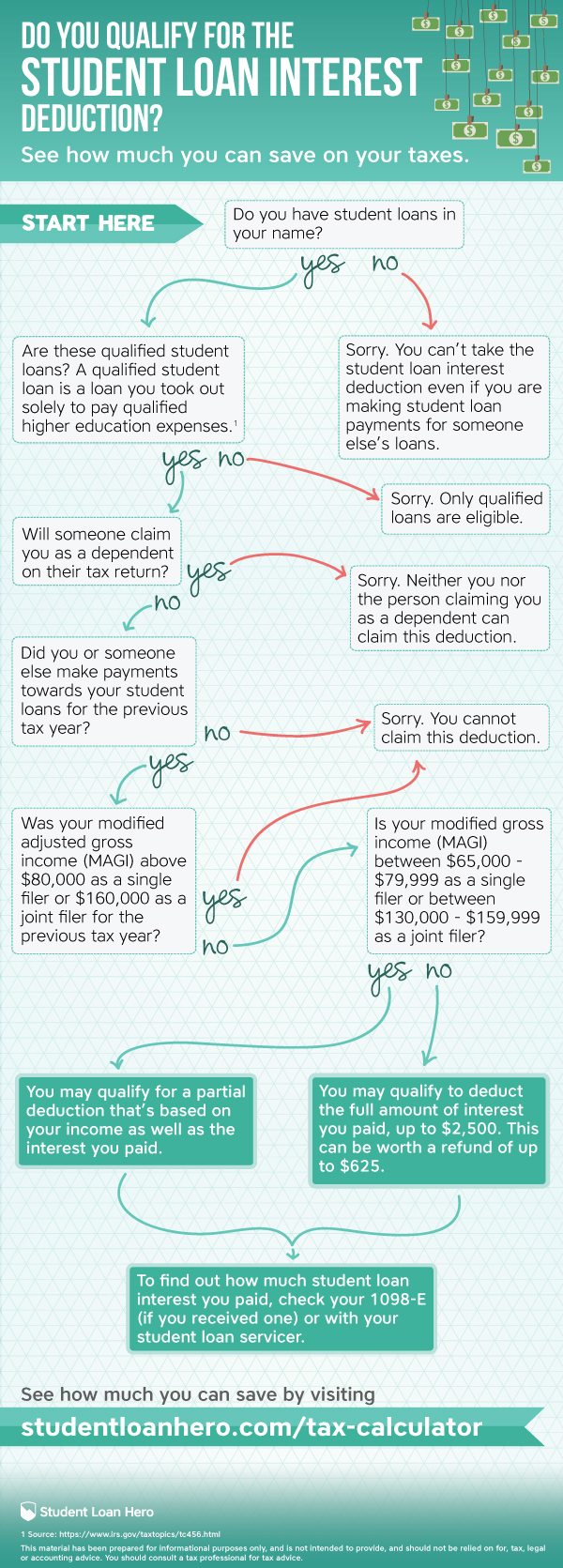

Is Student Loan Interest Deductible The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

