Is Reimbursement Taxable Under Gst A reimbursement may be subject to GST if it is consideration for a supply of goods or services On the other hand the recovery of a payment made on behalf of another party

Generally tax is levied only on the profit margin and not on any reimbursement amount cost or expense which we pay on behalf of the recipient to carry out the principal work But this is not as simple as it Understanding the chargeability of GST on reimbursement of expenses under section 15 of CGST Act Learn about the tax implications in relation to providing output services

Is Reimbursement Taxable Under Gst

Is Reimbursement Taxable Under Gst

https://www.peoplekeep.com/hubfs/All Images/Featured Images/Is employee mileage reimbursement taxable_featured.jpg#keepProtocol

Is Work From Home Reimbursement Taxable

https://babatax.com/wp-content/uploads/2023/08/Is-work-from-home-reimbursement-taxable-1024x683.jpg

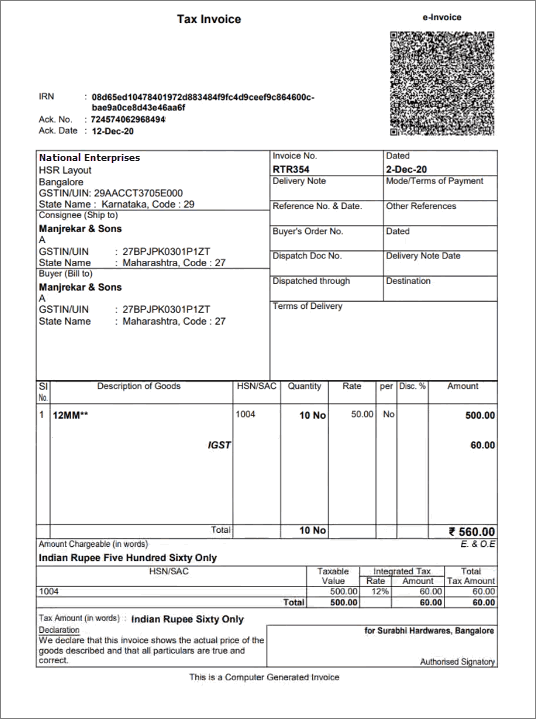

Gst Meaning With Example Invoice Template Ideas

https://simpleinvoice17.net/wp-content/uploads/2020/04/supply-under-gst-definition-meaning-scope-of-taxable-supply-gst-meaning-with-example.png

The taxability of reimbursement of expenses has been a prolonged debate since the inception of the GST The core issue revolves around the applicability of GST on amounts reimbursed by the recipient 2 1 The term reimbursement has not been defined in the Income tax Act 1961 IT Act It is also not defined in the Central Goods and Service Tax Act 2017 CGST Act

GST will be applicable on Reimbursement of Expenses in form of Incidental Expenses and no GST will be applicable on Reimbursement of Expenses in form of expenses paid by This article aims to clarify the concept of GST on the reimbursement of travel expenses outline the conditions for claiming input tax credit discuss the value

