Is Sales Tax On A New Car Deductible Deduction has limits on vehicle weight and taxpayer income This deduction only applies to sales taxes paid on new cars and trucks not used ones that weigh less than 8 500 pounds plus motorcycles and motor homes If you buy a vehicle for more than 49 500 you can only deduct the sales tax on that amount

Opus 17 Level 15 Title and lien fees are never deductible Sales tax is deductible if you itemize your deductions and if you choose to deduct sales tax instead of state income tax Registration fees may be deductible if a part of the registration fee is based on the value of the car You can deduct sales tax on a new or used purchased or leased vehicle or boat but if you live in a state with a state income tax it probably isn t to your advantage to do so To claim sales taxes on a vehicle or boat you need to meet two criteria

Is Sales Tax On A New Car Deductible

Is Sales Tax On A New Car Deductible

https://www.accountingfreedom.com/wp-content/uploads/2017/12/Is-Buying-a-New-Car-Tax-Deductible.jpg

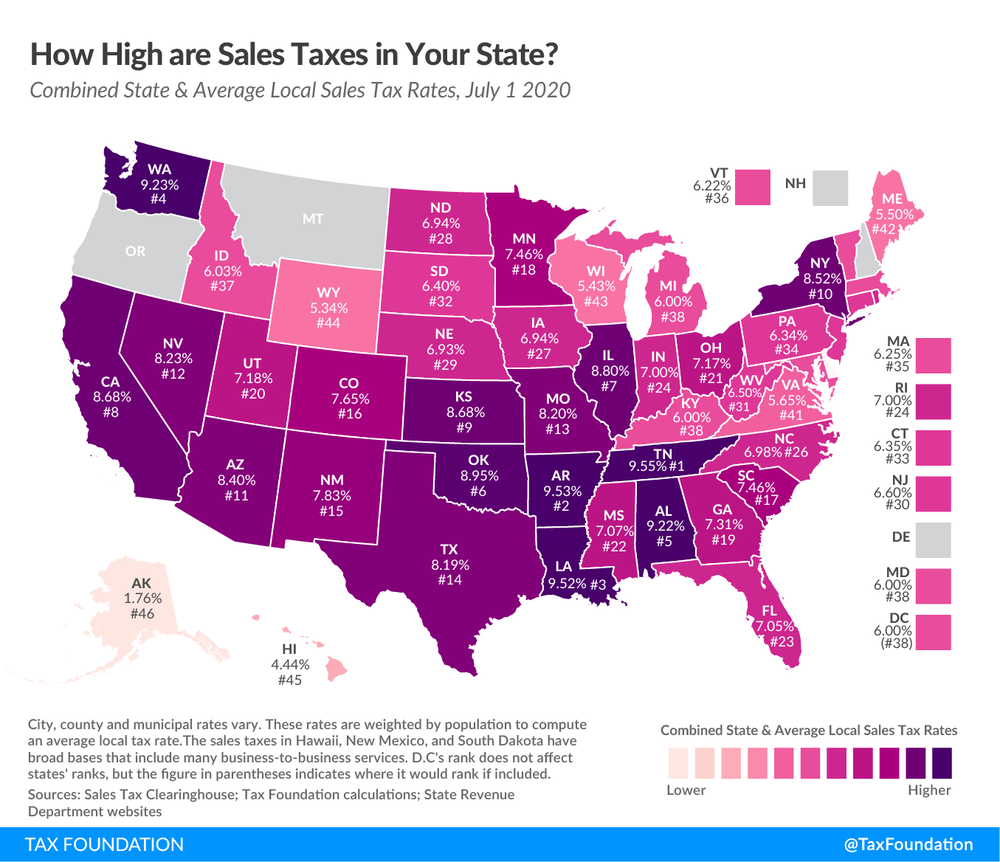

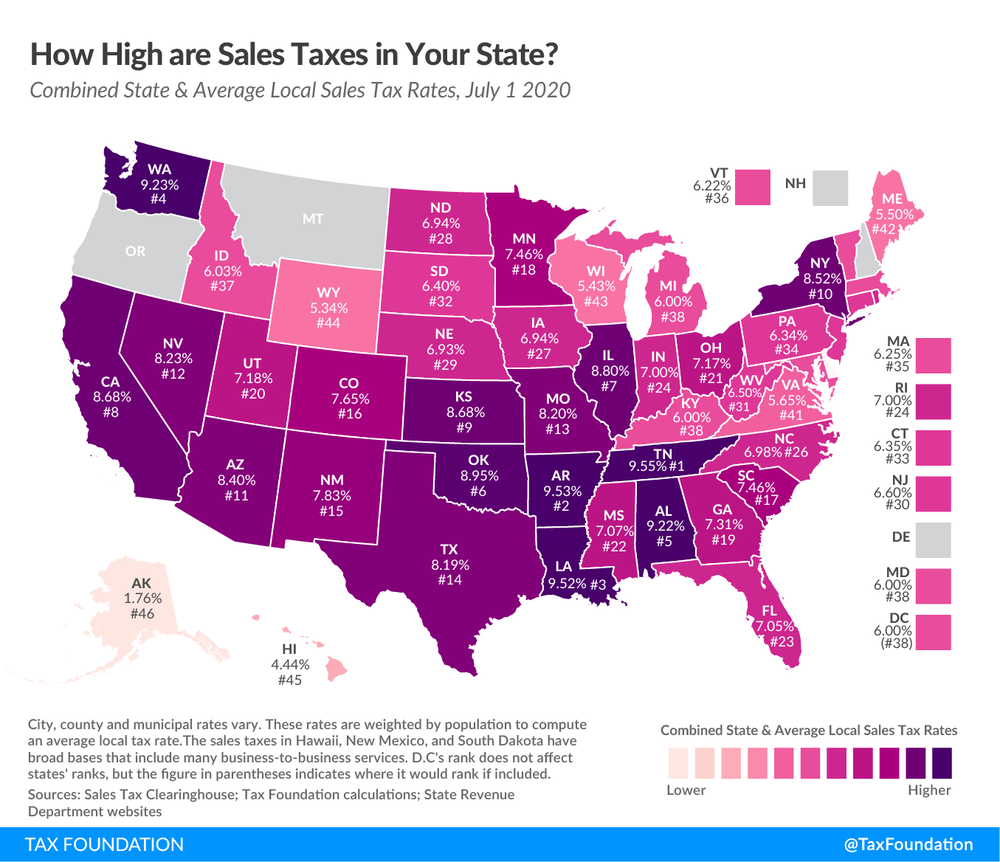

What Is The Sales Tax On A Car In Nevada Cars Amazing Automotive

https://carsamazing.com/wp-content/uploads/2021/03/COPY-Custom-dimensions-850x550-px-2021-03-23T042837.570-1.jpeg

Taxes Scolaires Granby

https://1.bp.blogspot.com/-FBZaqEQDH_o/UTeOM4UQVWI/AAAAAAAAAXI/-pdogFJD8xw/s1600/tax+map.png

Sales Tax You can elect to deduct state and local general sales taxes instead of state and local income taxes as an itemized deduction on Schedule A Form 1040 You cannot deduct both To figure your state and local general sales tax deduction you can use either your actual expenses or the state sales tax tables According to H R Block taxpayers can deduct sales tax on a vehicle purchase but only the state and local sales tax However it is important to note that this deduction is only beneficial if the taxpayer paid more in state and local sales tax than they paid in state and local income tax

There is no specific deduction for sales tax paid on a vehicle There is however a deduction for any sales tax in general that you paid throughout the year If you made a major purchase such as a vehicle it may behoove you to take this deduction This deduction isn t automatic however The amount to be taxed depends on the state s law in 42 states the sales tax is returned from the difference between the value of a new vehicle and the trade in amount you get In some states i e California sales

Download Is Sales Tax On A New Car Deductible

More picture related to Is Sales Tax On A New Car Deductible

What Is A Tax Engine For VAT GST Determination Why VAT Calculator Is

https://www.vatcalc.com/wp-content/uploads/Tax-Engine-1-1600x960.jpg

How Much Is Sales Tax On A Boat In Florida

https://cdn.denisonyachting.com/wp-content/uploads/2019/07/How-Much-Is-Sales-Tax-On-A-Boat-In-Florida.jpg

