Is Rent A Tax Deduction The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30 up to

Taxpayers cannot deduct residential rent payments on your federal income taxes But depending on where you live you might be able to deduct a portion of rent from your state income taxes Rent isn t tax deductible but some states offer a renter s tax credit Find out if your state offers it and what deductions you qualify for

Is Rent A Tax Deduction

Is Rent A Tax Deduction

https://static.helloskip.com/blog/2022/03/Untitled-design--11-.png

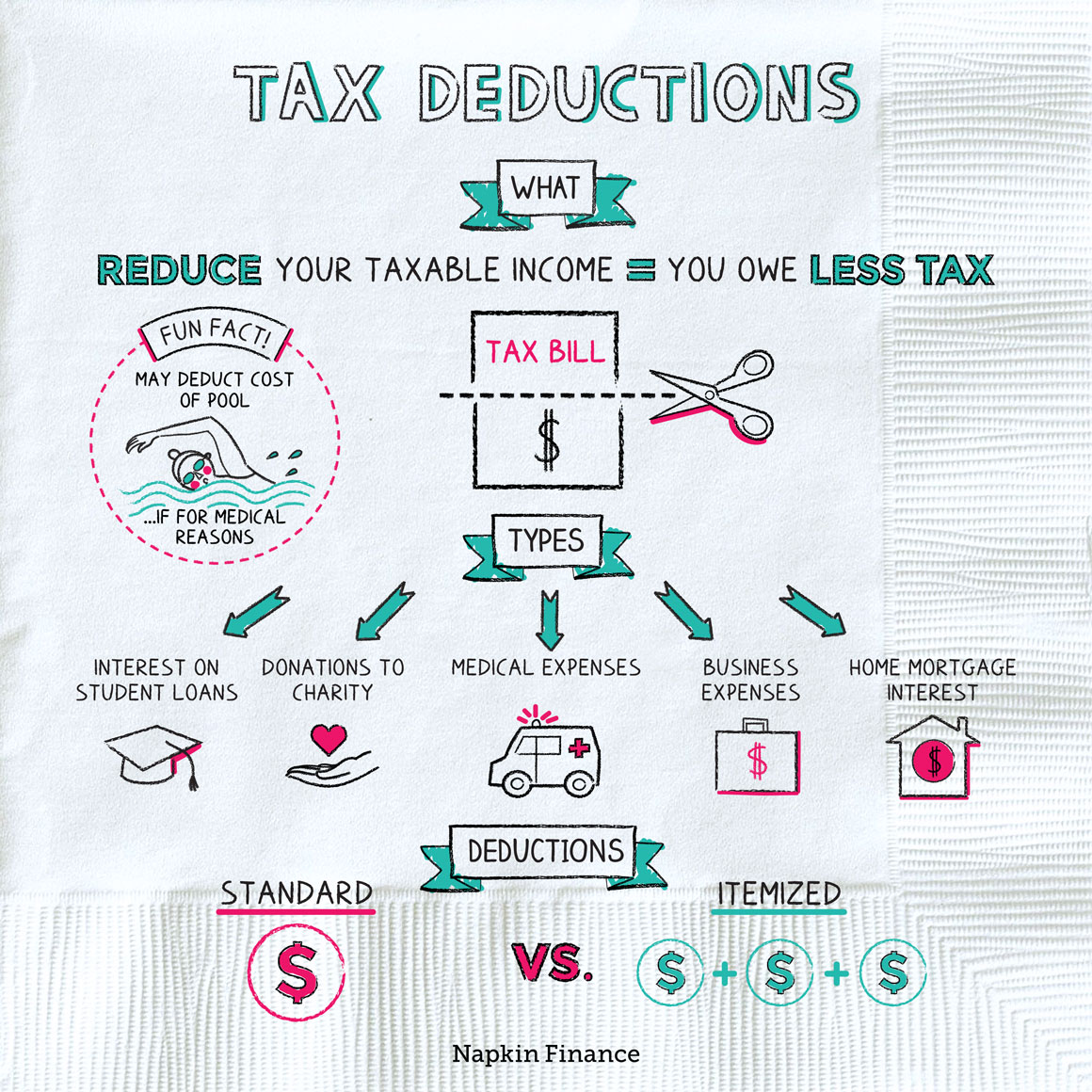

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

The Tax Deductions And Credits You Can Claim In Australia Your

https://www.taxback.com/resources/blogimages/20211123150053.1637672453254.ef2a32d3150203e35fb30b57f95.jpg

You can claim deductions for rental expenses against your rental and other income such as salary wages or business income If your other income isn t enough to Tax Tip 2022 37 March 9 2022 Rent is any amount paid for the use of property that a small business doesn t own Typically rent can be deducted as a business expense when the rent

Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income In general you can deduct Rented or leased property includes real estate machinery and other items that a taxpayer uses in his or her business and does not own Payments for the use of this property may be

Download Is Rent A Tax Deduction

More picture related to Is Rent A Tax Deduction

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

https://www.houseloanblog.net/wp-content/uploads/2021/12/220003_SM_BLOG_Homeowner-Tax-Breaks-2022-CHART.jpg

Is A Tax Deduction A Good Thing

https://www.getridoftaxes.com/img/e75343e701704ebaa6b7b8c500aa56d3.jpg?11

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

https://secureservercdn.net/160.153.137.184/mms.194.myftpupload.com/wp-content/uploads/2022/01/Deduction-in-income-tax-where-House-rent-is-paid-and-HRA-not-received-768x505.jpg

