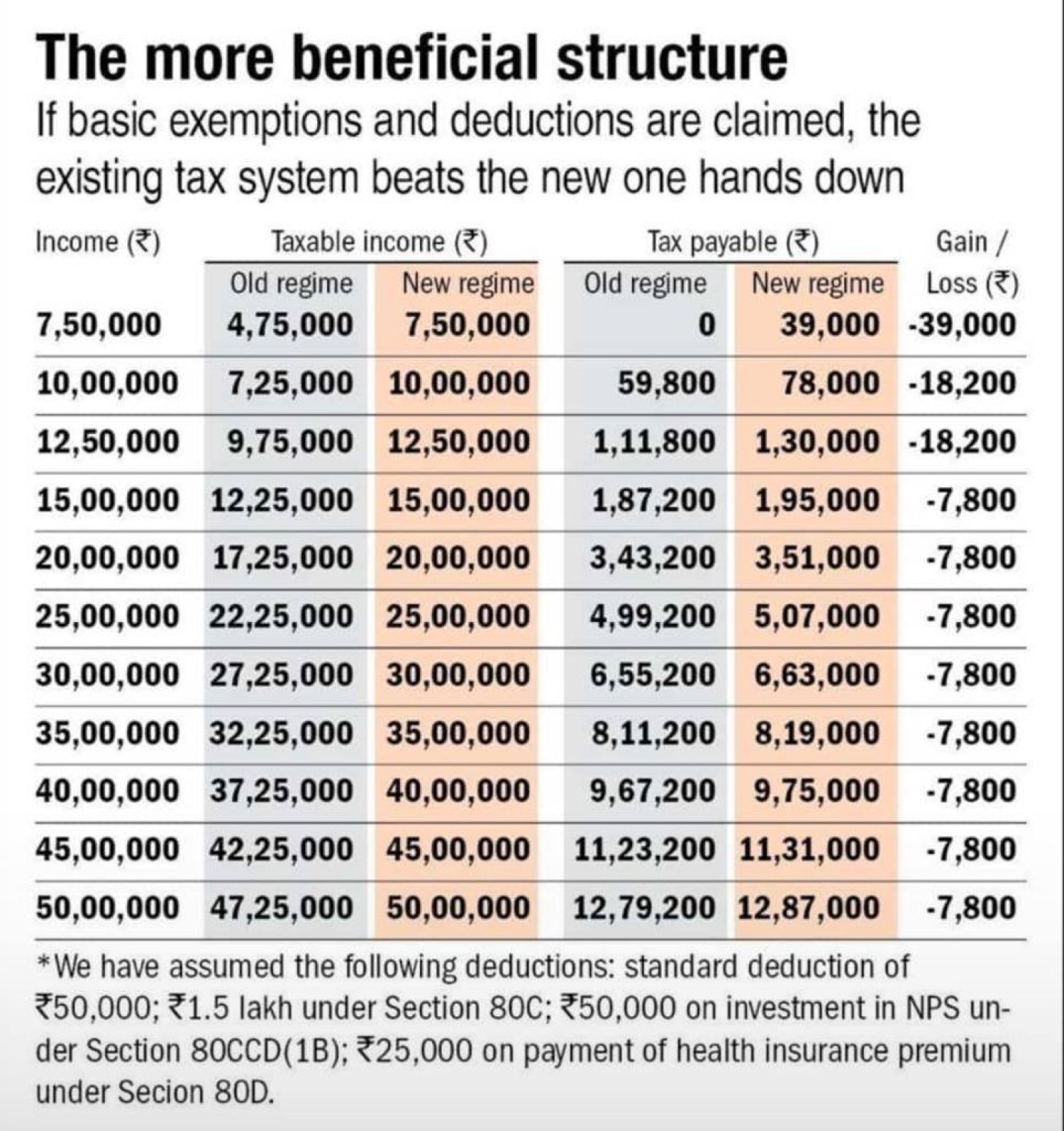

Is Rebate Applicable In New Tax Regime In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to pay any tax at all if they opt for the new tax regime

