Is Savings Bond Interest Tax Exempt Is savings bond interest taxable The interest that your savings bonds earn is subject to federal income tax but not state or local income tax any federal estate gift and excise

According to Treasury Direct interest from EE U S savings bonds is taxed at the federal level but not at the state or local levels for income Bonds typically If you cashed series EE or I U S savings bonds this year that were issued after 1989 you may be able to exclude from your income part or all of the interest on

Is Savings Bond Interest Tax Exempt

/ee-savings-bonds-139259410-5ac19e1ca474be0036067b55.jpg)

Is Savings Bond Interest Tax Exempt

https://www.thebalance.com/thmb/7RCziMbNvxHYg6V7cfIKKQDFd8c=/3008x2000/filters:fill(auto,1)/ee-savings-bonds-139259410-5ac19e1ca474be0036067b55.jpg

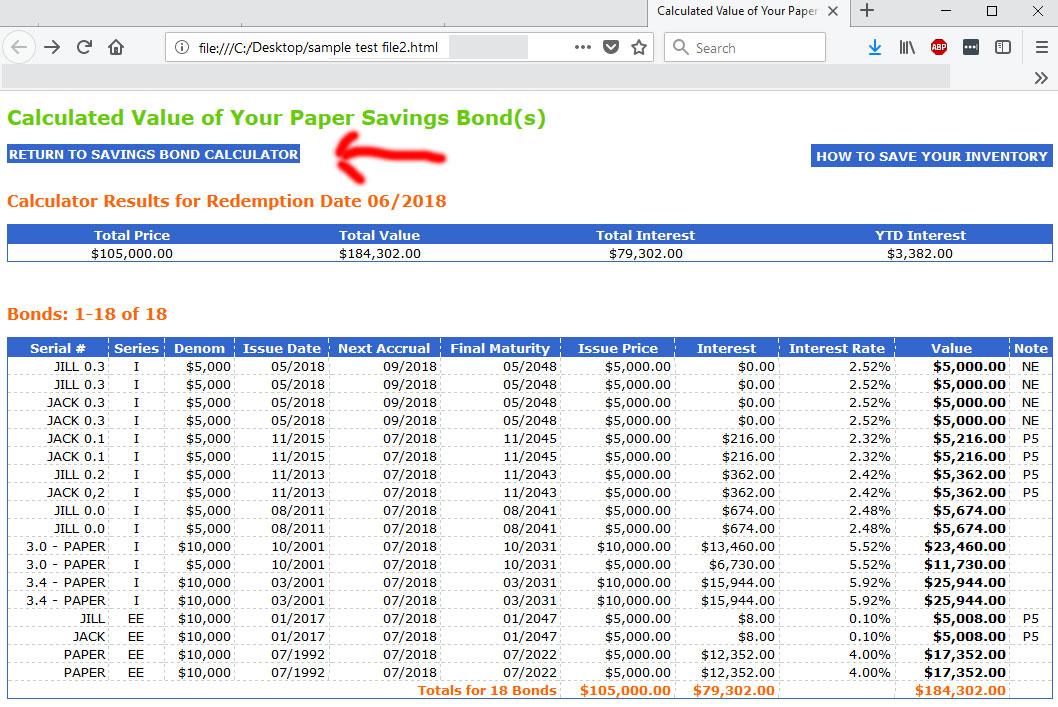

Series Ee Savings Bond Interest Rate Dollar Keg

https://dollarkeg.com/wp-content/uploads/2022/11/series-ee-savings-bond-interest-rate-1024x377.jpg

Image Of 2020 IRS Form 1040 With Line 2a Highlighted

https://studentaid.gov/sites/default/files/2020-tax-exempt-interest-income.PNG

Federal estate gift and excise taxes state estate or inheritance taxes Yes For federal income tax you choose whether to report earnings each year or wait to report all the Yes you are required to pay federal income taxes on the interest earned by inherited series I savings bonds The interest is taxed in the year it is earned and must

