Is Real Estate License Tax Deductible To be clear the costs related to attending real estate classes to prepare you for your initial real estate license is not deductible and does not qualify for Tuition and Fees

For example if a software engineer obtains a real estate license without intending to use it professionally the associated fees are typically non deductible The IRS requires a If your job requires you to obtain a license for your trade business or profession you can often write off the cost on your taxes If you re an employee rather than self employed it s harder to

Is Real Estate License Tax Deductible

Is Real Estate License Tax Deductible

https://i.pinimg.com/originals/74/0d/6a/740d6ac1e6a2c9a928c174152d0e4fec.jpg

The 5 Most Common Real Estate Tax Credits

https://info.courthousedirect.com/hs-fs/hubfs/Blog Image Fix/Depositphotos_45934253_original.jpg?width=2800&name=Depositphotos_45934253_original.jpg

What Are The Tax Benefits Of Investing In Real Estate A Guide For

https://www.canyonviewcapital.com/wp-content/uploads/2023/07/Tax-Benefits-of-Real-Estate-Investing.png

In real estate that means your state license renewal professional memberships and MLS dues An important caveat with regard to professional memberships the portion of your membership dues attributable to lobbying The good news is that license fees and renewals are generally tax deductible for real estate agents According to the Internal Revenue Service IRS agents can deduct ordinary and

Understanding commission splits is crucial for financial planning in real estate Mileage and auto travel expenses are deductible at 67 cents per mile for 2024 so be sure you Beyond insurance for most realtors keeping your real estate license up to date requires paying fees Lucky for you the license renewal fees to keep your license current are

Download Is Real Estate License Tax Deductible

More picture related to Is Real Estate License Tax Deductible

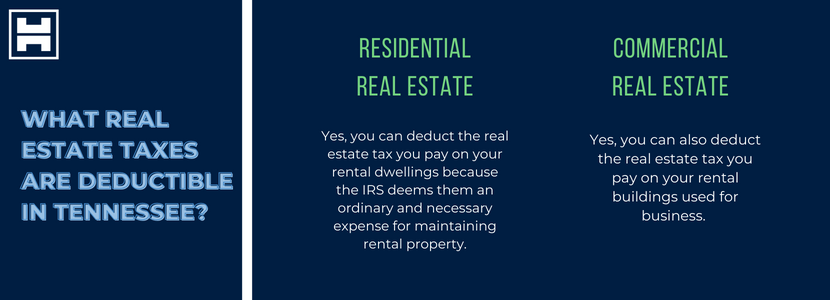

What Real Estate Taxes Are Deductible Hinge Development

https://hingedevelopment.com/wp-content/uploads/2022/06/HDR_Process_2B-11.png

Real Estate Form License Application Fill Online Printable Fillable

https://www.pdffiller.com/preview/611/274/611274314/large.png

2023 Real Estate License Reciprocity Portability Guide NY Real

https://www.nyrealestatetrend.com/wp-content/uploads/2023/02/2023-Real-Estate-License-Reciprocity-Portability-Guide.jpg

So here are ten common tax deductions for real estate agents 1 Commissions Paid Out Have you paid a portion of your commission to referring agents or a buyer s agent on your team Those are deductible 2 Broker and Real estate license renewal Some industries like real estate require licenses or certifications to be periodically renewed All those fees are tax deductible

No you cannot claim a business or work related deduction if the exam prepares you for a new trade or profession However you may qualify for a Lifetime Learning Credit Per Several IRS rules remove such courses exams and fees from the definition of a business expense In this article we ll discuss these rules and explain why such costs are not

Before Getting A Real Estate License Consider These Things Real

https://i.pinimg.com/originals/81/41/41/8141410ba3c9cb7e3323a038f2d7a91d.jpg

Real Estate License In U S Benefits Requirements Cost Renewal 2022

https://easycowork.com/wp-content/uploads/2021/12/house-g3b9e67e06_1280-1024x698.jpg

https://ttlc.intuit.com › community › tax-credits...

To be clear the costs related to attending real estate classes to prepare you for your initial real estate license is not deductible and does not qualify for Tuition and Fees

https://accountinginsights.org › are-professional...

For example if a software engineer obtains a real estate license without intending to use it professionally the associated fees are typically non deductible The IRS requires a

Quick FAQ Guide To Get Your Real Estate Questions Answered Real

Before Getting A Real Estate License Consider These Things Real

Facts About How Do I Get My Real Estate License Uncovered What Is A

Pin On Real Estate License Exam

Tax Deductible Home Ownership Expenses

Tax Deductions For Real Estate Agents Check Out This List Of Common

Tax Deductions For Real Estate Agents Check Out This List Of Common

Are Real Estate Taxes Deductible SCOUT Real Estate Partners

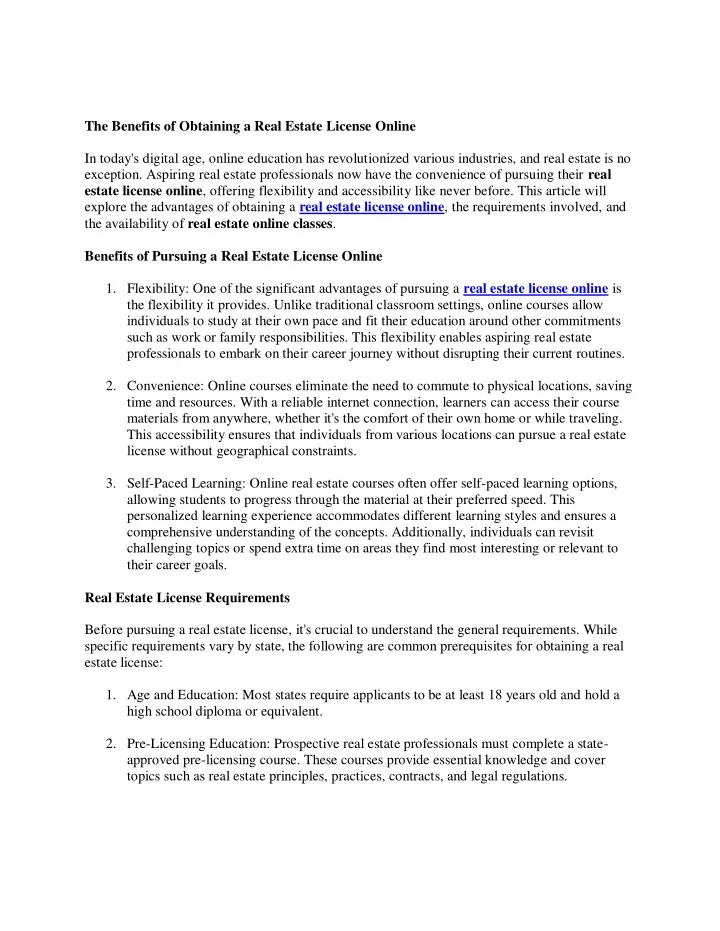

PPT The Benefits Of Obtaining A Real Estate License Online PowerPoint

Real Estate License Agreement Template Download In Word Google Docs

Is Real Estate License Tax Deductible - In real estate that means your state license renewal professional memberships and MLS dues An important caveat with regard to professional memberships the portion of your membership dues attributable to lobbying