Is Redundancy Pay Taxable In Spain If the redundancy pay meets certain requisites it is exempt of income tax As long as the indemnization has been established according to the Statute of Employees and doesn t

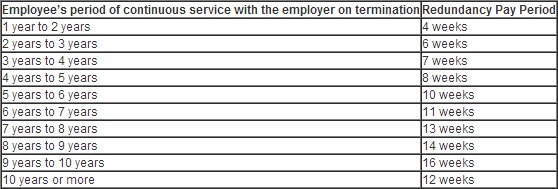

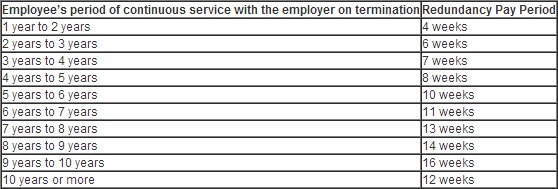

The taxation of severance pay in Spain presents a significant consideration for both employers and employees during the process of employment termination For Employees dismissed this way are entitled to receive 20 days of salary per years of service with the company This increases up to a maximum of 12 months of pay Severance pay like this applies to both

Is Redundancy Pay Taxable In Spain

Is Redundancy Pay Taxable In Spain

https://lirp.cdn-website.com/2377e54c/dms3rep/multi/opt/taxabke-1920w.jpg

Is Director Redundancy Pay Taxable Redundancy Claims UK

https://www.calculator.redundancyclaim.co.uk/images/articles/pulling-out-a-coin.jpg

What Compensation Is Taxable And What s Not GABOTAF

https://gabotaf.com/wp-content/uploads/2020/01/img_3738.jpg

If you are on an indefinite indefinido work contract and you ve been dismissed for objective reasons then you are entitled to a redundancy payment based on 20 1 10 Severance pay In cases of justified and fair objective dismissals or collective redundancies the minimum severance pay is 20 days salary per year of service capped

