Is Rental Rebate Taxable Landlords are required to provide rental waivers to eligible tenants through any of these methods Monetary payments to the tenants and or Reduction of rent or licence fee provided to the tenant and or Passing on the Property

Renters must make certain their landlords were required to pay property taxes or has made a payment in lieu of tax payments on the rental property You are eligible for a Property Tax Rent Rebate if you meet the requirements in each of the three categories below Category 1 Type of Filer Rental relief or additional support received in the form of rental waiver The reduced amount of rental expense incurred by the tenant or subtenants is tax deductible provide the expense is incurred in connection with the production of income and a deduction is not prohibited under section 15 1 of the ITA

Is Rental Rebate Taxable

Is Rental Rebate Taxable

https://i0.wp.com/www.usrebate.com/wp-content/uploads/2023/06/cropped-USRebate-Logo-1.png?fit=500%2C216&ssl=1

87A Tax Rebate Benefits Are Lost If Non taxable MF LTCG Is Added In ITR

https://freefincal.com/wp-content/uploads/2022/07/87A-tax-rebate-benefits-are-lost-if-non-taxable-MF-LTCG-is-added-in-ITR.jpg

Renters Rebate 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

Emergency Rental Assistance is intended to help eligible households that require financial assistance to pay for rent utilities home energy expenses and other related expenses and the payments are excluded from income only for those households The IRS has created a FAQ page addressing tax issues related to Section 501 Emergency Rental Assistance Q1 I am a renter who received Section 501 Emergency Rental Assistance payments from a Distributing Entity for use in paying my rent Are these payments includible in my gross income

The Rental Relief Framework is designed to provide mandated equitable co sharing of rental obligations between the Government landlords and tenants The principal aim is to help affected Small and Medium sized Enterprises SMEs who need more time and support to recover from the pandemic In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but isn t taxable

Download Is Rental Rebate Taxable

More picture related to Is Rental Rebate Taxable

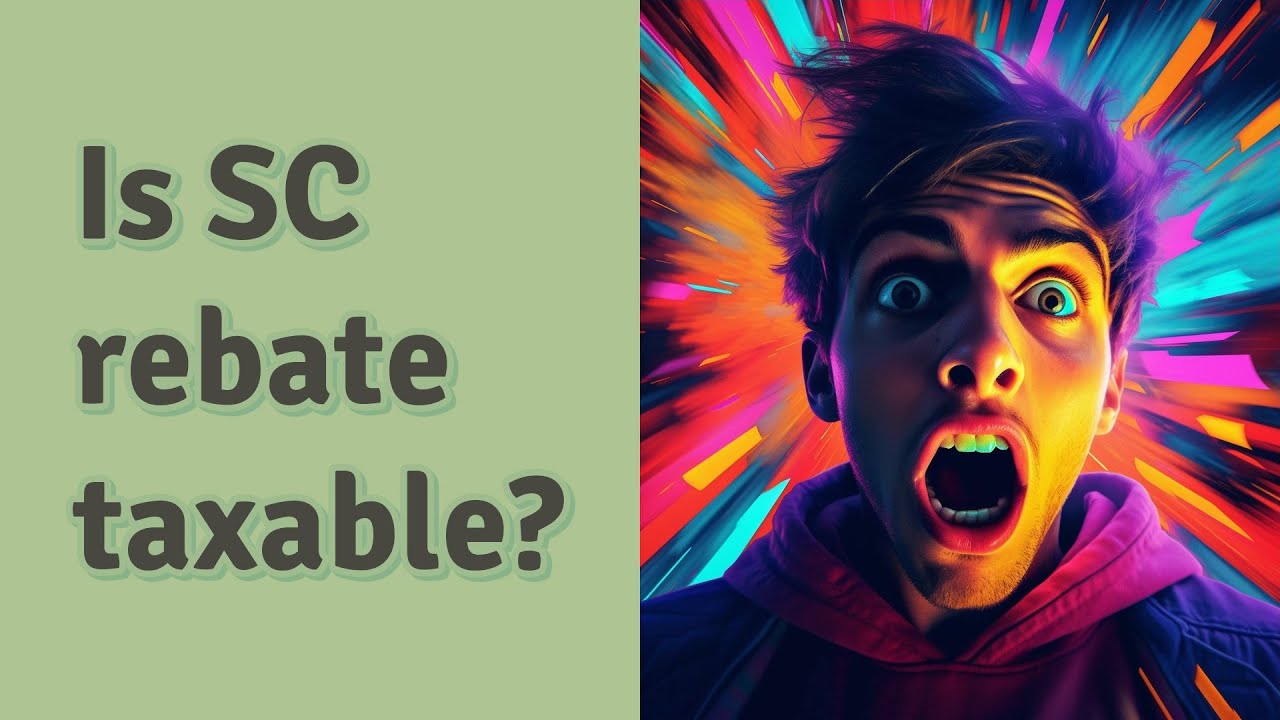

Is SC Rebate Taxable YouTube

https://i.ytimg.com/vi/7B8fysKAJJs/maxresdefault.jpg

PPT Realtor Rebate Taxable Insightrealtypittsburgh PowerPoint

https://cdn7.slideserve.com/12553346/realtor-rebate-taxable-insightrealtypittsburgh-com-n.jpg

