Is Property Tax Deductible In Texas Key Takeaways If you itemize your deductions you can deduct the property taxes you pay on your main residence and any other real estate you own The total amount of deductible state and local income taxes including

The Texas Property Tax Relief Bill of 2023 aims to reduce the financial burden of property taxes on Texas homeowners As mentioned it raises the homestead exemption from 40 000 to 100 000 meaning homeowners can take a larger amount of money off the taxable value of their primary residence It also limits annual appraisal The property tax deduction is an adjustment item if you re liable for the alternative minimum tax sometimes referred to as the AMT Property taxes aren t deductible when calculating the AMT You must add this deduction back into your taxable income

Is Property Tax Deductible In Texas

Is Property Tax Deductible In Texas

https://www.realized1031.com/hs-fs/hubfs/propertytax-1304677572.jpg?width=1500&height=784&name=propertytax-1304677572.jpg

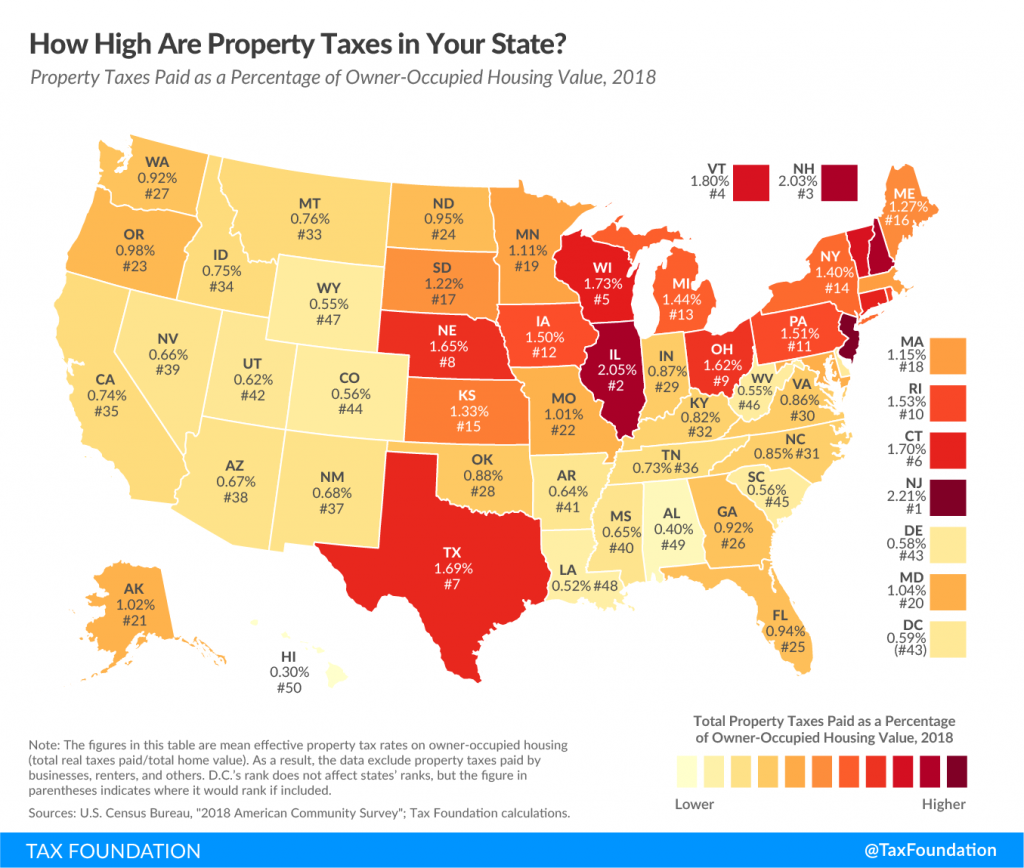

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

Property Tax What Is Property Tax And How It Is Calculated

https://homefirstindia.com/app/uploads/2022/11/Your-paragraph-text-2.png

Annual payments of Public Improvement District assessments in Texas are frequently billed and collected by county tax offices along with the standard Texas property taxes However PIDs are not included in property tax amounts they re paid in addition to any assessed real estate taxes Taxes paid on rental or commercial property and on property not owned by the taxpayer can not be deducted Starting in 2018 the deduction for state and local taxes including property

Property tax in Texas is locally assessed and locally administered All real and tangible personal property in Texas is taxable in proportion to its appraised value unless the Texas Constitution authorizes an exemption Real estate taxes are deductible if Based on the value of the property Levied uniformly throughout your community Used for a governmental or general community purpose Assessed and paid before the end of the tax year You can deduct up to 10 000 or 5 000 if married filing separately of state and local taxes including property taxes

Download Is Property Tax Deductible In Texas

More picture related to Is Property Tax Deductible In Texas

Property Tax Reduction Consultants What Is Property Tax

https://3.bp.blogspot.com/-0yBnji0bNjc/XAMgh65fEiI/AAAAAAAABjk/7gjnvY3diLMX4GvXGnJR2-BD4GHR-9wuACLcBGAs/s1600/shutterstock_1192455754.jpg