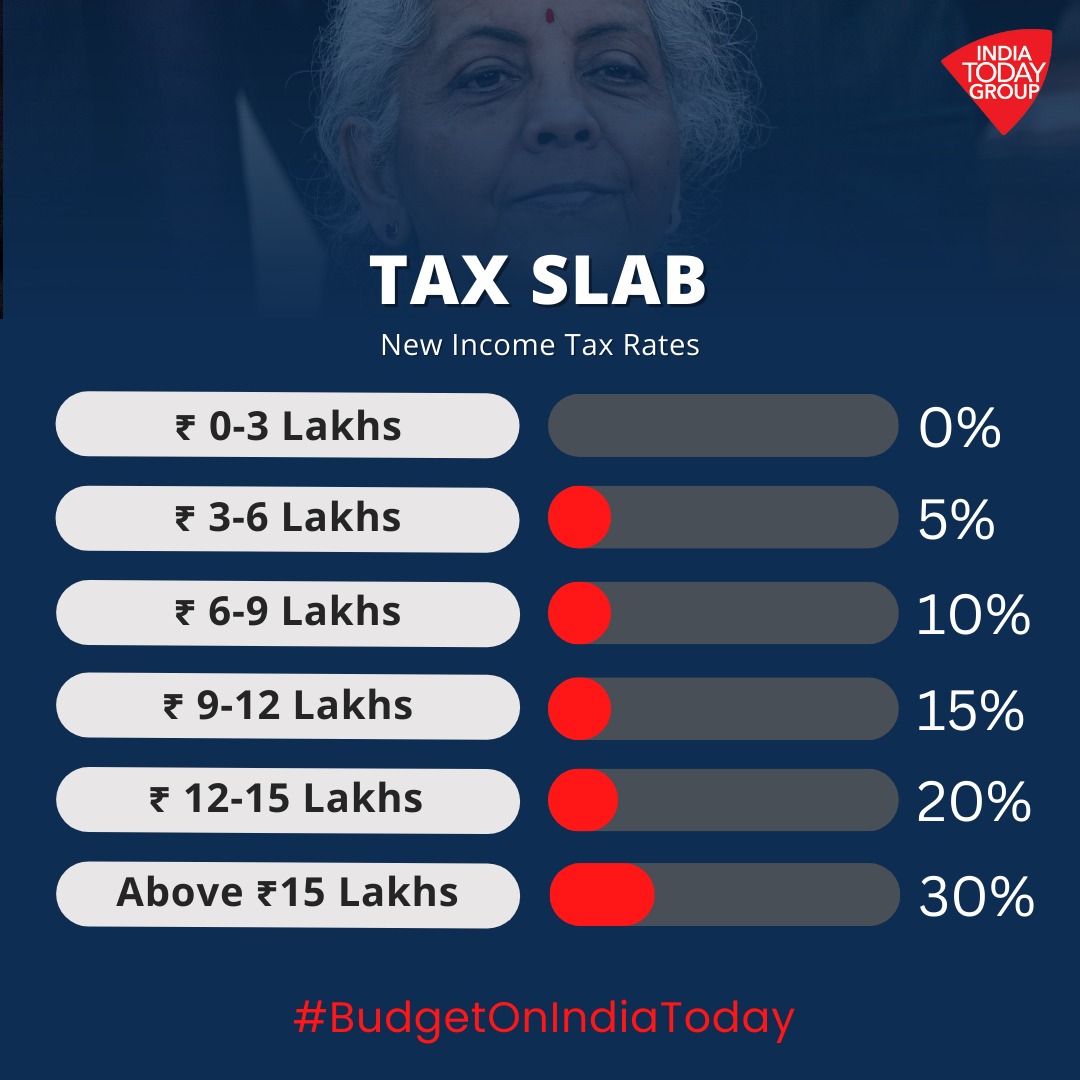

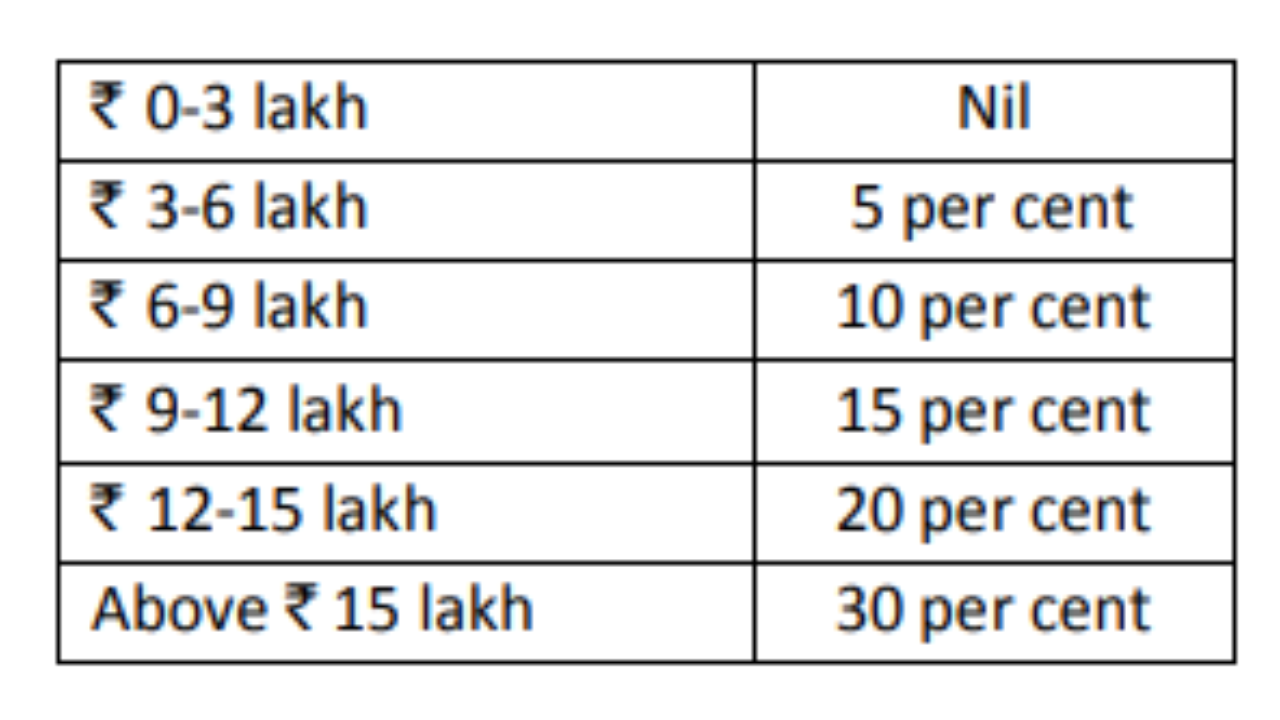

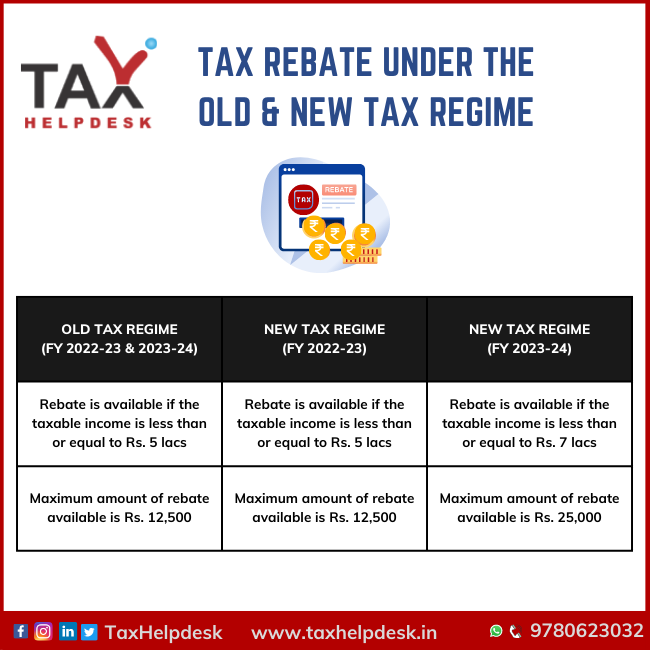

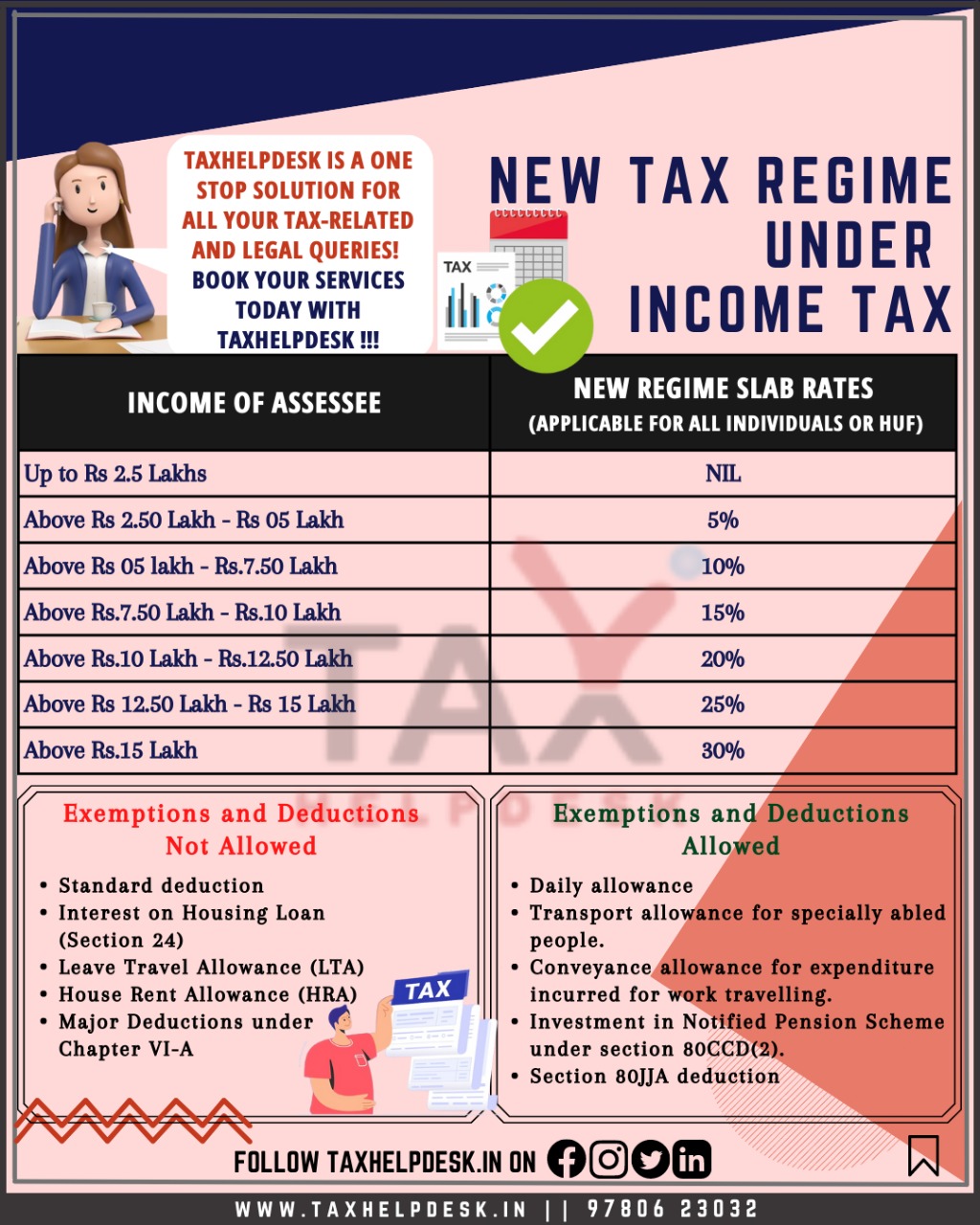

9 Is there any difference in tax rebate under section 87A in old and new tax regime In the old tax regime in case of a resident individual whose total income does not exceed Rs 5 00 000 there is rebate of 100 percent of income tax subject to a maximum of Rs 12 500 New Tax Regime Rebate Slab Rates AY 2024 25 Explained by TaxConcept January 9 2024 Everything about New regime for AY 2024 25 is answered Slide 1 TAX slabs for New vs Old for AY 2024 25 Slide 2 87A rebate for New regime Slide 3 New regime List of Deductions not allowed as compare to Old Slide 4 NEW vs Old colmparison for