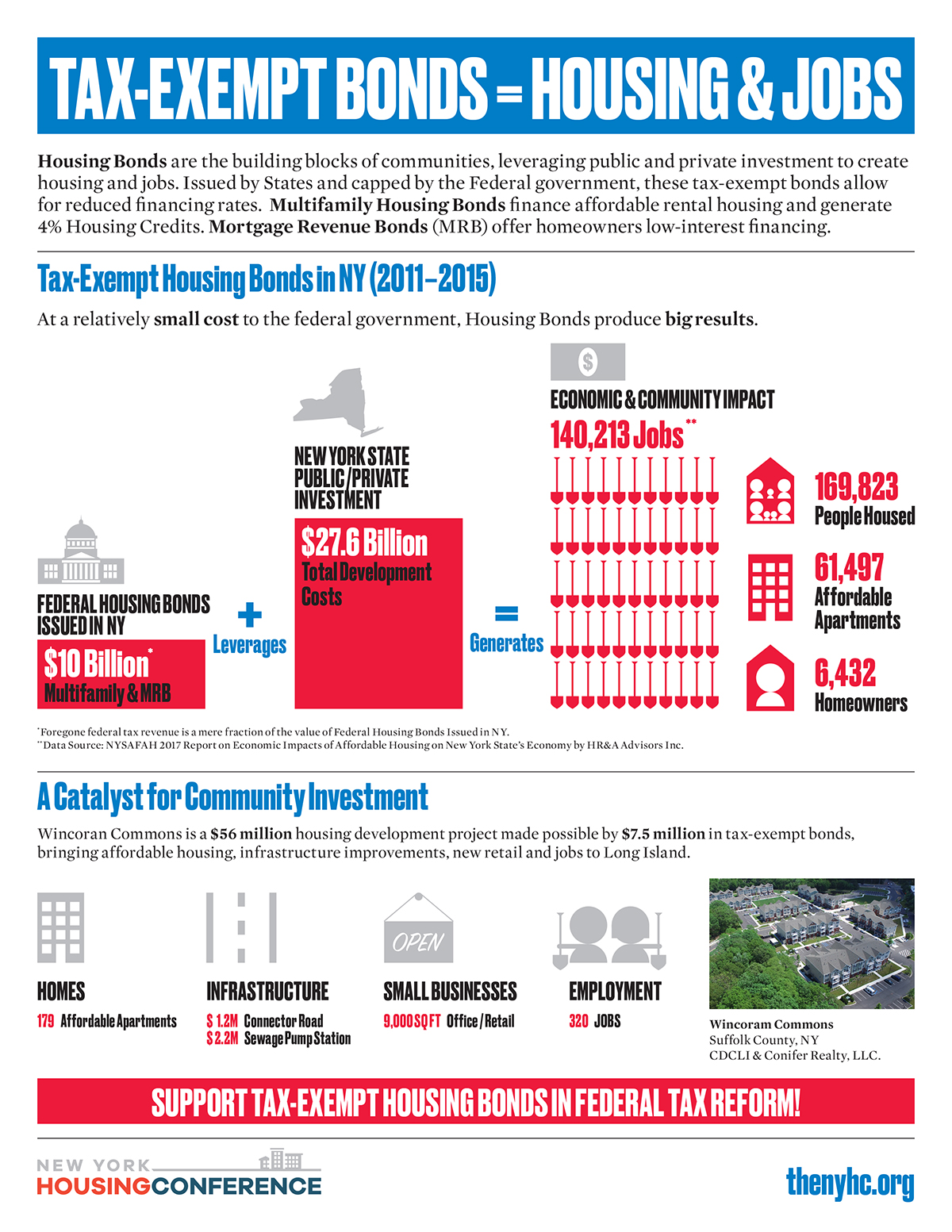

For example some or all of the interest from Series EE or I U S savings bonds issued after 1989 could be tax exempt if the interest is used for qualified higher Although the interest on these bonds is fully exempt from state and local taxes the federal tax treatment varies depending on who owns the bonds and in some

