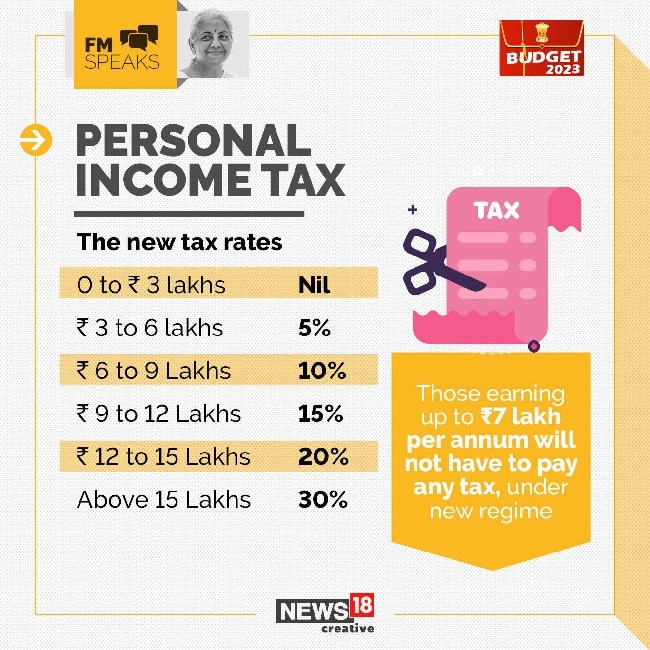

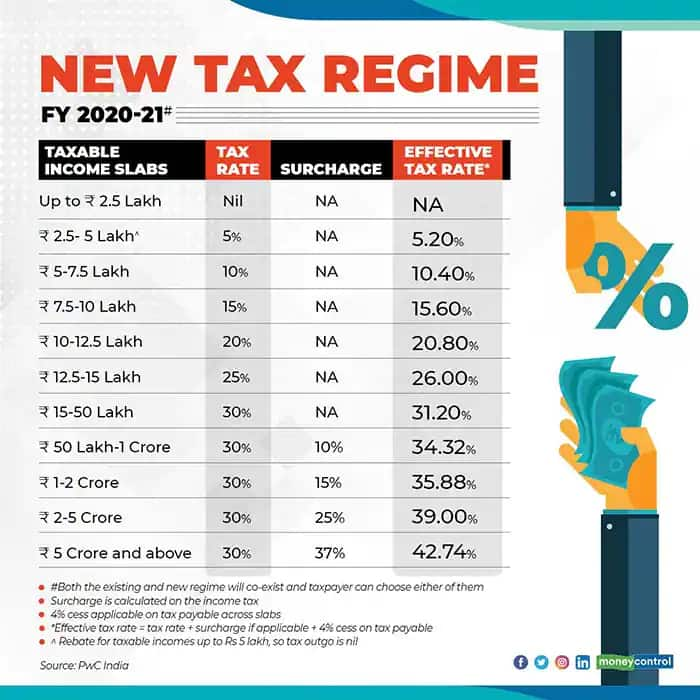

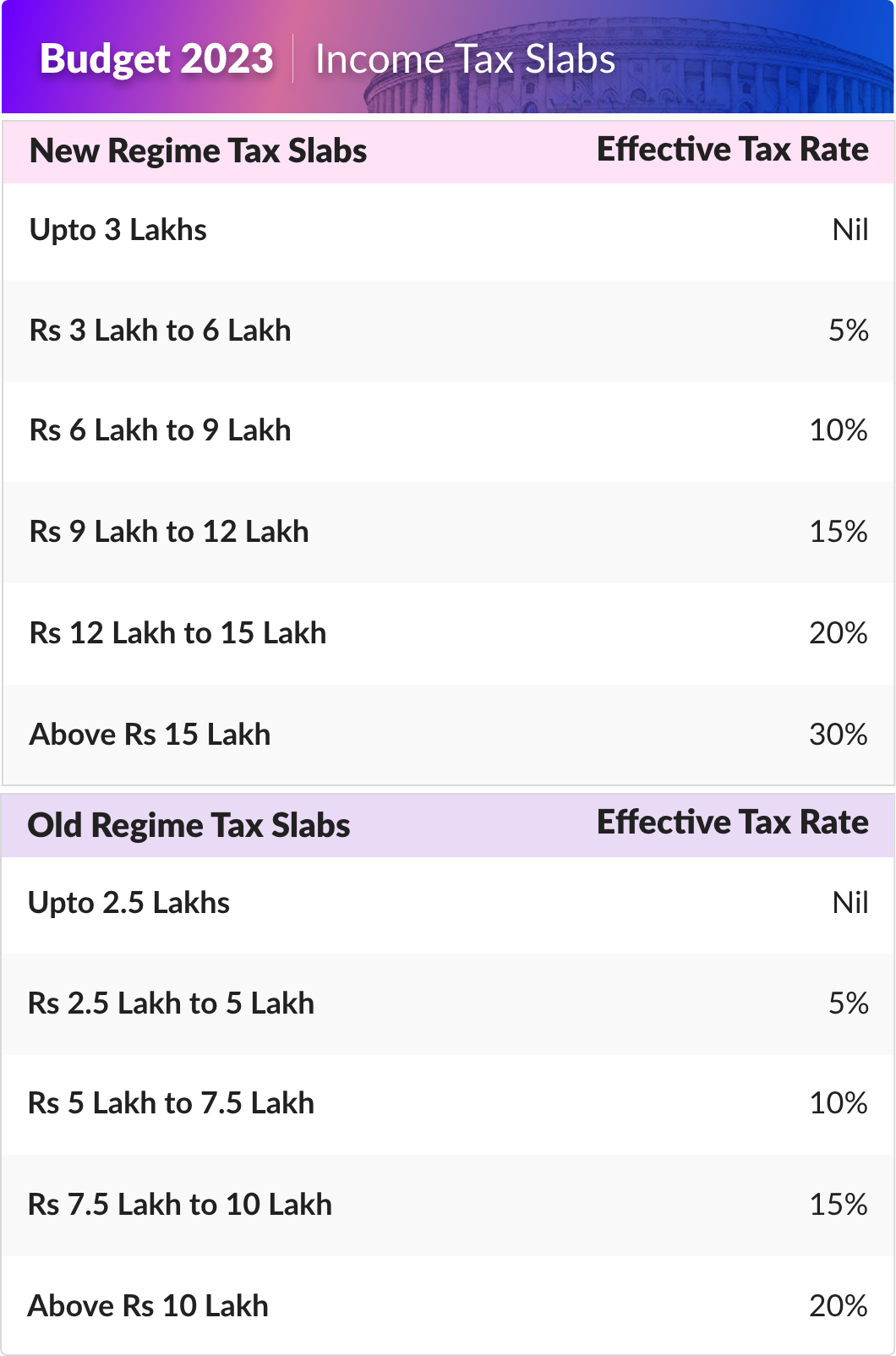

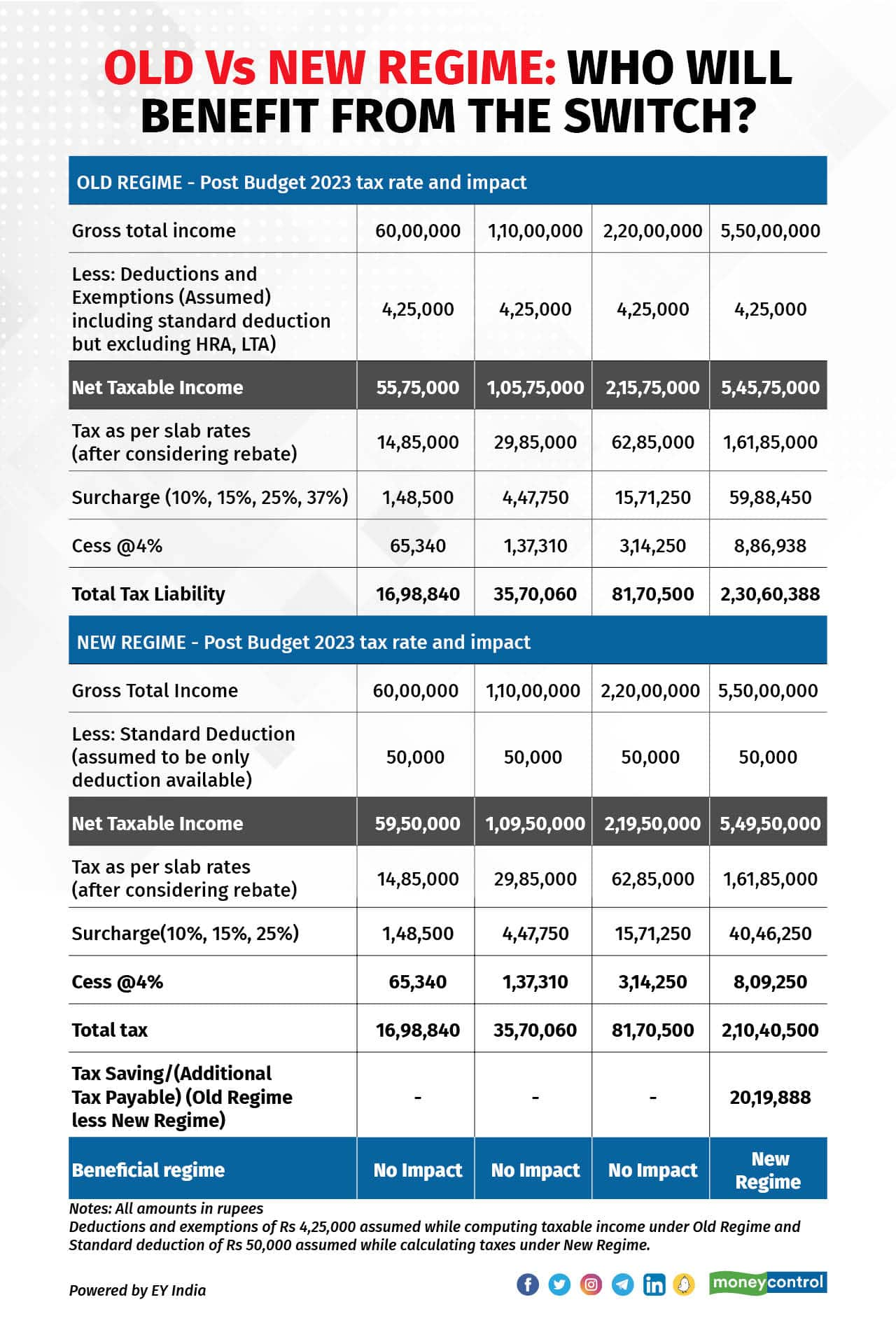

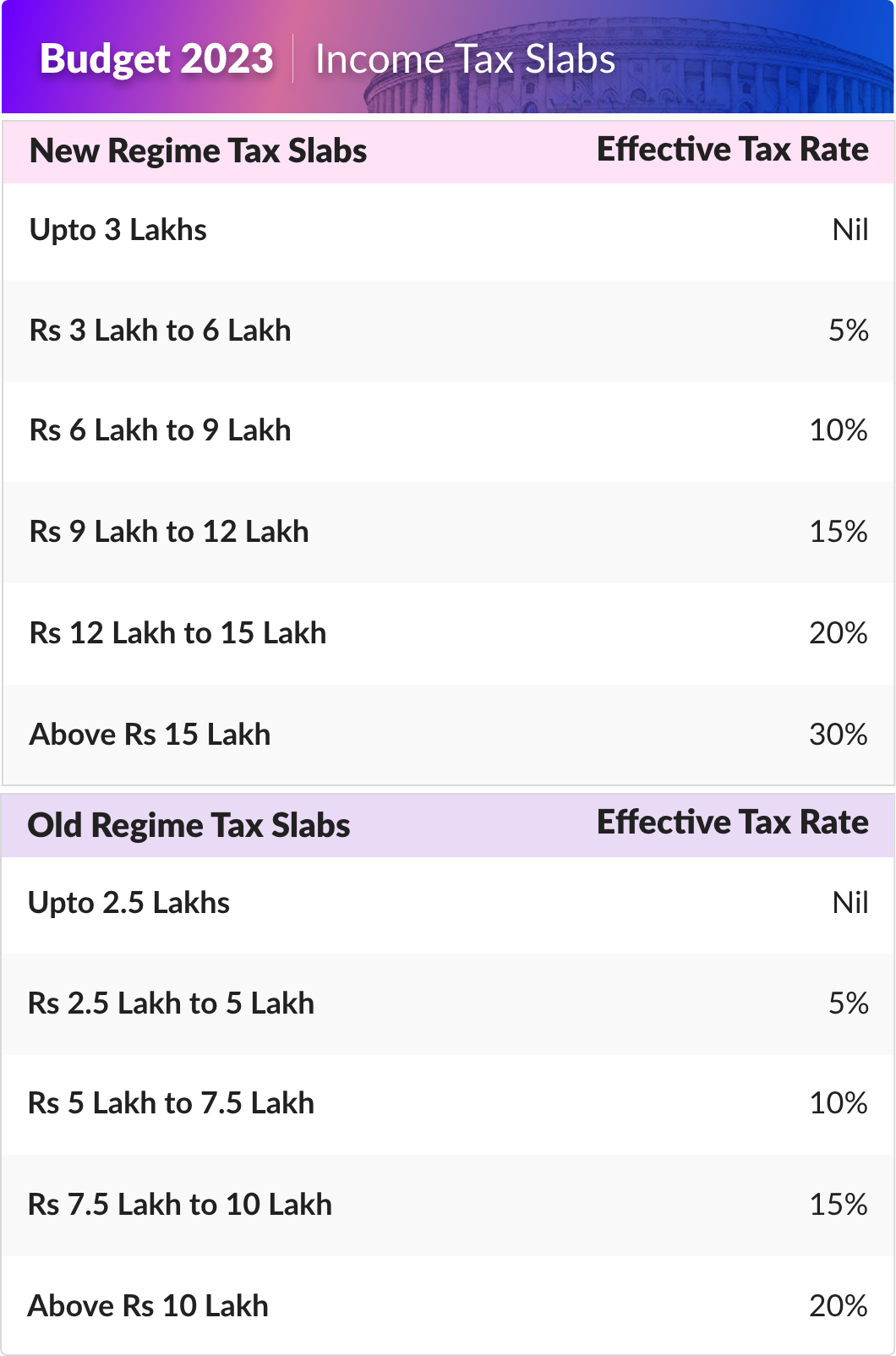

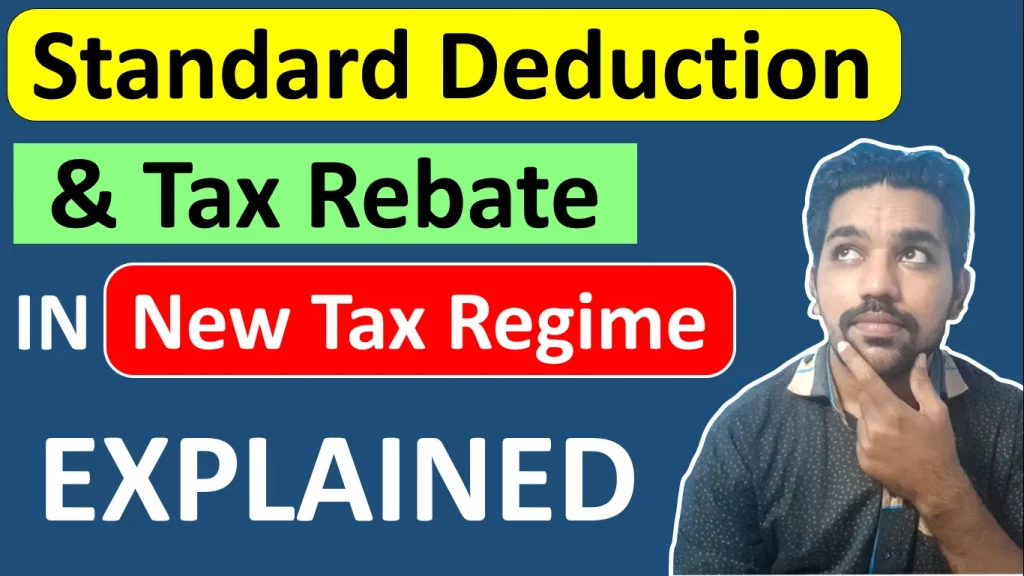

Is Standard Deduction Applicable In New Tax Regime 2023 Old Tax Regime New tax Regime until 31st March 2023 New Tax Regime From 