Is Solar Tax Credit Refundable Or Nonrefundable Web The Residential Clean Energy Credit is non refundable so you need to have enough solar tax liability available in order to receive the full value of that tax credit However there are options available if you don t have enough solar tax liability in a single tax year

Web 1 Aug 2023 nbsp 0183 32 No The solar tax credit can save you money on your tax bill but the amount of your credit can t exceed the total amount you owe That s because the credit is nonrefundable in Web 19 Okt 2023 nbsp 0183 32 When you purchase solar equipment for your home and have tax liability you generally can claim a solar tax credit to lower your tax bill The Residential Clean Energy Credit is non refundable meaning that it can offset your income tax liability dollar for dollar but any excess credit won t be refunded If the credit exceeds your

Is Solar Tax Credit Refundable Or Nonrefundable

Is Solar Tax Credit Refundable Or Nonrefundable

https://iveeleaguesolar.com/wp-content/uploads/2020/12/Untitled-design-1-1536x1024.png

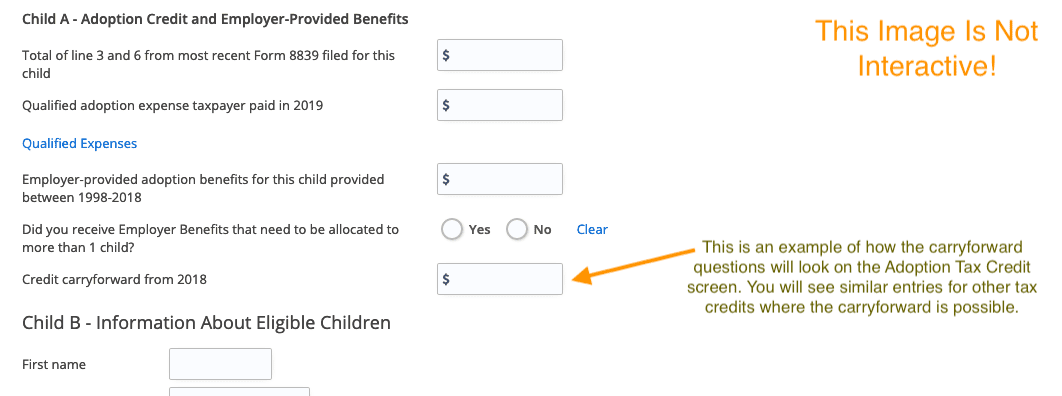

How To Claim Solar Tax Credit A Step by Step Guide

https://www.gov-relations.com/wp-content/uploads/2023/06/How-To-Claim-Solar-Tax-Credit.jpg

