Is Service Incentive Leave Taxable Benefits received by an employee by virtue of a collective bargaining agreement CBA and productivity incentive schemes provided that the total monetary value received from both

Service incentive leaves are leave credits extended to covered employees who may want to use them whenever they take a leave from work so that they remain paid during such Every employee who has rendered at least one 1 year of service is entitled to Service Incentive Leave SIL of five 5 days with pay This benefit applies to all employees subject to certain exemptions

Is Service Incentive Leave Taxable

Is Service Incentive Leave Taxable

https://kgconsult-ph.com/wp-content/uploads/2020/05/Service-Incentive-Leave-SIL-Computation-KG-Consult-Group-Inc-536x358.jpg

5 Days Service Incentive Leave For Employees Art 95 Of Labor Code Of

https://i.ytimg.com/vi/Ugiu84qBPaw/maxresdefault.jpg

Blogs Effective HRM

https://www.effective-hrm.co.uk/app/uploads/2021/12/annual-leave.png

Service Incentive Leave SIL is a mandatory leave benefit given to qualified employees as an incentive for the service they have rendered to the company The service incentive Eligible employees are entitled to 5 days of paid incentive leave per year According to the Philippine Labor Law the rule is that employees are entitled to five service leave credits

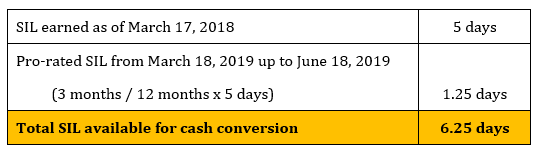

Is Service Incentive Leave Taxable Conversion of this service can be done on a pro rata basis There is no Service Incentive Leave exemption provided specifically for Service Incentive Leave Pay in the TRAIN Law Service Incentive Leave of five 5 days with pay is given to every employee who has rendered at least one 1 year of service in the company This is a mandatory benefit as lay down in Article 95 of the

Download Is Service Incentive Leave Taxable

More picture related to Is Service Incentive Leave Taxable

Service Incentive Leave Sparking Joy In Your Work Journey TAXGURO

https://www.philippinetaxationguro.com/wp-content/uploads/2023/07/service-incentive-leave.png

Service Incentive Leave SIL Philippines 2020 KG Consult Group Inc

https://kgconsult-ph.com/wp-content/uploads/2020/05/SIL-1-min.png

Incentive Free Of Charge Creative Commons Green Highway Sign Image

https://www.picserver.org/highway-signs2/images/incentive.jpg

Service Incentive Leave SIL An employee who has rendered at least one year of service shall be entitled to a yearly service incentive leave of five days 5 with pay The service incentive leave does not apply to those Business owners and managers should be aware that service charges paid out to employees form part of an employee s taxable income As such payroll computations may have to be adjusted to align with the

Service incentive leave Every employee who has rendered at least one 1 year of service is entitled to a Service Incentive Leave SIL of five 5 days with pay SIL may be used Service incentive leaves are five 5 leave credits with full pay Not all employees may avail the service incentive leave The service incentive leave shall be commutable to its

Write Off An Employee s Loan Tax Tips Galley And Tindle

https://galleyandtindle.co.uk/wp-content/uploads/2020/06/employee-loans.jpg

What Is Service Incentive Leave SIL Vyron Loares

http://vyronloares.com/wp-content/uploads/Law/CompenBen/Service-Incentive-Leave-SIL.png

https://taxacctgcenter.ph/tax-exempt-de-minimis...

Benefits received by an employee by virtue of a collective bargaining agreement CBA and productivity incentive schemes provided that the total monetary value received from both

https://laborlaw.ph/service-incentive-leave

Service incentive leaves are leave credits extended to covered employees who may want to use them whenever they take a leave from work so that they remain paid during such

