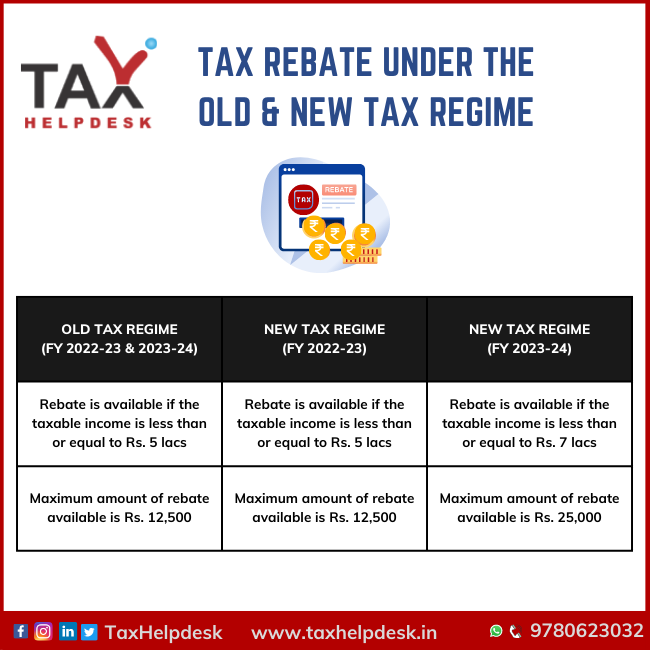

Is Rebate Available In New Tax Regime 9 Is there any difference in tax rebate under section 87A in old and new tax regime In the old tax regime in case of a resident individual whose total income does not exceed

In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to Yes income tax rebate u s 87A is available on taxable income which includes agricultural income as well Discover the income tax rebate available under

Is Rebate Available In New Tax Regime

Is Rebate Available In New Tax Regime

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://substack-post-media.s3.amazonaws.com/public/images/316efad8-0728-43bf-9973-c88f35a0b887_3200x2146.jpeg

