Is Senior Citizen Scheme Taxable Conclusion Stay informed about the latest SCSS rules providing senior citizens with a secure and beneficial investment avenue Explore eligibility deposit options and tax benefits to make informed financial decisions in alignment with the updated guidelines

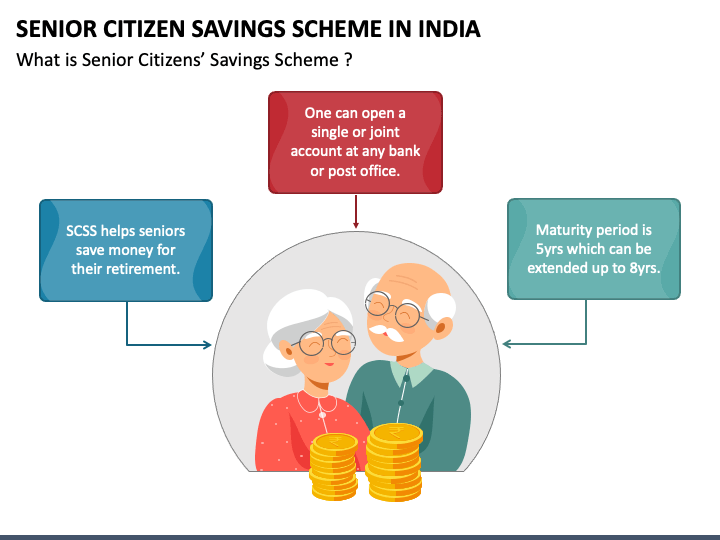

For senior citizens above the age of 60 years interest is taxable if the total interest paid in all SCSS accounts in a financial year exceeds Rs 50 000 for those below 60 years it is Rs 40 000 and TDS at the nominal rate is deducted from the total interest paid Senior Citizen Saving Scheme SCSS is a government backed initiative for senior citizens with tax benefits under Section 80C offering interest rates up to 8 2 and a tenure of 5 years

Is Senior Citizen Scheme Taxable

Is Senior Citizen Scheme Taxable

https://sarkarisuvidha.online/img/newimg/service/background/senior-citizen.jpg

Senior Citizen Saving Scheme Benefits Features

https://freosave.com/wp-content/uploads/2023/01/senior-citizen-savings-scheme.jpg

Senior Citizen Discount Requirement POSTER Lazada PH

https://filebroker-cdn.lazada.com.ph/kf/Sb05870109ae446a792a5645f491229972.jpg

Rakesh Bhargava Director Taxmann replies Yes you can claim tax deduction of up to Rs 50 000 under Section 80D However the deduction is allowed only if you are not covered by a health insurance policy This deduction is available to a senior citizen from financial year 2018 19 onwards The Senior Citizen Saving Scheme SCSS offers tax benefits under Section 80C of the Income Tax Act 1961

Senior citizens can claim a deduction of up to Rs 1 5 lakh under section 80C of the Income tax Act 1961 for investing in the Senior Citizens Savings Scheme Do remember interest paid by the scheme is taxable in the hands of the investor based on the income tax slab Yes the interest earned from the Senior Citizen Savings Scheme is taxable per the investor s income tax slab However investments made in the SCSS are eligible for tax benefits

Download Is Senior Citizen Scheme Taxable

More picture related to Is Senior Citizen Scheme Taxable

Senior Citizen Saving Scheme 2021 SCSS

https://www.knowledge4utech.com/wp-content/uploads/2019/12/scss1.jpg

News Citizen E

http://images.squarespace-cdn.com/content/v1/57ce1453197aea06e4915ed2/1499380151970-UC7ADR97AO8IR1E2BYXW/Citizen+E+-+logo+-+vector-01.png?format=1500w

Free Medical Card For Senior Citizen Malaysia Frank Paterson

https://thepinoyofw.com/wp-content/uploads/2022/03/senior-citizen-id-application-for-filipinos.jpg