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

To deduct vehicle sales tax you can use one of the following methods Save your sales receipts and deduct actual sales tax throughout the year Use the IRS sales tax tables in the instructions for Schedule A Use the IRS sales tax deduction calculator to figure out your deduction Car purchases can be deductible for self employed taxpayers who are using their vehicle for business use wrote Steber in an email to Cars The purchase can be deducted using a

Updated Feb 3 2023 Many people overlook possible tax deductions when they file their income tax returns One of the many deductions that people miss is the sales tax that was paid on a new or used car This is a tricky deduction however You can claim sales tax paid or state income tax withheld but not both on your income tax return Sales tax deduction Frequently asked questions The final verdict Personal Use Non Deductible Expenses When purchasing a car solely for personal use the cost of the vehicle is generally not tax deductible The Internal Revenue Service IRS does not provide specific tax benefits for personal car purchases

Ebay Global Shipping Program Cost Calculator RobertBregan

https://www.a2xaccounting.com/img/blog/salestax.png

How To Avoid Paying Car Insurance Deductible

https://www.general.com/sites/default/files/Car-insurance-deductible-min.jpg

https:// turbotax.intuit.com /tax-tips/tax-relief/...

Deduction has limits on vehicle weight and taxpayer income This deduction only applies to sales taxes paid on new cars and trucks not used ones that weigh less than 8 500 pounds plus motorcycles and motor homes If you buy a vehicle for more than 49 500 you can only deduct the sales tax on that amount

https:// ttlc.intuit.com /community/tax-credits...

Opus 17 Level 15 Title and lien fees are never deductible Sales tax is deductible if you itemize your deductions and if you choose to deduct sales tax instead of state income tax Registration fees may be deductible if a part of the registration fee is based on the value of the car

ANSWERED The Amount Of Sales Tax On A New Car Varies Directly To

Ebay Global Shipping Program Cost Calculator RobertBregan

Pin On Amazing Cars

9 99 Plus Tax TusharaMarya

Are Closing Costs Tax Deductible Under The New Tax Law PNWR

How To Claim Your New Car As Tax Deductible YourMechanic Advice

How To Claim Your New Car As Tax Deductible YourMechanic Advice

Sales Tax On Car Purchase Tax Deductible Car Sale And Rentals

Is Sales Tax On A Car Tax Deductible Classic Car Walls

Price Decline Continues For Used Vehicles Reflecting More Inventory

Is Sales Tax On A New Car Deductible - There is no specific deduction for sales tax paid on a vehicle There is however a deduction for any sales tax in general that you paid throughout the year If you made a major purchase such as a vehicle it may behoove you to take this deduction This deduction isn t automatic however