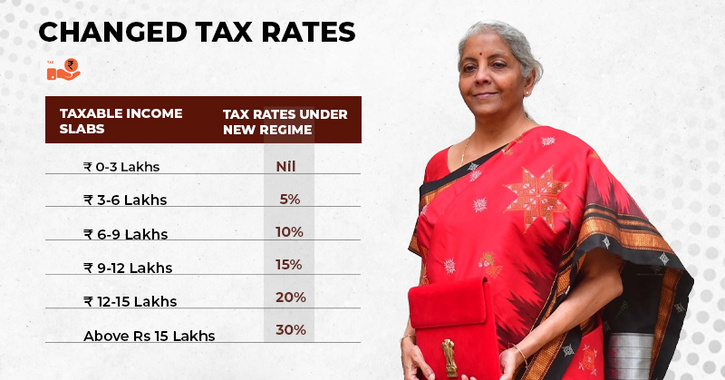

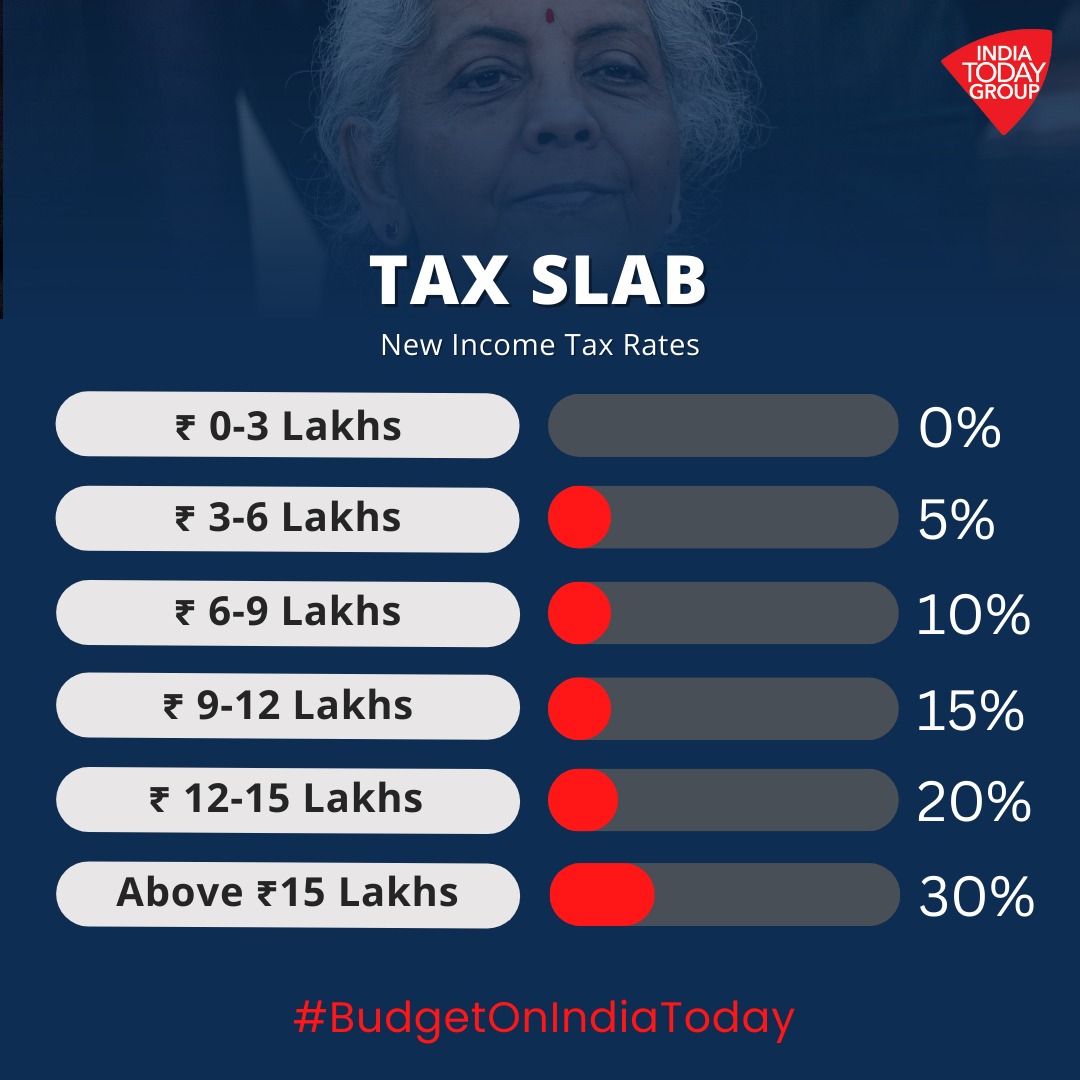

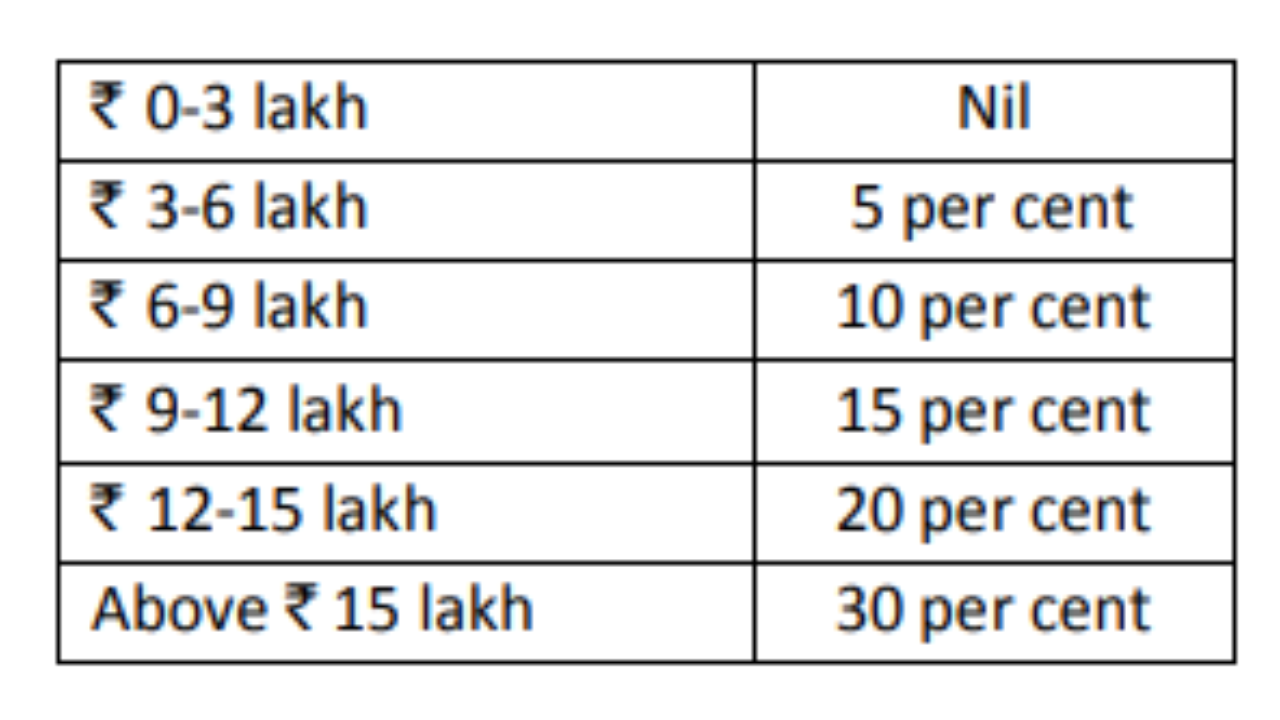

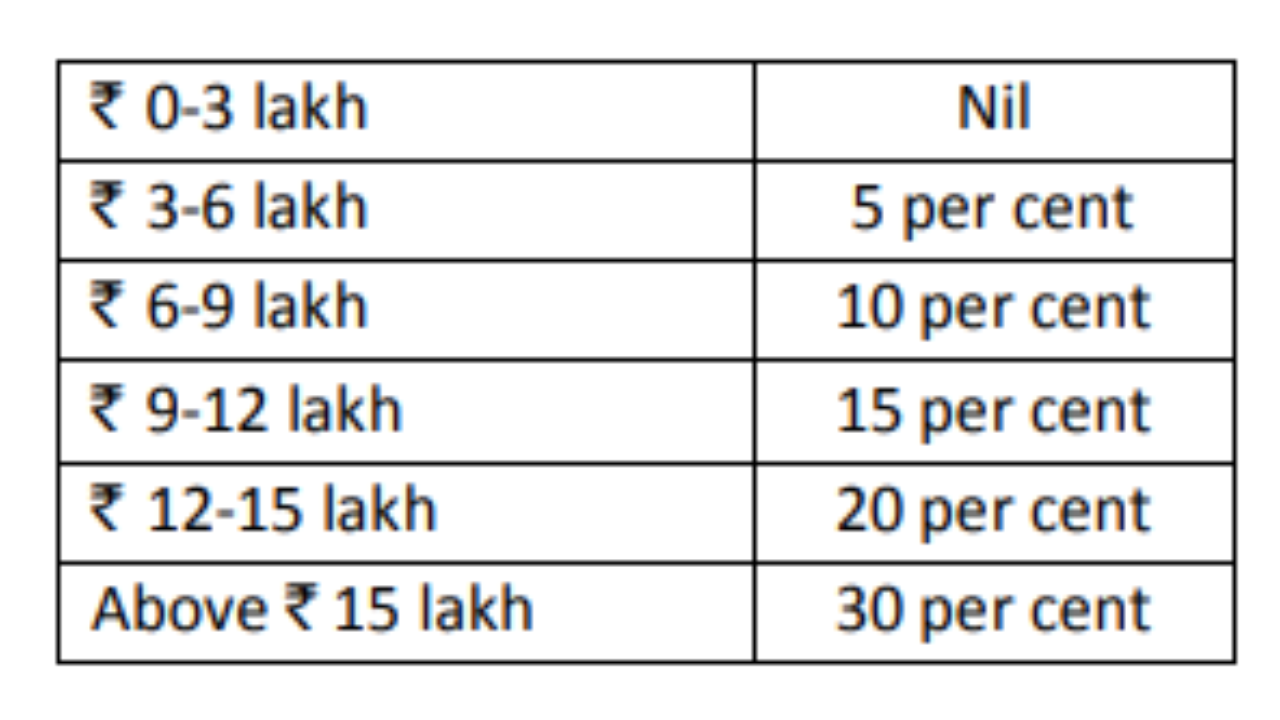

New Tax Regime Slabs Benefits Deductions Section 115BAC Old Vs

https://i.ytimg.com/vi/cFdWCd9EneI/maxresdefault.jpg

What Is 87 A Rebate Free Tax Filer Blog

https://blog.freetaxfiler.com/wp-content/uploads/2022/09/Tax-Rebate-1.jpg

In New Regime maximum rebate is 25000 income rebate is upto 7 00 000 But on 5th July 2024 the Income Tax Department updated the ITR utility which has impact those with special rate incomes such as New Tax Regime Rebate Slab Rates AY 2024 25 Explained by TaxConcept January 9 2024 Everything about New regime for AY 2024 25 is

As per the old tax regime the applicable rebate limit is Rs 12 500 for incomes up to Rs 5 lakhs However under the new tax regime this rebate limit has increased to Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if their

Download Is Rebate Available In New Tax Regime

More picture related to Is Rebate Available In New Tax Regime

Old Vs New Tax Regime Tax Slabs In India Explained Marketfeed

