Is Student Loan Interest Deductible In 2023 Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the If you ve paid interest on your student loans you may be able to reduce your federal taxable income by up to 2 500 thanks to the student loan interest deduction or

Is Student Loan Interest Deductible In 2023

Is Student Loan Interest Deductible In 2023

https://www.consolidatedcreditcanada.ca/wp-content/uploads/2021/08/Is-interest-on-student-loan-debt-tax-deductible.jpg

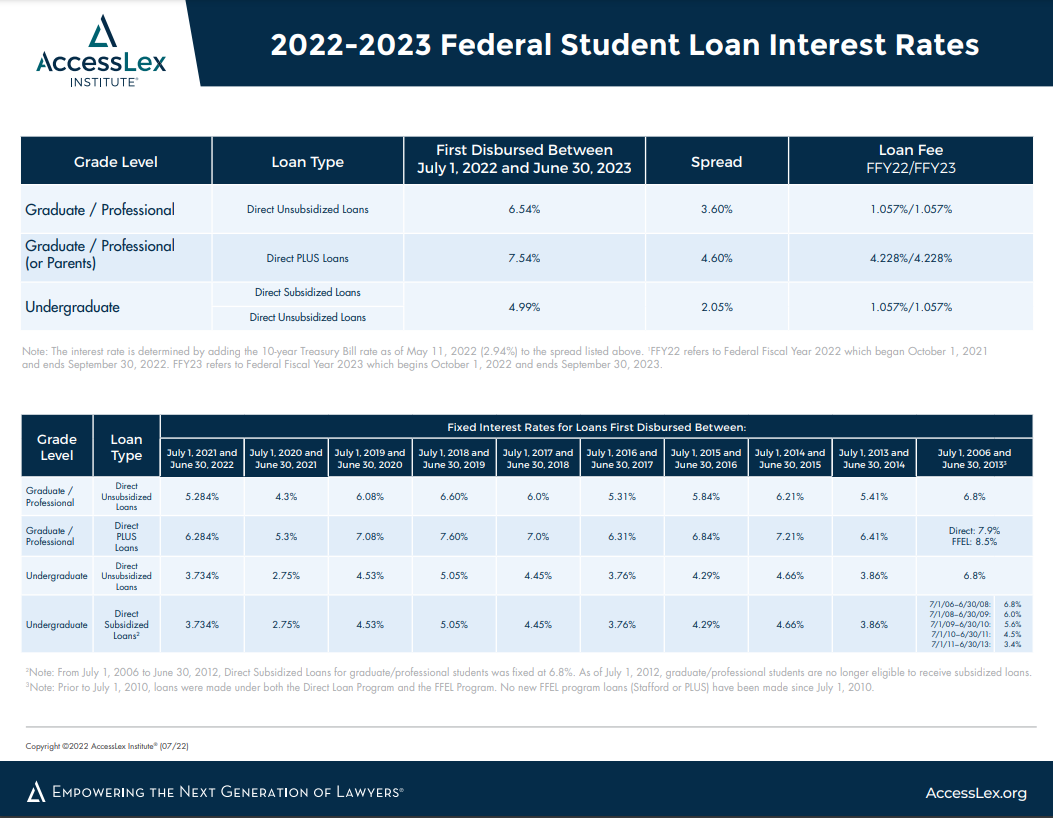

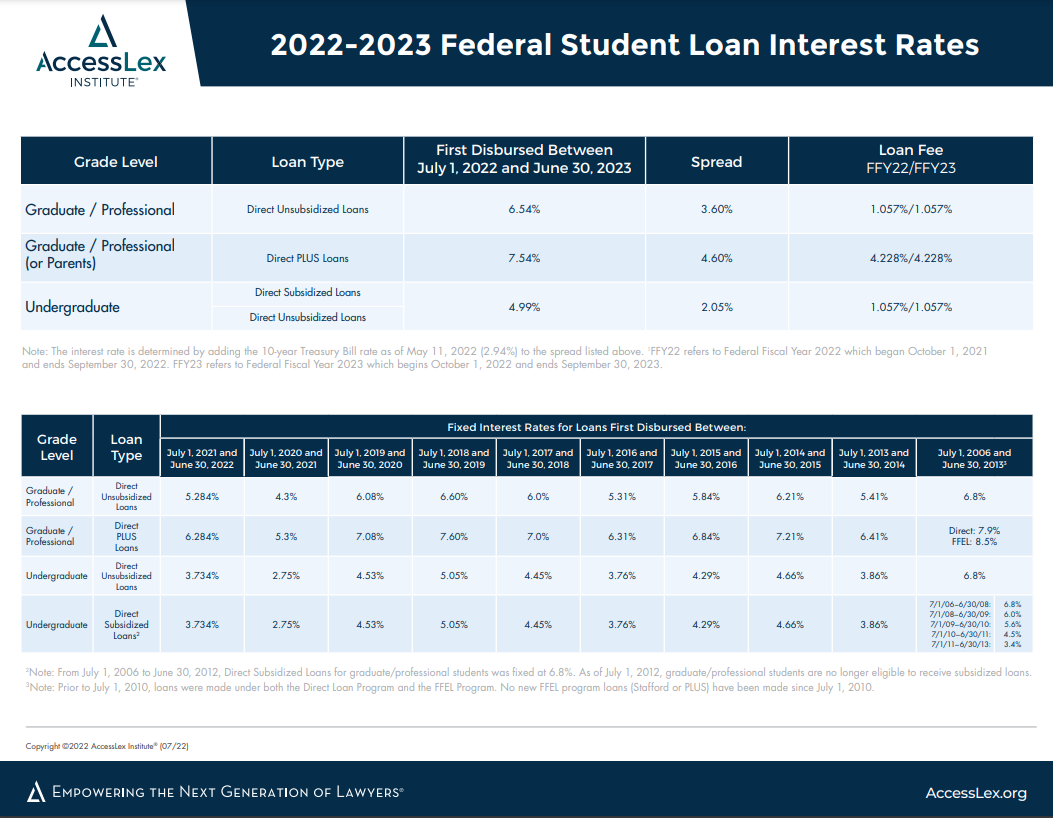

2022 2023 Federal Student Loan Interest Rates AccessLex

https://www.accesslex.org/sites/default/files/inline-images/Federal Student Loan Interest Rates_2022 2023.png

Mortgage Interest Tax Deduction 2020 Calculator JunaidKaleah

https://blog.turbotax.intuit.com/wp-content/uploads/2020/05/You-can-deduct-student-loan-interest-if-you-meet-the-following-qualifications.jpg?w=580

For 2023 the amount of your student loan interest deduction is gradually reduced phased out if your MAGI is between 75 000 and 90 000 155 000 and 185 000 if you file a joint return You can t claim the For the 2023 tax year the amount of your student loan interest deduction is gradually reduced or phased out if your modified adjusted gross income MAGI is between 75 000 and 90 000 for

Learn how to deduct up to 2 500 of student loan interest from your taxes in 2023 depending on your income level and other factors Find out how to claim The student loan interest deduction is a federal tax deduction that lets you deduct up to 2 500 of the student loan interest you paid during the year It reduces your taxable income which can

Download Is Student Loan Interest Deductible In 2023

More picture related to Is Student Loan Interest Deductible In 2023

How Much Is The Interest On Student Loans Niya Blog

https://www.gannett-cdn.com/-mm-/3095bbe1c7b29d9ac3460534e28a55c79c2eb0ef/c=0-226-1942-1318/local/-/media/2019/02/28/USATODAY/usatsports/MotleyFool-TMOT-d92ea364-student-loans.jpg?width=3200&height=1680&fit=crop

Student Loan Interest Deduction Who Can Claim Forbes Advisor

