Is Oasdi A Pre Tax Deduction According to the Social Security Administration as of 2020 you would calculate OASDI tax at 6 2 percent of taxable wages up to 137 700 for the year Let s say you earn weekly

OASDI stands for old age survivors and disability insurance tax and the money that your employer collects goes to the federal government in order to fund the Social Security OASDI also known as the Social Security tax is an acronym for the Old Age Survivors and Disability Insurance program which provides monthly benefits to qualified

Is Oasdi A Pre Tax Deduction

Is Oasdi A Pre Tax Deduction

https://phantom-marca.unidadeditorial.es/20ae938ce584cc8c14f4038c6ce7545c/resize/1200/f/jpg/assets/multimedia/imagenes/2022/04/23/16507348197606.jpg

What OASDI Tax Is And Why You Should Care The Motley Fool

https://g.foolcdn.com/editorial/images/439678/tax-gettyimages-507839992.jpg

OASDI Tax What Is It And Is It Mandatory To Pay The Tax Marca

https://phantom-marca.unidadeditorial.es/57bb8dad8636f7e2415710200cae7a14/resize/1320/f/jpg/assets/multimedia/imagenes/2023/01/26/16747454507416.jpg

OASDI taxes impose a 6 2 rate on employees and 12 4 on self employed workers Paying this tax simulates saving for retirement while funding the federal government s Social Security program which Is OASDI Tax Mandatory Yes federal law requires that workers and employers contribute to the OASDI fund through Social Security taxation on income of up to 160 200 for 2023 and 168 600 in

The OASDI Old Age Survivors and Disability Insurance tax is a U S tax that is levied on your earned income to fund the Social Security program The tax is a OASDI stands for Old Age Survivors and Disability Insurance Here s why you see the 6 2 tax taken from your paycheck and what your employer pays

Download Is Oasdi A Pre Tax Deduction

More picture related to Is Oasdi A Pre Tax Deduction

Tax Brackets For Paychecks BearSantino

https://fitsmallbusiness.com/wp-content/uploads/2021/08/Infographic_Pre-Tax_Deductions_vs_Post-Tax_Deductions.svg

What Is Fed OASDI EE Tax On My Paycheck Old Blog Posts

https://old.tonyflorida.com/wp-content/uploads/2022/09/federal-oasdi-paycheck-768x425.png

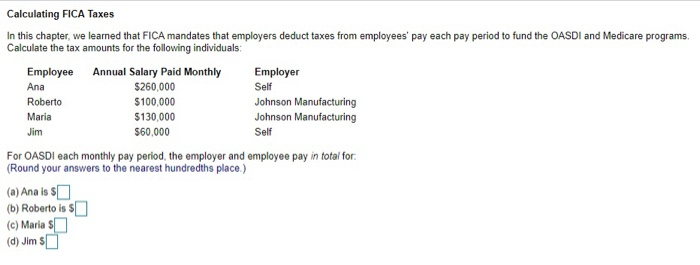

How To Calculate Oasdi And Medicare Taxes

https://media.cheggcdn.com/study/55a/55a81cbc-5b27-4d9e-9d4b-b32e7521878f/image.png

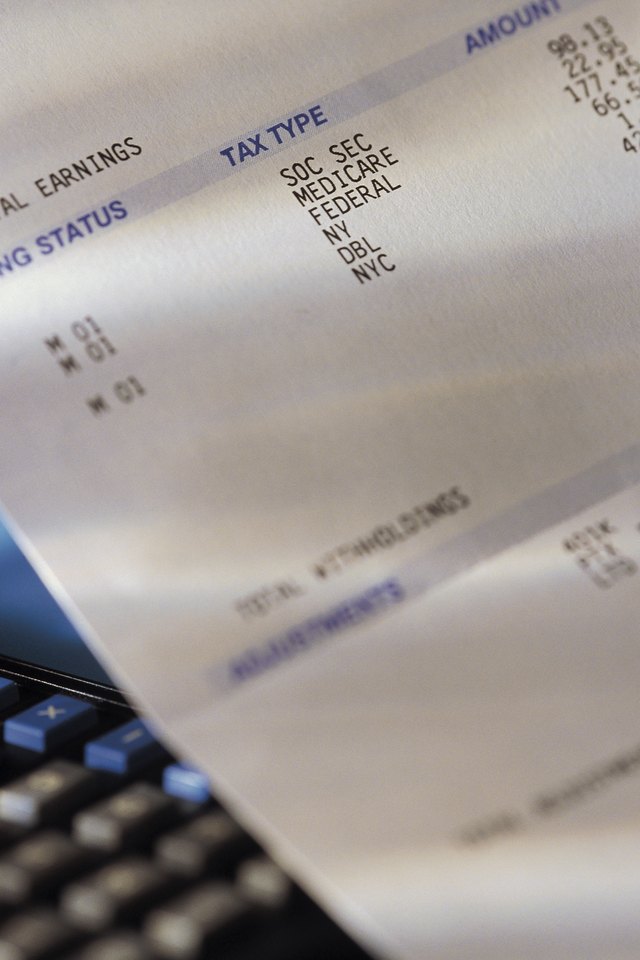

When an employee looks at their paycheck they ll probably see a deduction for OASDI meaning there was a mandatory deduction to pay their Social Security taxes OASDI OASDI Tax is Part of Your Paycheck Deductions The OASDI tax is significant but it s not the only deduction you see every paycheck Another term you

