Is Proof Required For 80d Preventive Health Checkup Therefore you must ensure that the payments for your medical expenses as well as your health insurance premium are done in a non cash mode Furthermore

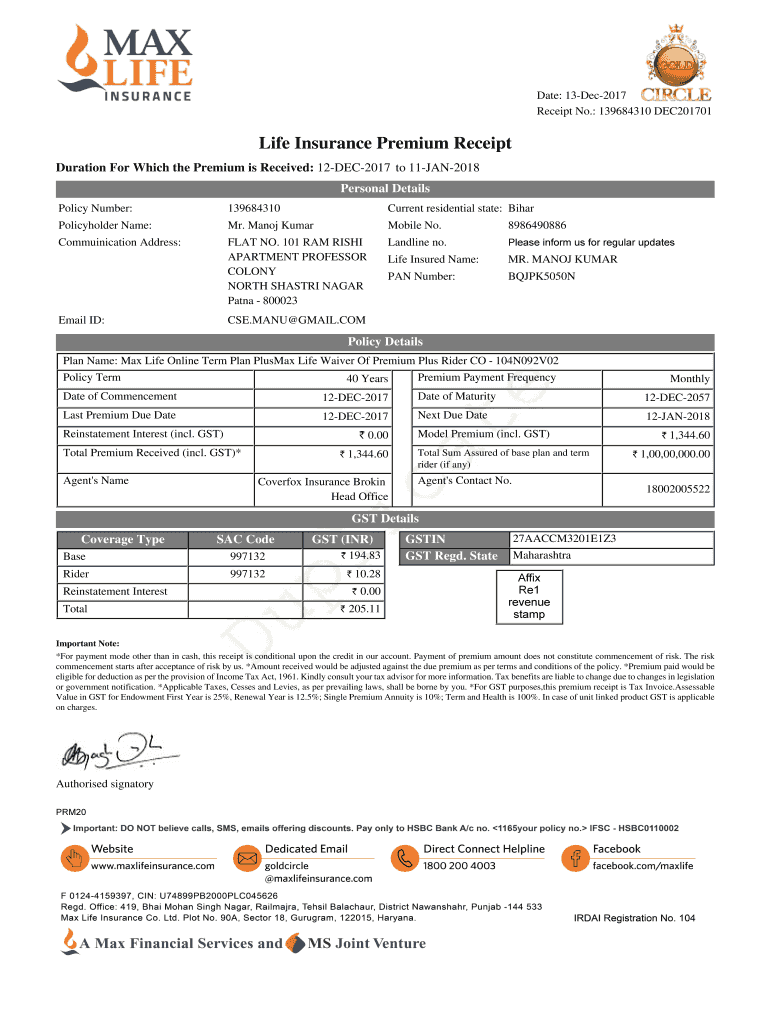

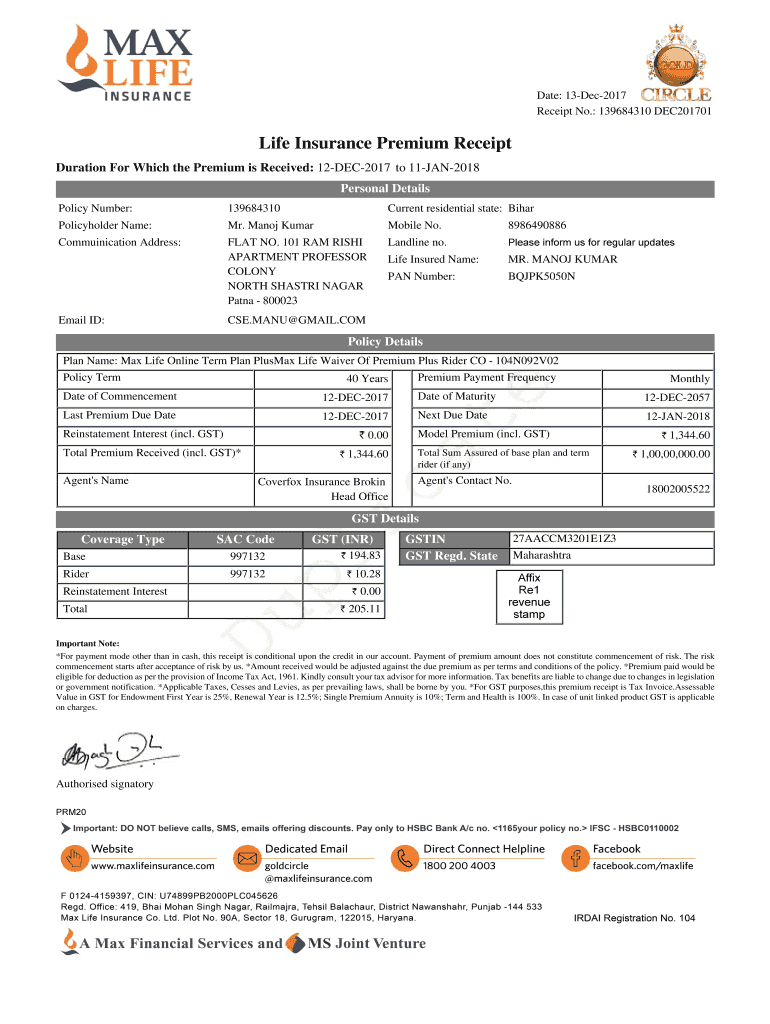

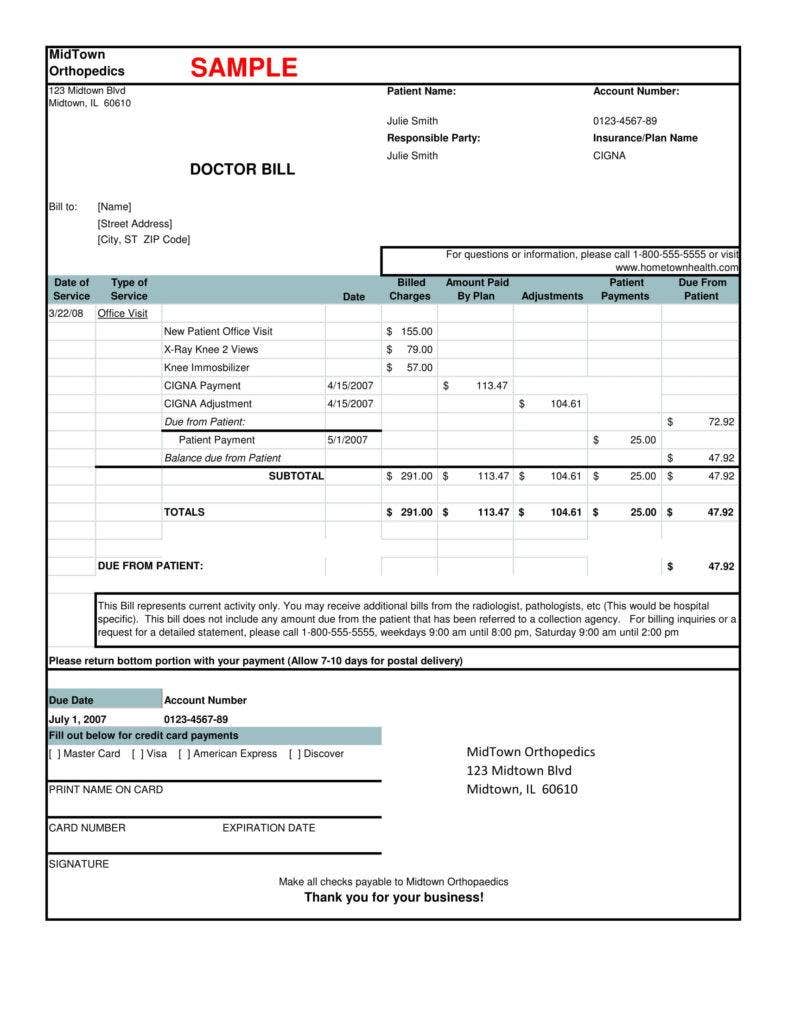

