Is Nri Fd Tax Free The fixed deposit for NRI s attract taxes as per Indian constitution Know about NRO tax deductions NRI account tax implication on FD investment in India and DTAA

NRE and FCNR fixed deposits offer tax free interest income while interest earned on NRO fixed deposits is taxable in India Explore the benefits of NRI fixed deposits in 2024 NRE Deposit is tax free in India as NRE Accounts are meant to maintain the income earned outside India If you withdraw the funds from your NRE Fixed Deposit Account

Is Nri Fd Tax Free

Is Nri Fd Tax Free

https://sbnri.com/blog/wp-content/uploads/2021/07/IDFC-NRI-FD-Rates.jpg

IRS In Flux New Funding And New Commissioner

https://imageio.forbes.com/specials-images/imageserve/6361672932afc59d9027c5a2/0x0.jpg?format=jpg&width=1200

NRI Taxation In India Under Income Tax NRI Taxation Taxes On Non

https://i.ytimg.com/vi/_SvCMYqkj8g/maxresdefault.jpg

NRE FCNR B fixed deposits offer tax free interest and unrestricted repatriation On the other hand NRO FDs attract taxes but allow repatriation upto USD 1 million An NRI Fixed Deposit is one of the safest ways to earn tax free interest in India You can choose between the options of an NRE NRO or an FCNR Fixed Deposit in India as an

TDS on NRI Account An NRE account is completely tax free This means that both savings and fixed deposits in NRE accounts as well as the interest earned on them in India To know if TDS is applicable for NRE These incomes are taxable for an NRI Income which is earned outside India is not taxable in India Interest earned on an NRE account and FCNR account is tax free Interest on

Download Is Nri Fd Tax Free

More picture related to Is Nri Fd Tax Free

1 000 000 TAX FREE The ROTH IRA Explained YouTube

https://i.ytimg.com/vi/ua-yuU5HjYY/maxresdefault.jpg

TAX FREE DRIGVA

https://drigva.com/wp-content/uploads/customs.jpg

Gifting The Stock Market JBVal

https://jbval.com/wp-content/uploads/2022/09/blog_tax-free.jpg

With HDFC Bank NRE Fixed Deposit Account for NRIs earn attractive tax free interest on savings Transfer funds from abroad in a freely convertible foreign currency NRIs can deposit their foreign currency into an India account using a Non Resident External NRE FD account The NRE account is denominated in Indian rupees and is tax free

Since an NRE account holds only that income that has been earned overseas and not in India it remains completely tax free This means that both the interest earned on an NRO FD Non Resident Ordinary or NRO Fixed Deposits allow NRIs to earn interest on the income earned in India These accounts can be opened jointly with a resident or non

Tax Deferred Tax Free Withdrawals Guaranteed YouTube

https://i.ytimg.com/vi/Dt-gwowYIfE/maxresdefault.jpg

SBI FD Interest Rate April 2023 Latest SBI Fixed Deposit Rates

https://navi.com/blog/wp-content/uploads/2023/04/SBI-FD-Interest-Rate.jpg

https://www.hdfcbank.com/personal/resources/...

The fixed deposit for NRI s attract taxes as per Indian constitution Know about NRO tax deductions NRI account tax implication on FD investment in India and DTAA

https://tax2win.in/guide/nri-fixed-deposit

NRE and FCNR fixed deposits offer tax free interest income while interest earned on NRO fixed deposits is taxable in India Explore the benefits of NRI fixed deposits in 2024

