Is Rebate Taxable In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but isn t taxable

A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking specific actions like opening a bank account it s considered income and The IRS has attempted for many years to categorize rebates as deductions rather than exclusions so that the restrictions of IRC 162 can be applied But the courts have allowed exclusion treatment for direct seller to buyer rebates

Is Rebate Taxable

Is Rebate Taxable

https://stimulusmag.com/wp-content/uploads/2022/12/is-recovery-rebate-taxable-2048x1583.jpeg

The 200 Energy Bills Rebate Everything You Need To Know TechRadar

https://cdn.mos.cms.futurecdn.net/YvEFFcJrGg5qJQJAKJYe7W-1920-80.jpg

Greek Rebate Free Stock Photo Public Domain Pictures

https://www.publicdomainpictures.net/pictures/270000/velka/greek-rebate.jpg

It s important to remember the difference between a cash back reward for a purchase you make and a taxable award or prize To illustrate suppose the company you purchase the cell phone from holds a drawing for all new customers Rebates Generally speaking the IRS considers transaction related points or rewards as rebates and not as taxable income Think of the rebate as a discount you ll receive on your purchase later Here s what the IRS has to say

Most income is taxable unless it s specifically exempted by law Income can be money property goods or services Even if you don t receive a form reporting income you should report it on your tax return Income is taxable when you receive it even if you don t cash it or use it right away No credit card cash back rewards are not taxable The IRS treats cash back rewards as a rebate on spending and not as income so you aren t required to pay income tax on these rewards

Download Is Rebate Taxable

More picture related to Is Rebate Taxable

Traderider Rebate Program Verify Trade ID

https://traderider.com/rebate/assets/img/rebate-forex.jpg

What Is Rebate GETBATS Blog

https://blog.getbats.com/uploads/images/202104/image_750x_607662dab7d45.jpg

Pennzoil Rebate Cheapest Sales Save 49 Jlcatj gob mx

https://i.ytimg.com/vi/Hztq_FdPKLk/maxresdefault.jpg

The guidance follows HMRC s decision in March 2013 that rebates are an annual payment and therefore subject to income tax HMRC started collecting tax on rebates in April last year The Financial Conduct Authority FCA announced its ban cash rebates on new business from 6 April Most tax experts agree that credit card rewards earned through credit cards are non taxable rebates and that you should be fine as long as you spend money to get something Based on this

[desc-10] [desc-11]

Rebate Management Software QuyaSoft

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/61f95ecbe938df0d4bae19c2_Rebate-Pyramid.png

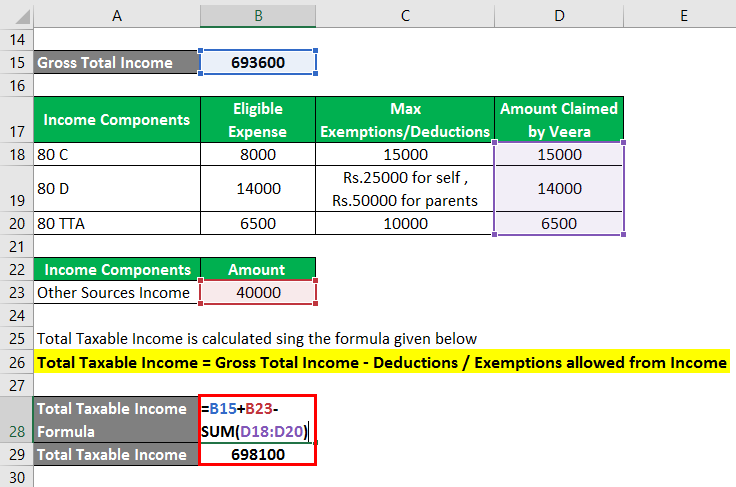

How To Calculate Gross Income Tax Haiper

https://www.educba.com/academy/wp-content/uploads/2019/06/Taxable-Income-2.7.png

https://www.irs.gov/publications/p525

In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but isn t taxable

https://donotpay.com/learn/are-rebates-taxable

A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking specific actions like opening a bank account it s considered income and

What Are Rebated Doors How To Fit Them Properly Doors More Guide

Rebate Management Software QuyaSoft

Rebate Definition Of Rebate YouTube

A Guide To Rebates On Discounted Bills

Rebates Vs Discounts What Are The Differences Enable

Is Recovery Rebate Taxable Find All Answers

Is Recovery Rebate Taxable Find All Answers

Difference Between Income Tax Deductions Exemptions And Rebate Plan

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Is A Real Estate Commission Rebate To Buyer Taxable 5 FAQs

Is Rebate Taxable - [desc-12]