Is Rebate Applicable In New Tax Regime

Is Rebate Applicable In New Tax Regime

https://i.ytimg.com/vi/cFdWCd9EneI/maxresdefault.jpg

Opinion It s Time For A New Tax Regime The Daily Iowan

https://dailyiowan.com/wp-content/uploads/2022/06/taxop.jpg

Old Tax Regime Articles IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2023/07/ITR-1-Key-Differences-between-the-Old-and-New-Tax-Regime-2.jpg

As per the old tax regime the applicable rebate limit is Rs 12 500 for incomes up to Rs 5 lakhs However under the new tax regime this rebate limit has increased to Rs 25 000 if the taxable income is less than or equal to Rs 7 lakhs Yes income tax rebate u s 87A is available on taxable income which includes agricultural income as well Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the

Rebate Applicability Old Tax Regime Rebate under Section 87A is available only if the taxable income is Rs 5 lakhs or less New Tax Regime The rebate is now applicable to individuals and HUFs with taxable income exceeding Rs 7 lakhs providing a marginal relief for those with incomes just above this threshold 2 Illustrative Examples Marginal Relief under section 87A of Income Tax Act 1961 for New Tax Regime u s 115BAC 1A Presently rebate is allowed u s 87A of Rs 12 500 in old regime of Income Tax if any resident individual whose total income during the

Download Is Rebate Applicable In New Tax Regime

More picture related to Is Rebate Applicable In New Tax Regime

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

https://live.staticflickr.com/7850/32304200437_b8b18b3f1c_b.jpg

New Tax Regime Vs Old Tax Regime Which Is Better Yadn Vrogue co

https://rupiko.in/wp-content/uploads/2020/08/New-vs-Old-Tax-Regime-1.png

IndiaToday On Twitter Finance Minister nsitharaman Has Proposed A

https://pbs.twimg.com/media/Fn3THz3agAgtAlm.jpg

In New Regime maximum rebate is 25000 income rebate is upto 7 00 000 But on 5th July 2024 the Income Tax Department updated the ITR utility which has impact those with special rate incomes such as Short term capital gains STCG on shares under Section 111A Long term capital gains LTCG Lottery winnings Income from gaming Before 5th What are the rebates in the new tax regime in 2024 Under the new tax regime if your taxable income is upto Rs 7 lakh you are eligible for a tax rebate and do not have to pay any tax The maximum tax rebate under the new tax regime can go upto Rs 20 000

Is there any difference in tax rebate under section 87A in old and new tax regime In the old tax regime in case of a resident individual whose total income does not exceed Rs 5 00 000 there is rebate of 100 percent of income tax subject to a maximum of Rs 12 500 Income tax rebate hiked in new tax regime Another change in the new tax regime is the hike in rebate amount under section 87A The rebate amount has been hiked by Rs 12 500 i e from Rs 12 500 earlier to Rs 25 000 in new tax regime

Exemption In New Tax Regime List Of All The New Tax Regime

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/tax-exemption.jpg

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

https://static.tnn.in/photo/msid-101208384/101208384.jpg

https://cleartax.in/s/new-tax-regime-frequently-asked-questions

In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to pay any tax at all if they opt for the new tax regime

https://www.incometax.gov.in/iec/foportal/sites...

9 Is there any difference in tax rebate under section 87A in old and new tax regime In the old tax regime in case of a resident individual whose total income does not exceed Rs 5 00 000 there is rebate of 100 percent of income tax subject to a maximum of Rs 12 500

Tax Rebate Under The Old New Tax Regime

Exemption In New Tax Regime List Of All The New Tax Regime

Share

New Income Tax Regime Vs Old Key Things To Consider Budget 2023 Regimes

Shift Between Old And New Tax Regime Cant Come Back To Old Tax Regime

Section 87A Income Tax Rebate

Section 87A Income Tax Rebate

New Tax Regime U s 115BAC 7

Budget 2023 Tax Saving Under New Tax Regime Vs Old Tax Regime For Rs 7

Income Tax Clarification Opting For The New Income Tax Regime U s

Is Rebate Applicable In New Tax Regime - Under the new tax regime resident individuals with taxable income up to Rs 7 00 000 are eligible for the rebate Under the old tax regime the maximum annual income eligible for the rebate was Rs 5 00 000 with a maximum rebate of Rs 12 500