Form For Renters Rebate RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/rent-rebate-form-1-free-templates-in-pdf-word-excel-download-15.png?fit=768%2C1024&ssl=1

Yes generally rental expenses can be deducted and some rental income isn t taxable under the Master s rule However deductions claimed must always be ordinary necessary and South Carolina s tax credit offers 25 of the cost of your solar system up to 35 000 or 50 of your tax liability for the year The state of Idaho offers a 40 tax deduction on the cost of a

Learn about the rental relief measures under the Rental Waiver Framework 2021 and the relevant tax treatment for landlords and tenants There s a minimum amount of rent you need to pay to get Rent Assistance For every 1 of rent you pay above this amount you ll get 75c You can t get more than the maximum amount We update Rent Assistance rates on 20 March and 20 September each year This is in line with the Consumer Price Index

HST New Rental Property Rebate Program HST Rebate For Landlords

https://www.stratosconsultants.ca/wp-content/uploads/bb-plugin/cache/HST-New-Rental-Property-Rebate-Program-1024x683-landscape.jpg

Mall Owners Too Soon To Decide On Rental Rebate Requests The Star

https://apicms.thestar.com.my/uploads/images/2020/02/19/566323.jpg

https://www.iras.gov.sg/news-events/singapore...

Landlords are required to provide rental waivers to eligible tenants through any of these methods Monetary payments to the tenants and or Reduction of rent or licence fee provided to the tenant and or Passing on the Property

https://revenue-pa.custhelp.com/app/answers/detail/a_id/181

Renters must make certain their landlords were required to pay property taxes or has made a payment in lieu of tax payments on the rental property You are eligible for a Property Tax Rent Rebate if you meet the requirements in each of the three categories below Category 1 Type of Filer

Is Rental Income Taxable Wegner CPAs

HST New Rental Property Rebate Program HST Rebate For Landlords

Property Tax Rebate Pennsylvania LatestRebate

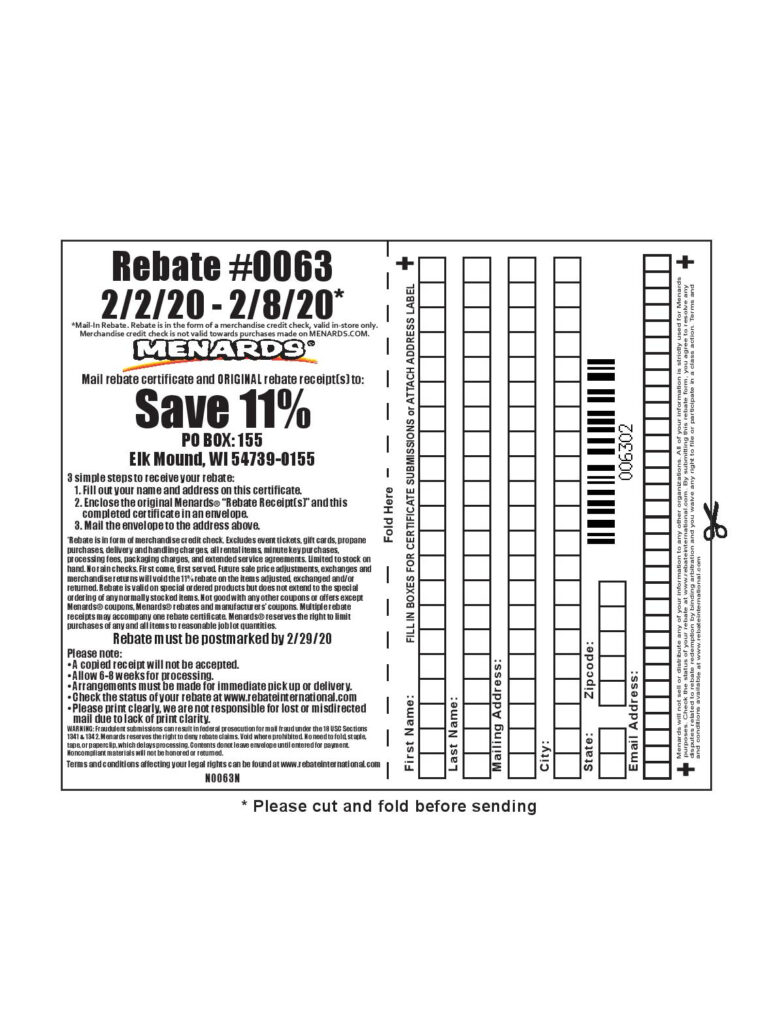

Menards Printable Rebate Form 2022 MenardsRebate Form

How To Reduce Your Taxable Income

Is CA EV Rebate Taxable

Is CA EV Rebate Taxable

Ca Electric Car Rebate 2022 Carrebate

8 2023 Social Security Tax Limit Ideas 2023 GDS

Minnesota Property Tax Refund Fill Out And Sign Printable PDF

Is Rental Rebate Taxable - If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage interest property tax operating expenses depreciation and repairs