Is Ppf Interest Taxable Contribution to the PPF scheme is governed by Section 2 11 of the Income Tax Act According to Section 10 11 any sum relating to contribution made in provident fund constituted by the central government is exempted

So all said and done and practically speaking the new rule change proposed in Budget 2021 that interest from PF contributions above Rs 2 5 lakh is taxable currently does not apply to the PPF or Public Provident Fund So for now PPF is excluded from the new rule on PF interest being taxed Interest amount and the maturity amount received from recognised provident fund are exempt from income tax under the new tax regime also by virtue of Section 10 11 and Section 10 12

Is Ppf Interest Taxable

Is Ppf Interest Taxable

https://www.maxlifeinsurance.com/content/dam/corporate/images/What_Is_a_Tax_Saving_Fixed_Deposit-2.png

All About Public Provident Fund Is PPF Interest Taxable Bharti AXA

http://www.bhartiaxa.com/sites/default/files/2023-03/Is-PPF-Interest-taxable.jpg

Public Provident Fund Know All About PPF Is PPF Interest Taxable 2023

https://www.maxlifeinsurance.com/content/dam/corporate/images/Public_Provident_Fund_taxable-2.png

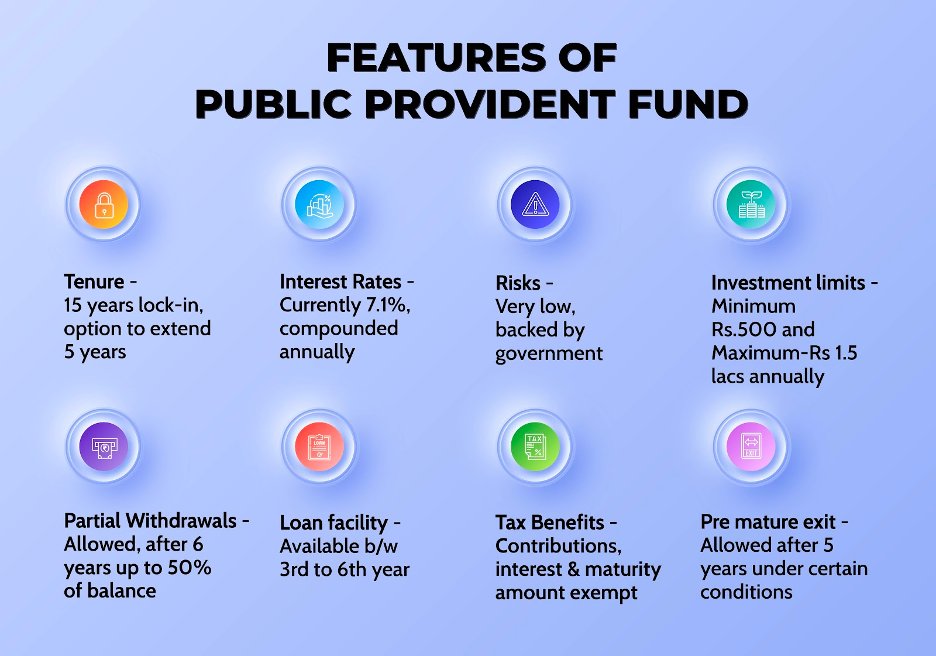

1 1 Section 10 11 and 10 12 of the Income Tax Act provides an exemption for the statutory provident fund and recognized provident fund respectively Till 31 st March 2021 the interest credited every year in the Employee provident fund account EPF was exempt from tax Under Section 80C you can deduct a maximum of Rs 1 5 lakh for PPF contributions Also interest earned and maturity received under the PPF scheme is tax free 4 How PPF interest rate is Calculated PPF is a fixed return investment with an interest rate decided by the Government of India quarterly

Apart from this interest earned and maturity proceeds are also tax free In short the PPF account is important for individuals who want to save invest and plan for their financial future while benefiting from tax incentives and the certainty of government backed security Features of the PPF account No the interest income from the Public Provident Fund PPF remains completely exempt from income tax even in the New Tax regime because the interest earned on PPF is considered as an

Download Is Ppf Interest Taxable

More picture related to Is Ppf Interest Taxable

Public Provident Fund Know All About PPF Is PPF Interest Taxable

https://www.maxlifeinsurance.com/static-page/assets/homepage/PPF_calculator_formula_ebc5e19bde_37e4939da7.webp

Why PPF Is Excluded From New Rule On Taxable PF Interest

https://freefincal.com/wp-content/uploads/2021/02/Why-PPF-is-excluded-from-new-rule-on-taxable-PF-interest.png

How Is Interest Calculated On PPF What Makes PPF So Popular The

https://img.etimg.com/thumb/msid-90775911,width-1070,height-580,overlay-etwealth/photo.jpg

Further the Union Budget 2021 introduced taxability on the interest accrued on the Employees Provident Fund EPF account for contributions in excess of Rs 2 5 lakh Further the interest you earn on it alongwith its maturity proceeds will be tax free in the hand of investor This article is covering various points related to PPF scheme Page Contents Eligibility for Investment in Public Provident Fund PPF Public Provident Fund PPF Investment and Returns Continuing PPF after the 15 year period

[desc-10] [desc-11]

PPF Interest Rate Chart 2003 To 2024 Heat Map Stable Investor

https://i0.wp.com/stableinvestor.com/wp-content/uploads/2023/07/PPF-Interest-Rate-Chart-2023.png?fit=715%2C525&ssl=1

PPF Interest Rate History 1968 To Present

https://freefincal.com/wp-content/uploads/2020/09/PPF-interest-rate-history-from-1968-to-2020.jpg

https://www.taxscan.in/article/taxability-of...

Contribution to the PPF scheme is governed by Section 2 11 of the Income Tax Act According to Section 10 11 any sum relating to contribution made in provident fund constituted by the central government is exempted

https://stableinvestor.com/2021/02/pf-interest-tax-applicable-ppf.html

So all said and done and practically speaking the new rule change proposed in Budget 2021 that interest from PF contributions above Rs 2 5 lakh is taxable currently does not apply to the PPF or Public Provident Fund So for now PPF is excluded from the new rule on PF interest being taxed

Interest Rates Stay On Hold Infinite Wealth

PPF Interest Rate Chart 2003 To 2024 Heat Map Stable Investor

Is Interest On Minor s PPF Account Taxable TechiAzi

PPF New Rules 2020 PPF Interest Calculation PPF Excel Calculator

PPF Interest Calculator India Posts Retired Officers Association

The Government Recently Hiked Interest Rates Of All Small Savings

The Government Recently Hiked Interest Rates Of All Small Savings

Know Process Of Save Income Tax And Get More Interest On PPF

Interest Rates On PPF And Other Small Savings Deposits May Rise

1000 PPF Interest Calculation For 15 Years FinCalC Blog

Is Ppf Interest Taxable - No the interest income from the Public Provident Fund PPF remains completely exempt from income tax even in the New Tax regime because the interest earned on PPF is considered as an