1st April 2023 Income level for rebate eligibility 5 lakhs 5 lakhs 7 lakhs Standard Deduction 50 000 50 000 Effective Tax Free Salary income 5 5 lakhs 5 lakhs 7 5 lakhs Rebate u s 87A 12 500 12 500 25 000 HRA Exemption X X

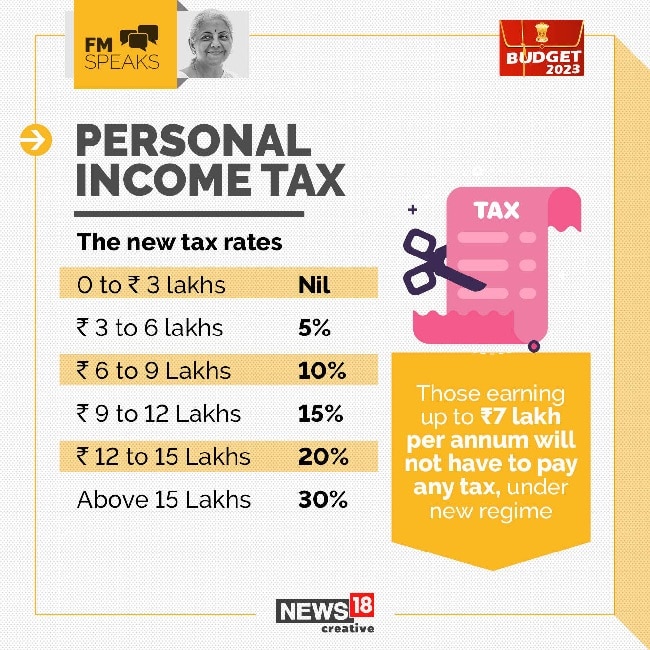

Yes Standard deduction of Rs 50 000 is available in new tax regime from FY 2023 24 starting from April 1 2023 How to claim standard deduction of Rs 50 000 under the new tax regime The standard deduction of Rs 50 000 is a straight deduction from your salary income The standard deduction is not allowed in new tax regime until FY 2022 23 AY 2023 24 However as per Budget 2023 proposal standard deduction of Rs 50 000 is allowed for salaried persons from FY 2023 24 AY 2024 25 onwards

Is Standard Deduction Applicable In New Tax Regime 2023

Is Standard Deduction Applicable In New Tax Regime 2023

https://images.cnbctv18.com/wp-content/uploads/2023/02/tax2.jpg

New Tax Regime Definition Advantages And Disadvantages Explained Mint

https://images.livemint.com/img/2023/02/01/original/New_Tax_Regime_1675252771001.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

However in Budget 2023 it was announced that the standard deduction benefit of Rs 50 000 will be available for the salaried and pensioners under the new tax regime Similarly family pensioners can claim deduction of The standard deduction benefit under the New Tax Regime will apply from AY 2024 25 i e for income tax return filing after FY 2023 24 More Stories on income tax returns

