Is Standard Deduction Of Rs 50000 Is Applicable In New Tax Regime There has been some confusion among taxpayers regarding the eligibility and the amount of standard deduction they can claim under the new tax regime Is it Rs 50 000 or Rs 52 500 Is it available to all taxpayers or only to those earning above Rs 15 5 lakh Standard deduction of Rs 50 000 or Rs 52 500

With the inclusion of the Rs 50 000 standard deduction in the new regime salaried taxpayers with an income up to Rs 50 000 will not be required to pay any tax In the recent Union Budget 2023 24 a standard deduction of 50 000 was introduced under the new tax regime which was previously available only under the old tax regime The Finance Minister Nirmala Sitharaman said My third proposal is for the salaried class and the pensioners including family pensioners for whom I propose to extend

Is Standard Deduction Of Rs 50000 Is Applicable In New Tax Regime

Is Standard Deduction Of Rs 50000 Is Applicable In New Tax Regime

https://i.ytimg.com/vi/_PUQVSwHovg/maxresdefault.jpg

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-12.jpg

Tratamento Da Dedu o Padr o De Rs 50000 Sob O Novo Regime Tribut rio

https://www.relakhs.com/wp-content/uploads/2020/12/Applicability-treatment-Standard-Deduction-Rs-50000-under-the-New-Tax-Regime-exisitng-old-FY-2020-21-AY-2021-22.jpg

