Is The 2024 Homeowner Tax Rebate Taxable 2024 tax refund calculator One way to check your refund is to plug in your income and other data into a 2024 tax refund calculator which are offered by tax prep companies such as

When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married For joint filers deductions apply to mortgage interest payments on loans up to 1 million or 750 000 for loans made after Dec 15 2017 Single filers can claim half these amounts 500 000 or 375 000 respectively To claim this deduction use IRS Form 1098 provided by your lender in early 2024 entering the amount from Line 1 onto Line

Is The 2024 Homeowner Tax Rebate Taxable

Is The 2024 Homeowner Tax Rebate Taxable

https://www.signnow.com/preview/585/571/585571881/large.png

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

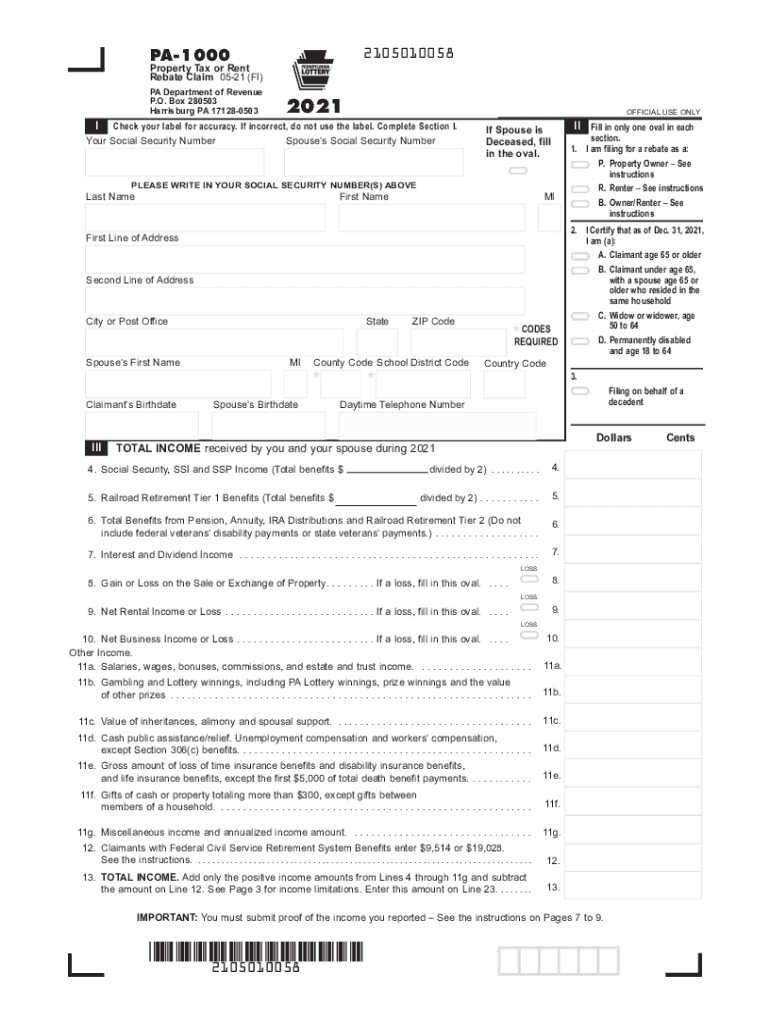

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Providing a tax rebate on income taxes owed it allowed a credit of up to 10 of the purchase price on a principal residence to a maximum of 8 000 The IRS defined a first time home buyer as WASHINGTON The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season

7 Earned income tax credit This earned income tax credit EITC is a refundable tax break for low income taxpayers with and without children For 2023 taxes filed in 2024 the credit ranges Is There a Tax Credit for Buying a New House There is no specific broad federal tax credit in the United States solely for buying a new house Tax credits and incentives related to homeownership can vary over time and may depend on specific circumstances such as being a first time homebuyer or making energy efficient improvements

