Is Student Loan Forgiveness Taxable In Pa Ensuring that student loan forgiveness through the PSLF and SLRN programs is not considered taxable income will remove one more barrier for

Generally such loan payments or forgiveness are not subject to Pennsylvania personal income tax unless the student provides services directly to the When is it taxable Income from cancellation of debt is taxable in Pennsylvania in only two circumstances Under Generally Accepted Accounting

Is Student Loan Forgiveness Taxable In Pa

Is Student Loan Forgiveness Taxable In Pa

https://d.newsweek.com/en/full/2138739/student-loan-forgiveness-cash-calculator.jpg

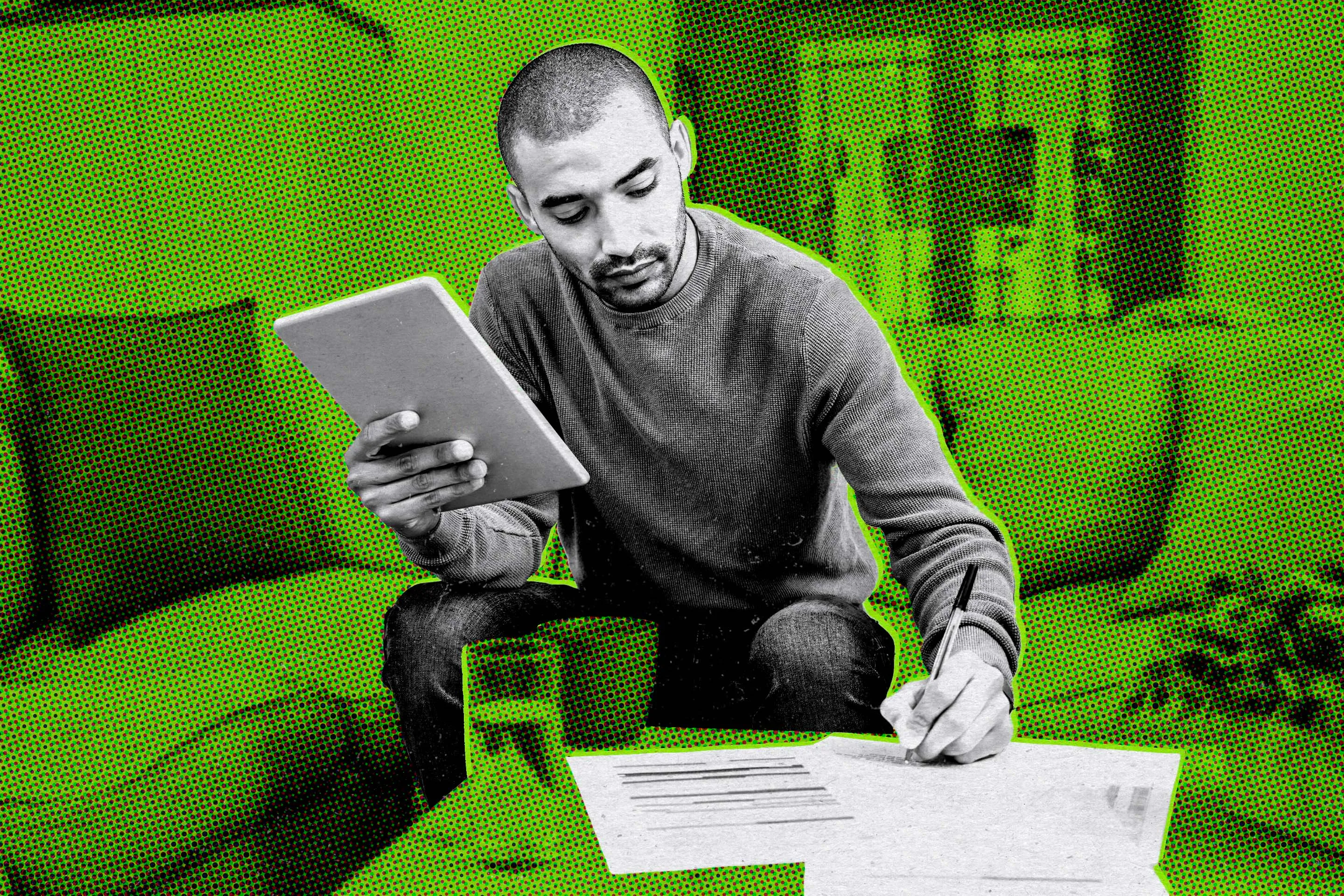

You Can Now Submit The Student Loan Forgiveness Application Money

https://img.money.com/2022/10/News-Borrowers-Start-Filling-Student-Loan-Forgiveness-Application.jpg?quality=85