Download Is Reimbursement Taxable Under Gst

More picture related to Is Reimbursement Taxable Under Gst

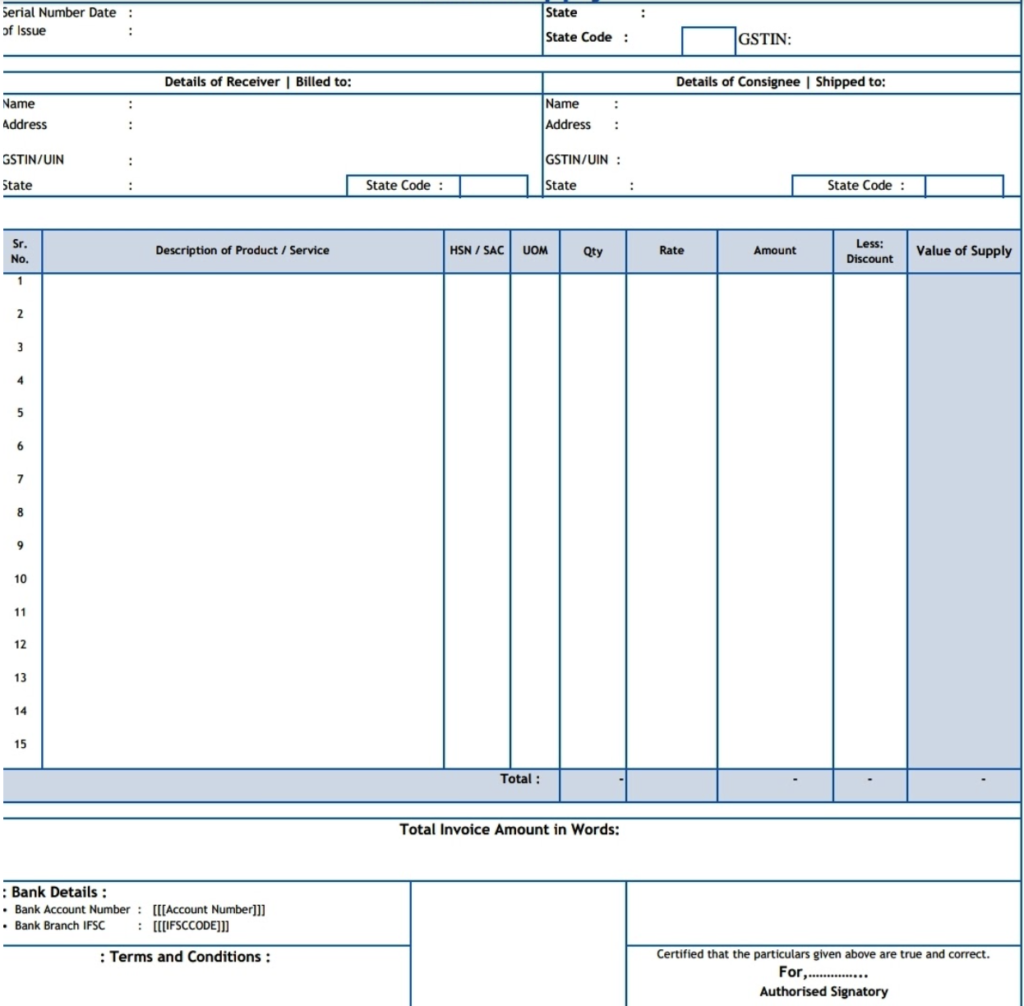

Reimbursement Invoice Format Under Gst Prosecution2012

https://i2.wp.com/prosecution2012.com/wp-content/uploads/2020/01/reimbursement-invoice-format-under-gst.jpg

