Is Portugal Tax Free For Expats The Non Habitual Residency NHR program is a tax incentive that has attracted many expats to Portugal offering significant tax advantages including a reduced income tax rate for certain professions

Is Portugal a tax friendly country Portugal can be a tax friendly country for non habitual residents who can benefit from fixed tax rates of around 20 percent for a Your tax liability as an expat in Portugal depends on your residency status which is defined by your time living and working in the country If you live in Portugal for 183 or

Is Portugal Tax Free For Expats

Is Portugal Tax Free For Expats

https://files.taxfoundation.org/20200812165900/linkedin-In-Stream_Wide___Portugal-3.jpg

Taxes In Portugal Tax System In Portugal YouTube

https://i.ytimg.com/vi/8UDQlxuUCBw/maxresdefault.jpg

The Tax System In Portugal A Guide For Expats

https://www.globalcitizensolutions.com/wp-content/uploads/2021/03/calculator-1680905_1280.jpg

Navigate Portuguese tax laws hassle free Our comprehensive guide simplifies tax obligations for expats in Portugal Expert advice at your fingertips Portugal does not have a specific Portugal tax free 10 years rule that exempts individuals from tax However Portugal had a Non Habitual Resident NHR

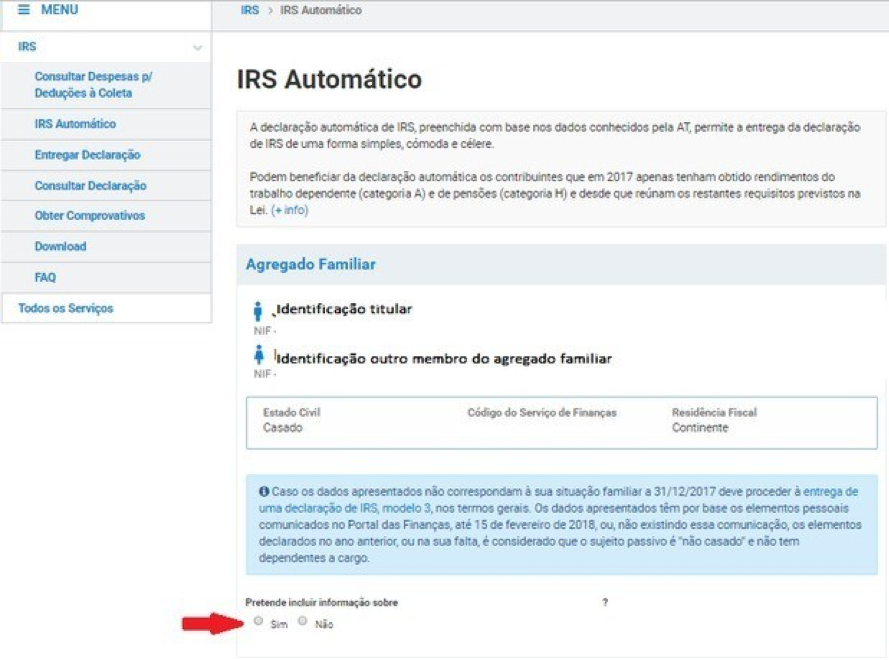

If you are an expat living in Portugal obtaining a N mero de Identifica o Fiscal NIF is indeed necessary before you can file your tax return The NIF serves as your tax identification number and is It works like this the tax code allows expats in some professions to benefit from a tax exemption on all forms of income employment business investment rental

Download Is Portugal Tax Free For Expats

More picture related to Is Portugal Tax Free For Expats

QROPS Portugal Tax Avoidance For British Expats In Portugal YouTube

https://i.ytimg.com/vi/OKIyM8qQa7I/maxresdefault.jpg

Guide To Taxes The Tax System In Portugal Portugal

https://www.portugal.com/wp-content/uploads/2022/04/standsome-worklifestyle-LunwV7uPbeE-unsplash-scaled.jpeg