Download Is The 2024 Homeowner Tax Rebate Taxable

More picture related to Is The 2024 Homeowner Tax Rebate Taxable

Tax Rebate Service No Rebate No Fee MBL Accounting

https://mblaccounting.co.uk/wp-content/uploads/2021/04/Tax-Rebate.jpg

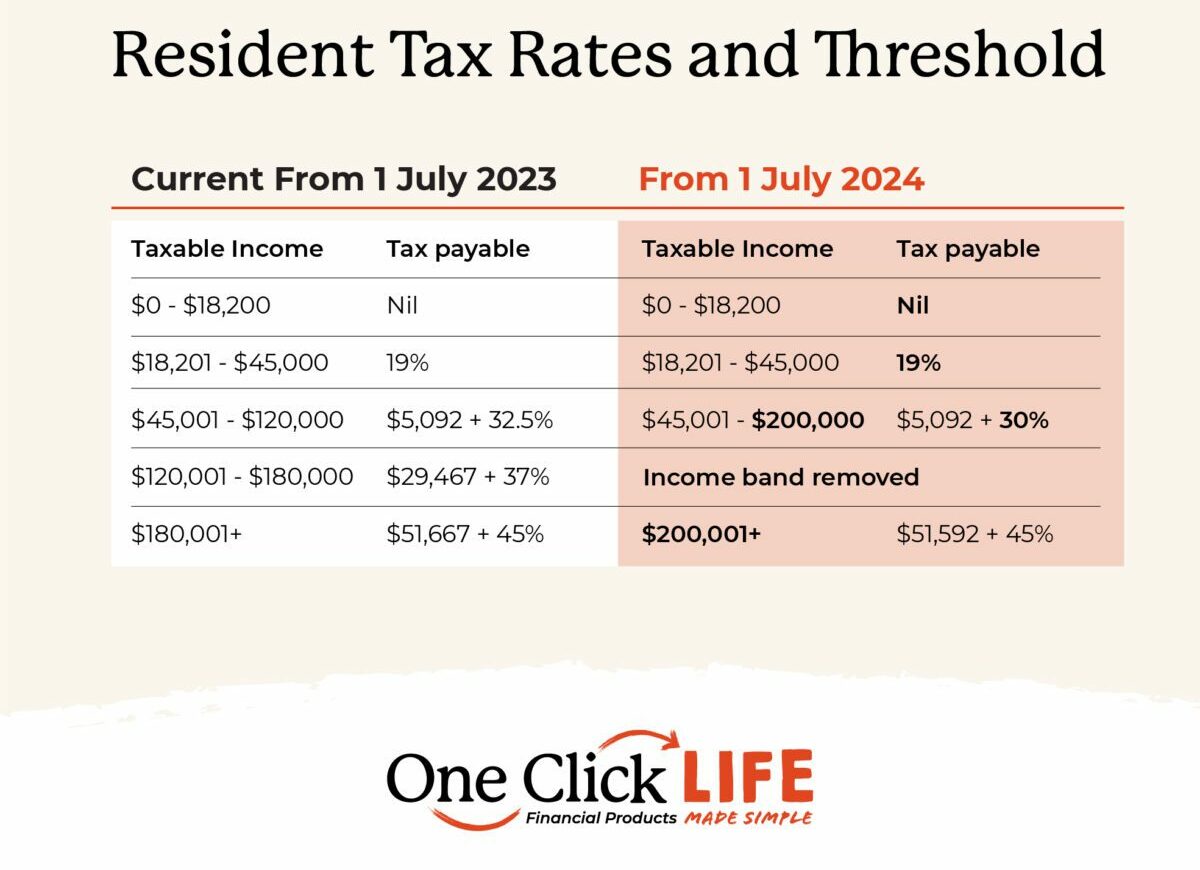

How To Calculate Tax In Australia One Click Life

https://oneclicklife.com.au/wp-content/uploads/2023/04/Budget-Tax-Rates-Threshold-01-scaled-e1681366579595.jpg

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check CNYcentral

https://chittenango.com/wp-content/uploads/2022/08/bb776db9-9697-43c3-882f-8577bedc9e89-large16x9_tax_rebate.PNG

Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 Congress introduced The First Time Homebuyer Act on April 28 2021 to make homeownership more affordable for low and middle income Americans The bill did not pass in the last congressional session and as of January 23 2024 Congress has yet to re introduce the bill

The tax for the year was 730 and was due and paid by the seller on August 15 You owned your new home during the property tax year for 122 days September 1 to December 31 including your date of purchase You figure your deduction for real estate taxes on your home as follows 1 Homestead exemption As part of an 18 billion property tax relief package Texas homeowners will see their homestead exemption on their property tax bill increase from 40 000 to 100 000 of

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

https://i.ytimg.com/vi/Dk6m3vyq3cY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYOSBUKHIwDw==&rs=AOn4CLAiLu8JQ1ipHT9vjuy4jqjIumoU2g