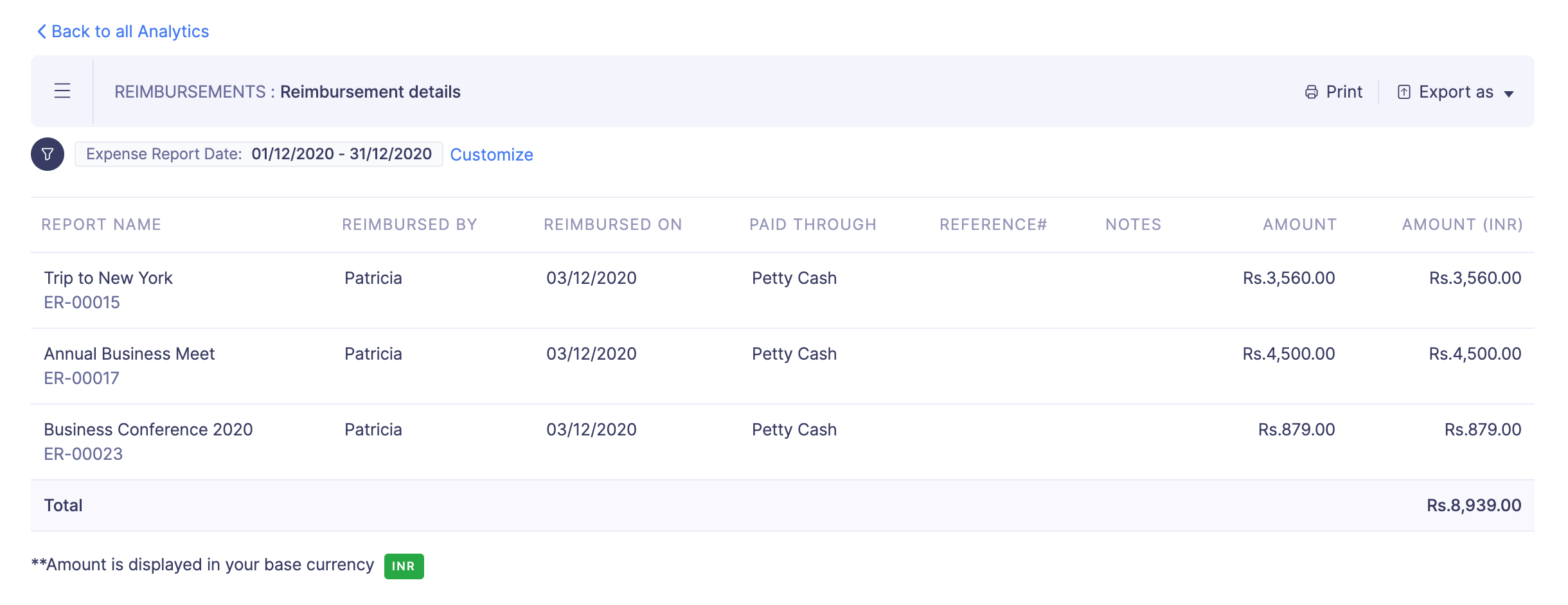

Reimbursement Analytics User Guide Zoho Expense

https://www.zoho.com/expense/help/analytics/reimbursement/reimbursement-details.png

GST On Reimbursement Of Expenses 2023 Details

https://instafiling.com/wp-content/uploads/2023/01/How-To-Register-Dsc-on-Income-Tax-Portal-16.png

It is reasonably common for consultants and contractors providing services to seek reimbursement for costs such as travel expenses in addition to the charge for Is there reimbursement of expenses under GST This article goes over how Suppliers or Pure Agents are reimbursed on expenses they bear on behalf of the receiver of goods

The Reimbursement of expenses concept forms an important matter of subject under the GST Law It has direct implications on the computation of taxable Section 24 of the CGST Act 2017 states that a person liable to pay GST under the reverse charge mechanism have to compulsorily register under GST The