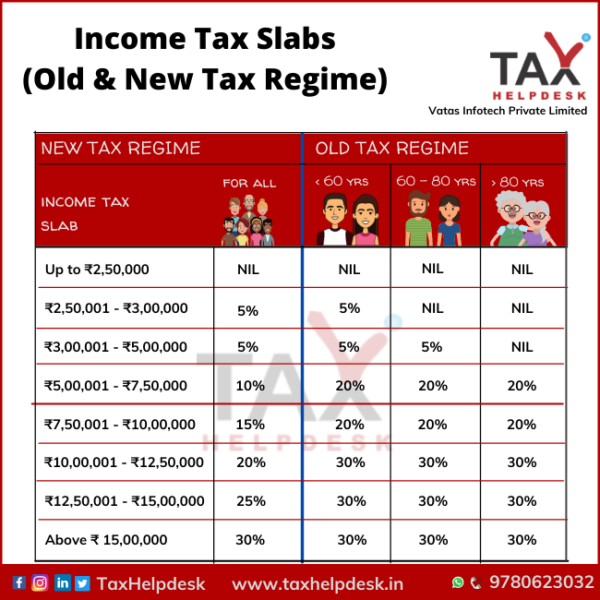

2 4 Available Deductions Exemptions a The new tax regime permits a standard deduction of Rs 50 000 for salaried persons and a deduction for a family pension being lower of Rs 15 000 or 1 3rd of the pension b Transport Allowance in case of an especially abled person What are the changes in the standard deductions in the tax regime As per the Union budget 2023 2024 the standard deductions applicable to the taxpayers under the old regime will now be available for all under section 115BAC of the Income Tax Act

Download Is Standard Deduction Applicable In New Tax Regime 2023

More picture related to Is Standard Deduction Applicable In New Tax Regime 2023

Understand About Deductions Under Old And New Tax Regime TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/Income-Tax-Slabs-Old-New-Tax-Regime-600x600.png

2023 IRS Standard Deduction

https://betterhomeowners.com/images/cached/deed5a26-242c-4893-95cb-399057c10352.jpg

Why The New Income Tax Regime Has Few Takers

https://images.moneycontrol.com/static-mcnews/2022/01/New-tax-regime-1.jpeg

Returns and Forms Applicable for Salaried Individuals for AY 2023 24 Disclaimer The content on this page is only to give an overview and general guidance and is not exhaustive For complete details and guidelines please refer Income Tax Act Rules and Notifications 2 ITR 2 Applicable for Individual and HUF Deductions available under the revised new tax regime Not all deductions are available under the new slab rates e g 80C 80D etc Very few deductions are available a For salaried individuals standard deduction upto Rs 50 000 b On pension standard deduction of Rs 15 000 or 1 3rs of pension whichever is lower c Employer s

Budget 2023 proposes to make the following deductions available to eligible individuals under the new tax regime from April 1 2023 i Standard deduction for salaried pensioners and family pensioners For the financial year 2023 24 the standard deduction is set at Rs 50 000 for salaried individuals and pensioners For family pensioners it is Rs 15 000 or 1 3rd of the family pension whichever