Tax Implications of Senior Citizen Savings Scheme SCSS Investment made in SCSS are also eligible for tax deductions in the following manner The principal amount deposited in SCSS is eligible for a tax deduction of up to Rs 1 5 Lakh per annum under section 80C of the Income Tax Act 1961 Individuals can avail of up to Rs 10 000 deduction against interest income from a savings bank account under Section 80TTA of the Income Tax Act and senior citizens can avail up to Rs 50 000 under Section 80TTB against interest income from a savings bank account time deposits recurring deposits

Explore investment planning for senior citizens covering tax slabs deductions and the Senior Citizens Savings Scheme SCSS Understand where how much and when to invest Learn about interest rates withdrawals and tax implications for a secure financial future Individuals can claim exemptions up to Rs 1 5 Lakh in a financial year u s 80C of Income Tax Act Interest payments are subject to taxation as per the tax slab rates If interest income exceeds Rs 50 000 in a year then it is subject to tax deducted at source

Senior Citizen Savings Scheme Best Scheme For Senior Citizens Will

https://www.businessleague.in/wp-content/uploads/2021/11/525x350.jpg

Senior Citizen Savings Scheme In Post Office Banking Tides

https://bankingtides.com/wp-content/uploads/2022/02/Senior-Citizen-Scheme.jpg

https://taxguru.in/income-tax/senior-citizen...

Conclusion Stay informed about the latest SCSS rules providing senior citizens with a secure and beneficial investment avenue Explore eligibility deposit options and tax benefits to make informed financial decisions in alignment with the updated guidelines

https://economictimes.indiatimes.com/wealth/tax/...

For senior citizens above the age of 60 years interest is taxable if the total interest paid in all SCSS accounts in a financial year exceeds Rs 50 000 for those below 60 years it is Rs 40 000 and TDS at the nominal rate is deducted from the total interest paid

File Citizen Promaster Eco Drive AP0440 14F Diver s 200 M On A 4 ring

Senior Citizen Savings Scheme Best Scheme For Senior Citizens Will

CITIZEN Asakusa sub jp

Never Too Late How ALS Can Help Senior Citizen Graduates Persevere

Senior Citizen Discount Benefits In Philippines 2020

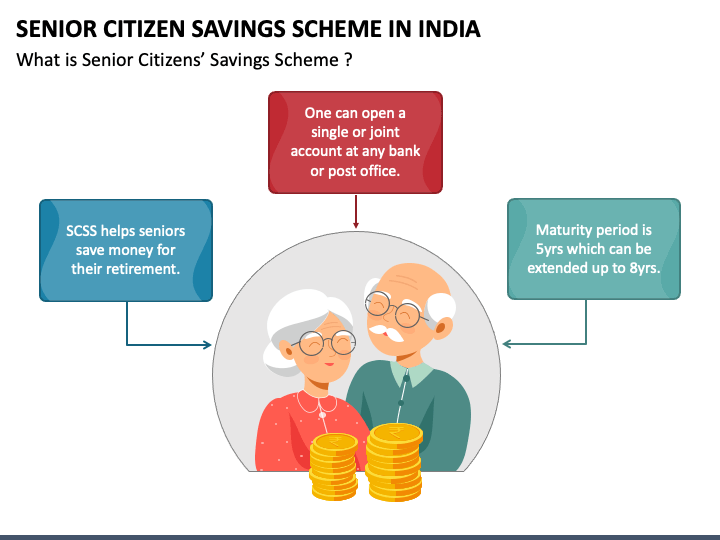

Descubrir 78 Imagen Senior Citizen Saving Scheme India Ecover mx

Descubrir 78 Imagen Senior Citizen Saving Scheme India Ecover mx

CITIZEN

Senior Citizen Id Template Doc Template PdfFiller

Posterization Senior Citizen Free Stock Photo Public Domain Pictures

Is Senior Citizen Scheme Taxable - Under Senior Citizens Savings Scheme SCSS a senior citizen can deposit 15 lakh However the interest on Senior Citizens Savings Scheme is fully taxable which is a major drawback of