Is Solar Power Income Taxable The Internal Revenue Service has not ruled that energy sold to a utility under a FIT is taxable gross income However in this

Bookmark Icon ChelsiE2 New Member Yes this income is taxable You need to report it as Other Income not subject to self employment tax on Line 21 of your Form 1040 Income from electricity generated from solar panels is no different from any other income and is therefore taxable When asked about this issue IRS spokesman

Is Solar Power Income Taxable

Is Solar Power Income Taxable

http://blog.hubcfo.com/wp-content/uploads/2015/04/What-Income-is-Taxable.png

Can You Make Money With Solar Income Smart Wave Solar

https://www.smartwavesolar.com/wp-content/uploads/2022/06/Solar-Income.jpg

Check Out How One State Is Working To Make Solar Power More Affordable

https://s3.amazonaws.com/groundswell-web-cache/images/groundtruth/2015/06/istock_000020321886_medium.00d26422.jpg

Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

Conclusion Until IRS or Congress issues more definitive advice relating to the taxability of SREC income we believe that the above mentioned PLR supports the The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed

Download Is Solar Power Income Taxable

More picture related to Is Solar Power Income Taxable

Energy Equity Bringing Solar Power To Low income Communities GreenBiz

https://www.greenbiz.com/sites/default/files/images/articles/featured/solarhomediyanadimitrovasstock.jpg

Solar Power Rebate Taxable Income PowerRebate

https://i0.wp.com/www.powerrebate.net/wp-content/uploads/2022/10/solar-energy-tax-credits-by-state-md-nj-pa-va-dc-fl.png

Environmental Benefits Of Switching To Solar Power Eco Green Energy

https://www.eco-greenenergy.com/wp-content/uploads/2023/05/5.19-website-banner-scaled.webp

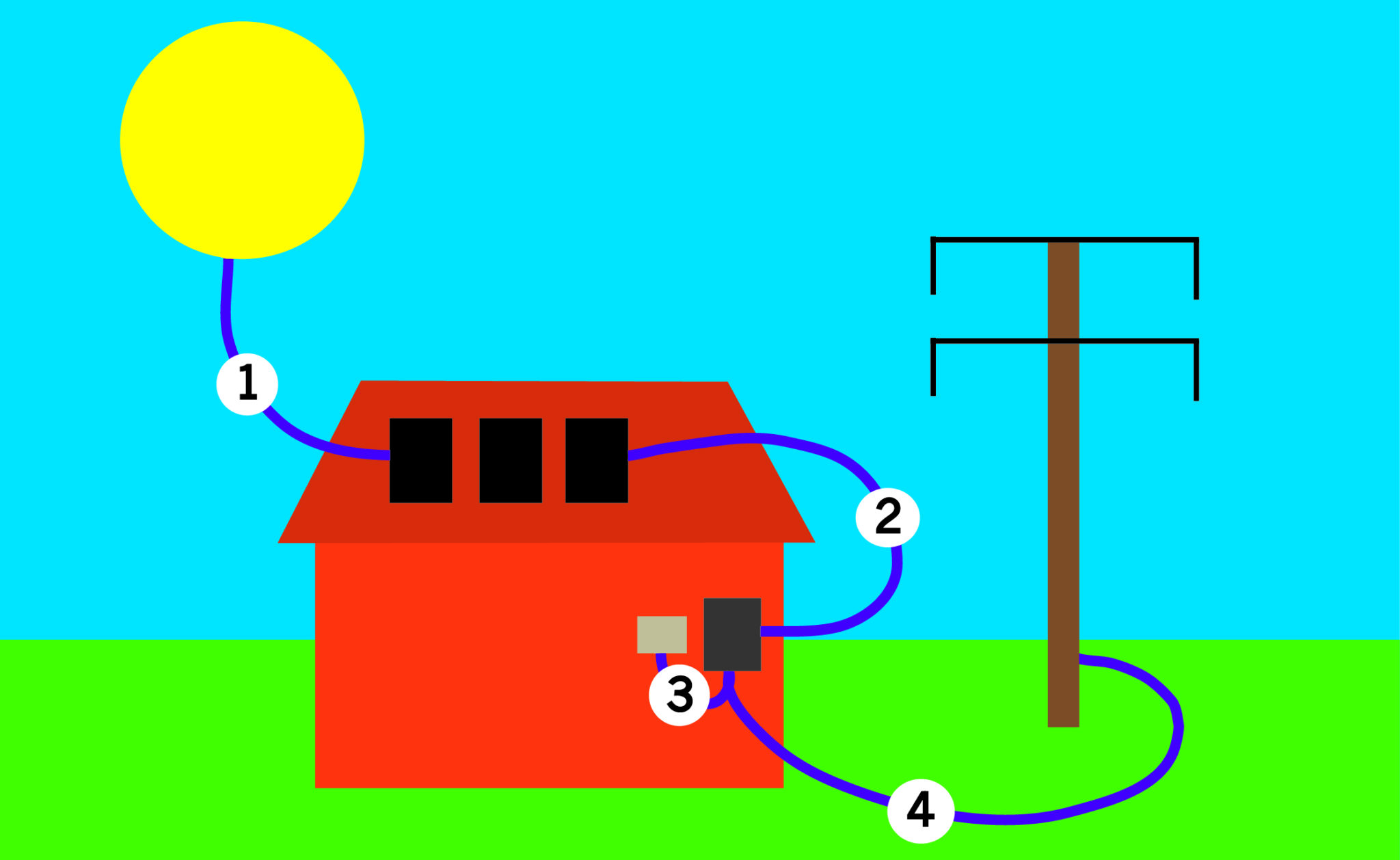

In Year Taxpayer purchased a grid tied solar electric power system Residential Solar System from X for a that allows Taxpayer to convert sunlight into utility grade IR 2024 97 April 5 2024 WASHINGTON The Department of Treasury and the Internal Revenue Service today issued Announcement 2024 19 PDF that addresses the federal

If you re using heat solely for personal domestic use the payments you receive aren t chargeable to Income Tax Whether you make less than 10 000 or over 500 000 per year you may be eligible for the same solar tax credit refund at equal system purchase price points

MA Properties Online Solar Power Explained

https://api.curaytor.io/sites/769/media/939428/rmfxgphjoaua7ypicpxt.jpg

What Is Solar Power Dan The Solar Man

https://danthesolarman.com.au/wp-content/uploads/2020/08/solar-energy-2048x1258.jpg

https://www.greentechmedia.com/article…

The Internal Revenue Service has not ruled that energy sold to a utility under a FIT is taxable gross income However in this

https://ttlc.intuit.com/community/retirement/...

Bookmark Icon ChelsiE2 New Member Yes this income is taxable You need to report it as Other Income not subject to self employment tax on Line 21 of your Form 1040

Common Terminology Used In Solar Industry Have Look At Glossaries

MA Properties Online Solar Power Explained

Solar Power A Renewable Energy Current Home

Solved Please Note That This Is Based On Philippine Tax System Please

Income Statement In Power BI NovyPro

Solved Please Note That This Is Based On Philippine Tax System Please

Solved Please Note That This Is Based On Philippine Tax System Please

Affordable Solar Power For Low Income Neighborhoods

Benefits Of Solar Energy For Low Income Communities Affordable Housing

What Is Taxable Income Explanation Importance Calculation Bizness

Is Solar Power Income Taxable - Conclusion Until IRS or Congress issues more definitive advice relating to the taxability of SREC income we believe that the above mentioned PLR supports the