Is Restaurant Food Taxed In Nj The Streamlined Sales and Use Tax Agreement affects the New Jersey Sales Tax treatment of certain products and services including but not limited to candy soft drinks prepared food certain clothing and footwear grooming

Is food taxable in New Jersey We ll walk you through when and when not to charge sales tax when selling food and beverages in New Jersey Since 2018 New Jersey has been imposing sales taxes on restaurants at the rate of 6 625 Any business including restaurants dealing in the sale of prepared food in dining or take out and beverages is subject to sales tax

Is Restaurant Food Taxed In Nj

Is Restaurant Food Taxed In Nj

https://www.tastingtable.com/img/gallery/19-best-diners-in-new-jersey-ranked/l-intro-1676731885.jpg

What Is The Most Taxed State

https://www.madisontrust.com/wp-content/uploads/2023/02/most-taxed-state-5_thumb.jpg

Is Food Taxed In Virginia YouTube

https://i.ytimg.com/vi/KwAsRi6SbBQ/maxresdefault.jpg

Are Food and Meals subject to sales tax While New Jersey s sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes This page describes the taxability of food and meals in New Jersey including catering and grocery food Sales and Use taxpayers in New Jersey were taxed in one of six categories from 2018 to 2021 through 1 sales receipts from retail trade rental or use of tangible property sales 2 receipts of energy 3 the sales receipts of certain purchases of tangible personal property at qualified businesses in Urban Enterprise Zones taxed 4

The majority of purchases including food and drinks served in restaurants are subject to a sales tax in the state of New Jersey However what precisely is the food tax in New Jersey How much should you anticipate paying In New Jersey the sales tax rate is 6 625 You may notice that sales tax is being charged at the bottom of your receipt the next time you go shopping Items that are subject to sales tax in New Jersey are physical items such as automobiles furniture fixtures and meals bought at restaurants

Download Is Restaurant Food Taxed In Nj

More picture related to Is Restaurant Food Taxed In Nj

Is Dog Food Taxed In Ohio YouTube

https://i.ytimg.com/vi/FpfBtCrdSlg/maxresdefault.jpg

Is Food Taxed In The US YouTube

https://i.ytimg.com/vi/Tx264juR4Yo/maxresdefault.jpg

How Is Social Security Taxed How Much Of Your Social Security Income

https://i.ytimg.com/vi/_b3sVqfoOFQ/maxresdefault.jpg

This bulletin explains the New Jersey Sales Tax rules that apply to the sale of food and beverages It also briefly describes other taxes administered by the Division of Taxation for which a restaurant or food related service business may be liable The table below outlines the taxability of non prepared grocery food by state Most states that exempt grocery food exclude soft drinks candy and confections States also charge sales tax for prepared food in restaurants and grocery stores as it is a meal

New Jersey Prepared food is taxable Receipts from the sale of prepared food in or by restaurants taverns or other establishments in the state or by caterers including in the amount of such receipts any cover minimum entertainment or other charge made to patrons or customers are subject to tax Restaurant meals of course are subject to sales tax tips and gratuities are exempt Telephone answering services should they still be needed these days are taxable

Least Tax friendly States

https://s.hdnux.com/photos/24/22/71/5320312/4/1200x0.jpg

Is Food Taxed In Arkansas YouTube

https://i.ytimg.com/vi/0cNStmNqxH0/maxresdefault.jpg

https://www.nj.gov/treasury/taxation/pdf/pubs/sales/su4.pdf

The Streamlined Sales and Use Tax Agreement affects the New Jersey Sales Tax treatment of certain products and services including but not limited to candy soft drinks prepared food certain clothing and footwear grooming

https://www.taxjar.com/blog/food/food-sales-tax-new-jersey

Is food taxable in New Jersey We ll walk you through when and when not to charge sales tax when selling food and beverages in New Jersey

Is Hot Food Taxed In Florida YouTube

Least Tax friendly States

Junk food Tax 79 People Want Unhealthy Foods Taxed More Finds Survey

Qatar Tackles Obesity Epidemic With Hefty junk Food Tax

A Beginner s Guide To S Corporation Taxes

Food Tech Connect Will My Restaurant Get Taxed On Gift Cards GoFundMe

Food Tech Connect Will My Restaurant Get Taxed On Gift Cards GoFundMe

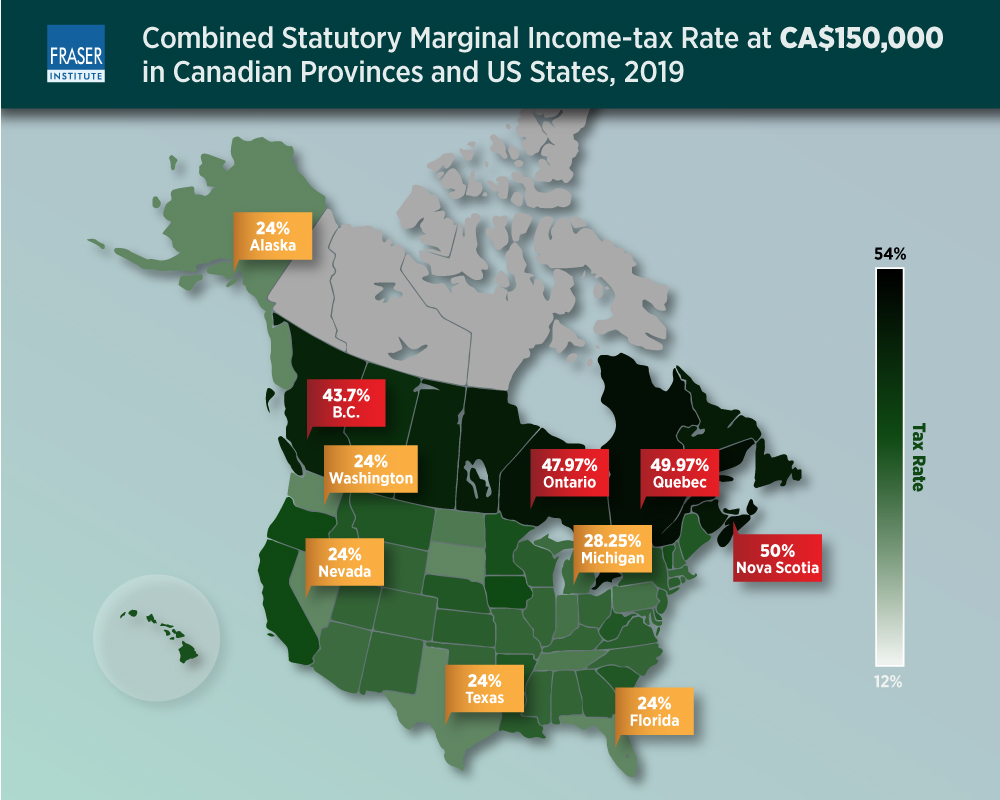

Comparison Do Canadians Pay More Taxes Than Americans To Do Canada

Tax On Dividend Income In India How Is Your Dividend Taxed

Dem Leaders Shoppers Don t Want Food Taxed Again On A Frigid Tuesday

Is Restaurant Food Taxed In Nj - In New Jersey certain items may be exempt from the sales tax to all consumers not just tax exempt purchasers Several examples of exemptions to the sales tax are most clothing items prescription drugs and jewelry