SOLUTION Labor Law Service Incentive Leave Studypool

Write Off An Employee s Loan Tax Tips Galley And Tindle

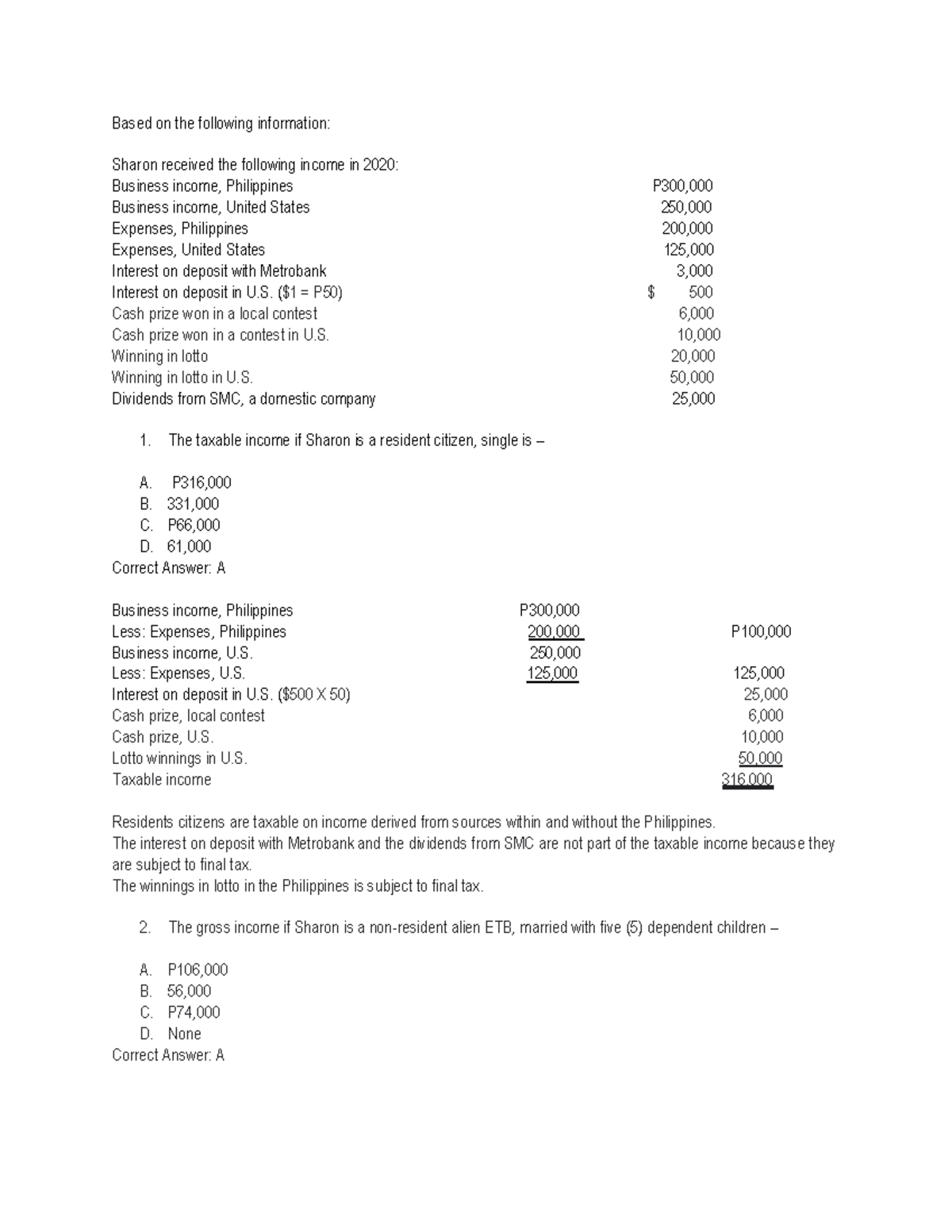

WORD Problems Taxation Mavod Based On The Following Information

Long Term Incentive Plan Stock Options Zufabodoryteb web fc2

Leave Request Letter Email

Leaves Leaves Service Incentive Leave It Is A 5 day Leave With Pay

Leaves Leaves Service Incentive Leave It Is A 5 day Leave With Pay

Congress Approves 10 Day Incentive Leave With Pay For All Employees

How To Launch The Best Incentive Program Incentive Solutions

Corporate Incentive And Reward Program What An Event

Is Service Incentive Leave Taxable - Is Service Incentive Leave Taxable Conversion of this service can be done on a pro rata basis There is no Service Incentive Leave exemption provided specifically for Service Incentive Leave Pay in the TRAIN Law