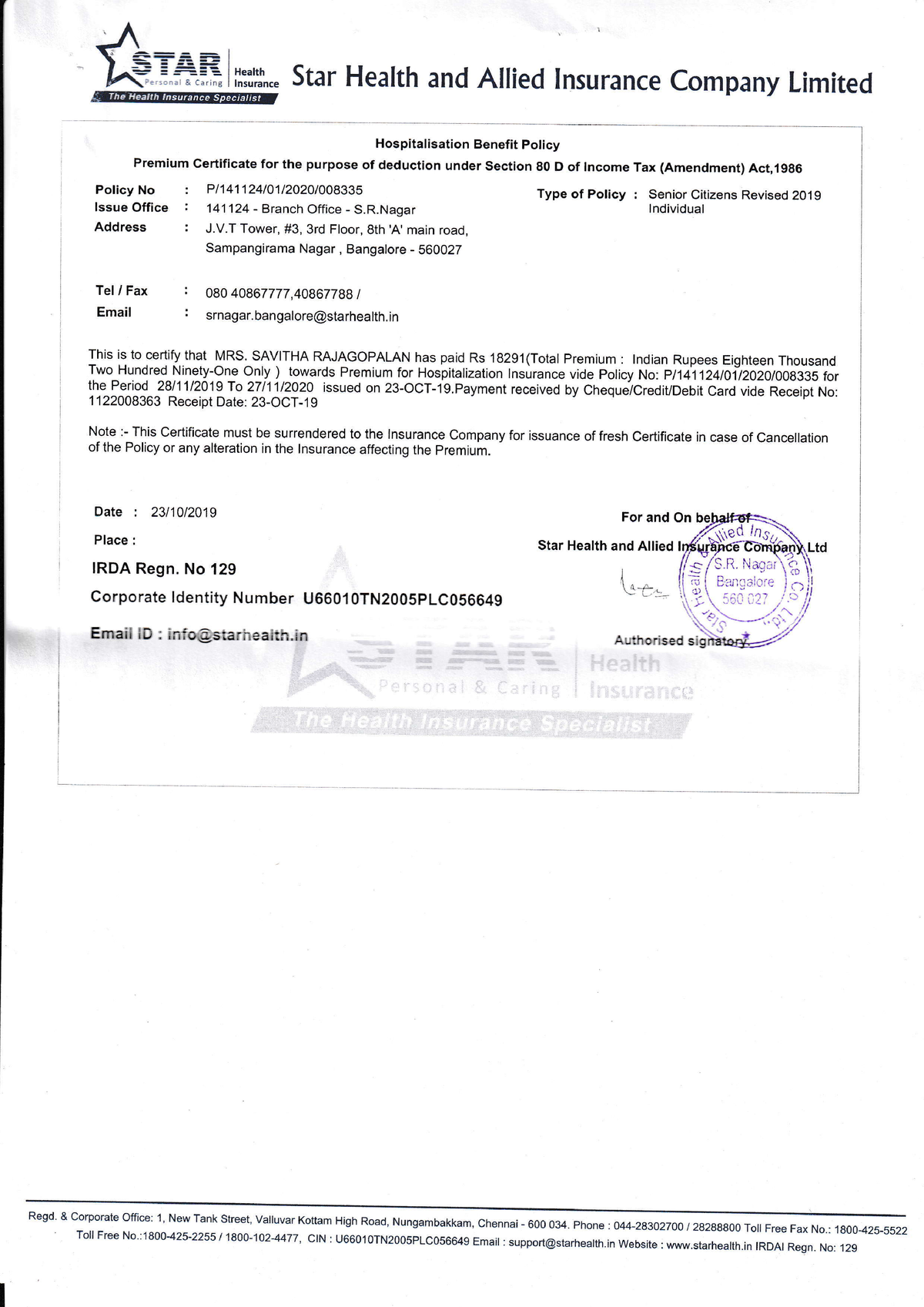

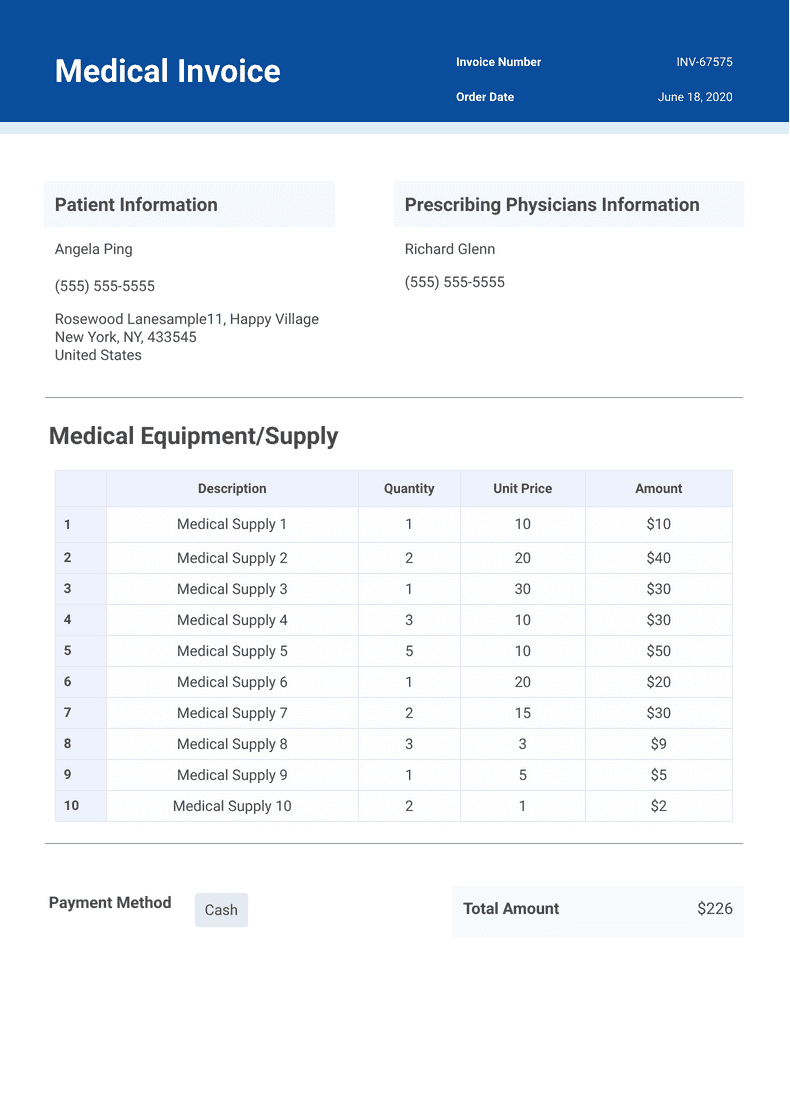

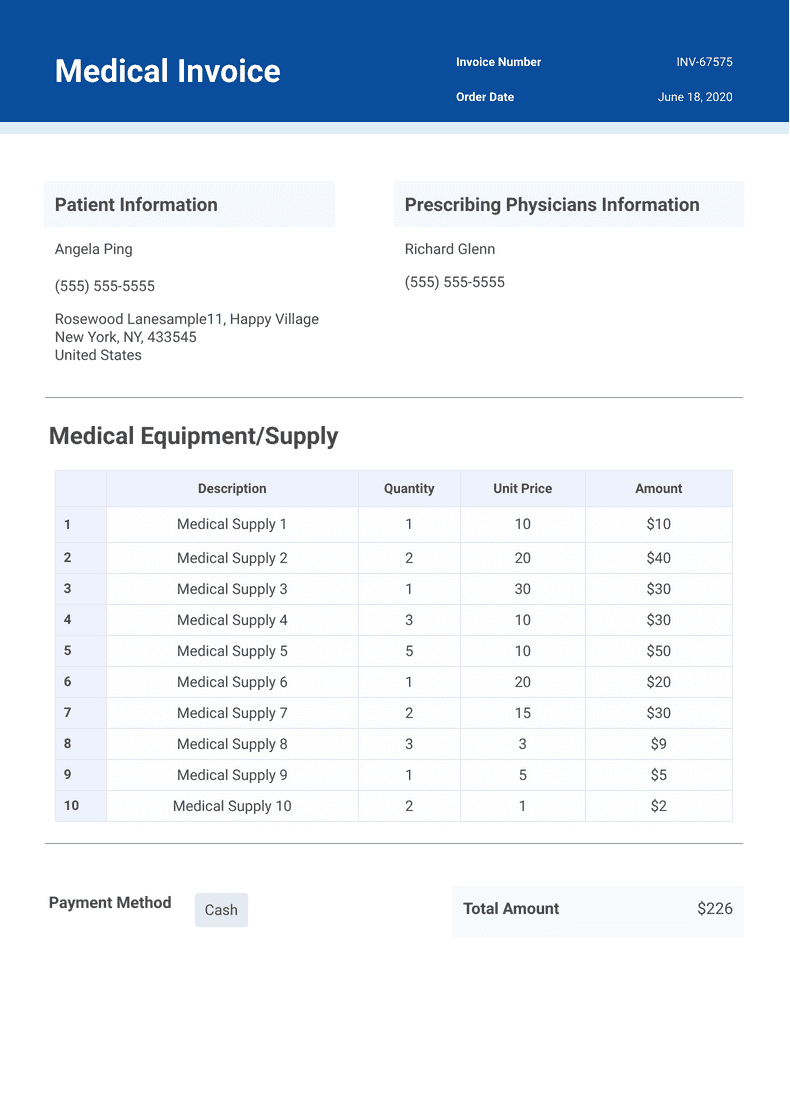

The process of claiming deduction under section 80D is simple The assessees are required to provide proof of payment for the amount of medical insurance premium paid or the amount paid for Documents Required for 80D Preventive Health Check up Deduction If you are wondering which documents you need to file a claim for preventive health