Download Is Savings Bond Interest Tax Exempt

More picture related to Is Savings Bond Interest Tax Exempt

Interest Rates On Series EE And I Savings Bonds Increased In May

https://ww1.prweb.com/prfiles/2014/05/13/11849725/five-hundred-dollar-series-ee-savings-bond-united-states.gif

Current Savings Bond Rates Dollar Keg

https://dollarkeg.com/wp-content/uploads/2022/11/current-savings-bond-rates.png

Full Tax Exempt Bond Infographic NYHC

https://thenyhc.org/wp-content/uploads/Advocacy/Tax-Exempt-Bonds/Full-Tax-Exempt-Bond-Infographic.jpg

You don t have to pay state or local income tax on them You can choose not to pay federal income tax on them until you cash them or they mature whichever is first Under Interest on U S savings bonds is exempt from state and local taxes The Form 1099 INT you receive will indicate the amount that is for U S savings bonds interest in box 3 Do

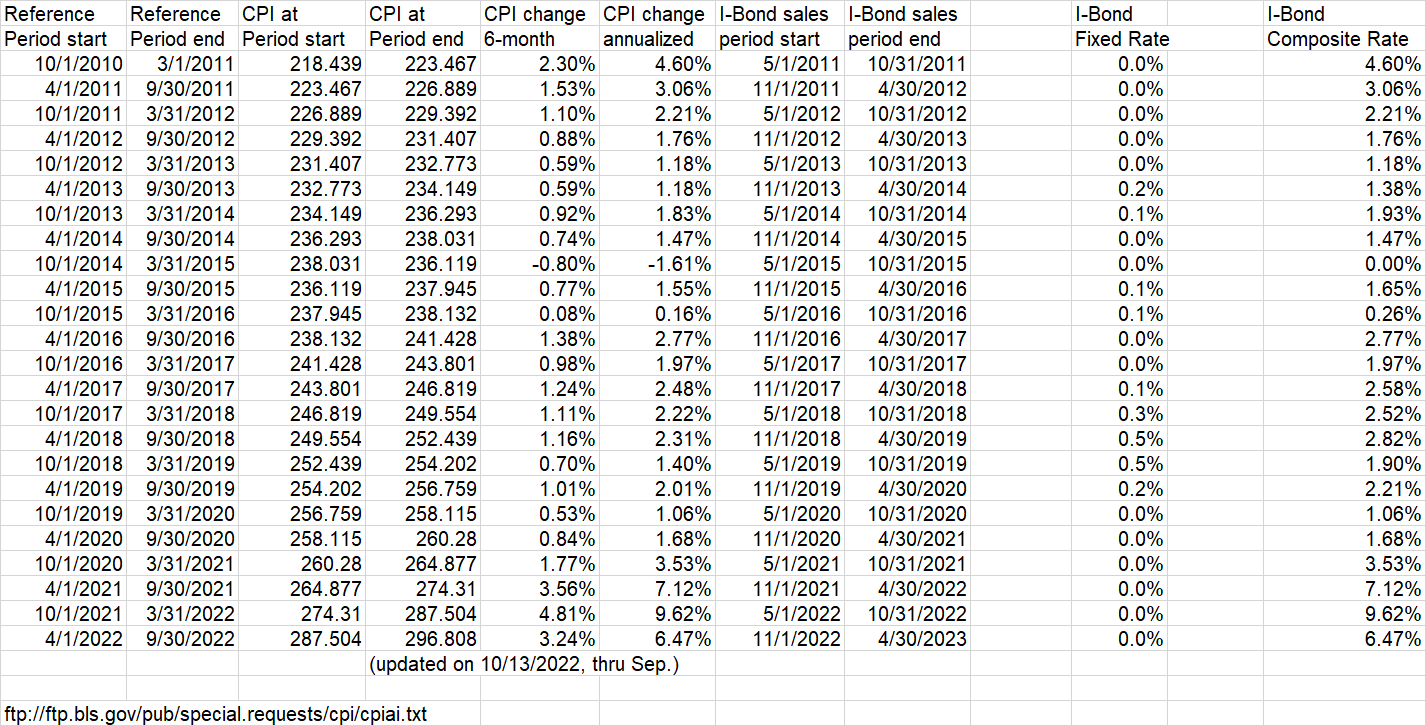

For example interest earned on I bonds is exempt from state and local taxation Also owners can defer federal income tax on the accrued interest for up to 30 Series EE savings bonds earnings can be exempt from state and local taxes If you invest in Series EE savings bonds for college you can exclude part or all of

/savings-bond-580a2dfa5f9b58564c732822.jpg)

