Is Settlement Discount Granted An Expense Settlement discount granted is an expense the opposite of this is settlement discount received which is an income for your business Because settlement discount granted is an expense

From the perspective of the seller settlement discount granted is considered as an expense This is because the seller is offering a discount to the buyer as an incentive for early payment The IFRS 15 considers there to be a five step approach when recognising revenue Prompt payment discounts also known as settlement or cash discounts are offered to credit customers to

Is Settlement Discount Granted An Expense

Is Settlement Discount Granted An Expense

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/bc2f56bee20f040c99c321f261cda606/thumb_1200_849.png

criture Au Journal Pour Le R glement Complet final StackLima

https://media.geeksforgeeks.org/wp-content/uploads/20220426151044/Fullsettlementex.PNG

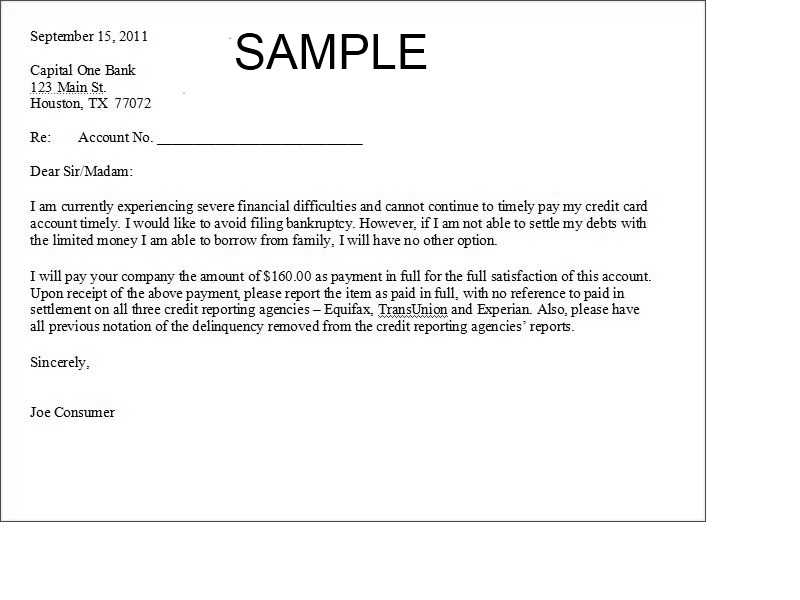

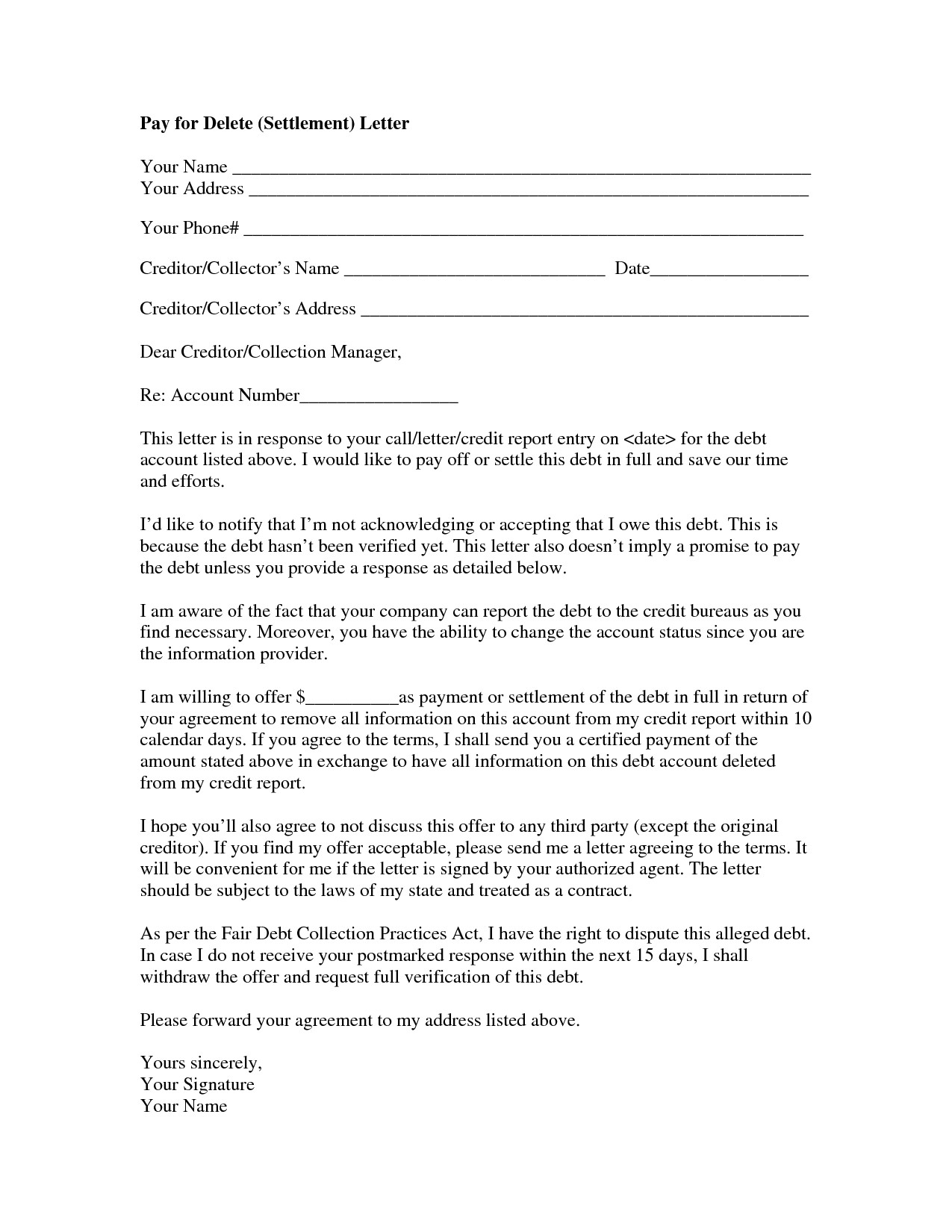

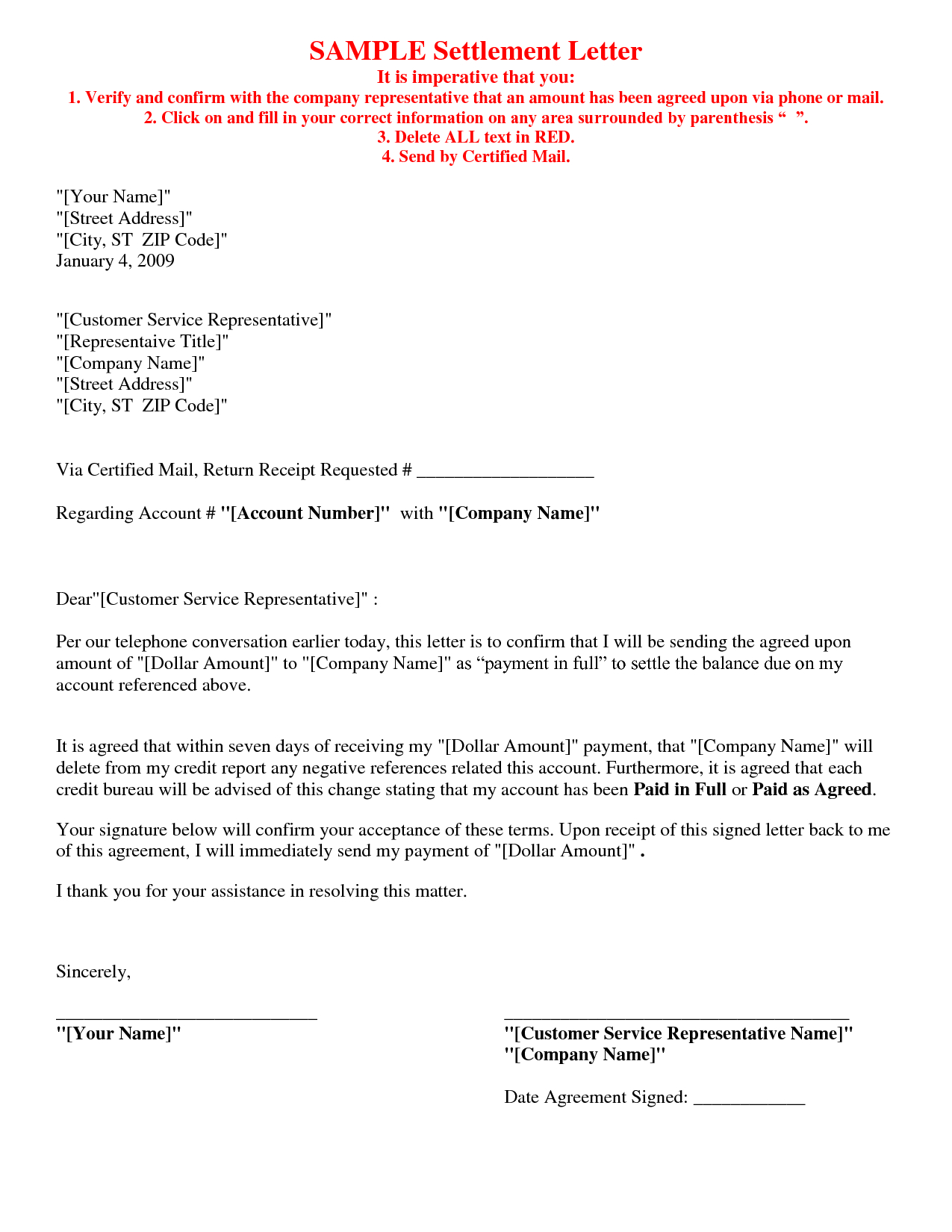

Should I Answer To A Settlement Letter

http://www.printablelegaldoc.com/wp-content/uploads/2015/08/settlement-letter-sample-523.jpg

