Is Software Taxable In Georgia Tax imposed on non exempt items and taxable services that were not taxed at the point of sale If a taxpayer purchases taxable goods or services in Georgia without the

Matthew Soifer Feb 04 2020 Since most businesses utilize software in their operations it is important for tax and accounting professionals to Effective January 1 2024 the legislation makes certain amendments to the state s sales and use tax provisions including imposing tax on certain specified digital products other

Is Software Taxable In Georgia

Is Software Taxable In Georgia

https://philpad.com/wp-content/uploads/2018/04/income-tax-table-2023.jpg

Are Personal Injury Settlements Taxable In Georgia Her Lawyer

https://herlawyer.com/wp-content/uploads/2022/10/Personal-Injury-Settlements-Taxable-Georgia.jpg

What Is Taxable Income And How To Calculate Taxable Income

https://ebizfiling.com/wp-content/uploads/2022/04/Taxable-Income.png

Beginning January 1 2024 Georgia will join over half of the U S states in taxing some or all digital items Technology companies with customers in Georgia should understand Taxable services and because such services do not include the transfer of tangible personal property charges for the services are not subject to Georgia sales and

Lawmakers in Georgia are looking to extend the state s sales and use tax to digital goods and services If House Bill 594 is enacted as written audiovisual works Effective 1 1 24 Georgia Will Begin Imposing Sales and Use Tax on Digital Products Goods and Codes Effective January 1 2024 Georgia will apply sales and

Download Is Software Taxable In Georgia

More picture related to Is Software Taxable In Georgia

Is Labor Taxable In Georgia Nexus Tax Defense Mansoor Ansari

https://i.ytimg.com/vi/tlLKmRcojKY/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGEsgWihlMA8=&rs=AOn4CLC1KiS4lxBsbKvW_7arIahaSOIgVA

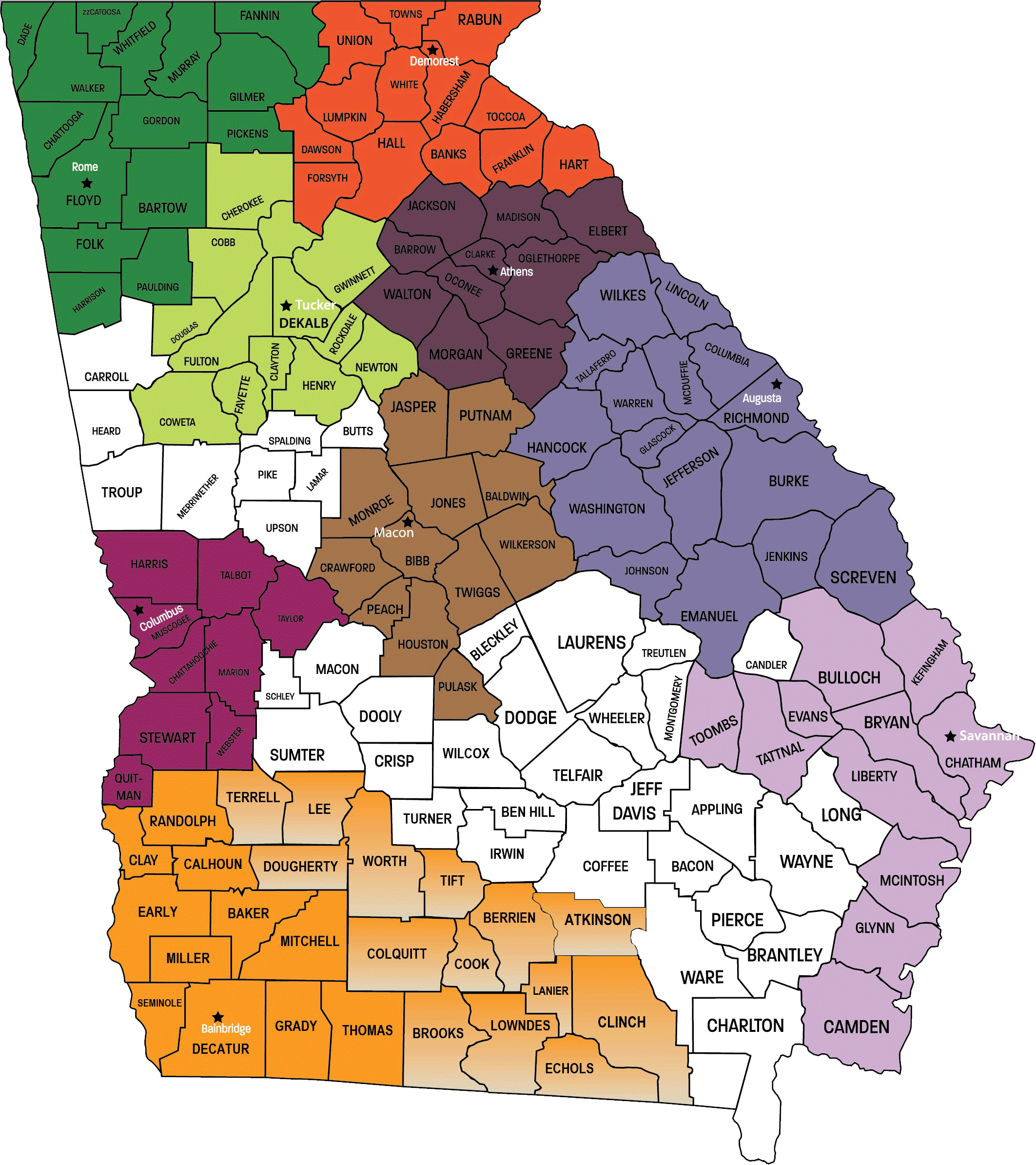

How Many Counties Are In Georgia Examples And Forms

https://www.silcga.org/wp-content/uploads/2018/10/Center-Map-2018.png

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

Enacted on May 9 2022 House Bill 1291 amends the exemption from sales and use tax on the sale or lease of any computer equipment to be used by qualifying Colorado digital games are exempt other digital products are taxable Idaho photographs delivered electronically are exempt other digital products are taxable