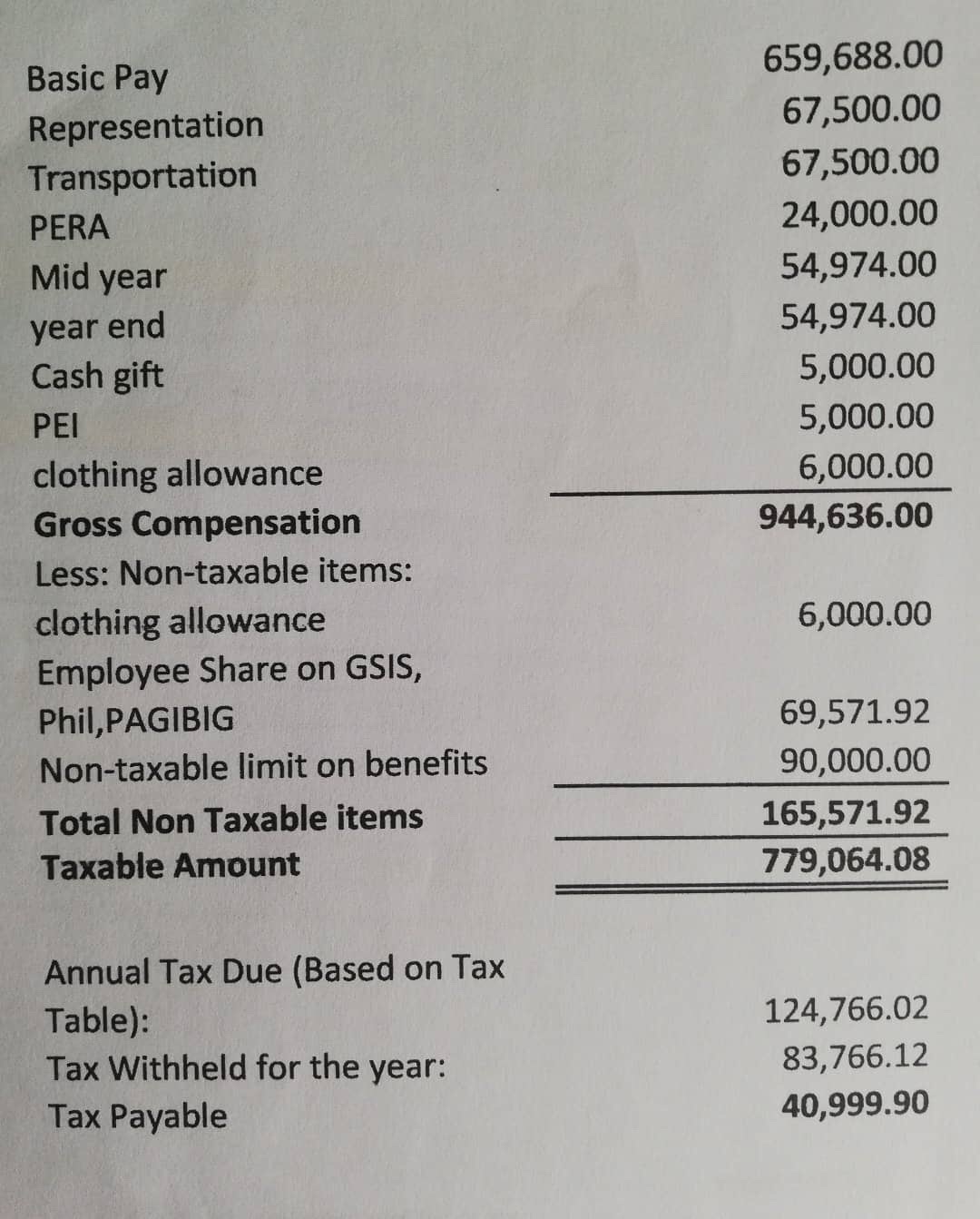

In Spain taxable income is the amount left over after deductions for social security pension personal allowance and professional expenses It is important to The severance pay has to be paid on the date of the dismissal The employer cannot impose a deferment of the severance pay Bear in mind that when the

Download Is Redundancy Pay Taxable In Spain

More picture related to Is Redundancy Pay Taxable In Spain

Suspension Of Employer s Obligation On Redundancy Payments Lifted

https://www.crowe.com/ie/-/media/crowe/firms/europe/ie/crowe-ireland/images/posts/redundancy-payments.jpg?h=521&w=750&rev=50d22d707cd3453e83fe6386025bb983&hash=8B7F1BB51DA1DA5912BB9C1D2263F6C5

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

F rmula De Los Ingresos Gravables Aprenda M s FinancePal

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1-768x552.png

Severance Pay Fair individual redundancy 20 days or 33 days of salary pay per year of service up to 12 months For collective layoffs this is usually increased through collective consultations Fair In comparison to an unfair dismissal situation termination by mutual agreement raises the issue that any agreed termination payments will be taxable in the

Tax residents in Spain are entitled to certain allowances and deductions Basic personal allowances Similarly to the UK every resident has a basic personal Say it was 17 you had worked 17 days in the month you were fired Well your redundancy payment would work like this 1 300 30 days a month 43 33 per

New Job Affect On Redundancy Pay Workingmums co uk

https://www.workingmums.co.uk/wp-content/uploads/2012/04/Redundancy.jpeg

Redundancy Calculator How Much Are Employees Entitled To Factorial

https://factorialhr.co.uk/wp-content/uploads/2022/04/27174159/InfographicRedundancyPay.-scaled.jpg

https://www.citizensadvice.org.es/faq/redundancy...

If the redundancy pay meets certain requisites it is exempt of income tax As long as the indemnization has been established according to the Statute of Employees and doesn t

https://www.lawants.com/en/sevrance-pay-spain

The taxation of severance pay in Spain presents a significant consideration for both employers and employees during the process of employment termination For

Redundancy Pay In Liquidation What Happens To My Employees

New Job Affect On Redundancy Pay Workingmums co uk

Director s Redundancy Concept Explained CMA

What Is Redundancy Pay And How Much Will You Get

5 Redundancy Letter Template Uk Sampletemplatess Within Failed

Redundancy Pay Redundancy Entitlements Mini Guide Owen Hodge Lawyers

Redundancy Pay Redundancy Entitlements Mini Guide Owen Hodge Lawyers

What Is Redundancy Pay Ease Insurance NZ

Dismissal Letter For Redundancy Template Rocket Lawyer UK

How Does Redundancy Pay Work In The UK A Guide For HR Teams

Is Redundancy Pay Taxable In Spain - A termination payment often comprises different elements some of which are contractual e g payment in lieu of notice or gardening leave payments some