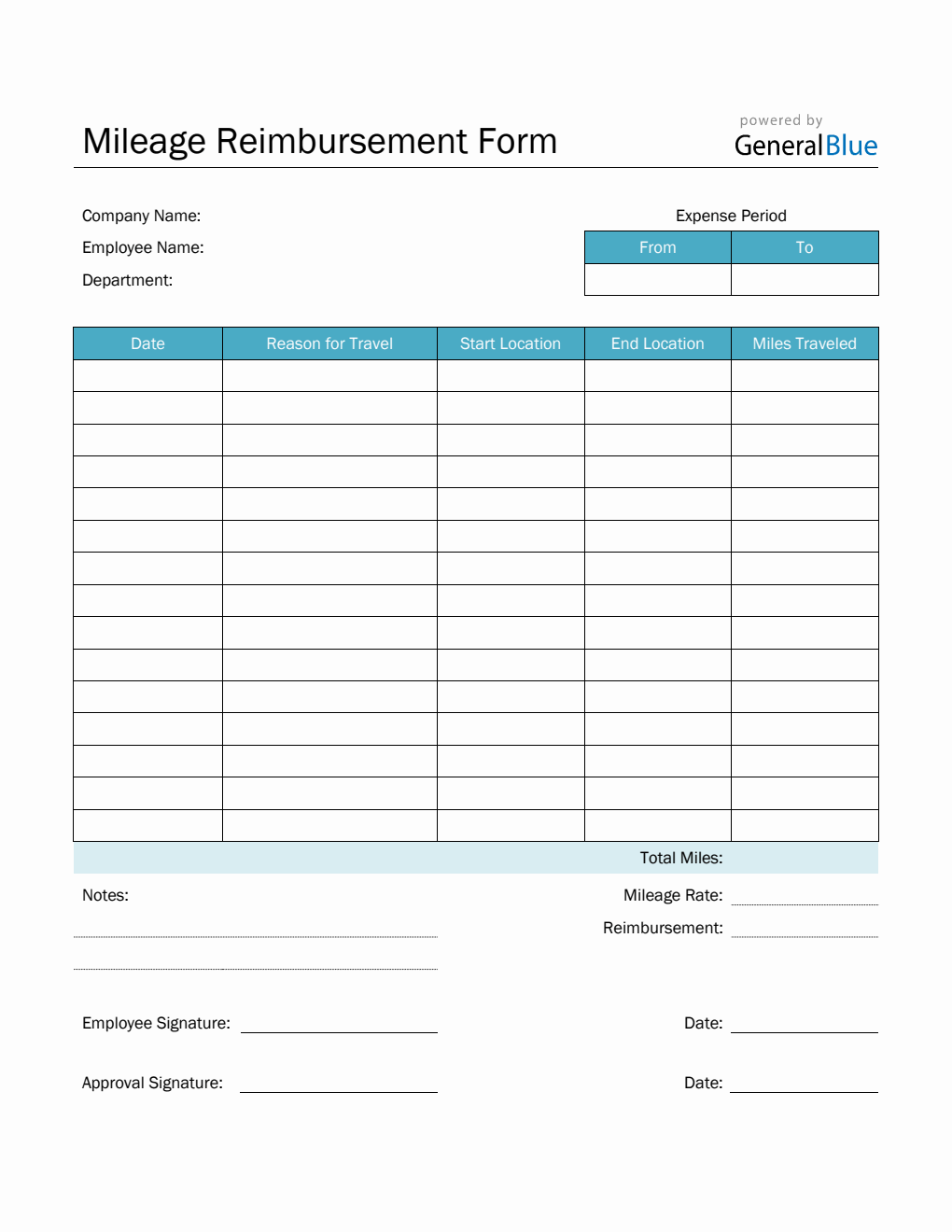

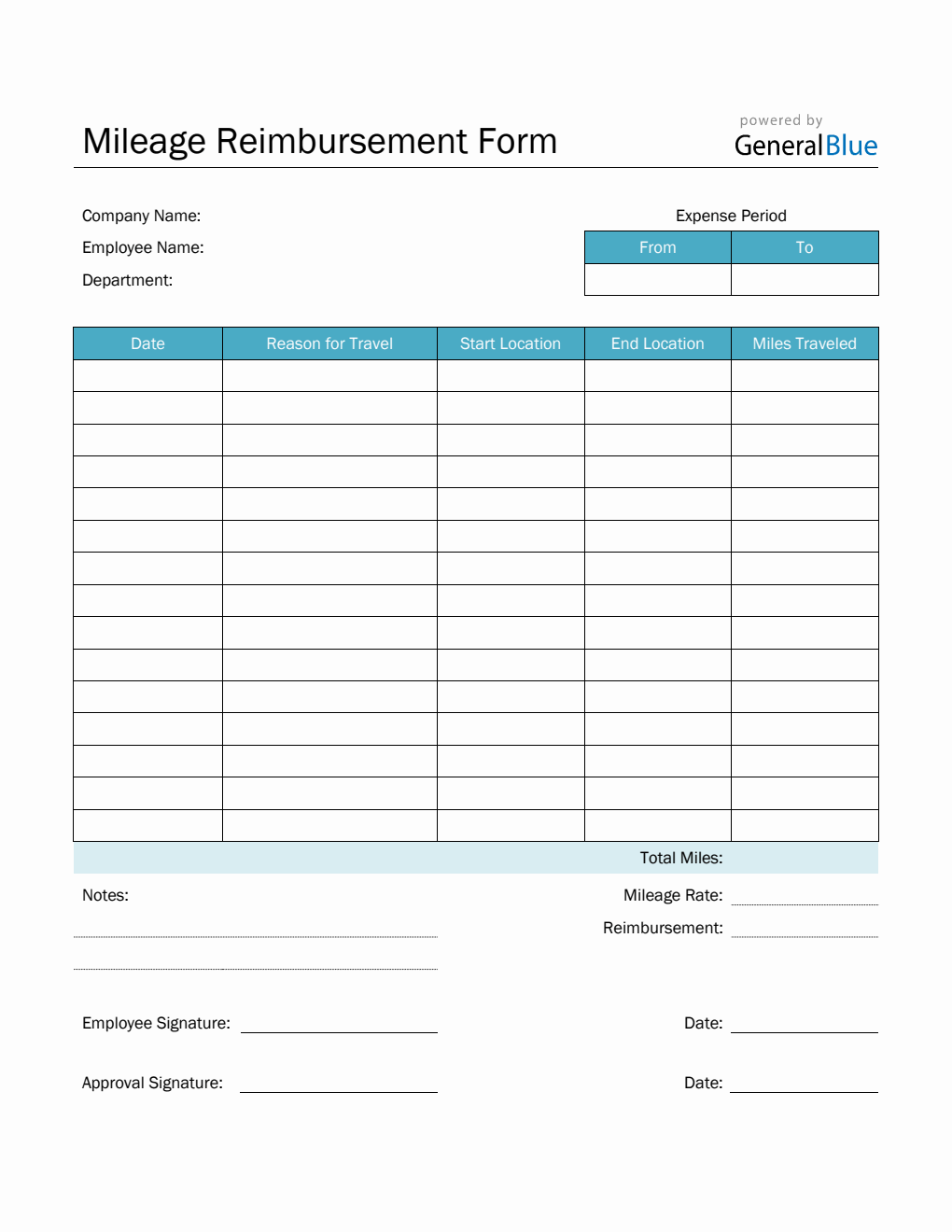

Mileage Reimbursement Form In PDF Basic

https://www.generalblue.com/mileage-reimbursement-form/p/tbm51rd9k/f/basic-mileage-reimbursement-form-in-pdf-md.png?v=99b37856fd604291698117ba17c0f966