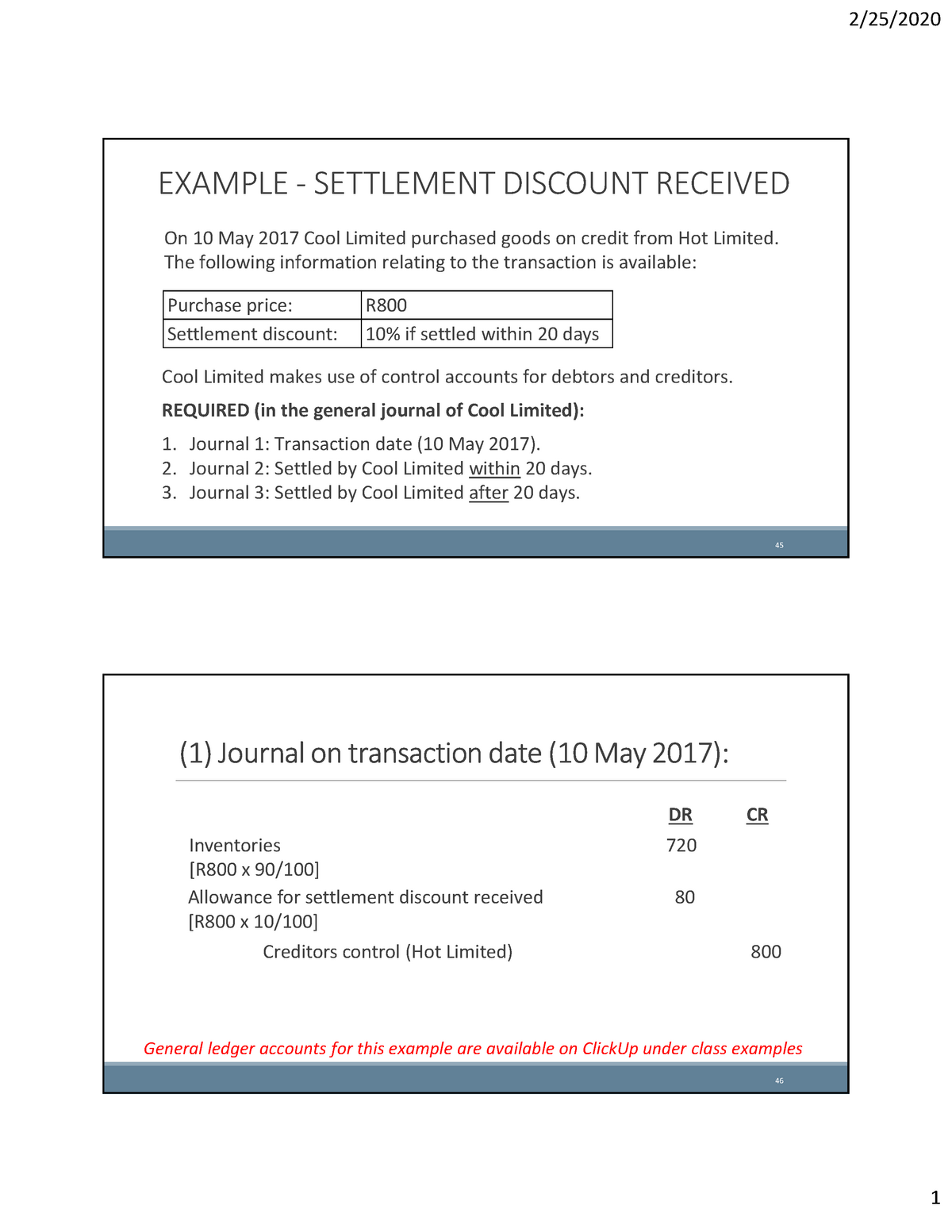

Yes settlement discount received is a type of income and so it should be included in the income statement If it is not a large amount you can include it in a general line such as Other Income or Miscellaneous Income Discounts and rebates can be offered to purchasers in a number of ways for example trade discounts settlement discounts volume based rebates and other rebates Accounting for

When discounts refund some selling expenses then these discounts are not deducted from the costs of inventories but treated as income Another consideration might relate to settlement discounts i e discounts received from Settlement discount is a discount for prompt payment of invoice by the customer Let s say you sell something for 1 000 on 30 day credit and you offer 3 off if a customer pays

