdrawals Under Section 80CCD 1B

Tax benefit on lump sum withdrawal Eligible for tax exemption on lumpsum withdrawal of 60 of accumulated pension wealth upon attaining the age of 60 or superannuation Tax Benefits Under NPS As Per May 2024 The contributions to NPS are tax deductible under 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Indian Income Tax Act 1961 The tax

Download Is Nps Withdrawal Taxable

More picture related to Is Nps Withdrawal Taxable

Resume Instance Sample Withdrawal Letter

https://lh5.googleusercontent.com/proxy/ZCSx9t3THmLmee9xKbZkCOAk9OscQQUmItxzY2bHNPHy0ZUU3yOQlZImu3EG7fVtW0GtG5hbeYI2PsmyRFUMJ2j-qFxZhvCLx13wtbceGWSl_CtqZa2DSLjr9k4TQCP9QmM=s0-d

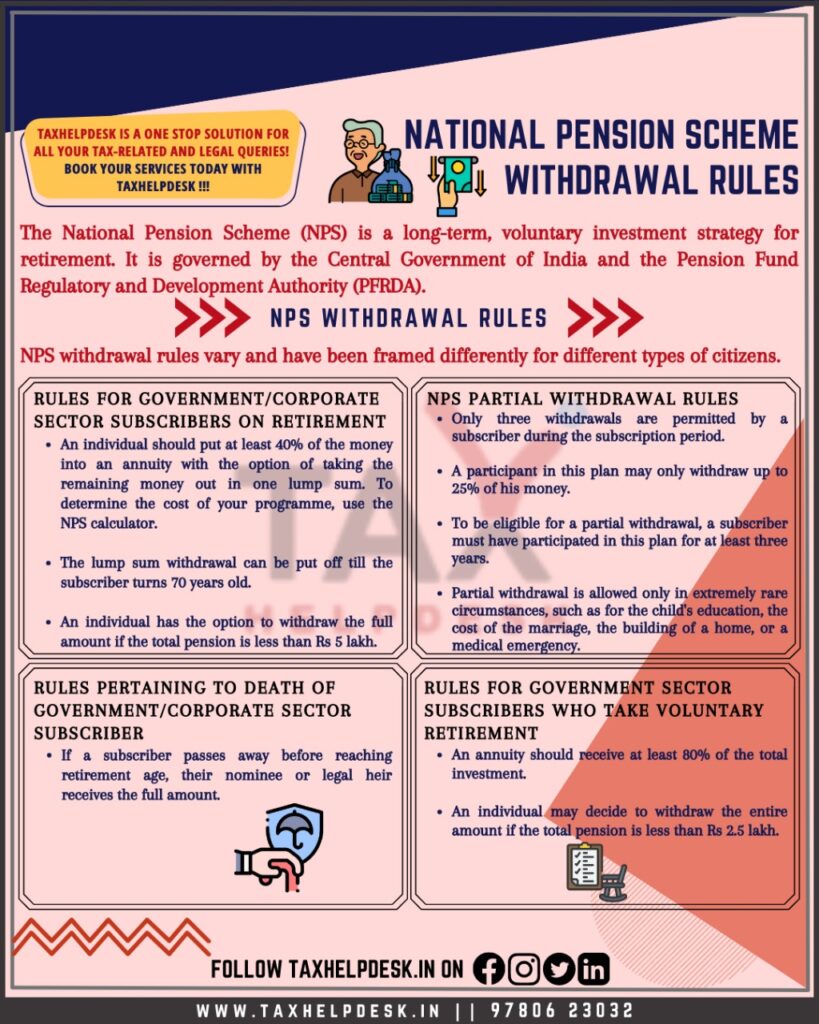

NPS Withdrawal Rules Corporate Government Employees

https://www.thebuyt.com/wp-content/uploads/2021/10/NPS-withdrawal-rule-scaled.jpg

![]()

Withdrawal Procedure Overseas Programs

https://overseas.wustl.edu/files/overseas/Icons/IQPlan_420x420.png

Employer s NPS contribution for the benefit of employee up to 10 of salary Basic DA is deductible from taxable income up to 7 5 Lakh Corporates Employer s Contribution Tax on NPS withdrawal Following are the tax rules for NPS withdrawal Taxation of NPS withdrawal amount upon maturity Upon maturity of the NPS account

Partial Withdrawal From NPS Pre mature withdrawal is not allowed from the scheme however for some specific purposes say Higher education of children You can withdraw entire NPS corpus lumpsum if Rs 5 lakh or less but 40 will be taxable By Sudhakar Sethuraman Vijayalakshmi Kartik ET

Understanding Casino Withdrawal Limits Brango Magazine

https://casinobrango.com/blog/wp-content/uploads/2019/09/withdrawal.jpg

Partial Withdrawal Form For Tier I Account Under NPS

https://lh3.googleusercontent.com/-w9_zuGubPyQ/ZDBD1_h4oVI/AAAAAAAADr8/pl1NP11nGFEJjD1HNkazEX_sn7h00MHZACNcBGAsYHQ/s1600/1680884686159421-2.png

https://www.livemint.com/money/personal-finance/is...

As per the provisions of section 10 12A of the Income tax Act 1961 any withdrawal from the NPS Trust is exempt up to 60 of the total amount payable at the

https://cleartax.in/s/nps-national-pension-scheme

The NPS can earn higher returns than the PPF or FDs but it is not as tax efficient upon maturity For instance you can withdraw up to 60 of your accumulated

Partial Withdrawals From NPS For Different Purpose And Procedural

Understanding Casino Withdrawal Limits Brango Magazine

NPS National Pension Scheme

Important National Pension Scheme NPS Withdrawal Rules

Latest NPS Withdrawal Rules Govt Corporates BestInvestIndia

NPS Withdrawal Rules All You Need To Know

NPS Withdrawal Rules All You Need To Know

Travis Texas Motion For Withdrawal Of Counsel Motion To Withdraw As

Computer Use Addiction And Withdrawal Syndromes What You Need To Know

NPS Withdrawal Online Process Forms Rules Limit Taxation

Is Nps Withdrawal Taxable - The full value of the money withdrawn from Tier II account cannot be taxed as the law makers would not have contemplated taxing something at the time of