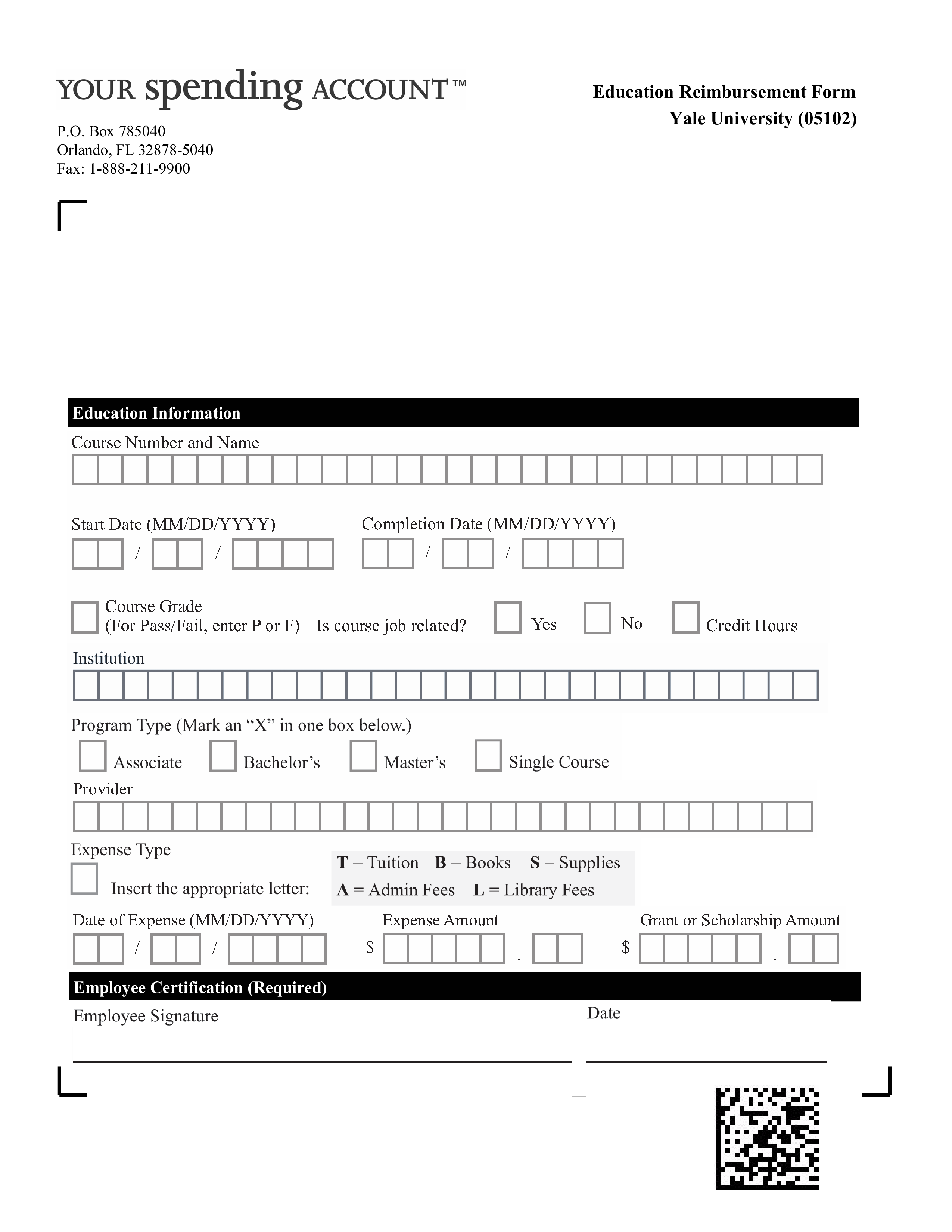

Education Reimbursement Form Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/c5b720e2-7c3a-4fd4-ad0b-b598af070302_1.png

https://www.iras.gov.sg/taxes/goods-services-tax...

A reimbursement may be subject to GST if it is consideration for a supply of goods or services On the other hand the recovery of a payment made on behalf of another party

https://taxguru.in/goods-and-service-tax/gst...

Generally tax is levied only on the profit margin and not on any reimbursement amount cost or expense which we pay on behalf of the recipient to carry out the principal work But this is not as simple as it

Is Tuition Reimbursement Taxable A Guide ClearDegree

Mileage Reimbursement Form In PDF Basic

GST Invoice Bill Format Invoice Rules Tally Solutions

What Is A GST Tax Invoice How To Create A Tax Invoice The Step By

Who Is Eligible For Medicare Part B Reimbursement ClearMatch Medicare

Cash Flow Basics Disbursement Vs Reimbursement

Cash Flow Basics Disbursement Vs Reimbursement

Reimbursement Scholarships IDA Arizona

Are Reimbursements Taxable IRS Guidelines On Reimbursements

Reimbursement Meaning Types Examples How It Works

Is Reimbursement Taxable Under Gst - This article aims to clarify the concept of GST on the reimbursement of travel expenses outline the conditions for claiming input tax credit discuss the value