Download Is Settlement Discount Granted An Expense

More picture related to Is Settlement Discount Granted An Expense

Solved The Total Of The Settlement Discount Granted Column In The

https://www.coursehero.com/qa/attachment/20955763/

Solved The Total Of The Settlement Discount Granted Column In The

https://www.coursehero.com/qa/attachment/20955251/

Free Debt Settlement Offer Letter Template And Example With Regard To

https://i.pinimg.com/736x/07/7a/c9/077ac90e9739a8c7a84e2cc6a8c835f0.jpg

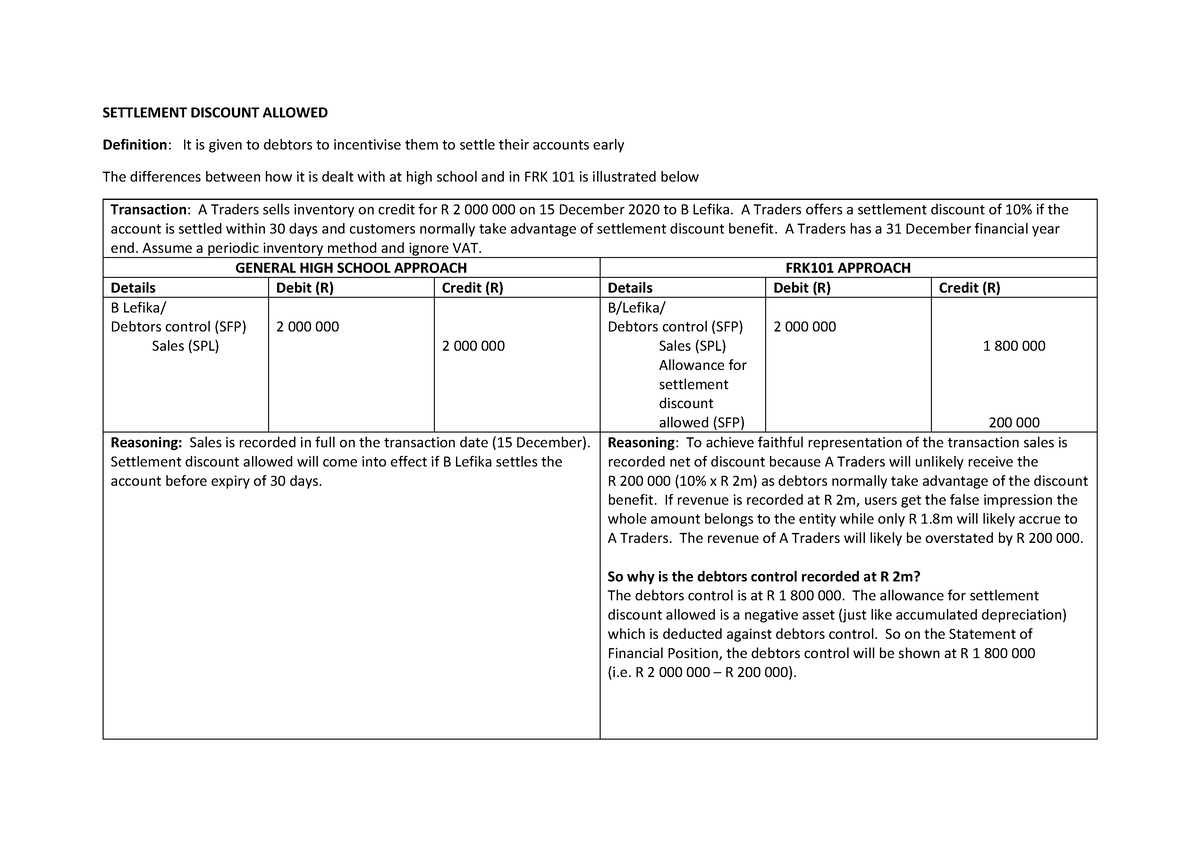

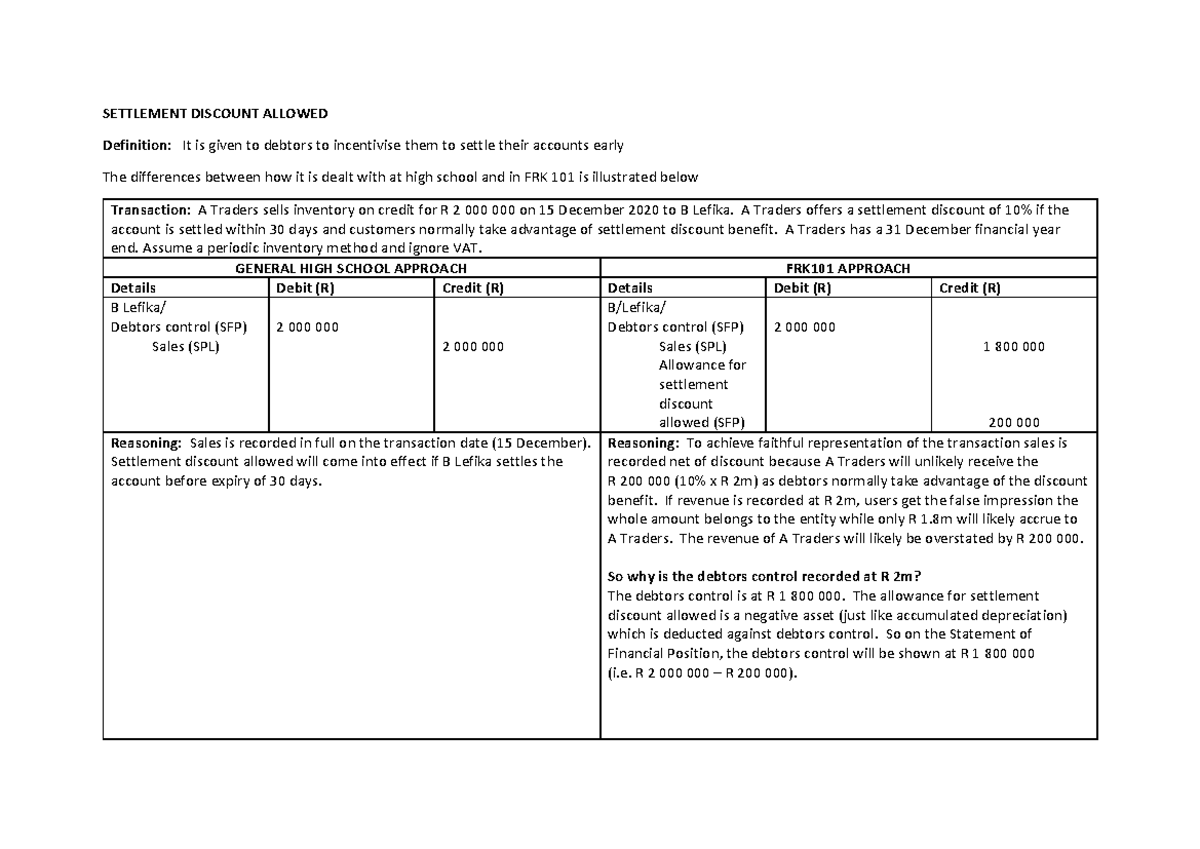

The allowance for settlement discount allowed is a negative asset just like accumulated depreciation which is deducted against debtors control So on the Statement of Financial Position the debtors control will be shown at R 1 800 In addition the terms will often allow a sales discount to be taken if the invoice is settled at an earlier date The sales discount is based on the sales price of the goods and is sometimes referred to as a cash discount on sales

Both IFRS and ASPE account for discounts in a similar manner discounts should be netted from Revenue amounts They are not considered Expenses and should not be What happens to VAT on a settlement discount Settlement discount granted is an expense the opposite of this is settlement discount received which is an income for your