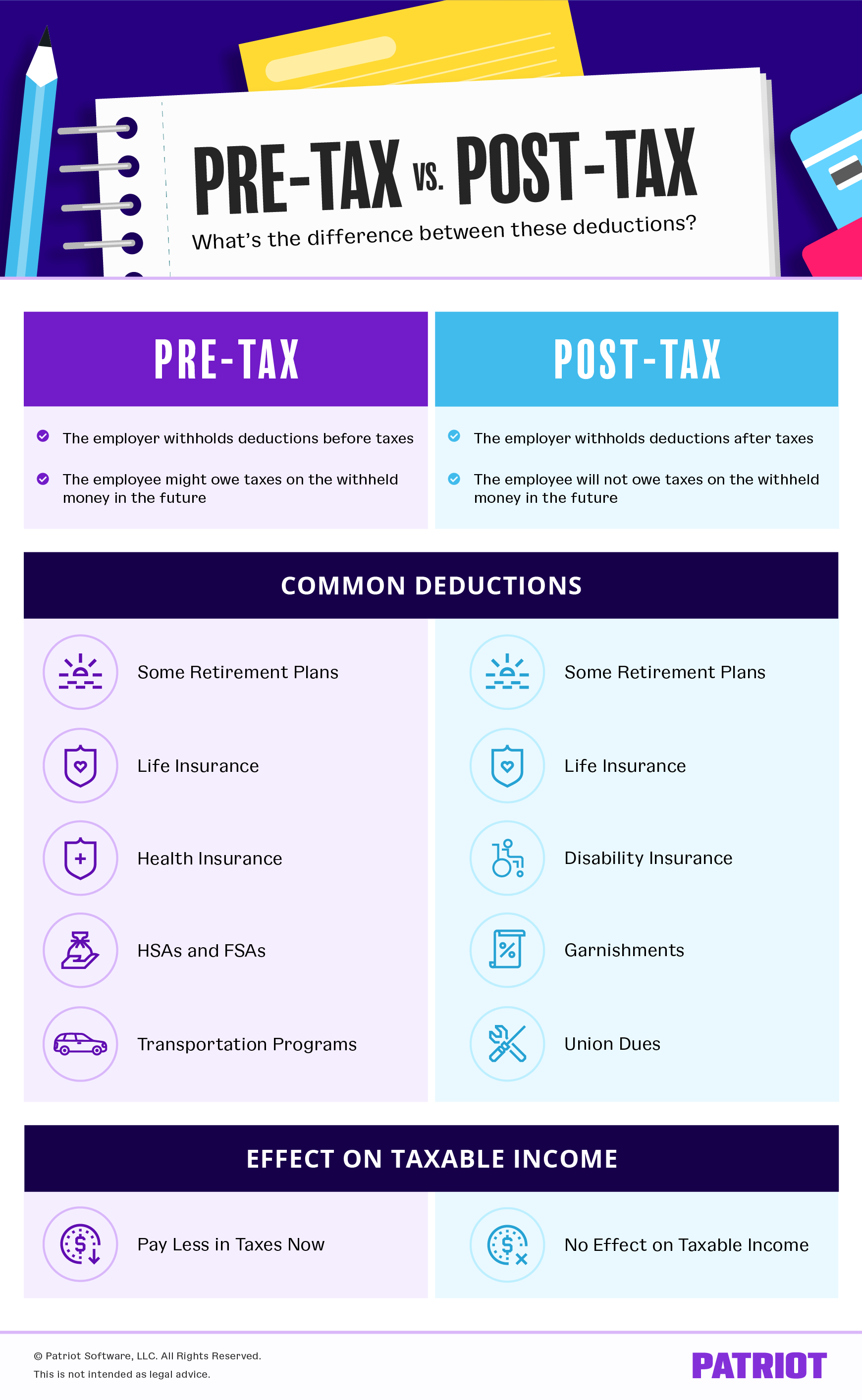

Wages subject to OASDI are gross wages less non taxable entitlements pre tax items such as Federal Employees Health Benefits FEHB Dental Vision and A payroll deduction plan withholds money from an employee s paycheck to pay for taxes or certain benefits and services Voluntary payroll deductions are