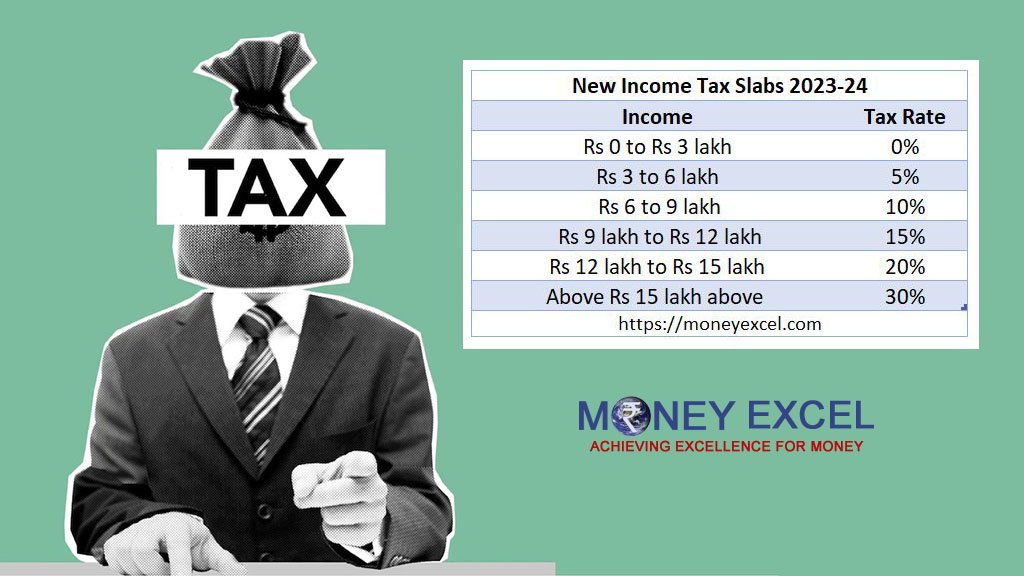

New Income Tax Slab 2023 24

https://moneyexcel.com/wp-content/uploads/2023/02/incometax-slab-2023-24.jpg

https://www.cbsnews.com/news/tax-refund-2024-what-to-expect-when-will-i-get/

2024 tax refund calculator One way to check your refund is to plug in your income and other data into a 2024 tax refund calculator which are offered by tax prep companies such as

https://www.cnet.com/personal-finance/taxes/homeowner-tax-breaks-all-the-ways-your-house-can-boost-your-tax-refund/

When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

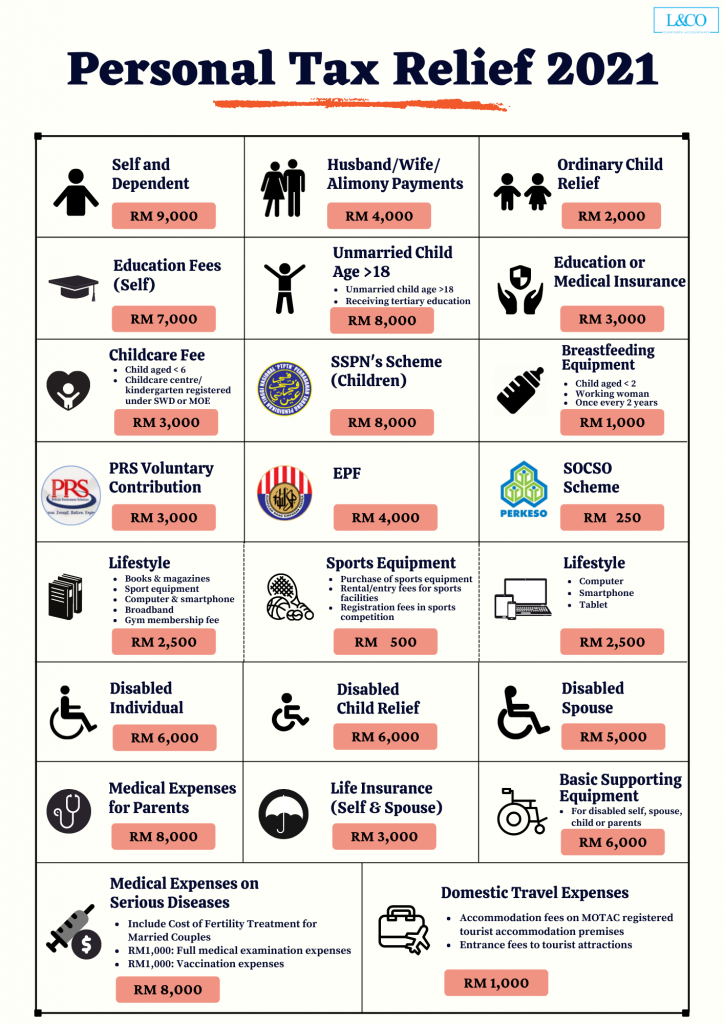

Personal Tax Relief 2021 L Co Accountants

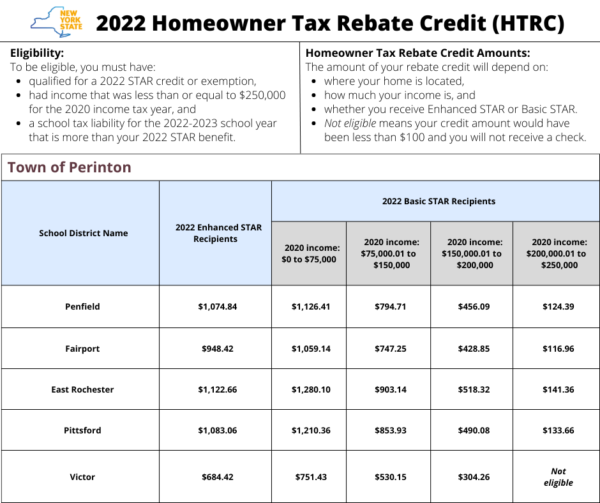

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

Your Stories Q A Are You Still Waiting For Your Homeowner Tax Rebate Credit Check YouTube

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

NYS 2023 Homeowner Tax Rebate Tax Rebate

Direct Payments Worth Up To 1 050 Being Sent To Millions Of Americans NOW Are You Eligible

Is The 2024 Homeowner Tax Rebate Taxable - 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit