Is Reimbursement Taxable In India Section 195 of the Income Tax Act states that TDS must be deducted on payments made to non residents if the amount paid is taxable in India The applicability

Are travel reimbursements in India taxable Most travel reimbursements and allowances will not be taxable in India as long as they have a business purpose In case employers are granting reimbursements for purchasing assets or incurring expenditure it is possible to claim such reimbursement as non taxable in the

Is Reimbursement Taxable In India

Is Reimbursement Taxable In India

http://upload.wikimedia.org/wikipedia/commons/2/24/India_Para.jpg

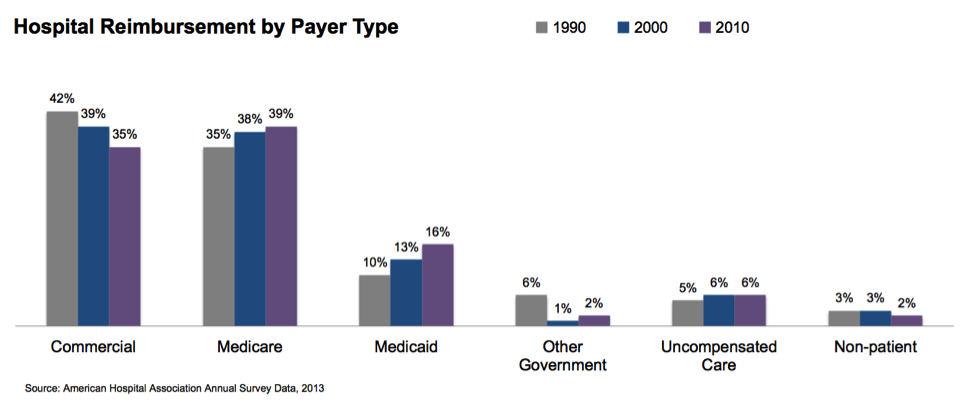

Key To Transitioning From Fee for service To Value based Reimbursements

https://www.healthcatalyst.com/wp-content/uploads/2021/05/hospital-reimbursement.png

Are QSEHRA Reimbursements Taxable

https://www.peoplekeep.com/hubfs/All Images/Featured Images/Are QSEHRA reimbursements taxable_featured.jpg#keepProtocol

Reimbursements are also made in the form of tax refunds by the government in case of over taxation As opposed to any other compensation reimbursements are not subject The income tax law allows employees to claim tax free reimbursement of expenses incurred on mobile and internet This reimbursement is on the bill amount paid or amount provided in the

Treatment of reimbursement of expense under GST Relevant provision of the GST Act Rules 1 Section 7 1 of CGST Act Reimbursement is supply or not 2 In case the reimbursement of travelling expenses as FTS Taxable Reimbursement of Audit fees Taxable Conclusion If the main expenditure is not chargeable to tax in India either under IT Act or DTAA then

Download Is Reimbursement Taxable In India

More picture related to Is Reimbursement Taxable In India

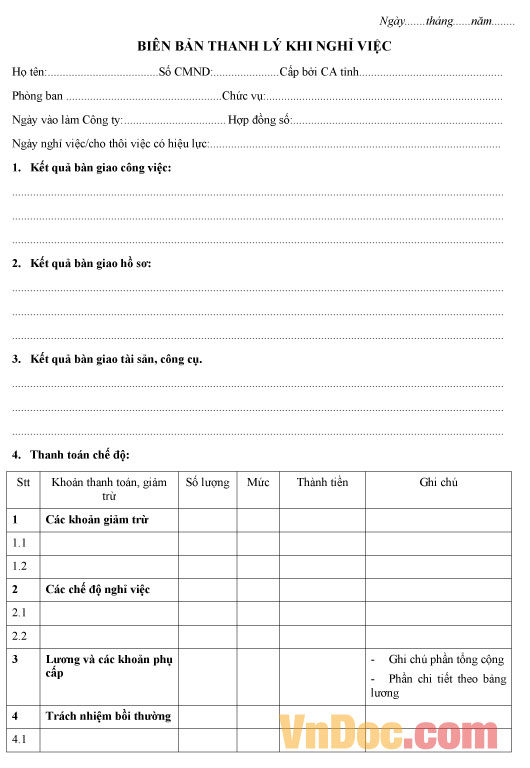

M u Bi n B n Thanh L Ngh Vi c T m p n Gi i B i T p H c T t

https://i.vdoc.vn/data/image/2016/12/02/mau-bien-ban-thanh-ly-nghi-viec.jpg

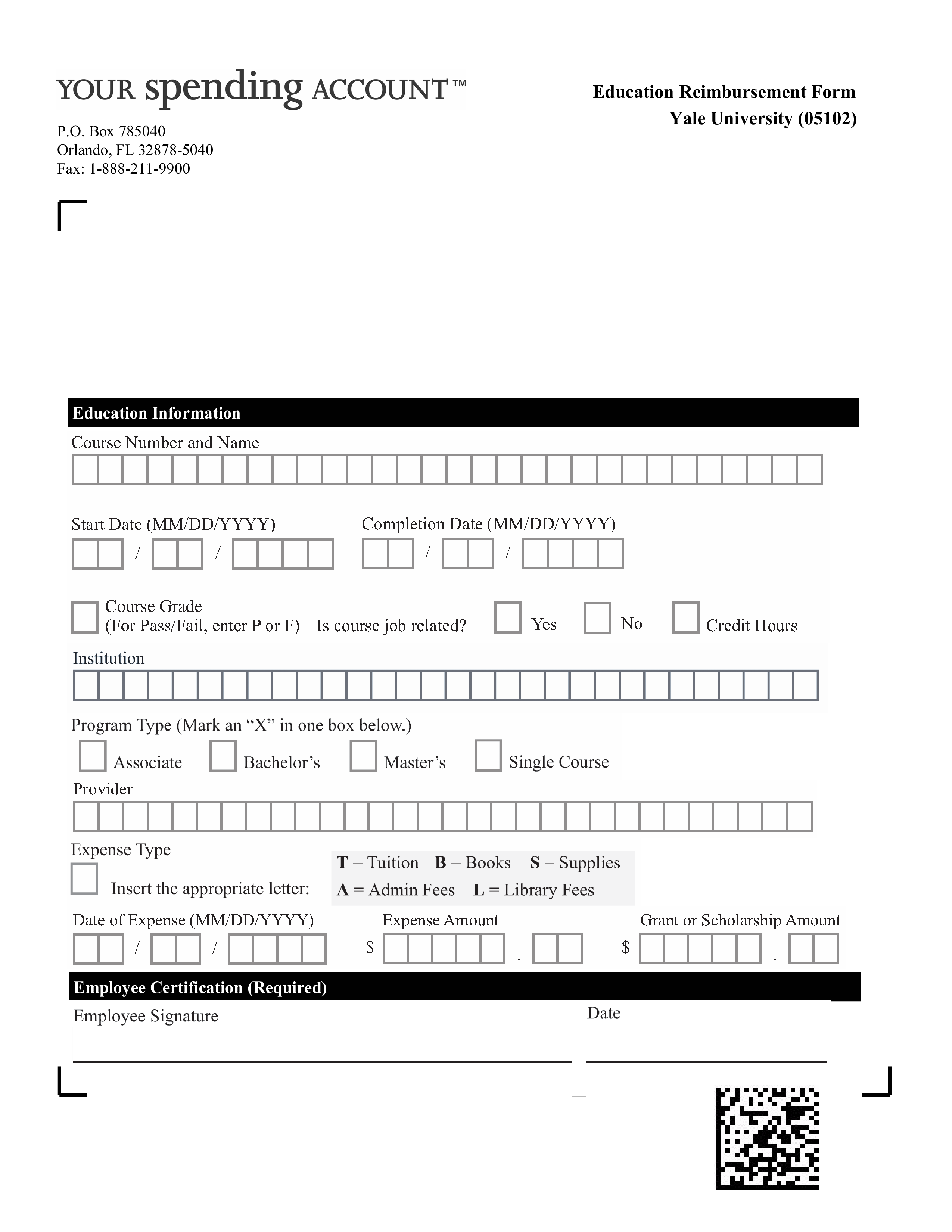

Education Reimbursement Form Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/c5b720e2-7c3a-4fd4-ad0b-b598af070302_1.png

Reimbursement Invoice Format Under Gst Prosecution2012

https://i2.wp.com/prosecution2012.com/wp-content/uploads/2020/01/reimbursement-invoice-format-under-gst.jpg

The TDS may have been deducted by the principal while reimbursing the payment to the assessee nevertheless the same were mere reimbursements and could Medical Allowance is fully taxable and employee is not required to furnish any bills to employer to get the medical allowance 1B Medical Reimbursement It

Further such remittance is not taxable in India under the relevant tax treaties The Tribunal also held that the tax is not required to be deducted on reimbursement of various However in some cases even without profit element tax authorities and courts have held reimbursement of expenses as income of recipient liable for TDS and

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

https://cdn.collegereaction.com/is_fica_tuition_reimbursement_taxable.jpg

Reimbursement For Lost Wages

https://www.dreishpoon.com/wp-content/uploads/2014/08/Queens-Reimbursement-for-Lost-Wages.jpg

https://cleartax.in/s/tds-on-reimbursement-of-expenses

Section 195 of the Income Tax Act states that TDS must be deducted on payments made to non residents if the amount paid is taxable in India The applicability

https://www.forum-expat-management.com/posts/a...

