Is Tesla Federal Tax Credit Refundable You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

The credit is nonrefundable which means it can lower or eliminate your tax liability but you won t get any overage of the credit refunded once your liability hits zero The maximum credit is 7 500 It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find information on credits for used clean vehicles and new EVs purchased in 2023 or after

Is Tesla Federal Tax Credit Refundable

Is Tesla Federal Tax Credit Refundable

https://fsmedia.imgix.net/67/67/cc/77/8332/4819/8f12/b4d7bf43a0b1.png?rect=0,191,1468,488&auto=format,compress&q=70

Tesla Confirms Hitting Federal Tax Credit Threshold 7 500 Credit Cut

https://i1.wp.com/electrek.co/wp-content/uploads/sites/3/2018/02/screen-shot-2018-02-20-at-9-46-49-pm.jpg?w=2500&quality=82&strip=all&ssl=1

Your Guide To The Increased 30 Federal Solar Tax Credit Absolute

https://www.aesinspect.com/wp-content/uploads/2022/11/AdobeStock_535970711-scaled.jpeg

A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models qualify As part of the 2023 Inflation Reduction Act eligible businesses and tax exempt organizations can claim up to a 7 500 credit when purchasing new Tesla vehicles with a gross vehicle weight rating GVWR of up to 14 000 pounds

If the New Clean Vehicle Credit amount is more than my income tax liability for the year is the credit refundable or able to be carried forward updated July 26 2024 Since 2010 anyone purchasing a qualified electric vehicle including any new Tesla model has been eligible to receive a 7 500 federal tax credit This tax credit begins to phase out once a manufacturer has sold 200 000 qualifying vehicles in the U S

Download Is Tesla Federal Tax Credit Refundable

More picture related to Is Tesla Federal Tax Credit Refundable

Tesla Says All New Model 3s Now Qualify For Full 7 500 Tax Credit

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1c3oLv.img?w=1476&h=1012&m=4&q=100

Tesla s Genius Pricing Plan To Save You Thousands My Tech Methods

https://mytechmethods.com/wp-content/uploads/2021/09/tesla-tax-credit-2021-copy-2.jpg

Only Six EVs Will Qualify For The 7 500 Federal Tax Credit Starting

https://bgr.com/wp-content/uploads/2021/12/Tesla-Cars.jpg?quality=82&strip=all

The new 7 500 federal tax credit for electric vehicles in the US is coming into effect on January 1 2023 but there are still a lot of details we don t know about Your 2023 Clean Vehicle Report IRS form 15400 is available for download through your Tesla Account You will need this document to claim your 2023 EV tax credit

The full 7 500 federal tax credit for Tesla customers ends in less than two weeks and we re doing everything we can to try to ensure those who order a vehicle today can take delivery by December 31st and take advantage of the savings The federal EV tax credit worth up to 7 500 is a nonrefundable tax credit that has been an effective way to lower the cost of EV ownership for taxpayers The Inflation Reduction Act of 2022 changed this tax credit by extending its life through 2032 and expanding it to cover more vehicles

Tesla Model 3 Federal Tax Credit Consumers Have Only Few Days Left To

https://assets1.cbsnewsstatic.com/hub/i/2018/10/10/1c6ad0b2-1ca1-4889-a830-b5d5674fb716/tesla-model-3.jpg

Tesla Qualify For Federal EV Tax Credit Up To 7500 shorts YouTube

https://i.ytimg.com/vi/FLfIxeKEBIA/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYZSBgKE4wDw==&rs=AOn4CLA1QBUcaav4VtAT_fKPG-lbzcVqvA