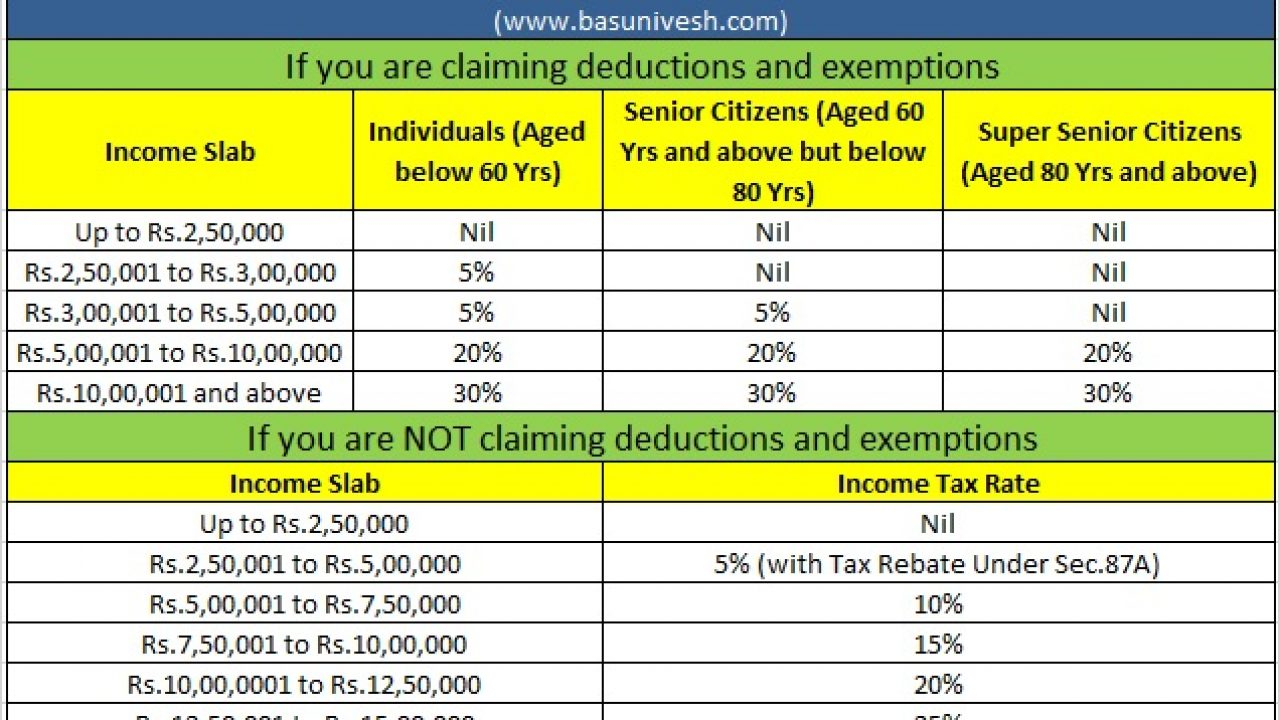

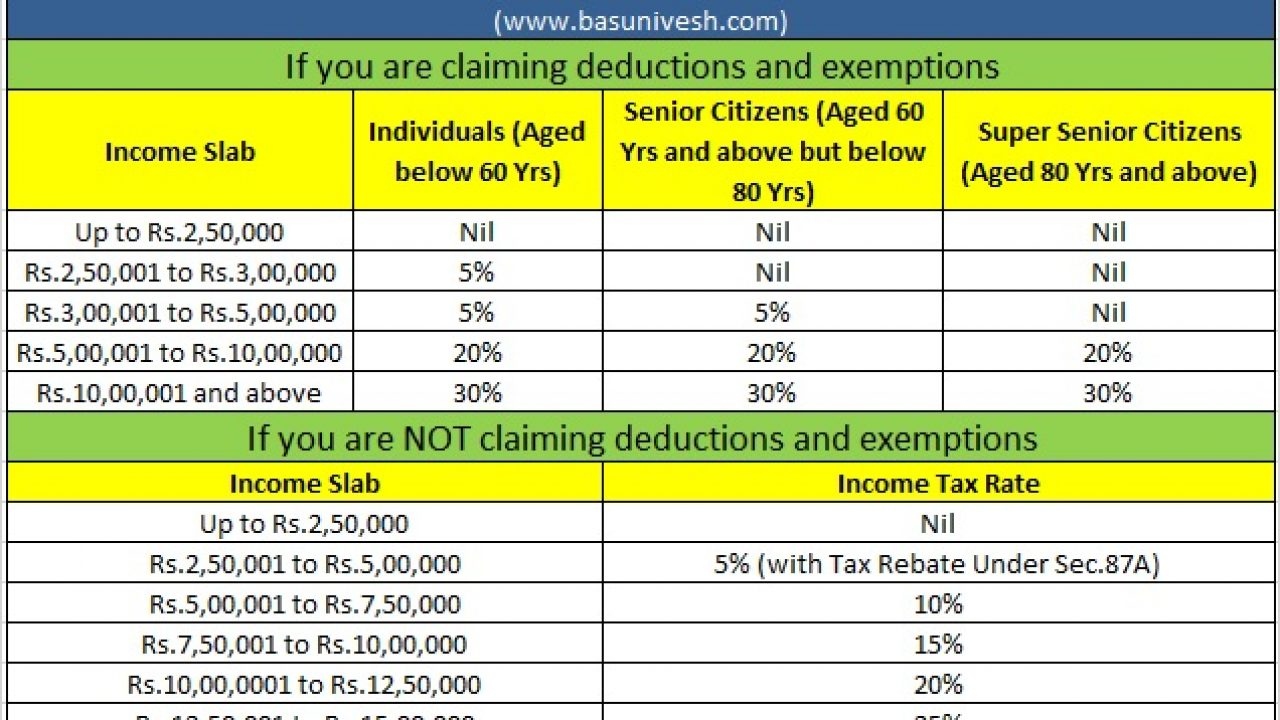

The standard deduction of Rs 50 000 has been extended to the new tax regime as well The highest surcharge rate of 37 has been reduced to 25 under the new tax regime This move impacts taxpayers earning more than Rs 5 crore As a result their overall tax rate will decrease from 42 74 to 39 As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also What is Standard Deduction for Salaried Individuals The standard deduction is a flat deduction of Rs 50 000 from your income that is taxable under the head salaries