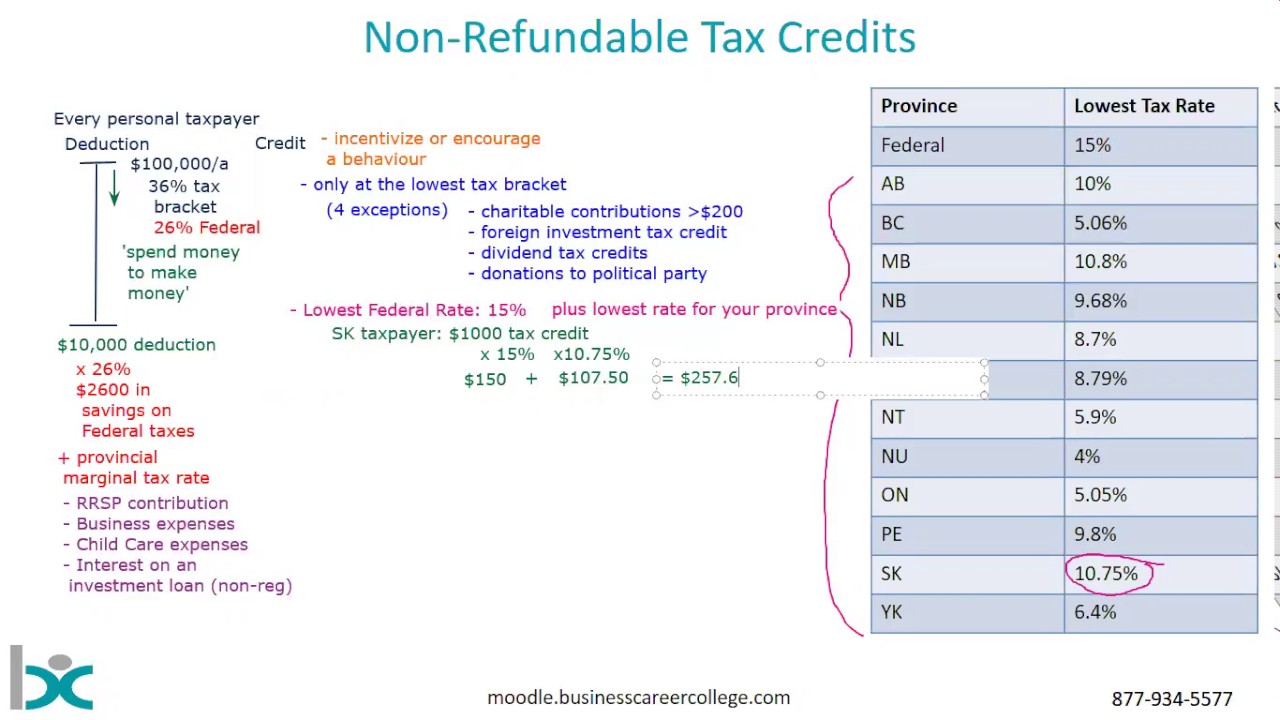

Refundable Vs Nonrefundable Tax Credits Experian

https://s28126.pcdn.co/blogs/ask-experian/wp-content/uploads/A-Person-Holds-A-Coffee-Cup-While-Writing-On-Tax-Forms-On-Their-Desk.jpg

Web 16 Nov 2023 nbsp 0183 32 What if My Solar Tax Credit Is More Than My Tax Owed The Residential Clean Energy Credit is non refundable If you claim 30 of your solar power system as a credit and it exceeds what you owe in federal income taxes for that year you won t receive a check for the difference Web 17 Aug 2023 nbsp 0183 32 By reducing your federal tax liability the credit can increase your refund or reduce the amount you owe when you file your federal tax return How do I claim my solar tax credit from the IRS The solar tax credit is claimed on tax form 5695 when you file your federal income tax return

Web 20 Juni 2023 nbsp 0183 32 The solar tax credit is a non refundable credit worth 30 of the gross system cost of your solar project That means that if the gross system cost is 20 000 your tax credit would be 6 000 20 000 x 30 6 000 It s important to note that the solar tax credit is not a check the automatically comes in the mail when you install a solar Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Download Is Solar Tax Credit Refundable Or Nonrefundable

