Is The Energy Tax Credit Still Available As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200 Beginning January 1

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the

Is The Energy Tax Credit Still Available

Is The Energy Tax Credit Still Available

https://i1.wp.com/eyeonhousing.org/wp-content/uploads/2014/12/res-energy-credits_09_12.jpg

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

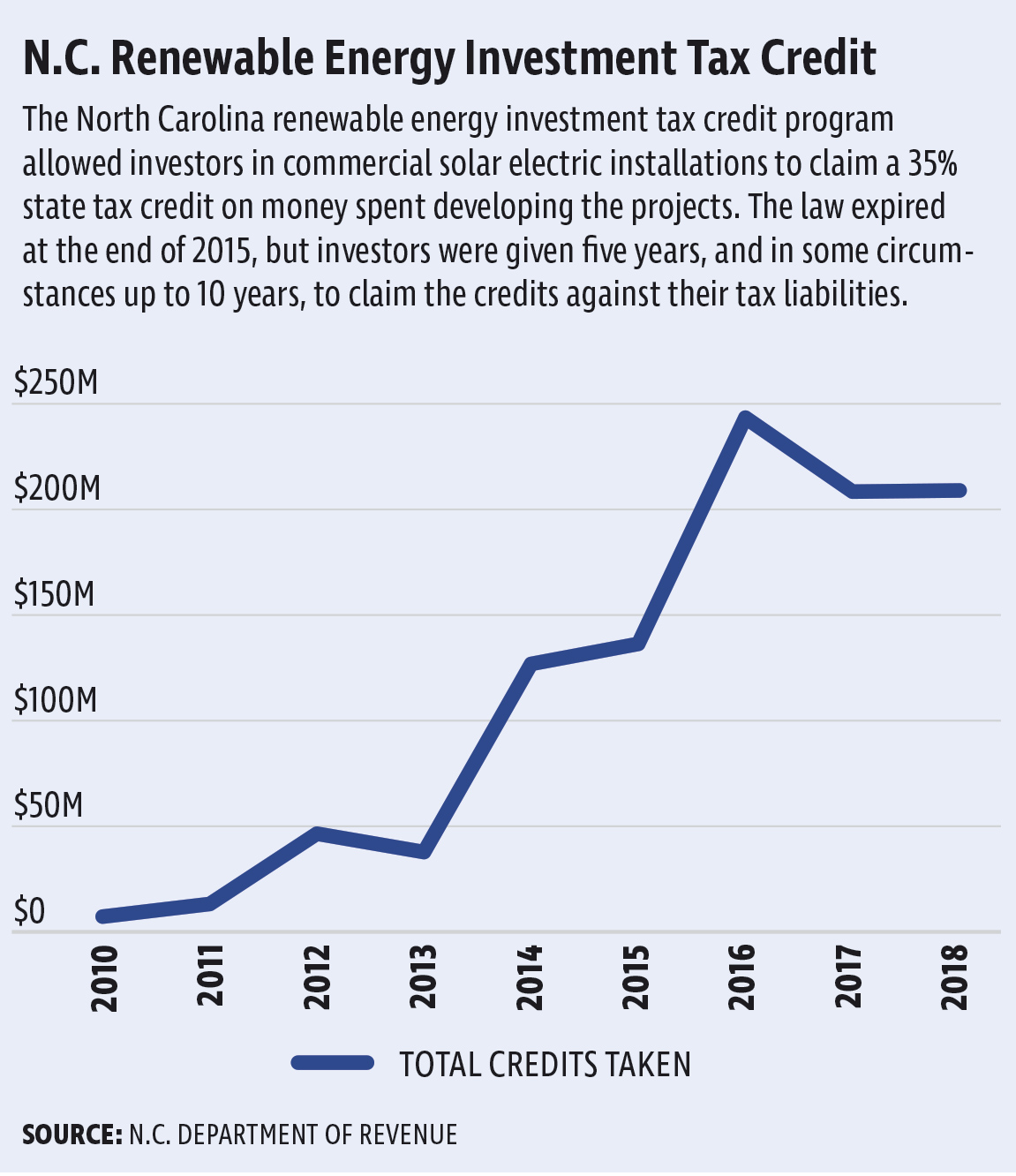

NCSEA s View Renewable Energy Tax Credit Continues To Have Strong ROI

https://ci4.googleusercontent.com/proxy/Nbbuj2U1GP-OwKa_UM33FdW_oJhuLL_9nYTNZ11vEaQDklIMMxJLwR3sN7TO6jHw6lcBVYTeJshv_s2BH-l6n0yyyjWaU1btTcXaoB0Ov9xPtc22gDgLdXaPFWMf17wIWNs56hBrCrMsgu5LTuonS_CugJFZJ3zz1nGkQgQ=s0-d-e1-ft#https://gallery.mailchimp.com/7d1232a9c04409a38e644fbba/images/fa1c2f82-6a3e-4e8a-9a2f-e33679769cdf.jpg

Several energy related tax credits are available for 2023 including two major energy tax credits for homeowners the Energy Efficient Home Improvement Credit and the OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax What is the energy efficient home improvement credit The energy efficient home improvement credit can help homeowners cover costs related to qualifying

Download Is The Energy Tax Credit Still Available

More picture related to Is The Energy Tax Credit Still Available

Energy Secretary Says Time Is Right For Clean Energy Tax Credits

https://dailyenergyinsider.com/wp-content/uploads/2022/06/FV26YCZWQAEgcTH.jpeg

N C Has Issued More Than 1 Billion In Renewable Energy Tax Credits

https://www.carolinajournal.com/app/uploads/2019/06/nc-renewable-energy-tax-credit.jpg

New Residential Energy Tax Credit Estimates Eye On Housing

https://i0.wp.com/eyeonhousing.org/wp-content/uploads/2015/08/25C_2012.jpg?w=1400&ssl=1

December 21 2022 Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub to learn more about saving Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

Claiming energy tax credits for 2022 and 2023 4 min read Share Making energy efficient updates to your home is a great move for our environment But you might feel the pinch The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also covers

Solar Power System Sacramento Want Solar Panels For Your House Ask

https://dta0yqvfnusiq.cloudfront.net/westc59685250/2018/07/Residential-Renewable-Energy-Tax-Credit-Allowances-5b3e961a6a7c2.jpg

Residential Renewable Energy Tax Credit Pynamite

http://www.pynamite.net/wp-content/uploads/2020/01/solar-clip-art.jpg

https://www. irs.gov /credits-deductions/frequently...

As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200 Beginning January 1

https://www. irs.gov /credits-deductions/home-energy-tax-credits

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Solar Power System Sacramento Want Solar Panels For Your House Ask

Environmental Conservation And Clean Energy Organizations Rally For

Geothermal Energy Credits The Energy Tax Credit Is Back

The Basics Of ITC Vs PTC For Solar Projects Stracker Solar

Balancing Oregon s Budget Legislators Must Revisit The Energy Tax

Balancing Oregon s Budget Legislators Must Revisit The Energy Tax

New Mexico s Solar Energy Tax Credit Passes Legislature

Green Tax Reform Energy Tax Challenges For The Netherlands PBL

Form 5695 Residential Energy Credits 2014 Free Download

Is The Energy Tax Credit Still Available - OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023