So Standard Deduction Section 16 ia of the Income Tax Act of Rs 50 000 for FY 2020 21 AY 2021 22 is not available under the New Income Tax Regime To know which Income Tax Deductions Exemptions are allowed under New Tax Regime AY 2021 22 you may kindly go through this article Income Tax Deductions under Standard Deduction and Family Pension Deduction Salary income The standard deduction of 50 000 which was only available under the old regime has now been extended to the new tax regime as well This along with the rebate makes 7 5 lakhs as your tax free income under the new regime

Download Is Standard Deduction Of Rs 50000 Is Applicable In New Tax Regime

More picture related to Is Standard Deduction Of Rs 50000 Is Applicable In New Tax Regime

Is Standard Deduction Before Or After AGI

https://www.zrivo.com/wp-content/uploads/2021/08/Is-standard-deduction-before-or-after-AGI-768x432.jpg

Standard Deduction In New Tax Regime EXPLAINED FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2023/02/standard-deduction-and-tax-rebate-in-new-tax-regime-video.webp

What Is Standard Deduction In India Plan Your Finances

https://www.planyourfinances.in/wp-content/uploads/2019/04/28.jpg

As per Section 16 ia of the Income Tax Act this deduction is only available to salaried individuals and pensioners who can claim a deduction of upto Rs 50 000 It is a flat deduction so you don t require any type of evidence or proof of investment Deductions available under the revised new tax regime Not all deductions are available under the new slab rates e g 80C 80D etc Very few deductions are available a For salaried individuals standard deduction upto Rs 50 000 b On pension standard deduction of Rs 15 000 or 1 3rs of pension whichever is lower

Standard deduction The new tax regime provides a standard deduction of Rs 50 000 for salaried individuals As per the new tax regime a taxpayer can enjoy tax exempt income up to Rs 7 5 lakh after applying the standard deduction and tax rebate It is important to note that the standard deduction was claimed by those who opt for the old tax regime however from financial year 2023 23 this deduction is also available under the new tax regime Who Is Not Eligible For Standard Deduction The standard deduction of Rs 50 000 or the amount of the salary whichever is less is available to

Rs 50000 Standard Deduction From FY 2019 20 AY 2020 21 Impact

https://www.relakhs.com/wp-content/uploads/2019/07/Rs-50000-Standard-Deduction-FY-2019-20-AY-2020-21-impact-on-your-net-salary-income-how-much-tax-can-you-save.jpg

Standard Deduction For Salaried Employees Impact Of Standard

https://i.pinimg.com/originals/05/8c/32/058c32cbbbd99e3ad8dfee9a313112a1.jpg

https://economictimes.indiatimes.com/wealth/tax/...

There has been some confusion among taxpayers regarding the eligibility and the amount of standard deduction they can claim under the new tax regime Is it Rs 50 000 or Rs 52 500 Is it available to all taxpayers or only to those earning above Rs 15 5 lakh Standard deduction of Rs 50 000 or Rs 52 500

https://www.financialexpress.com/money/standard...

With the inclusion of the Rs 50 000 standard deduction in the new regime salaried taxpayers with an income up to Rs 50 000 will not be required to pay any tax

Union Budget 2022 23 What Is Standard Deduction Why It Must Be

Rs 50000 Standard Deduction From FY 2019 20 AY 2020 21 Impact

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Standard Deduction On Salary In India 2023 Limits Calims

Standard Deduction What Is It Vs Itemized Example

What Is Standard Deduction For Salaried Employees FinCalC Blog

What Is Standard Deduction For Salaried Employees FinCalC Blog

Budget 2023 Tax Saving Under New Tax Regime Vs Old Tax Regime For Rs 7

Income Tax Rs 50 000 Standard Deduction By Swipe May 2023 Medium

What Is Standard Deduction ExcelDataPro

Is Standard Deduction Of Rs 50000 Is Applicable In New Tax Regime - Yes Standard Deduction of Rs 50 000 is now available for EVERY Salaried Pensioners under the New Tax Regime in India 2023 This new change has been introduced under Section 16 ia in Budget 2023 and for new tax regime which was introduced as an alternative tax system under section 115BAC