More picture related to Is Solar Tax Credit Refundable Or Nonrefundable

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

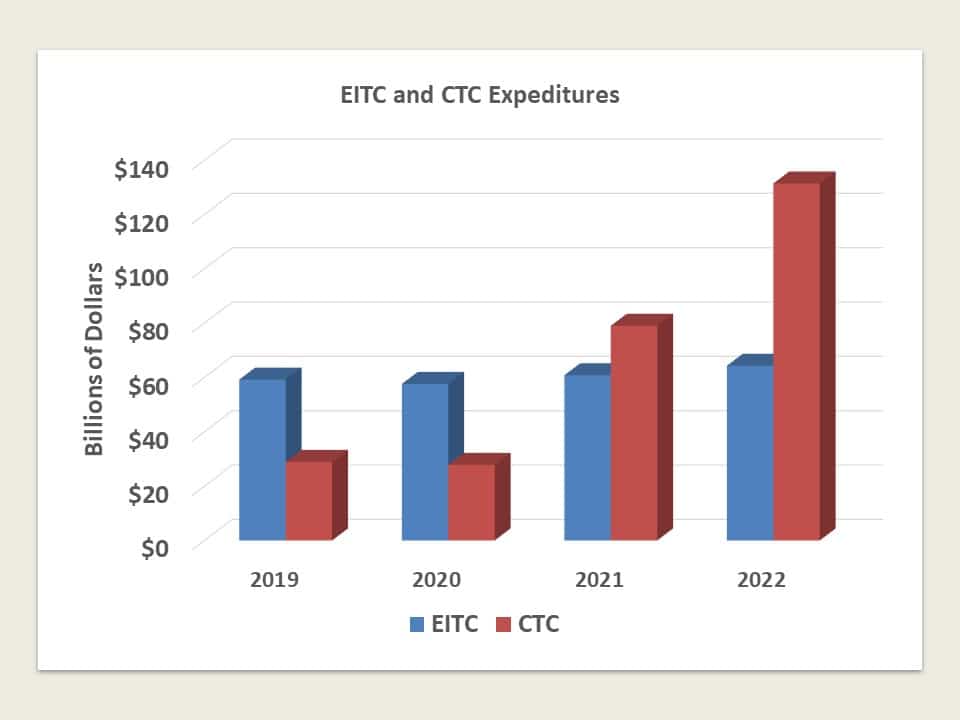

Refundable Tax Credits

https://federalsafetynet.com/wp-content/uploads/2023/03/cos2.jpg

What Is Solar Tax Credit How Does It Work Supreme Solar Electric

https://supreme.solar/wp-content/uploads/2022/07/solar-tax-credit.jpg

Web Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2021 Web The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill On average a typical EnergySage Marketplace

Web What s the Solar Energy Tax Credit A Solar Energy Tax credit is a nonrefundable credit Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress pas You need to enable JavaScript to run this app Open TurboTax Sign In Why sign in to Support Get personalized help Join the Community Web Unfortunately the solar tax credit is nonrefundable meaning that if your tax liability is less than the amount of the credit you will not be sent a check for the difference Luckily the credit lasts for 20 years so you should have no problem being able

What Are Refundable Tax Credits YouTube

https://i.ytimg.com/vi/Ya86EU_smGE/maxresdefault.jpg

How Does The Solar Tax Credit Work Solar Pricing NJ Solar Power

https://njsolarpower.com/wp-content/uploads/2021/05/iStock-697170112.jpg

https://palmetto.com/learning-center/blog/solar-tax-credit-what-if...

Web The Residential Clean Energy Credit is non refundable so you need to have enough solar tax liability available in order to receive the full value of that tax credit However there are options available if you don t have enough solar tax liability in a single tax year

https://www.nerdwallet.com/article/taxes/solar-tax-credit

Web 1 Aug 2023 nbsp 0183 32 No The solar tax credit can save you money on your tax bill but the amount of your credit can t exceed the total amount you owe That s because the credit is nonrefundable in

The 30 Solar Tax Credit Has Been Extended Through 2032

What Are Refundable Tax Credits YouTube

Solar Tax Credit Innovative Energies

How Does The Solar Tax Credit Work A M Sun Solar

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

Refundable Vs Non Refundable Tax Credits

Refundable Vs Non Refundable Tax Credits

Easy Solar Tax Credit Calculator 2022 32

How Tax Credits Work File And Claim Tax Credits On Your Return

Non Refundable Tax Credits YouTube

Is Solar Tax Credit Refundable Or Nonrefundable - Web 16 Nov 2023 nbsp 0183 32 What if My Solar Tax Credit Is More Than My Tax Owed The Residential Clean Energy Credit is non refundable If you claim 30 of your solar power system as a credit and it exceeds what you owe in federal income taxes for that year you won t receive a check for the difference