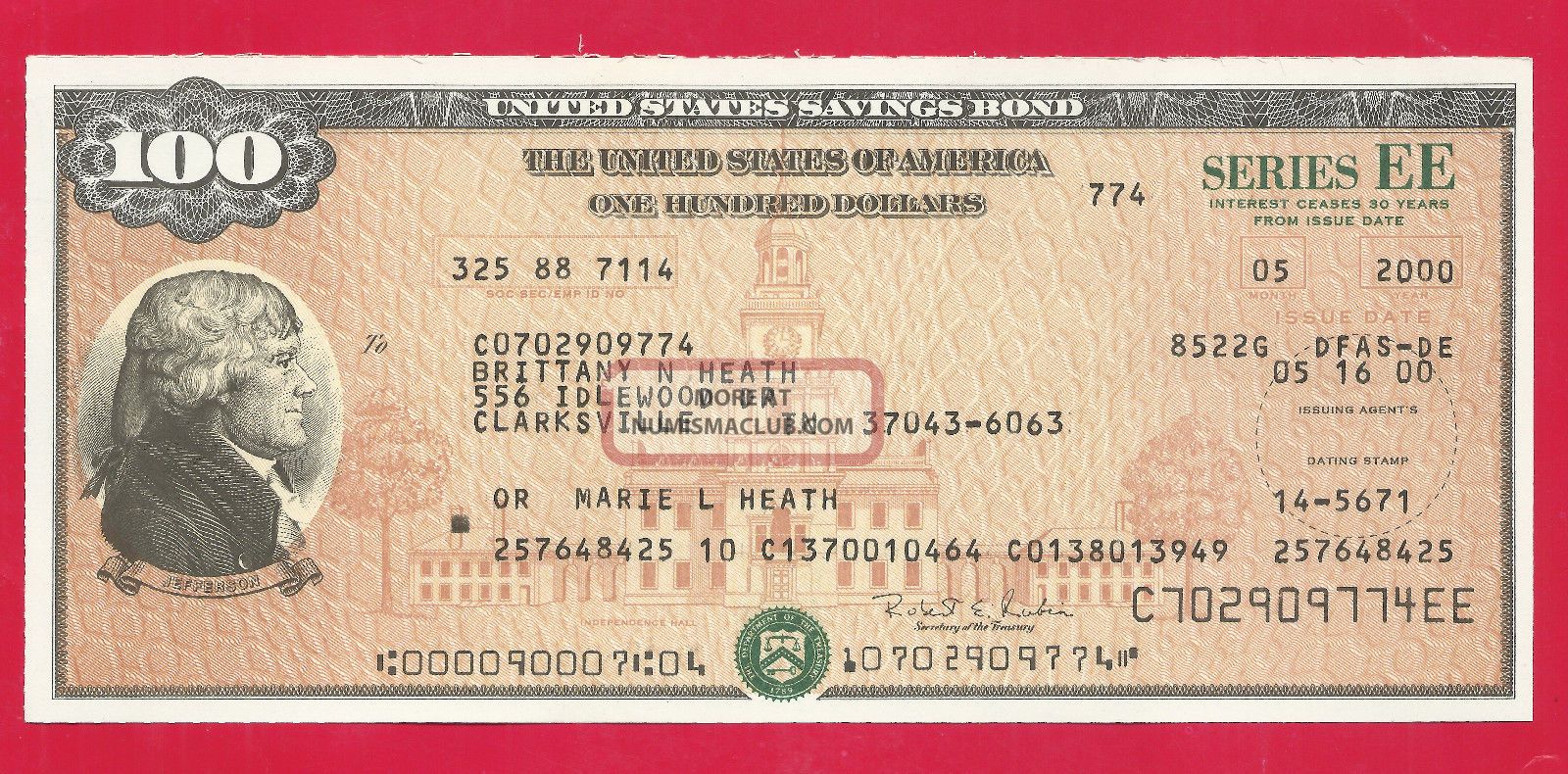

Reading Paper Savings Bonds And Other Bond Certificates

https://www.thebalance.com/thmb/8COmYe8NP9sdaM19ANPPMRClaTs=/640x291/filters:fill(auto,1)/savings-bond-580a2dfa5f9b58564c732822.jpg

Taxation Of Exempt Interest Dividends In Arizona An Overview Lietaer

https://imgtaer.lietaer.com/is_taxexempt_interest_taxable.jpg

/ee-savings-bonds-139259410-5ac19e1ca474be0036067b55.jpg?w=186)

https://www.treasurydirect.gov/indiv/research/in...

Is savings bond interest taxable The interest that your savings bonds earn is subject to federal income tax but not state or local income tax any federal estate gift and excise

https://www.investopedia.com/ask/answers/111314/...

According to Treasury Direct interest from EE U S savings bonds is taxed at the federal level but not at the state or local levels for income Bonds typically

