Is Redundancy Pay Taxable In Ghana Is my employer required to pay me when I am made redundant Yes The worker who is affected by the redundancy is entitled to be paid by the employer prior to the close down arrangement or amalgamation

Income Tax Exemptions are the amounts that are reduced or removed from Income amounts because they are exempt from taxation These exemptions are to be outlined during filing Exempt amounts include According to Ghana s Labour Law a worker whose employment is terminated under such circumstances is entitled to be compensated and receive redundancy pay

Is Redundancy Pay Taxable In Ghana

Is Redundancy Pay Taxable In Ghana

https://agricbank.com/wp-content/uploads/2022/04/E-levy-scaled.jpg

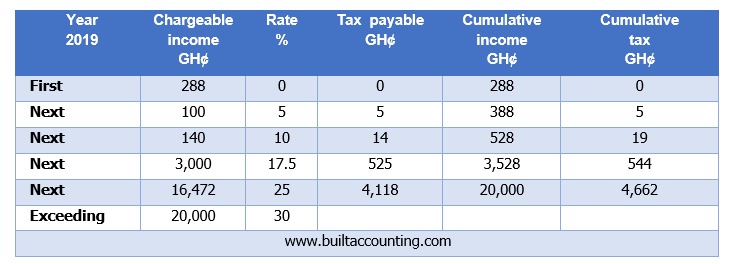

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

F rmula De Los Ingresos Gravables Aprenda M s FinancePal

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1-768x552.png

Other than redundancy pay for economic dismissals workers are also entitled to following payments on termination of employment any remuneration earned by the worker before contract termination any deferred pay due to the worker before contract termination any compensation due to the worker in respect of sickness or accident and redundancy pay among others Income from business A person s business income is the gains and profits from that business for the year or during the year This includes service fees consideration received in respect of trading stock a gain from realisation of capital assets and liabilities of the business

According to the law a worker or employee is entitled to be paid any remuneration owed him before the termination any deferred payments owed him before termination as well as any compensation due to the worker as a result of sickness or an accident According to Ghana s Labour Law a worker whose employment is terminated under such circumstances is entitled to be compensated and receive redundancy pay

Download Is Redundancy Pay Taxable In Ghana

More picture related to Is Redundancy Pay Taxable In Ghana

Are Redundancy Payments Taxable

https://lirp.cdn-website.com/2377e54c/dms3rep/multi/opt/taxabke-1920w.jpg

Non Taxable Allowances In Ghana Africa Tax Review

https://africataxreview.com/wp-content/uploads/2022/12/Non-Taxable-Allowances-in-Ghana--1024x576.webp

How To Calculate Redundancy Pay In Australia 2022 Update

https://australialawyers.com.au/wp-content/uploads/2022/08/redundancy-pay.jpeg

Yes The worker who is affected by the redundancy is entitled to be paid by the employer prior to the close down re arrangement or amalgamation What should an employer consider in determining the terms and conditions of employment of a worker who has suffered diminution Redundancy pay For an amount to be deemed a gain or profit from employment the amount must be in respect of past present or prospective employment and must be provided by the employer an associate of the employer or a third party under an arrangement with the employer or the associate of the employer 6

[desc-10] [desc-11]

Redundancy Pay In Liquidation What Happens To My Employees

https://business-insolvency-helpline.co.uk/wp-content/uploads/2020/07/redundancy-pay-for-employees.jpg

Salary Calculator Ghana Sugiono Salary

https://builtaccounting.com/wp-content/uploads/2020/01/2019.png

https://mywage.org/ghana/labour-law/employment...

Is my employer required to pay me when I am made redundant Yes The worker who is affected by the redundancy is entitled to be paid by the employer prior to the close down arrangement or amalgamation

https://gra.gov.gh/domestic-tax/tax-types/income-tax-exemptions

Income Tax Exemptions are the amounts that are reduced or removed from Income amounts because they are exempt from taxation These exemptions are to be outlined during filing Exempt amounts include

Redundancy Payment What To Do With It

Redundancy Pay In Liquidation What Happens To My Employees

Redundancy Calculator How Much Are Employees Entitled To Factorial

What Is Data Redundancy Dataconomy

The Importance Of Redundancy 123NET

Social Security Cost Of Living Adjustments 2023

Social Security Cost Of Living Adjustments 2023

Is Redundancy Pay Taxable The Motley Fool UK

What Is Redundancy Definition And Meaning Market Business News

Redundancy Management

Is Redundancy Pay Taxable In Ghana - [desc-13]