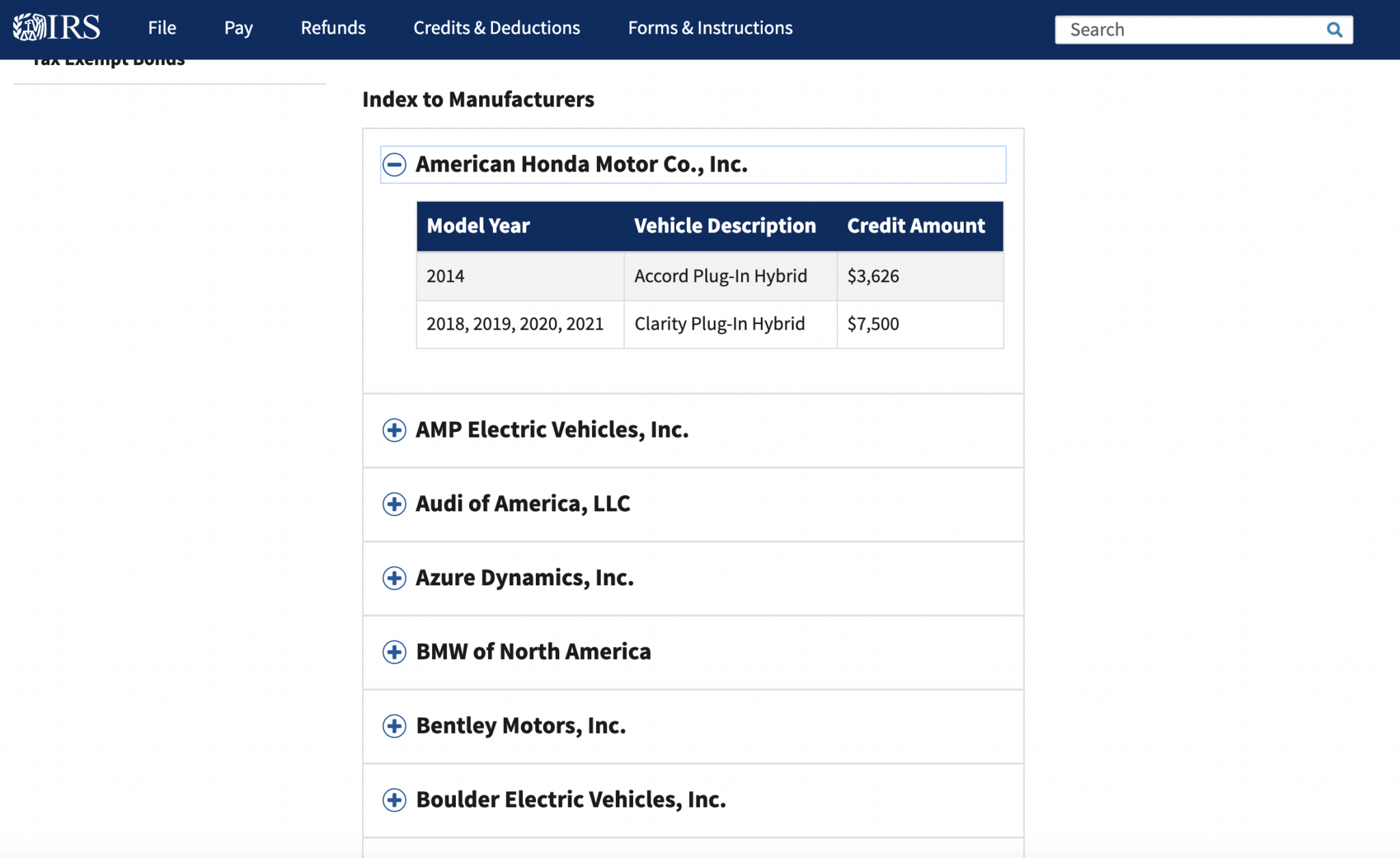

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

https://www.nerdwallet.com/article/taxes/ev-tax...

The credit is nonrefundable which means it can lower or eliminate your tax liability but you won t get any overage of the credit refunded once your liability hits zero

Can Tesla s Expiring Federal Tax Credit Lift Q4 Deliveries

Tesla Model 3 Federal Tax Credit Consumers Have Only Few Days Left To

There Was ANOTHER Tesla Price Increase On The Model 3 Y And What

Latest EV Tax Credit Status Tesla Motors Club

U S Lawmakers Propose To Extend EV Tax Credit At A Cost Of 11 4

Tesla Federal Credit Expiry And Model 3 Cost Estimator By Teslanomics

Tesla Federal Credit Expiry And Model 3 Cost Estimator By Teslanomics

Tesla Holds 80 Of US EV Market Despite Losing Federal Tax Credit

Lease Question Federal Tax Credit Tesla Motors Club

The Federal Tax Credit For Electric Cars How To Save 7 500

Is Tesla Federal Tax Credit Refundable - Tesla s website now claims every new Model 3 is eligible for the full 7 500 federal tax credit in the United States after those credits were previously cut in half on April 18th