Three Things Every Savings Bond Owner Should Know According To

/savings-bond-580a2dfa5f9b58564c732822.jpg)

Reading Paper Savings Bonds And Other Bond Certificates

Savings Bond Serial Number Treecenters

Series I Savings Bond Rate Leaps To 4 60 Percent Up From 0 74 Percent

Jefferson 100 00 Savings Bond Series Ee 05 2000 Uncashed

How To Calculate Savings Bond Interest 14 Steps with Pictures

How To Calculate Savings Bond Interest 14 Steps with Pictures

I Bonds What s Next Seeking Alpha

Why Banks Won t Increase Savings Account Rates Even After Interest

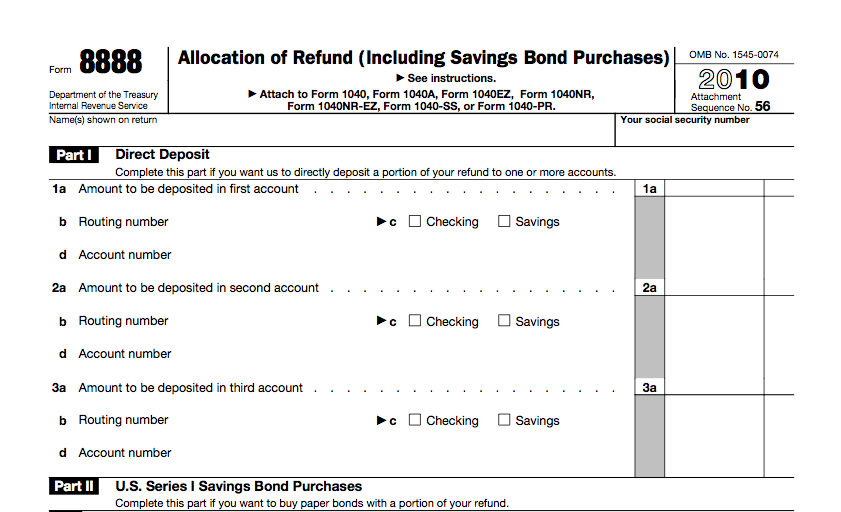

How To Save Your Tax Refund In Series I U S Savings Bonds MyBankTracker

Is Savings Bond Interest Tax Exempt - The interest on series EE savings bonds is paid monthly and compounded twice per year They are exempt from state and local income taxes making them a