Is Tax Benefits Taxable Income Taxable income is the portion of your gross income that the IRS deems subject to taxes It consists of both earned and unearned income Taxable income comes from compensation businesses

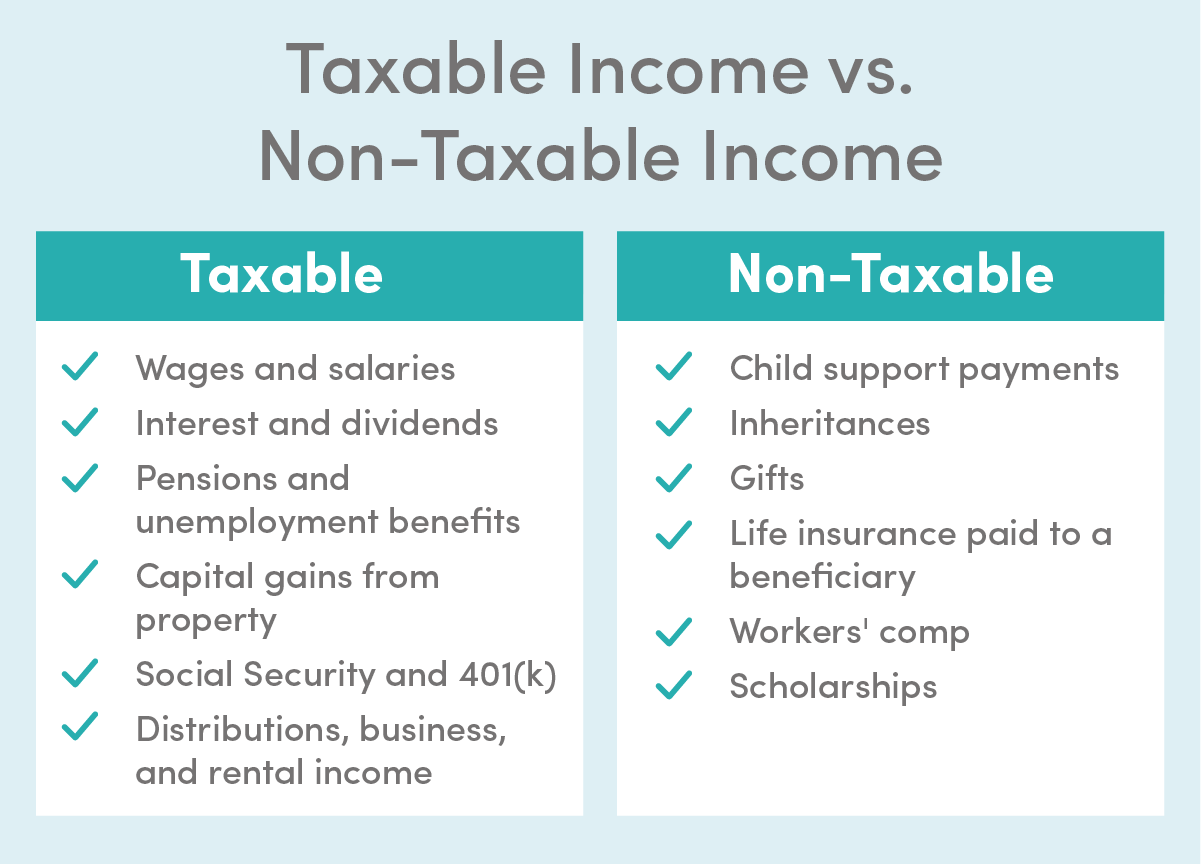

Taxable income is the portion of your gross income that s actually subject to taxation Allowable deductions are subtracted from gross income to arrive at your taxable income In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but isn t taxable

Is Tax Benefits Taxable Income

Is Tax Benefits Taxable Income

https://static.wixstatic.com/media/981417_74c0a5e60ca840669969650a8b09f736~mv2.png/v1/fit/w_1000%2Ch_588%2Cal_c/file.png

What Are The Benefits Of Filing Your Income Tax Return Regularly

https://life.futuregenerali.in/media/nqfbbwh5/what-are-the-benefits-of-paying-income-tax.jpg

What Is Taxable Income Explanation Importance Calculation Bizness

https://i1.wp.com/biznessprofessionals.com/wp-content/uploads/2020/02/Capture34.png?fit=2630%2C1497&ssl=1