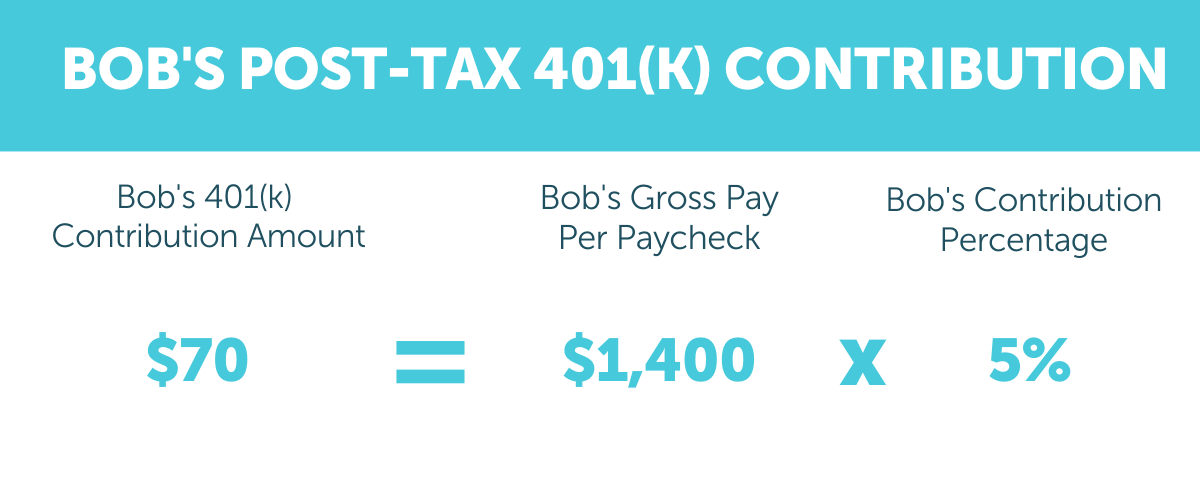

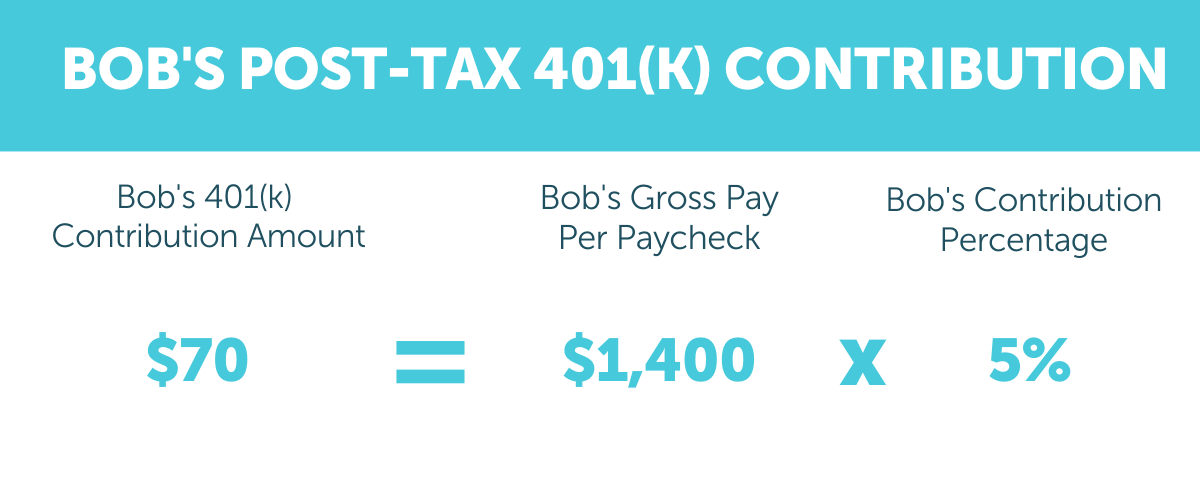

401k Reduce Taxable Income Calculator ArmaanHakeem

https://apspayroll.com/wp-content/uploads/2021/07/Bobs-Post-Tax-401k-Contribution.png

What Is The OASDI Deduction On A Paycheck Sapling

https://img.saplingcdn.com/640/photos.demandstudios.com/getty/article/88/2/78457575.jpg

https://work.chron.com

According to the Social Security Administration as of 2020 you would calculate OASDI tax at 6 2 percent of taxable wages up to 137 700 for the year Let s say you earn weekly

https://www.fool.com › taxes › what-oasdi-tax-is-and...

OASDI stands for old age survivors and disability insurance tax and the money that your employer collects goes to the federal government in order to fund the Social Security

What Is OASDI Tax

401k Reduce Taxable Income Calculator ArmaanHakeem

What Is OASDI Tax

What Are Pre Tax Deductions

ZIP Maker Pro How To Quickly Understand OASDI Tax

How To Get W2 From Walmart After Quitting Gina s Blog

How To Get W2 From Walmart After Quitting Gina s Blog

What Is OASDI Tax

Is Wages Or Salary Before Or After Federal Tax Deductions Federal

What Is OASDI Tax

Is Oasdi A Pre Tax Deduction - OASDI taxes impose a 6 2 rate on employees and 12 4 on self employed workers Paying this tax simulates saving for retirement while funding the federal government s Social Security program which