Are travel reimbursements in India taxable Most travel reimbursements and allowances will not be taxable in India as long as they have a business purpose

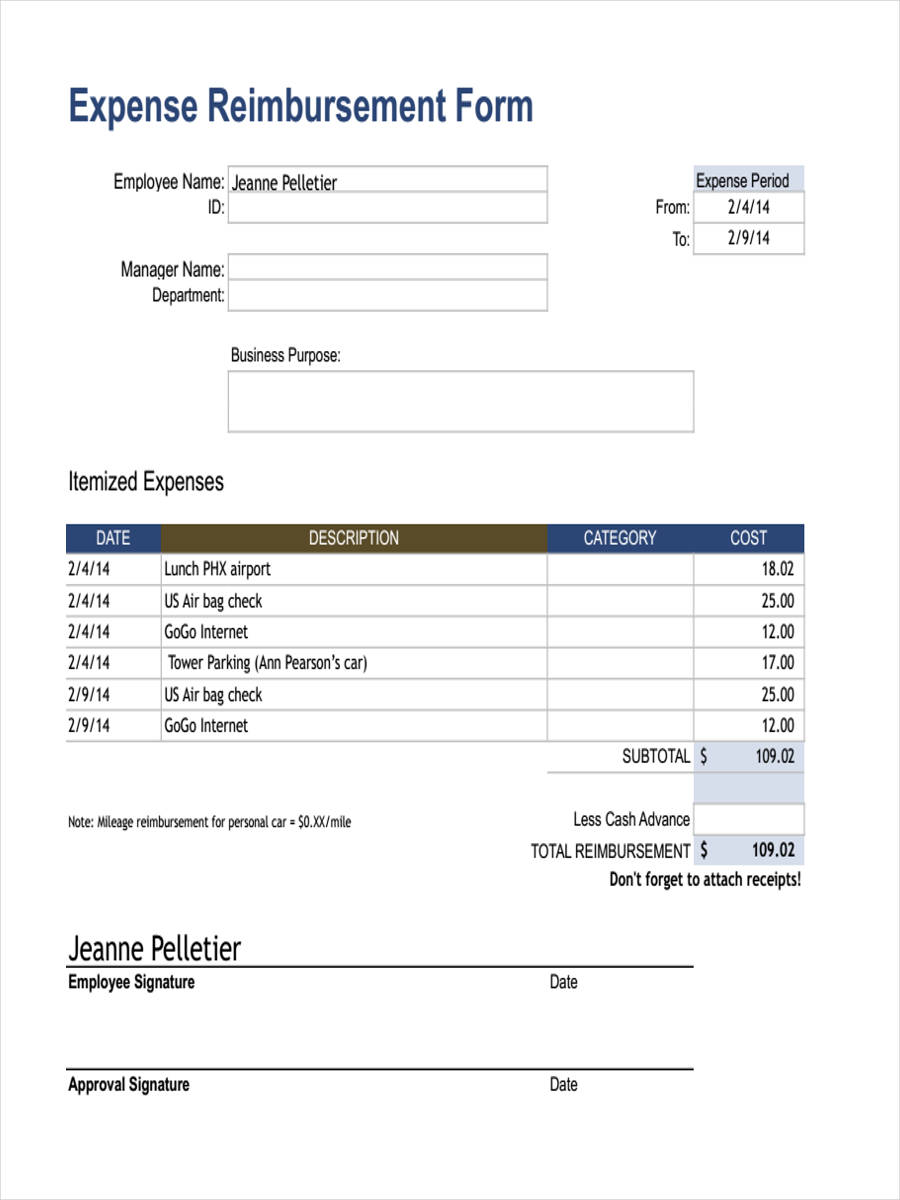

Reimbursement Submit Fill Online Printable Fillable Blank PdfFiller

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

Is Tuition Reimbursement Taxable A Guide ClearDegree

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

Reimbursement Meaning Types Examples How It Works

Reimbursement Gorilla ROI

Reimbursement Gorilla ROI

2021 Employee Expense Reimbursement Form Fillable Printable Pdf Porn

Who Is Eligible For Medicare Part B Reimbursement ClearMatch Medicare

Healthcare Reimbursement How It Works For Providers

Is Reimbursement Taxable In India - Treatment of reimbursement of expense under GST Relevant provision of the GST Act Rules 1 Section 7 1 of CGST Act Reimbursement is supply or not 2