https://www.forbes.com/advisor/wp-content/uploads/2022/10/getty_student_loan_interest_deductible.jpeg.jpg

Student Loan Interest Deduction H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/shutterstock_119968390.jpg

Interest on federal student loans began accruing again on Sept 1 and the first payments were due in October for more than 40 million Americans If you started Student loan interest is deductible if your modified adjusted gross income or MAGI is less than 70 000 145 000 if filing jointly If your MAGI was between

Student loan interest deduction For 2023 the amount of your student loan interest deduction is gradually re duced phased out if your MAGI is between 75 000 and Taxpayers may be eligible for a student loan interest deduction SLID Subject to income limitations taxpayers may deduct up to 2 500 of qualified student

Student Loan Interest Deduction 2013 PriorTax Blog

https://www.blog.priortax.com/wp-content/uploads/2014/02/Student-Loan-Interest-Deduction-2013-1024x576.jpg

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

The Federal Student Loan Interest Deduction

https://www.thebalancemoney.com/thmb/4CpyfpIiY3PR6DdBUhGkiXJXdEE=/1500x1000/filters:fill(auto,1)/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif

https://smartasset.com/taxes/student-lo…

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know

https://www.forbes.com/advisor/taxes/s…

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

How Much Is Student Loan Interest Really Costing You Student Loan

Student Loan Interest Deduction 2013 PriorTax Blog

Investment Expenses What s Tax Deductible Charles Schwab

Federal Student Loan Interest Rate For 2019 20 PayForED

Is Student Loan Interest Deductible Henssler Financial

Deducting Student Loan Interest Payments MileIQ

Deducting Student Loan Interest Payments MileIQ

Student Loan Interest Deduction And Tuition Fees Deduction Offer Tax

Are Student Loans Tax Deductible Bold

Learn How The Student Loan Interest Deduction Works

Is Student Loan Interest Deductible In 2023 - Learn how to deduct up to 2 500 of student loan interest from your taxes in 2023 depending on your income level and other factors Find out how to claim