Student Loan Forgiveness The Guide To 80 Programs Loan Forgiveness

https://i.pinimg.com/originals/71/ca/37/71ca37d51c3155339969ab1e5ac1f457.png

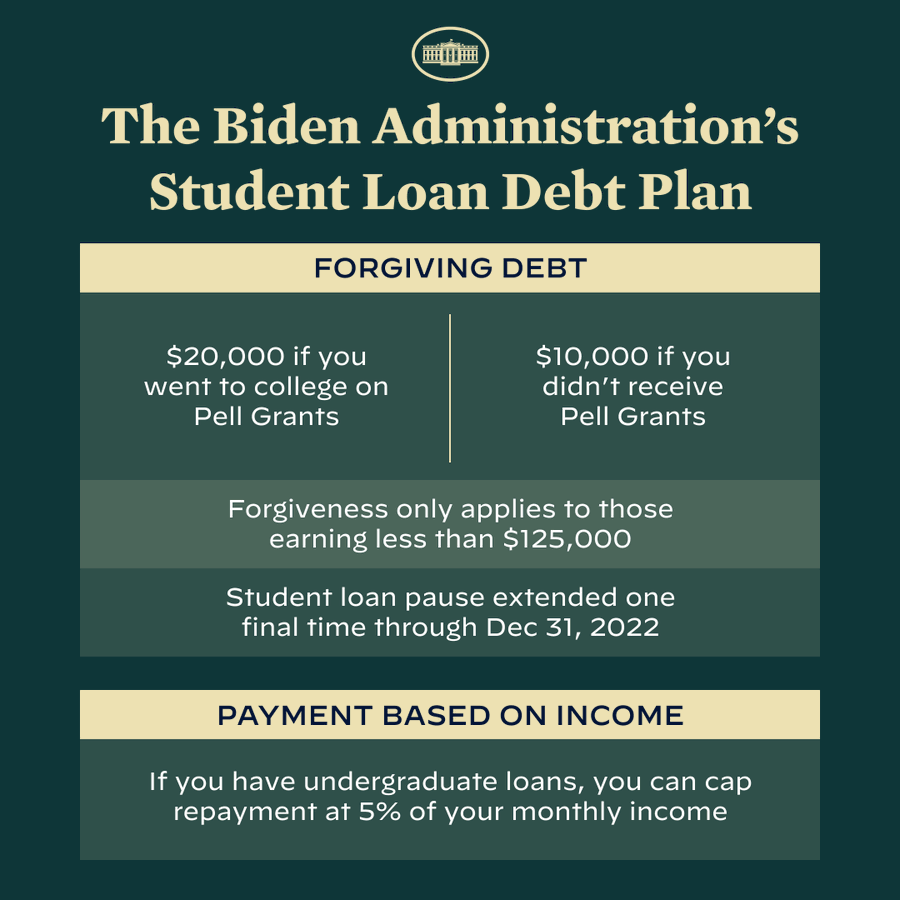

Finally while some states such as Pennsylvania typically tax debt forgiveness borrowers won t need to pay tax on their student loan relief With student loan forgiveness taxes work differently In March 2021 President Joe Biden signed the American Rescue Plan into law which included a clause

Pennsylvanians who use federal student loan forgiveness programs won t have to worry about being hit with an unexpected surprise in their state income tax bill Gov Tom Wolf said Wednesday that Pennsylvania student loan borrowers who will receive up to 20 000 in relief under President Biden s Student Debt Relief Plan

Download Is Student Loan Forgiveness Taxable In Pa

More picture related to Is Student Loan Forgiveness Taxable In Pa

Student Loan Forgiveness January 2024 Updates To Know Money

https://img.money.com/2024/01/News-Student-Loan-Forgiveness-Developments.jpg?quality=85

How Will Student Loan Forgiveness Affect Your Credit Lexington Law

https://www.lexingtonlaw.com/blog/wp-content/uploads/2017/10/Student-Loan-Forgiveness.jpg

When Is Student Loan Forgiveness Taxable

https://www.taxdefensenetwork.com/wp-content/uploads/2022/09/student-loan-forgiveness.webp

Is the cancellation of student loan debt announced by the Biden administration taxable for Pennsylvania Personal Income Tax purposes No It is not Meanwhile in Pennsylvania officials have announced that the Biden administration s cancellation of student loan debt is not taxable though the rationale for

Gov Wolf notes that for a public service worker with 50 000 in forgiven student loans in Pennsylvania will now be able to avoid a 1 535 state income tax bill Some states plan to collect taxes on student loan forgiveness Here s how to prepare if you re affected Ongoing changes have been afoot for student loan

Is Student Loan Forgiveness Taxable In Wisconsin YouTube

https://i.ytimg.com/vi/-aOJw3-WmKY/maxresdefault.jpg

Loan Forgiveness How Student Debt In The U S Has Skyrocketed The

https://static01.nyt.com/images/2022/08/26/your-money/student-loan-forgiveness-debt-promo/student-loan-forgiveness-debt-promo-videoSixteenByNine3000.png

https://www.pennlive.com/life/2022/08/pennsylvania...

Ensuring that student loan forgiveness through the PSLF and SLRN programs is not considered taxable income will remove one more barrier for

https://revenue-pa.custhelp.com/app/answers/detail/a_id/2682

Generally such loan payments or forgiveness are not subject to Pennsylvania personal income tax unless the student provides services directly to the

Student Loan Forgiveness Could Help More Than 40 Million AP News

Is Student Loan Forgiveness Taxable In Wisconsin YouTube

What To Know If You ve Applied For Student Loan Forgiveness AP News

Is Student Loan Forgiveness Taxable Newscentermaine

Covering Student Loan Forgiveness 5 Tips From Danielle Douglas Gabriel

Student Loan Forgiveness Is Not The Solution CNSNews

Student Loan Forgiveness Is Not The Solution CNSNews

Is Student Loan Forgiveness Taxable It Depends

Student Loan Forgiveness The Navigator

Is Your Student Loan Forgiveness Taxable In Your State How To Request

Is Student Loan Forgiveness Taxable In Pa - The Center Square Gov Tom Wolf announced a Department of Revenue change that will eliminate state income tax on student loan relief through two major