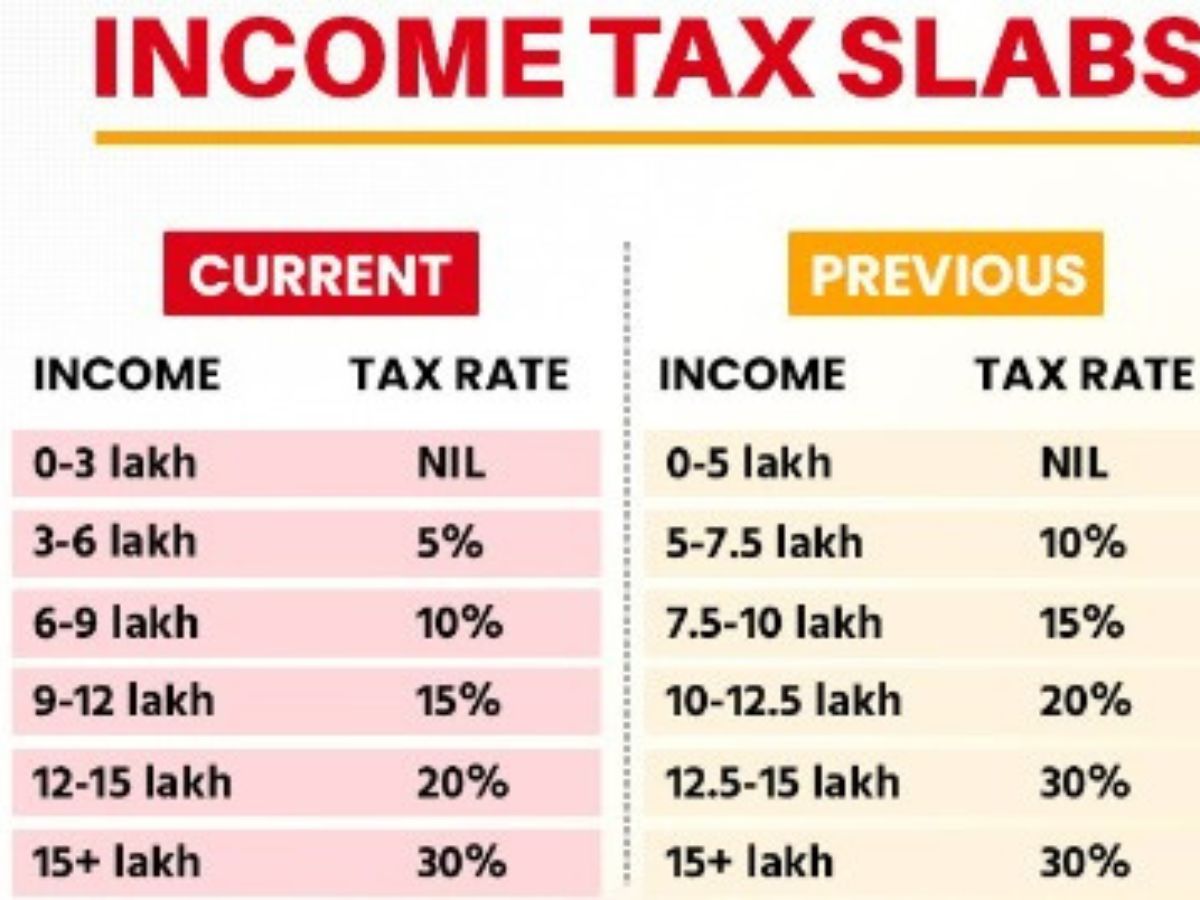

Budget 2023 New Income Tax Slabs How To Calculate Your Tax Hindustan

https://images.hindustantimes.com/img/2023/02/01/original/Tax_Regime_table_Web_1675260619284.png

New Tax Regime Vs Old Tax Regime Which Is Better Yadnya Investment Vrogue

https://images.moneycontrol.com/static-mcnews/2023/02/Old-vs-new-tax-regime-0202_002-2.jpg

https://cleartax.in/s/old-tax-regime-vs-new-tax-regime

Old Tax Regime New tax Regime until 31st March 2023 New Tax Regime From 1st April 2023 Income level for rebate eligibility 5 lakhs 5 lakhs 7 lakhs Standard Deduction 50 000 50 000 Effective Tax Free Salary income 5 5 lakhs 5 lakhs 7 5 lakhs Rebate u s 87A 12 500 12 500 25 000 HRA Exemption X X

https://economictimes.indiatimes.com/wealth/tax/...

Yes Standard deduction of Rs 50 000 is available in new tax regime from FY 2023 24 starting from April 1 2023 How to claim standard deduction of Rs 50 000 under the new tax regime The standard deduction of Rs 50 000 is a straight deduction from your salary income

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Budget 2023 New Income Tax Slabs How To Calculate Your Tax Hindustan

Standard Deduction In New Tax Regime EXPLAINED FinCalC Blog

Rebate Limit New Income Slabs Standard Deduction Understanding What

Standard Deduction 2020 Age 65 Standard Deduction 2021

Old Personal Tax Regime Vs New Tax Regime Choosing Made Easy Here Mint

Old Personal Tax Regime Vs New Tax Regime Choosing Made Easy Here Mint

Budget 2023 Tax Saving Under New Tax Regime Vs Old Tax Regime For Rs 7

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

Changes In New Tax Regime All You Need To Know

Is Standard Deduction Applicable In New Tax Regime 2023 - The standard deduction benefit under the New Tax Regime will apply from AY 2024 25 i e for income tax return filing after FY 2023 24 More Stories on income tax returns