Is Proof Required For 80d Preventive Health Checkup

Is Proof Required For 80d Preventive Health Checkup

https://i.ytimg.com/vi/1Tn-SwO-Sg4/maxresdefault.jpg

Medical Insurance Premium Receipt PDF Complete With Ease AirSlate

https://www.signnow.com/preview/470/590/470590793/large.png

80D Tax Benefits How To Fill Schedule 80d In ITR Health Insurance

https://i.ytimg.com/vi/Yhy8228qShk/maxresdefault.jpg

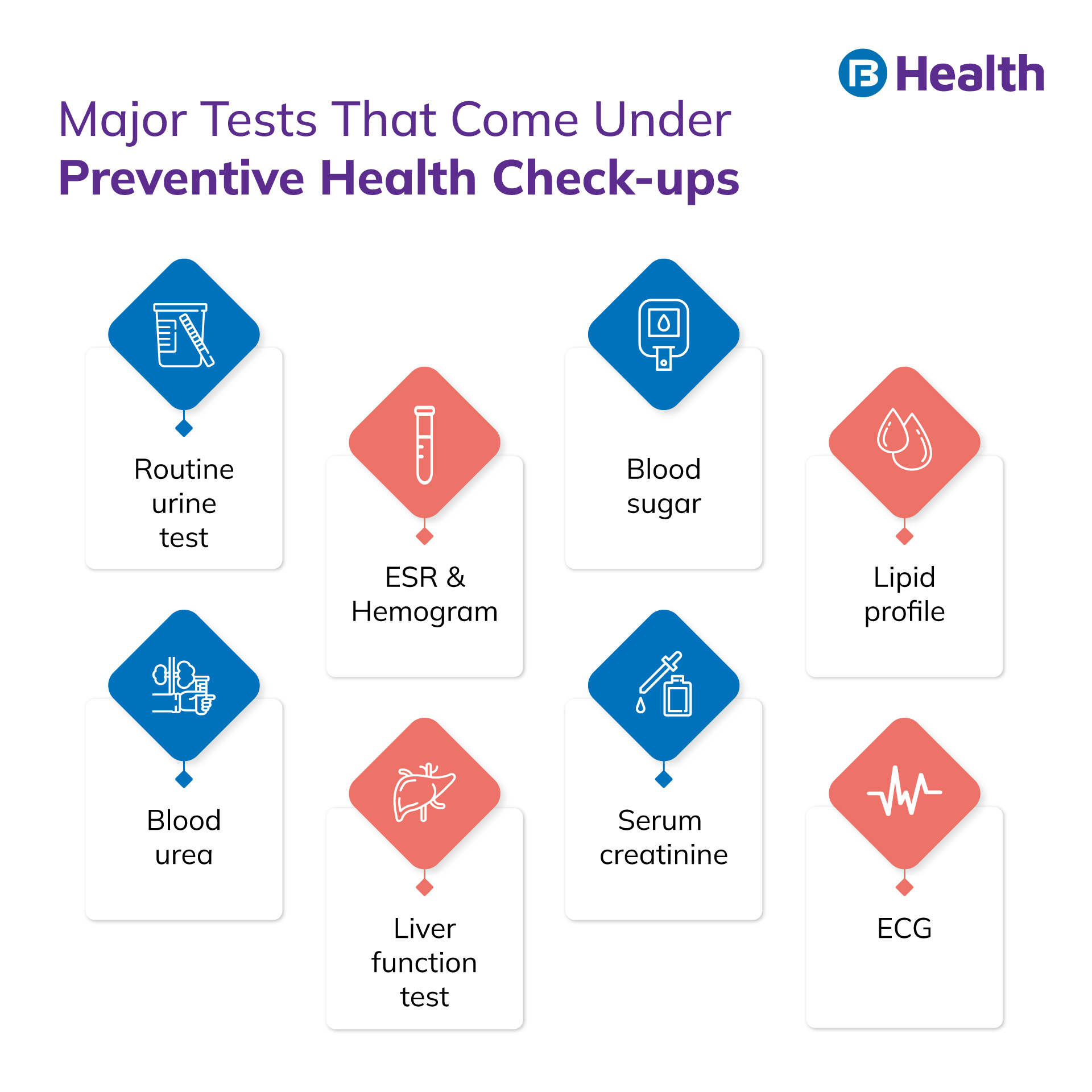

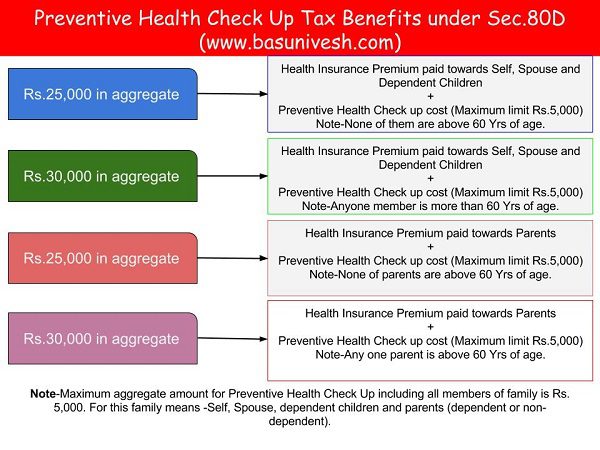

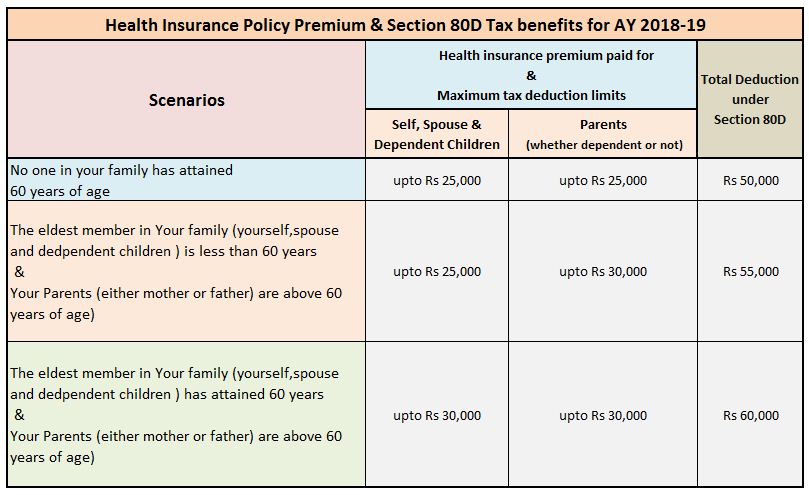

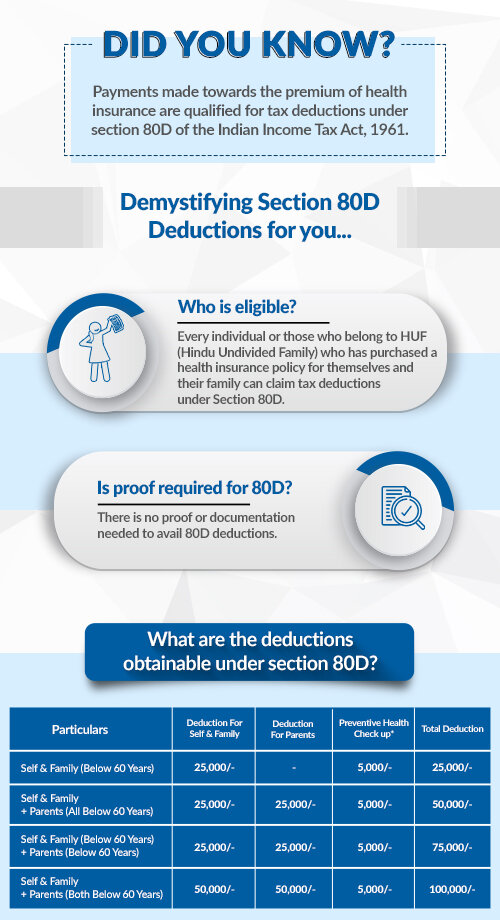

The deduction of amount spent on preventive health checkup cannot exceed INR 5 000 individually i e to say INR 5 000 for individual spouse dependent Preventive health check up You can claim a maximum tax deduction worth Rs 5 000 on expenses related to preventative health check ups This comes under the

Under Section 80D of the Income Tax Act a tax deduction of Rs 5 000 per financial year is allowed towards preventive health check ups within the overall limit of Under Section 80D individuals can claim a deduction of up to 5 000 for payments made towards preventive health check ups This deduction can be availed by the taxpayer for