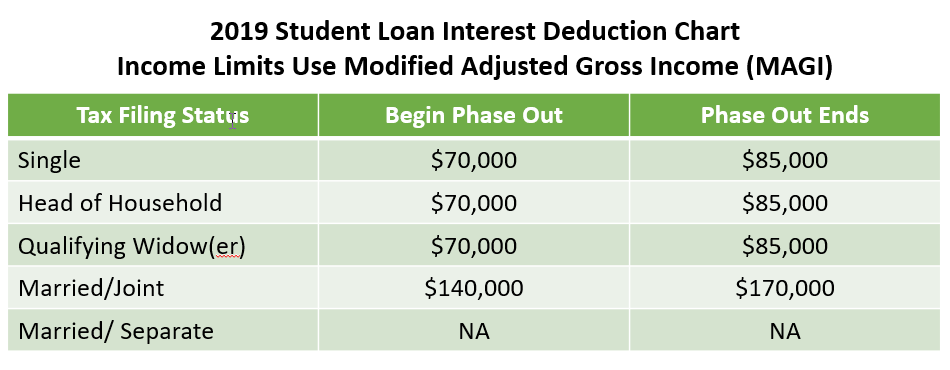

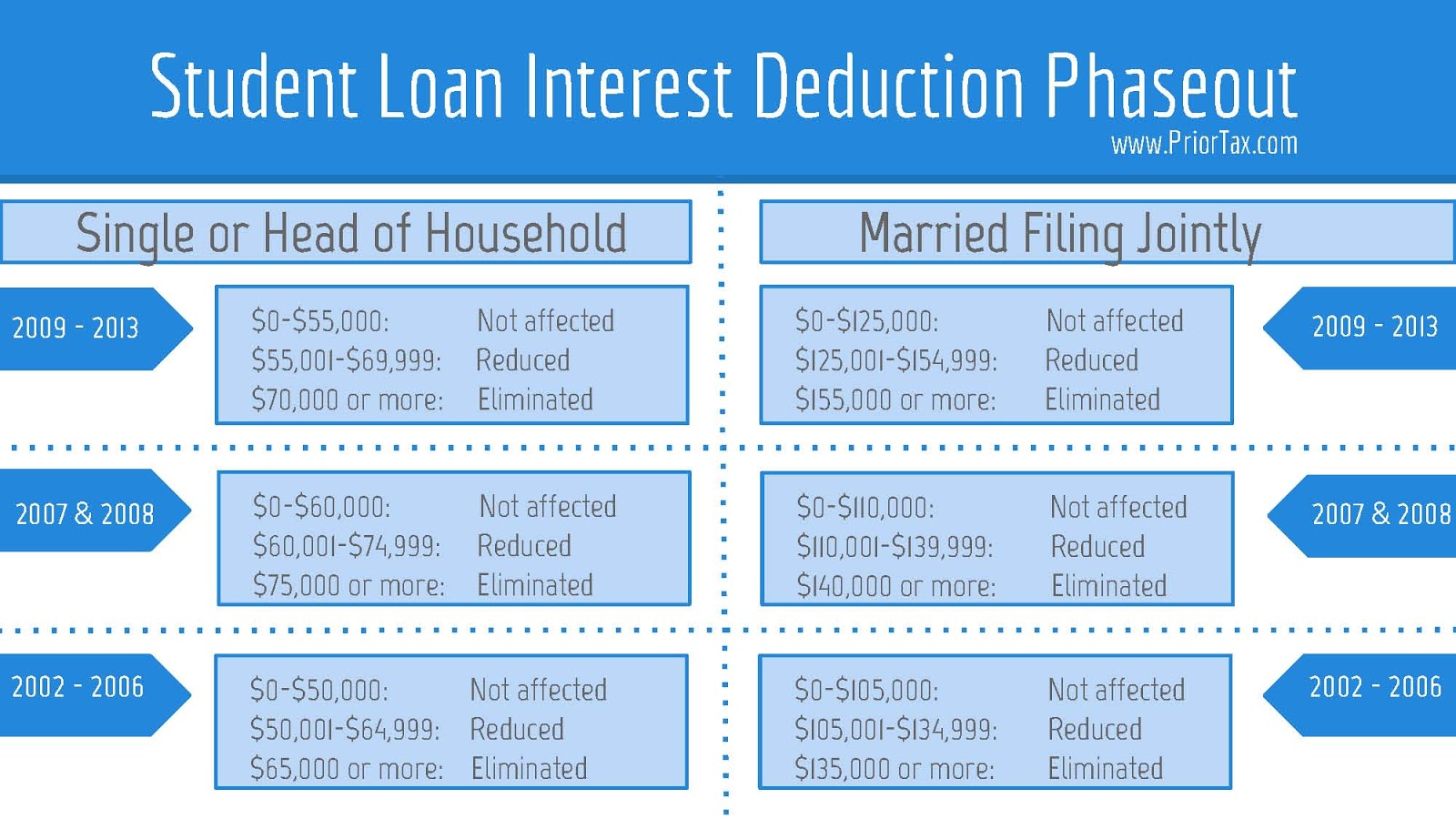

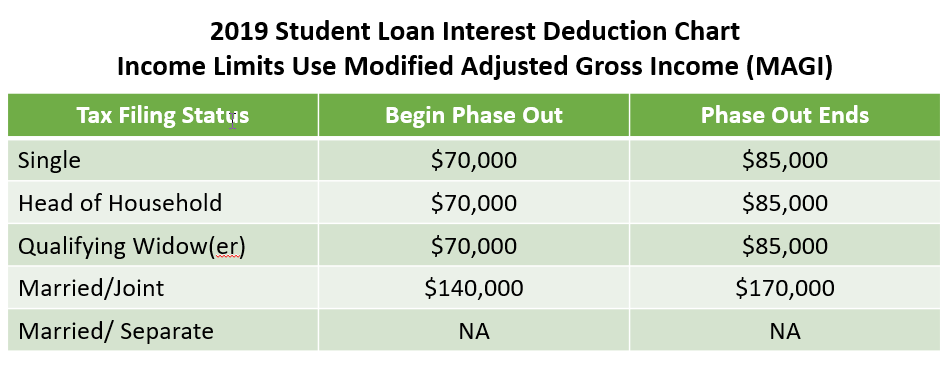

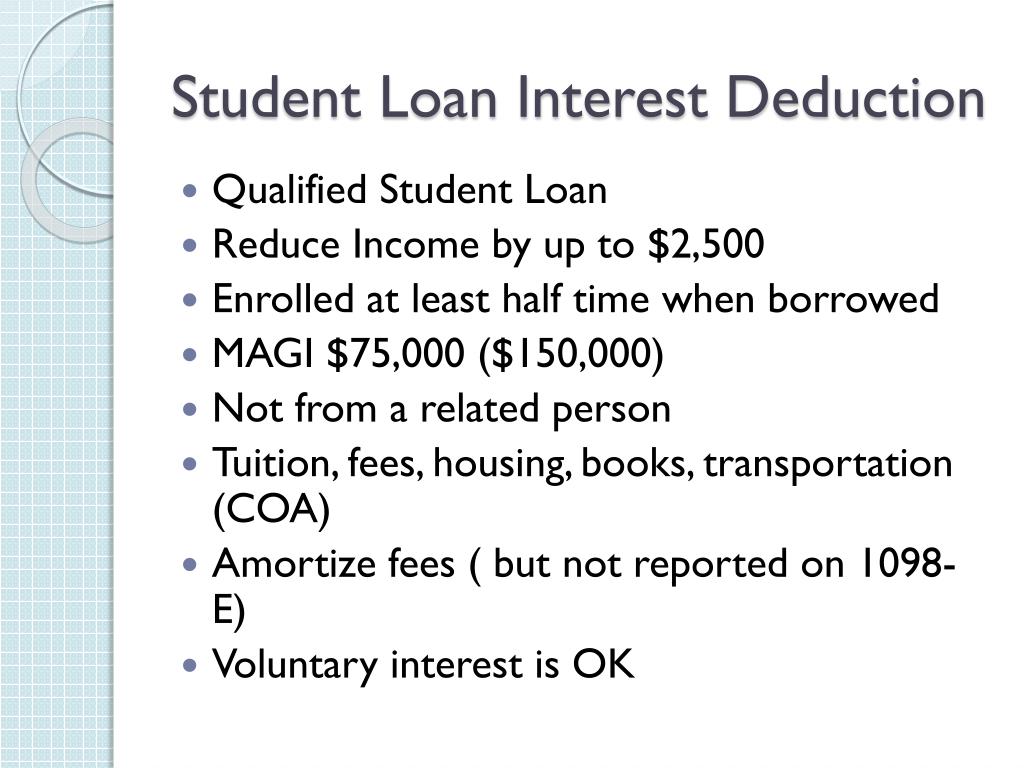

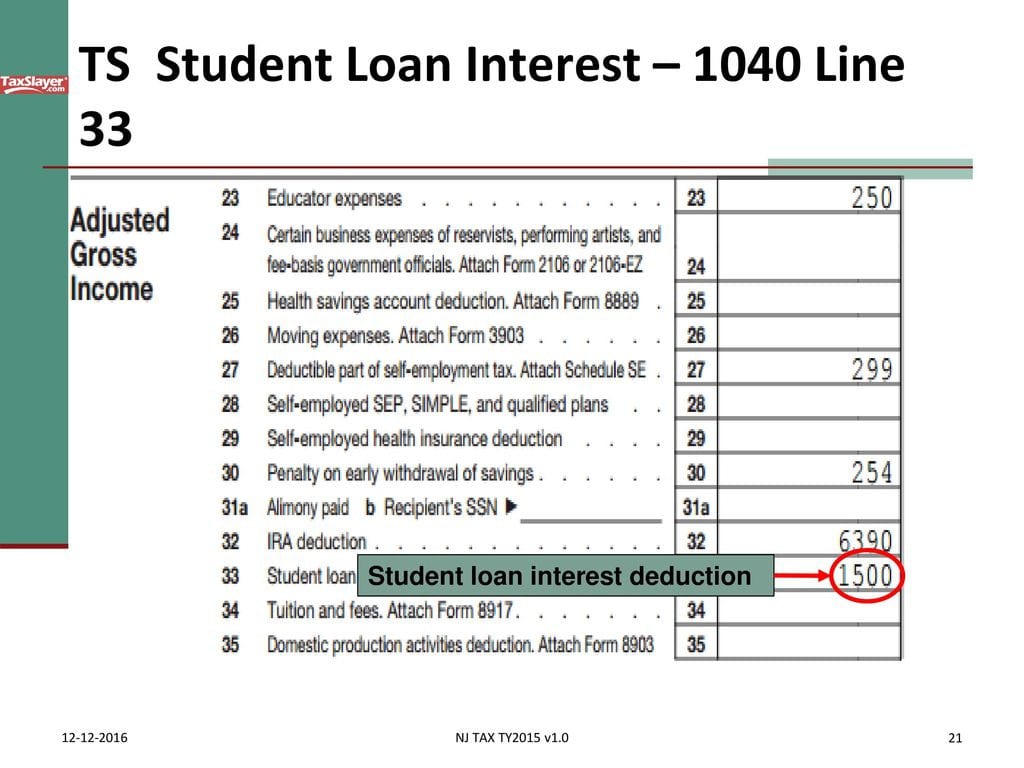

The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student loans from their taxable income Student loan interest is deductible if your modified adjusted gross income or MAGI is less than 70 000 145 000 if filing jointly If your MAGI was between 70 000 and 85 000 175 000 if

Is Student Loan Interest Deductible

Is Student Loan Interest Deductible

https://1.bp.blogspot.com/-nazXdL4vRO0/VGP037cD9_I/AAAAAAAABS4/kMBhXDLg02s/s1600/Student-Loan-Interest-Deduction-20131.jpg

How Much Student Loan Interest Is Deductible PayForED

https://www.payfored.com/wp-content/uploads/2020/01/2019-Student-Loan-Interest-Deduction-Chart.png

Student Loan Interest Deduction 2013 PriorTax Blog

https://www.blog.priortax.com/wp-content/uploads/2014/02/Student-Loan-Interest-Deduction-2013.jpg

The student loan interest tax deduction is for students and their parents who are repaying federal student financial aid It s the above the line adjustment to your adjusted gross income AGI if you have paid interest to a The student loan interest deduction is a federal tax deduction that lets you deduct up to 2 500 of the student loan interest you paid during the year It reduces your taxable income which can