Fringe benefits are generally included in an employee s gross income there are some exceptions The benefits are subject to income tax withholding and employment taxes State benefits that are taxable The most common benefits that you pay Income Tax on are Bereavement Allowance previously Widow s pension Carer s Allowance or in Scotland only

A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit Tax benefits include tax credits tax deductions and tax deferrals Some tax benefits can show up directly on your paycheck Most income is taxable unless it s specifically exempted by law Income can be money property goods or services Even if you don t receive a form reporting income you

Download Is Tax Benefits Taxable Income

More picture related to Is Tax Benefits Taxable Income

Foreign Social Security Taxable In Us TaxableSocialSecurity

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

https://www.marottaonmoney.com/wp-content/uploads/2022/04/Form1040.png

Taxable Social Security Worksheet 2022

https://www.socialsecurityguide.net/wp-content/uploads/2022/10/social-security-benefits-worksheet-lines-20a-and-20b-2016-worksheet.gif

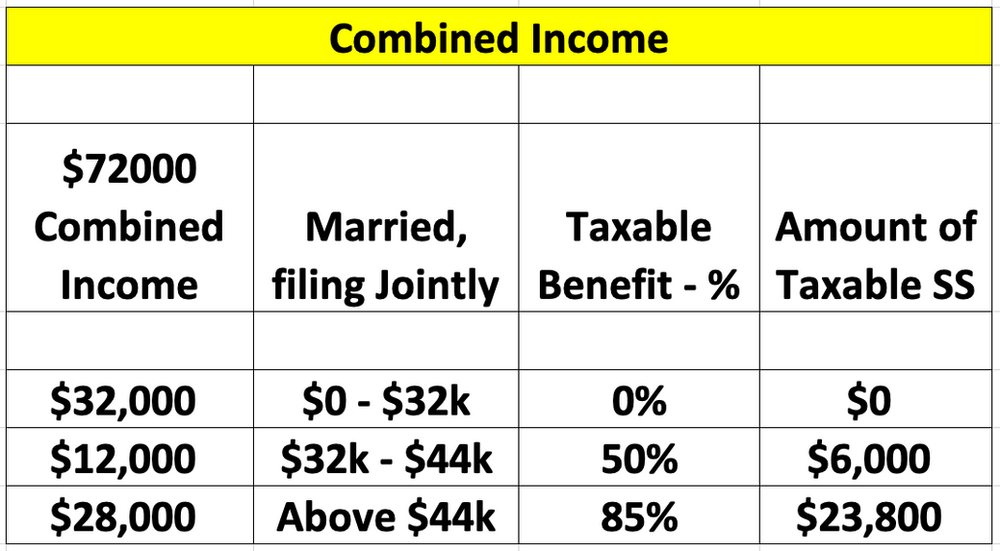

Taxable income Your taxable income is your assessable income minus any allowable deductions Your taxable income is used to work out how much tax you need to pay Depending on your income up to 85 of your Social Security benefits can be subject to tax That includes retirement and benefits from Social Security trust funds like survivor and disability

Taxable income is the amount of income subject to tax after deductions and exemptions Taxable income is different from gross income For both individuals and corporations taxable income differs from and is less than gross income How some income in retirement is taxed Social Security Benefits Depending on provisional income up to 85 of Social Security benefits can be taxed by the IRS at ordinary

20 Social Security Benefits Worksheet 2019 Worksheets Decoomo

https://i2.wp.com/www.irs.gov/pub/xml_bc/24811v37.gif

Maximize Your Paycheck Understanding FICA Tax In 2023

https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png

https://www.investopedia.com/terms/t/t…

Taxable income is the portion of your gross income that the IRS deems subject to taxes It consists of both earned and unearned income Taxable income comes from compensation businesses

https://www.investopedia.com/ask/ans…

Taxable income is the portion of your gross income that s actually subject to taxation Allowable deductions are subtracted from gross income to arrive at your taxable income

Taxable Income Formula Financepal

20 Social Security Benefits Worksheet 2019 Worksheets Decoomo

How To Find Average Income Tax Rate Parks Anderem66

8 2023 Social Security Tax Limit Ideas 2023 GDS

Are My Social Security Benefits Taxable Calculator

Taxable Social Security Calculator

Taxable Social Security Calculator

2022 Taxable Social Security Worksheet

Retirement Income Planning In Pennsylvania Rolek Retirement Planning

Social Security Taken Out Of Paycheck JubranShuman

Is Tax Benefits Taxable Income - Tax deductions can lower the amount of income that is subject to tax Here s more on how tax deductions work plus 22 tax breaks that might come in handy