Tax Free Em Portugal Como Funciona Preciso Viajar

https://precisoviajar.com/wp-content/uploads/2019/12/tax-free.jpg

If you are a tax resident in Portugal meaning you reside in Portugal for 183 days or more a year you need to pay income tax on your worldwide income If you Portugal is not tax free for expats but it does offer some tax benefits under the Non Habitual Resident NHR regime Expats who qualify for the NHR status can

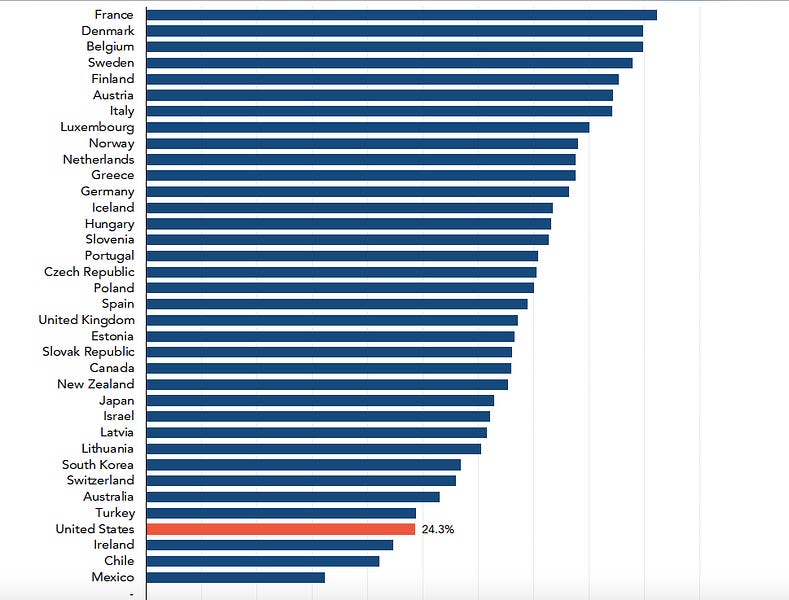

Residents in Portugal for tax purposes are taxed on their worldwide income at progressive rates varying from 13 25 to 48 for 2024 Non residents are liable to Even outside of NHR Portugal can be highly tax efficient While income is taxable at progressive income tax rates up to 48 there are often ways to lower taxes

Golden Visa Portugal Crypto Tax Laws

https://golden-visa-portugal.com/wp-content/uploads/2021/12/portugal-crypto-tax.png

Portugal Tax Myths Why Portugal Is Bad For Freelancers And Digital

https://i.ytimg.com/vi/9vM3KlHEJf4/maxresdefault.jpg

https://getnifportugal.com/taxes-in-portugal-f…

The Non Habitual Residency NHR program is a tax incentive that has attracted many expats to Portugal offering significant tax advantages including a reduced income tax rate for certain professions

https://www.movingto.io/pt/taxes-in-portugal

Is Portugal a tax friendly country Portugal can be a tax friendly country for non habitual residents who can benefit from fixed tax rates of around 20 percent for a

Portugal US Tax Treaty Tax Treatment For Americans Golden Port Visa

Golden Visa Portugal Crypto Tax Laws

Portugal NHR TAX FREE Don t Move To Portugal BEFORE Watching This

Tax Breaks Expats Head For Portugal The Portugal News

How Will You Be Taxed In Portugal Portugal Confidential

Personal Tax Deductions In Portugal For 2022

Personal Tax Deductions In Portugal For 2022

Portugal Tax Benefits By Nancy Whiteman

Taxes In Portugal VAT Property Taxes And Income Tax As A Resident

How To File And Submit Your Online IRS Income Tax Return In Portugal

Is Portugal Tax Free For Expats - Detailed overview of tax in Portugal for expats and foreign nationals living in or moving to Portugal including the Non Habitual Resident tax scheme