Georgia Gov Brian Kemp signed H B 56 into law on May 2 2023 which implements a new tax law subjecting sales and purchases of specified digital products In Georgia software is generally taxable if purchased downloaded or sold However certain types of software are exempt from taxation The taxable software

.png?width=800&name=Sales Tax Blog Images (1).png)

Georgia Sales Tax Guide

https://blog.accountingprose.com/hs-fs/hubfs/Sales Tax Blog Images (1).png?width=800&name=Sales Tax Blog Images (1).png

When Is Salary Income Taxable In Georgia TPsolution

https://tpsolution.ge/wp-content/uploads/2022/08/alary-income-taxable-in-Georgia.png

https://dor.georgia.gov/taxes/sales-use-tax/what-subject-sales-and-use-tax

Tax imposed on non exempt items and taxable services that were not taxed at the point of sale If a taxpayer purchases taxable goods or services in Georgia without the

https://www.salesandusetax.com/georgia-sal…

Matthew Soifer Feb 04 2020 Since most businesses utilize software in their operations it is important for tax and accounting professionals to

Solve My Sales Tax

.png?width=800&name=Sales Tax Blog Images (1).png)

Georgia Sales Tax Guide

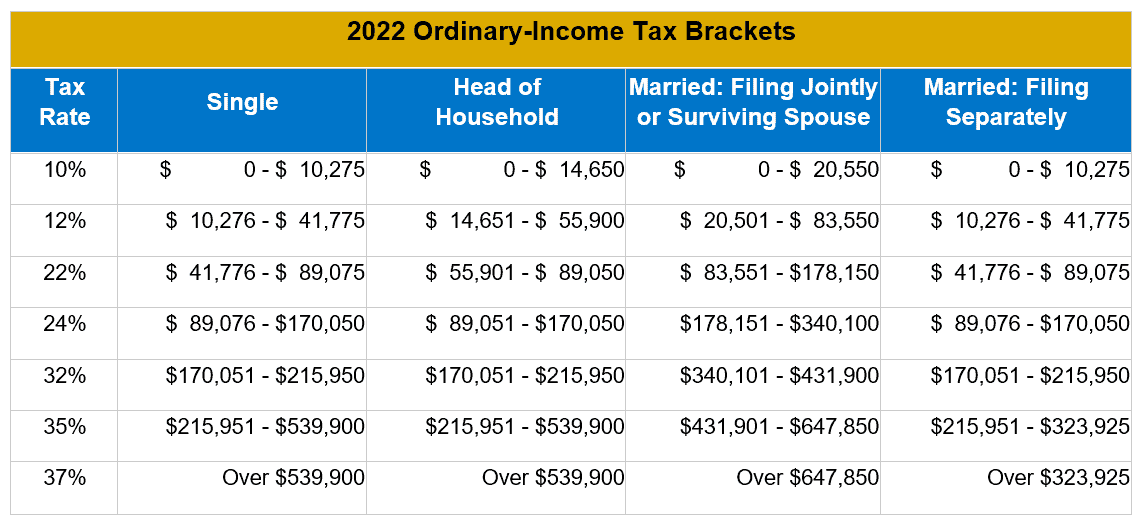

2022 Cost of Living Adjustments Tax Planning CPA Atlanta GA

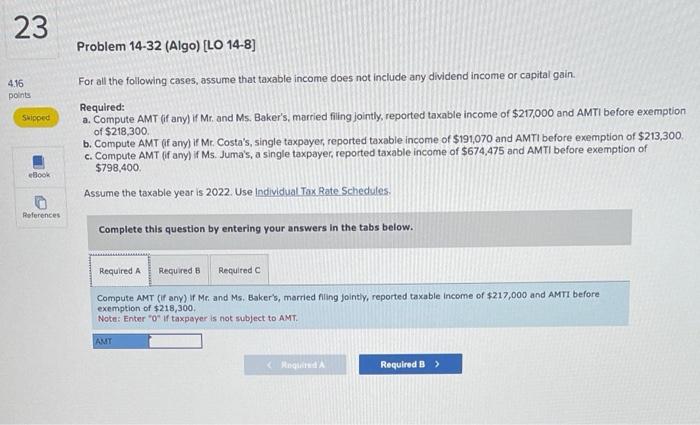

Solved Need Solution For All Three Requirements Please F

Tax Loss Carry Forward Balance Sheet Financial Statement Alayneabrahams

How To Calculate Taxable Income For Georgia State Income Tax Pocketsense

How To Calculate Taxable Income For Georgia State Income Tax Pocketsense

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Is SaaS Taxable In Maryland The SaaS Sales Tax Index

Is SaaS Taxable In Illinois The SaaS Sales Tax Index

Is Software Taxable In Georgia - Effective 1 1 24 Georgia Will Begin Imposing Sales and Use Tax on Digital Products Goods and Codes Effective January 1 2024 Georgia will apply sales and