This interview will help you determine if you can deduct the interest you paid on a student or educational loan Information you ll need Filing status Basic income information Your adjusted gross income Educational expenses paid with nontaxable funds Student loan interest deduction You can t deduct as interest on a student loan any interest paid by your employer after March 27 2000 and before January 1 2026 under an educational assistance program See chapter 4 Student loan forgiveness

Download Is Student Loan Interest Deductible

More picture related to Is Student Loan Interest Deductible

Is Student Loan Interest Tax Deductible

https://media.marketrealist.com/brand-img/bU74cXhUO/768x628/stuloaninttaxded1-1598274991518.jpg

Student Loan Interest Deduction H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/shutterstock_119968390.jpg

Student Loan Interest Deduction Worksheet

https://www.unclefed.com/TaxHelpArchives/2000/1040Instrs/wrksht_pg29.gif

Student loan interest is tax deductible if you meet the following requirements You took out the student loan for yourself spouse or dependent The tax deduction is available for both federal and private student loans in your or your spouse s name The deduction also applies to Parent PLUS loans used to pay for your child s The student loan interest deduction reduces your taxable income based on how much interest you paid on top of your student loan principal payments As an example If you re single and make 40 000 a year all of it is subject to taxes But a 2 000 deduction can bring your taxable income down to 38 000

[desc-10] [desc-11]