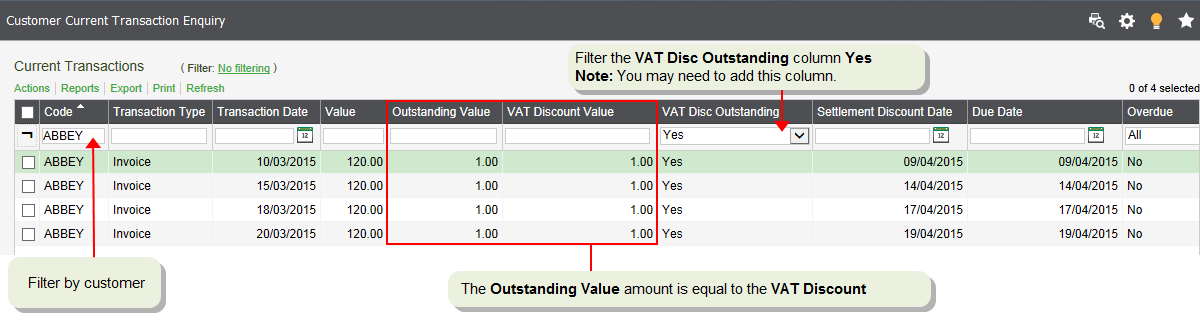

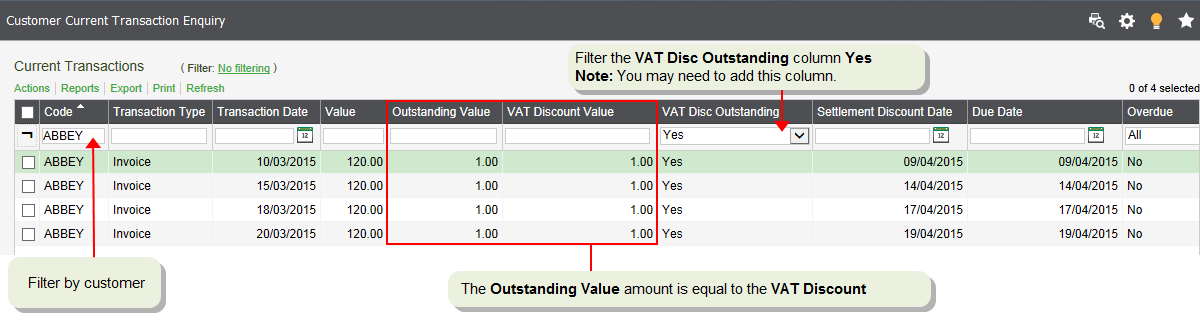

Settlement Discounts On Sales Transactions

http://desktophelp.sage.co.uk/sage200/sage200standard/Content/Resources/Images/SL Images/SettleDiscCustEnq.png

Refuse Discount Letter 4 Free Templates Writolay

https://writolay.com/wp-content/uploads/2020/10/42-letter-to-decline-discount-request.png

https://www.accounting-basics-for-students.com › ...

Settlement discount granted is an expense the opposite of this is settlement discount received which is an income for your business Because settlement discount granted is an expense

https://www.studocu.com › en-za › messages › question › ...

From the perspective of the seller settlement discount granted is considered as an expense This is because the seller is offering a discount to the buyer as an incentive for early payment The

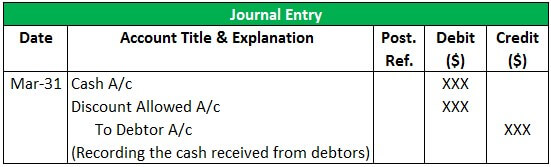

Discount Allowed And Discount Received Journal Entries With Examples

Settlement Discounts On Sales Transactions

Study Tips Discounts Posting foundation Bookkeeping AAT Comment

Asiento De Diario Para Descuento Permitido Y Recibido Barcelona Geeks

Settlement Offer Template

Settlement Discount Granted And VAT Tax Accounting Consulting Services

Settlement Discount Granted And VAT Tax Accounting Consulting Services

Class Example Settlement Discount Journals 2 25 1 45 EXAMPLE

How To Write A Debt Settlement Letter With Sample

Full And Final Settlement Agreement Template

Is Settlement Discount Granted An Expense - YES the settlement discount given on the invoice should be taken into account when preparing the Credit Note If you don t do this you could end up paying the customer more than they