https://149494764.v2.pressablecdn.com/wp-content/uploads/2023/07/25th-may-2047.png

Standard Deduction Tax Rebate EXPLAINED In New Tax Regime With

https://i.ytimg.com/vi/qxMqXY80pBc/maxresdefault.jpg

Old Vs New Tax Regime What Investment Proofs Must Taxpayers Submit To

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202401/taxx2.jpg?itok=pyW3X_3R

The new tax regime aims to simplify income tax for individual taxpayers by offering lower tax rates in exchange for preceding most deductions and exemptions available under the old regime What is What are the rebates in the new tax regime in 2024 Under the new tax regime if your taxable income is upto Rs 7 lakh you are eligible for a tax rebate and do not have to pay any tax The maximum

Rebate is available to the extent of Rs 25 000 and no rebate will be available if total income exceeds Rs 7 00 000 The situation is exhibited in the Table given herein below New Marginal Scheme Total The decision is likely to further sweeten the new tax regime particularly for small taxpayers In the Union Budget for 2023 24 the government expanded the scope

Tax Computation Tax Rates Old New Tax Regime Siddharth Agarwal

https://i.ytimg.com/vi/57s1JoNYgqU/maxresdefault.jpg

10 FAQs About The New Income Tax Regime s Changes Effective From FY 2023 24

https://im.indiatimes.in/content/2023/Apr/new-tax-regime_642eac064dbfe.jpg

https://www.incometax.gov.in/iec/foportal/sites...

9 Is there any difference in tax rebate under section 87A in old and new tax regime In the old tax regime in case of a resident individual whose total income does not exceed

https://cleartax.in/s/new-tax-regime-frequently-asked-questions

In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

Tax Computation Tax Rates Old New Tax Regime Siddharth Agarwal

Old Tax Regime Vs New Tax Regime

IndiaToday On Twitter Finance Minister nsitharaman Has Proposed A

Old Versus New Regime Thousands Use Tax Department s Calculator To

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

Tax Rebate Under The Old New Tax Regime

Section 87A Income Tax Rebate

Budget 2023 Tax Saving Under New Tax Regime Vs Old Tax Regime For Rs 7

Is Rebate Available In New Tax Regime - New Tax Regime Rebate Slab Rates AY 2024 25 Explained by TaxConcept January 9 2024 Everything about New regime for AY 2024 25 is