Student Loan Interest Tax Deduction Calculator Internal Revenue Code

https://www.irstaxapp.com/wp-content/uploads/2020/10/student-loan-interest-tax-deduction.png

Is Student Loan Interest Deductible Everything You Need To Know YouTube

https://i.ytimg.com/vi/-EUo1_IXVYM/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AZQDgALQBYoCDAgAEAEYZSBYKE8wDw==&rs=AOn4CLCJ_SnLeRRJC6d3fdndK-pRavcYrA

https://www.forbes.com/advisor/taxes/student-loan...

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

https://www.investopedia.com/terms/s/slid.asp

The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student loans from their taxable income

Interest Loan Rumah 2017 Used Vehicle Loan A Shorter Loan Term Is

Student Loan Interest Tax Deduction Calculator Internal Revenue Code

Will Student Loan Interest Be Deductible In 2020 TAXIRIN

PPT Student Finance The Big Picture PowerPoint Presentation Free

Is Student Loan Interest Deductible Henssler Financial

Is Student Loan Interest Deductible A Comprehensive Guide

Is Student Loan Interest Deductible A Comprehensive Guide

Student Loan Interest Deduction Worksheet Db excel

Is There Tax Savings For The Interest On Student Loan Debt

2014 Form IRS 1040 Schedule 1 Lines 33 Through 36 Fill Online

Is Student Loan Interest Deductible - The student loan interest tax deduction is for students and their parents who are repaying federal student financial aid It s the above the line adjustment to your adjusted gross income AGI if you have paid interest to a