Labour Would Freeze Council Tax This Year Radio NewsHub

Tax Deferred Tax Free Withdrawals Guaranteed YouTube

NRI Account Types And Their Differences 2023 Guide

Exploring The Attributes Of Income Tax On NRI

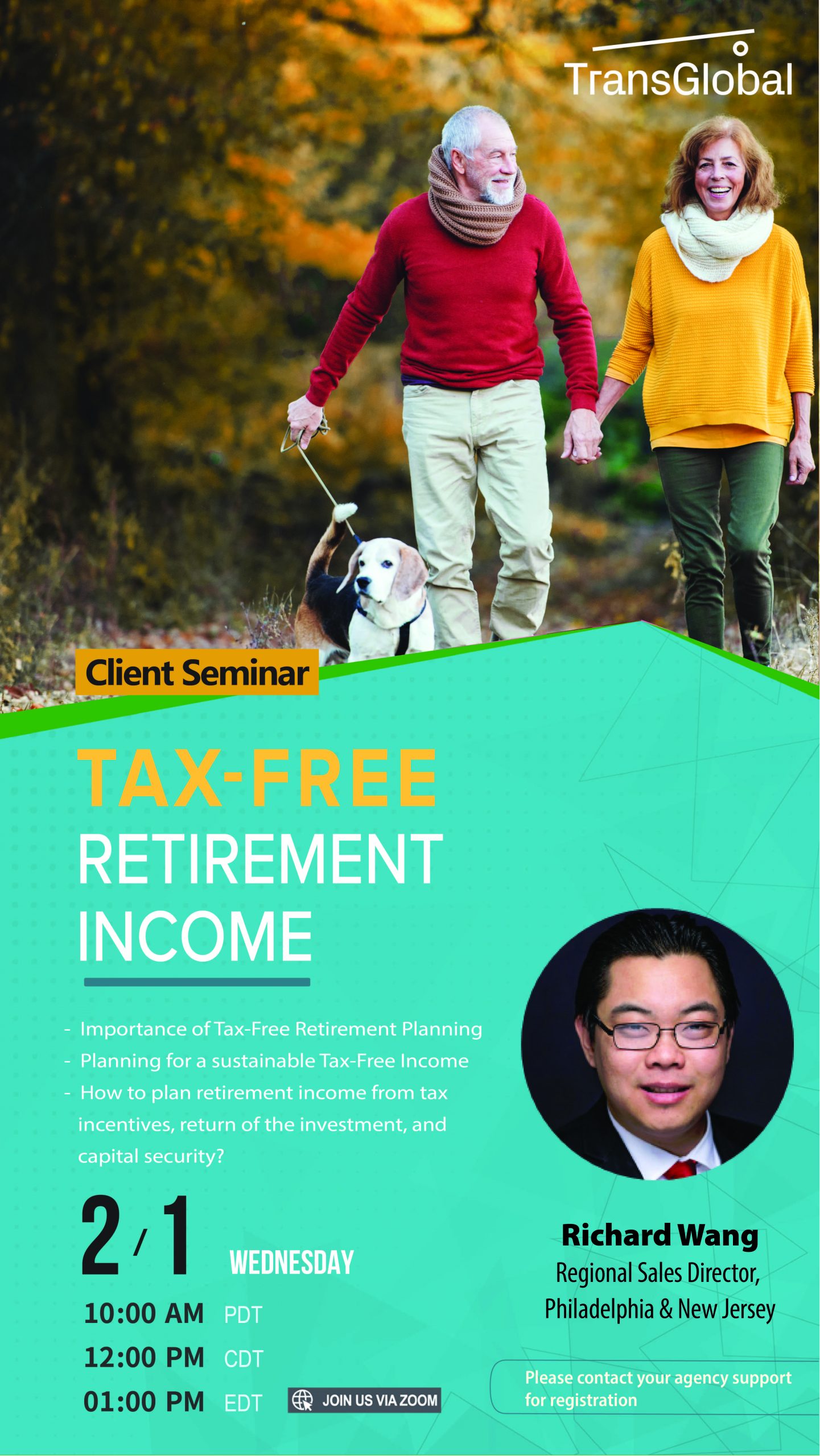

Tax Free Retirement Income TransGlobal Holding Company

A Complete Guide On NRI Income Tax Return Filing In India Ebizfiling

A Complete Guide On NRI Income Tax Return Filing In India Ebizfiling

NRI NRI NRI

Tax Free Entertainment

1 000 TAX FREE CASH 100 INSTANT WINS RaffledUp

Is Nri Fd Tax Free - NRE FCNR B fixed deposits offer tax free interest and unrestricted repatriation On the other hand NRO FDs attract taxes but allow repatriation upto USD 1 million