As the deadline for filing Income Tax returns nears authorities have warned against using fake rent receipts to claim house rent allowance HRA deductions According to rules If you own a rental property the IRS allows you to deduct expenses you pay for the upkeep and maintenance of the property conserving and managing the property and

Rent itself can t be deducted from your taxable income but there are other tax breaks you can claim to lower your liability when you don t own a home See if you qualify Whether you qualify for tax deductions as a renter depends on the nature of your work how you plan to file your taxes and where you live Here s a breakdown of the top

The 6 Best Tax Deductions For 2020 The Motley Fool

https://g.foolcdn.com/editorial/images/550999/getty-tax-deductions-irs-return-taxes.jpg

What Is A Tax Deduction Tax Credits Tax Deductions Deduction

https://i.pinimg.com/originals/a4/c8/51/a4c85197b9f35d1d483da88c3145d8a2.jpg

https://www.vero.fi/en/individuals/property/rental_income

The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30 up to

https://smartasset.com/taxes/can-you-ded…

Taxpayers cannot deduct residential rent payments on your federal income taxes But depending on where you live you might be able to deduct a portion of rent from your state income taxes

Income Tax Deduction For Rent Paid Section 80GG IndiaFilings

The 6 Best Tax Deductions For 2020 The Motley Fool

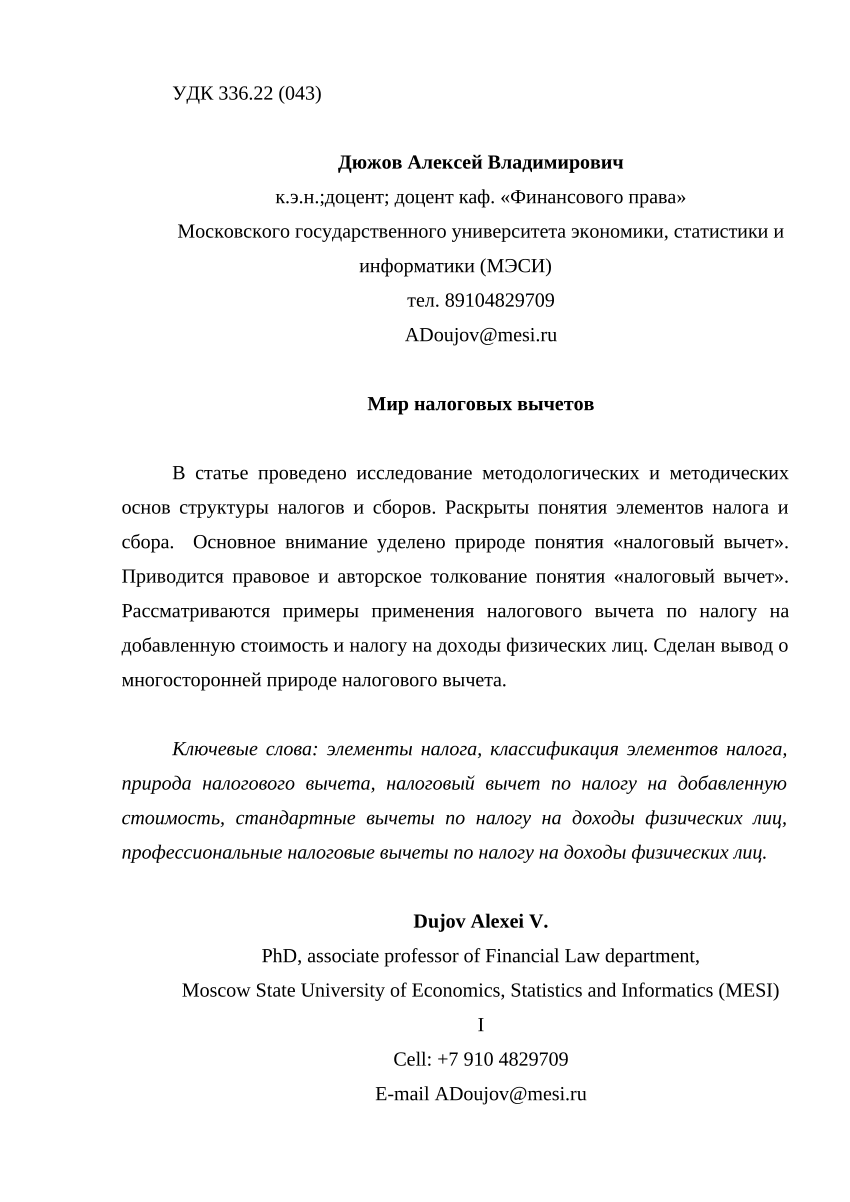

PDF The World Of Tax Deductions

What Is A Tax Deduction

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

1040 Deductions 2016 2021 Tax Forms 1040 Printable

1040 Deductions 2016 2021 Tax Forms 1040 Printable

Tax Deductions Template For Freelancers Google Sheets

Standard Deduction 2020 Self Employed Standard Deduction 2021

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

What To Expect When Filing Your Taxes This Year

Is Rent A Tax Deduction - The nine most common rental property tax deductions are 1 Mortgage Interest Most homeowners use a mortgage to purchase their own home and the same goes for rental