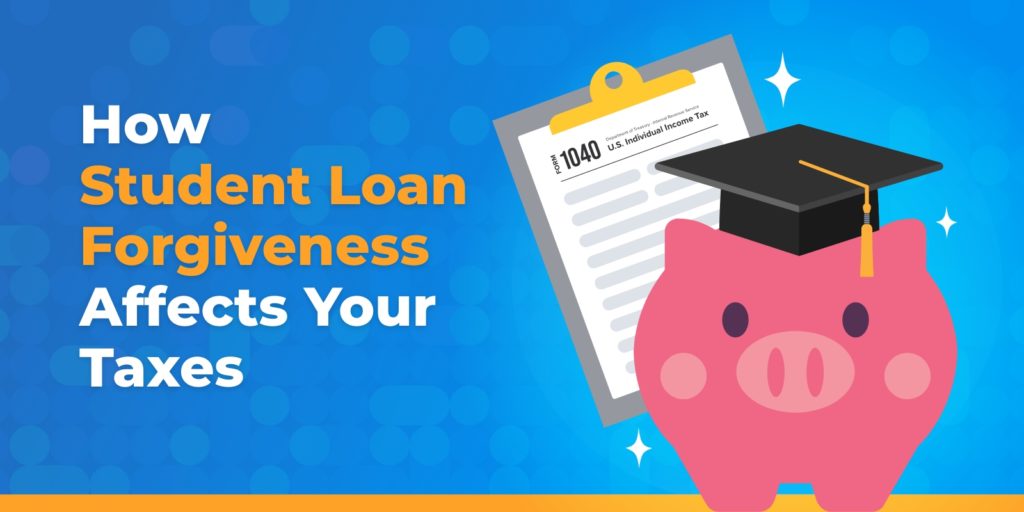

Is Student Loan Forgiveness Taxed In California Under state law student loan debt canceled that way is not taxable in California The federal Department of Education itself is remaining mum on the issue saying more details will be

For taxable years beginning on and after January 1 2019 and before January 1 2024 California provides an exclusion from gross income for the discharge of a student loan of an eligible individual RTC section 17144 6 California allows an exclusion from gross income for student loan debt that is cancelled or repaid under the income based repayment programs administered by the U S Department of Education

Is Student Loan Forgiveness Taxed In California

Is Student Loan Forgiveness Taxed In California

https://img.money.com/2022/10/News-Borrowers-Start-Filling-Student-Loan-Forgiveness-Application.jpg?quality=85

How Easy Is Filing Your Student Loan Forgiveness Application Newsweek

https://d.newsweek.com/en/full/2138739/student-loan-forgiveness-cash-calculator.jpg

Student Loan Forgiveness The Guide To 80 Programs Loan Forgiveness

https://i.pinimg.com/originals/71/ca/37/71ca37d51c3155339969ab1e5ac1f457.png

According to the Tax Foundation California has confirmed it will be treating Biden s student debt forgiveness as income for state tax purposes Although the American California confirms it will not tax Biden s 20 000 student loan forgiveness plan Other states like Indiana and North Carolina said the federal relief could be subject to state

California allows an exclusion from gross income for student loan debt that is cancelled or repaid under the income based repayment programs administered by the U S Department of Education Biden is canceling up to 10K in student loans 20K for Pell Grant recipients But seven states are out of step with federal tax policy and have either said they will tax debt relief or still

Download Is Student Loan Forgiveness Taxed In California

More picture related to Is Student Loan Forgiveness Taxed In California

Student Loan Forgiveness And Refunds What Gets Taxed The Student

https://studentloansherpa.com/wp-content/uploads/2022/11/taxes-on-student-loan-forgiveness-and-refunds-scaled.jpeg

How To Qualify For Biden s Student Loan Forgiveness Plan Astrolakejob

https://astrolakejob.com/wp-content/uploads/2022/09/Student-Loan-Forgiveness.png

Student Loan Forgiveness January 2024 Updates To Know Money

https://img.money.com/2024/01/News-Student-Loan-Forgiveness-Developments.jpg?quality=85

Forgiven student loan debt and other pandemic related financial relief for students would be exempt from California income tax under a bill lawmakers passed Thursday The bill exempts Californians from paying income on their student loan forgiveness through 2026 and would take effect immediately if approved by both houses by a two thirds majority and signed by Governor Newsom

The law signed on Monday May 15 is in conformity with the American Rescue Plan Act of 2021 which exempts student loan forgiveness from being federally taxed until 2025 However California legislators have promised to change the state s tax code to exempt student debt forgiveness from being taxed On Sept 9 California Assembly Speaker

Pin On Student Loan Forgiveness

https://i.pinimg.com/736x/c7/02/ea/c702ea79e10910ce8dc3cd1e3e33a09a--pay-student-loans-student-loan-payment.jpg

What Is The New Student Debt Relief Plan How To Sign Up For Student

https://wegotthiscovered.com/wp-content/uploads/2022/08/Student_loan_Forgiveness.jpg

https://www.latimes.com/california/story/2022-09...

Under state law student loan debt canceled that way is not taxable in California The federal Department of Education itself is remaining mum on the issue saying more details will be

https://www.ftb.ca.gov/tax-pros/law/legislation/...

For taxable years beginning on and after January 1 2019 and before January 1 2024 California provides an exclusion from gross income for the discharge of a student loan of an eligible individual RTC section 17144 6

What To Know If You ve Applied For Student Loan Forgiveness AP News

Pin On Student Loan Forgiveness

Are You Eligible For 5 Billion In Student Loan Forgiveness

Student Loan Forgiveness Could Help More Than 40 Million AP News

How Student Loan Forgiveness Affects Your Taxes Optima Tax Relief

Student Loan Forgiveness Taxed In NC For Now YouTube

Student Loan Forgiveness Taxed In NC For Now YouTube

Covering Student Loan Forgiveness 5 Tips From Danielle Douglas Gabriel

White House Releases Student Loan Forgiveness Application What To Know

Student Loan Forgiveness What To Expect

Is Student Loan Forgiveness Taxed In California - While the president s student loan forgiveness will be excused from federal taxation your state may tax your canceled student debt Student loan forgiveness is not taxable in most states