Download Is Proof Required For 80d Preventive Health Checkup

More picture related to Is Proof Required For 80d Preventive Health Checkup

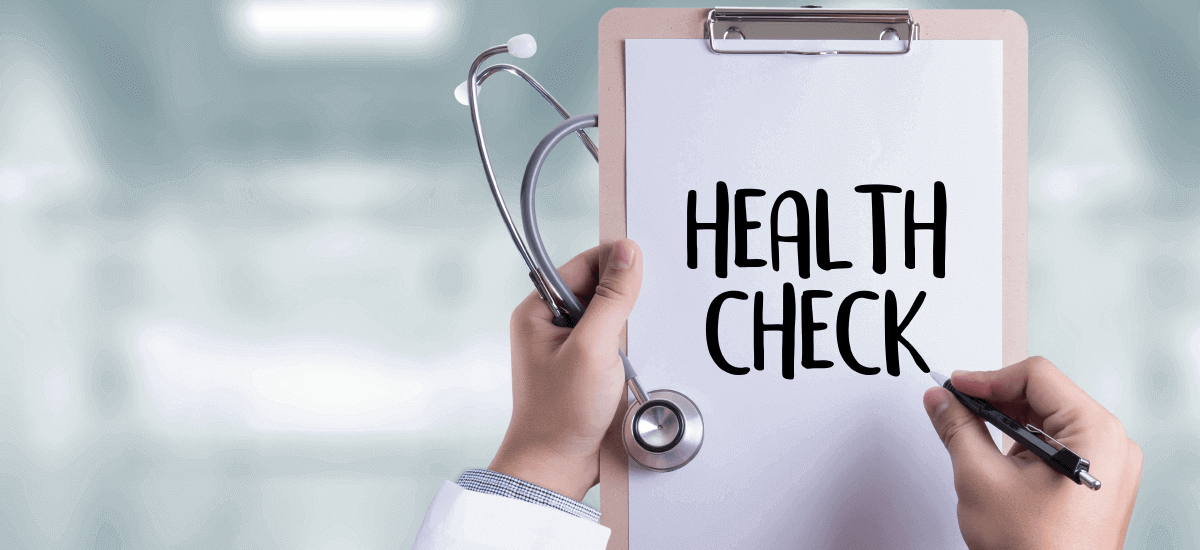

Preventive Health Check Up Benefits Tax Deductions

https://images.ctfassets.net/uwf0n1j71a7j/76knwryILCxFdd8oQGiTDt/79062fd764146f15917f323f9e066289/preventive-health-check-up.png?w=3840&q=75

![]()

Referral Template

https://images.sampleforms.com/wp-content/uploads/2017/06/Child-Health-Check-Up-Tracking.jpg

Preventive Health Checkup 80d Proof Deduction And Income Tax Benefits

https://www.paybima.com/blog/wp-content/uploads/2022/12/Preventive-Health-Checkup-80d-Desduction-Cover-Page-1-1.jpg

A deduction of Rs 5 000 is allowed under Section 80D for any payments made for preventive health checkups This deduction has an overall upper cap Rs Documents Required for 80D Preventive Health Check up Deduction You don t need to submit any specific documents to claim a tax deduction for a

In India Section 80D of the Income Tax Act 1961 provides tax advantages to individuals and Hindu Undivided Families HUFs for premiums paid towards Health Medical insurance policies enable policyholders to avail a tax deduction of a maximum of Rs 5 000 under Section 80D of the Income Tax Act 1961 for the

Preventive Health Checkup Receipt PDF Medicine Service Industries

https://imgv2-2-f.scribdassets.com/img/document/621834353/original/0c8010822a/1686306075?v=1

Preventive Health Check up Major Benefits You Should Know

https://wordpresscmsprodstor.blob.core.windows.net/wp-cms/2022/05/6-3.jpg

https://www.tataaig.com/knowledge-center/health...

Therefore you must ensure that the payments for your medical expenses as well as your health insurance premium are done in a non cash mode Furthermore

https://tax2win.in/guide/section-80d-deduction...

The process of claiming deduction under section 80D is simple The assessees are required to provide proof of payment for the amount of medical insurance premium paid or the amount paid for

Sample Medical Bill Receipt Invoice Template

Preventive Health Checkup Receipt PDF Medicine Service Industries

Start health insurance 80D scnal Caring Health Lnsurance Star

Preventive Health Check Up Tax Benefits Under Sec 80D

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Medical Invoice Template PDF Templates Jotform

Medical Invoice Template PDF Templates Jotform

Is Proof Required For Claiming Medical Expenses Under 80D

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

What Is Preventive Health Check Up Under 80D

Is Proof Required For 80d Preventive Health Checkup - Preventive health check up You can claim a maximum tax deduction worth Rs 5 000 on expenses related to preventative health check ups This comes under the