Are Property Taxes Deductible Where Is My US Tax Refund

https://whereismyustaxrefund.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-14-at-5.41.57-PM.png

Are Utilities Tax Deductible For Rental Property Owners

https://luxurypropertycare.com/wp-content/uploads/2022/02/Are-Utilities-Tax-Deductible-For-Rental-Property-Owners.jpg

Texas law requires property values used in determining taxes to be equal and uniform It establishes the process for local officials to follow in determining property values setting tax rates and collecting taxes Exhibit 1 includes some basic property tax rules from the Texas Constitution EXHIBIT 1 Taxes State tax Texas Property Tax Relief in 2024 Homeowners have started saving due to a Texas property tax relief package passed last year Here s a breakdown of the tax cuts

[desc-10] [desc-11]

Property Tax What It Is And How To Save Property Tax Grievance

https://i0.wp.com/hellertaxgrievance.com/wp-content/uploads/2018/12/reduce-property-taxes.jpg

How High Are Property Taxes In Your State Tax Foundation

https://files.taxfoundation.org/20170110101027/PropertyTax.png

https://turbotax.intuit.com/tax-tips/home-ownership/claiming...

Key Takeaways If you itemize your deductions you can deduct the property taxes you pay on your main residence and any other real estate you own The total amount of deductible state and local income taxes including

https://victorsteffen.com/guides/texas-property-tax-relief-bill...

The Texas Property Tax Relief Bill of 2023 aims to reduce the financial burden of property taxes on Texas homeowners As mentioned it raises the homestead exemption from 40 000 to 100 000 meaning homeowners can take a larger amount of money off the taxable value of their primary residence It also limits annual appraisal

Rental Property Utilities Tax Deductible Business Property

Property Tax What It Is And How To Save Property Tax Grievance

Personal Loan Tax Deduction Tax Benefit On Personal Loan EarlySalary

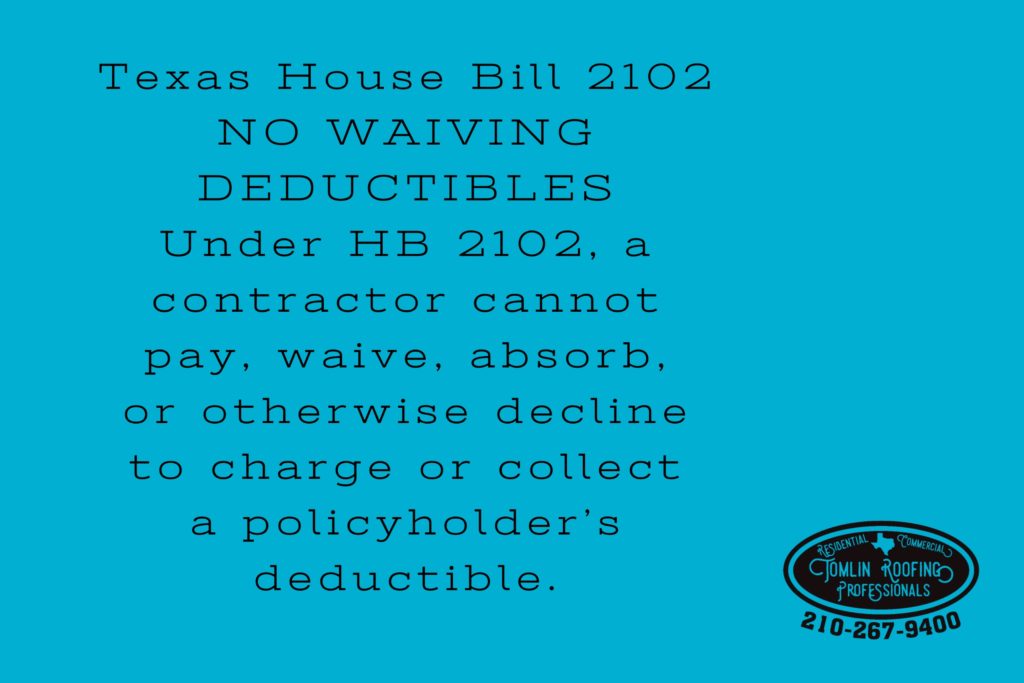

New Law Cracks Down On Roof Scams Tomlin Roofing Professionals

Is Home Insurance Tax Deductible In Canada Surex

Rental Property Tax Deductions What Is Tax Deductible For Rental Property

Rental Property Tax Deductions What Is Tax Deductible For Rental Property

The Best Investments Are Tax Deductible YouTube

Is Home Insurance Tax Deductible For Rental Property

What Is A Wind Hail Deductible

Is Property Tax Deductible In Texas - Taxes paid on rental or commercial property and on property not owned by the taxpayer can not be deducted Starting in 2018 the deduction for state and local taxes including property