Is The Federal Solar Tax Credit Refundable The credit is nonrefundable so the credit amount you receive can t exceed the amount you owe in tax You can carry forward any excess unused credit though and apply it to reduce the tax you owe in future years

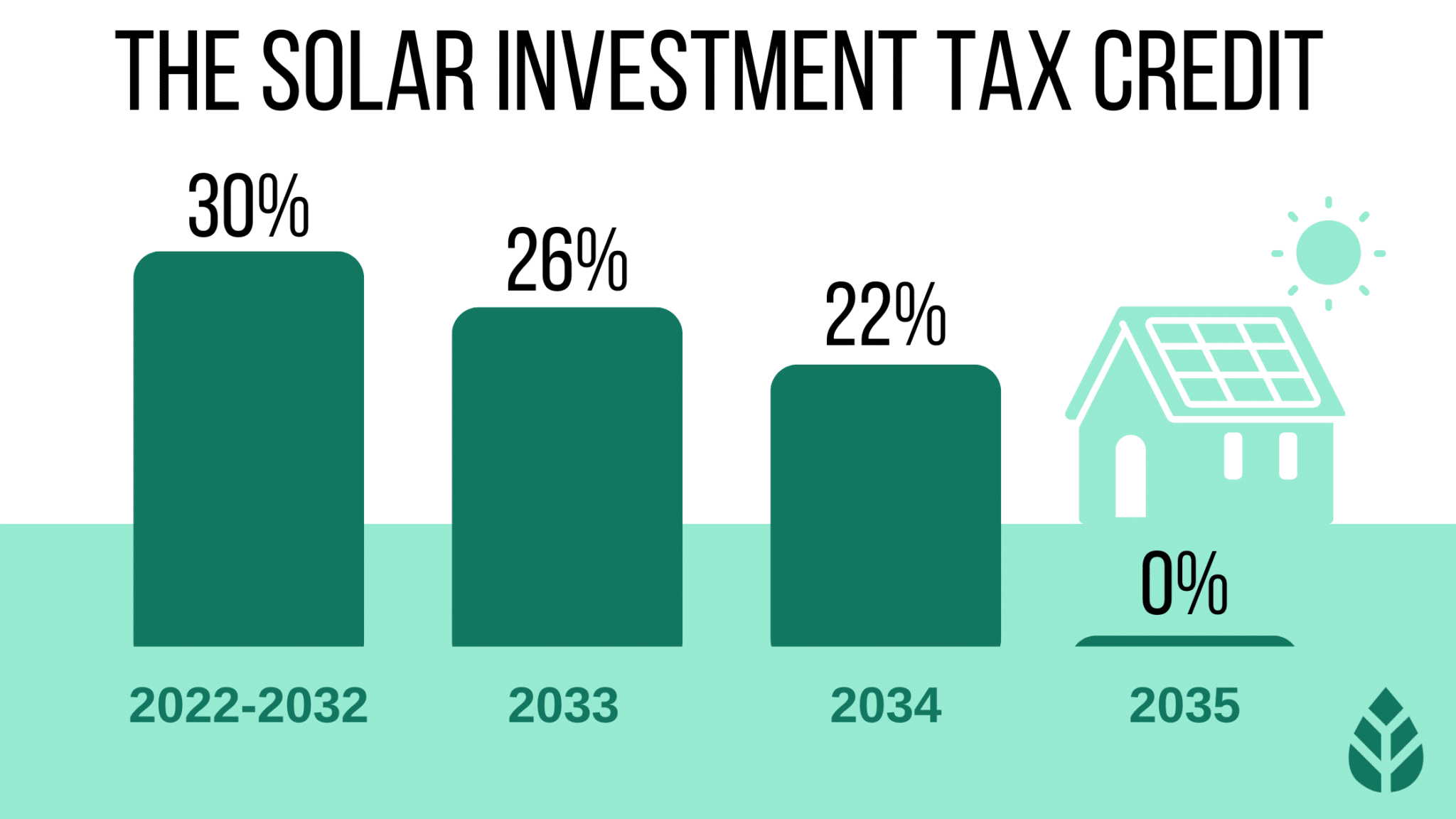

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit The federal solar tax credit is valuable because the it s a dollar for dollar reduction of your federal tax bill It s different than a rebate or a deduction because it directly reduces what you owe in taxes

Is The Federal Solar Tax Credit Refundable

Is The Federal Solar Tax Credit Refundable

https://www.livesmartconstruction.com/wp-content/uploads/2020/05/solar-tax-credit.jpg

Your Guide To The Increased 30 Federal Solar Tax Credit Absolute

https://www.aesinspect.com/wp-content/uploads/2022/11/AdobeStock_535970711-scaled.jpeg

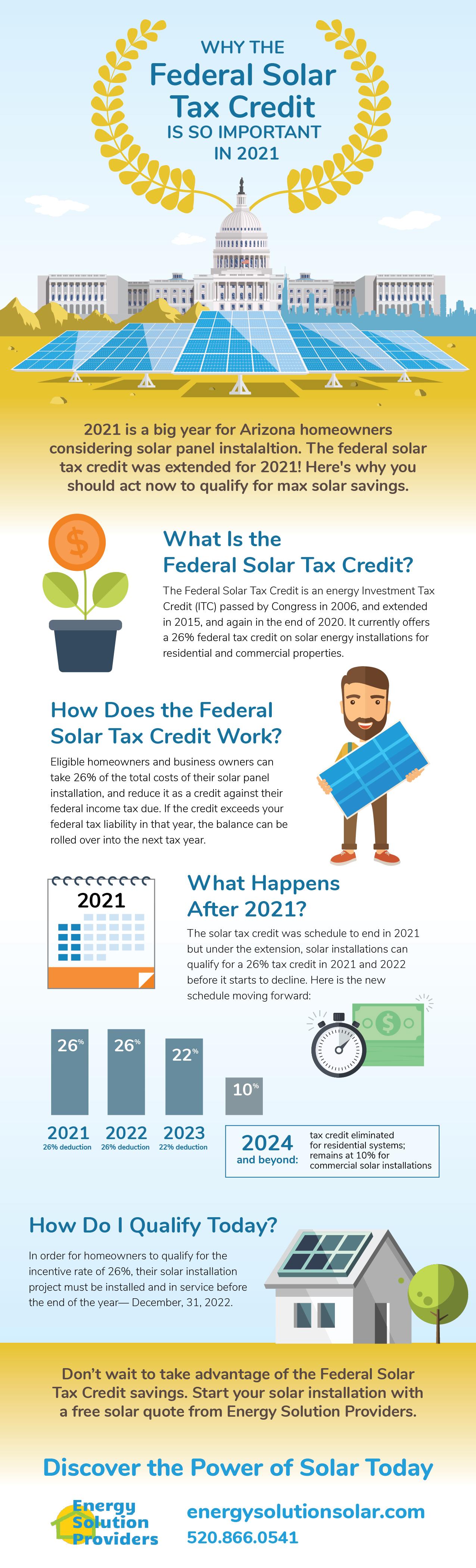

The Federal Solar Tax Credit Energy Solution Providers Arizona

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2021-01.jpg?itok=SJbBX9lJ

No the solar tax credit is a non refundable tax credit which means it can only be used to offset your tax liability This only comes into play if the value of the tax credit is greater than your tax liability The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the If you install solar energy equipment in your residence any time this year through the end of 2032 you are entitled to a nonrefundable credit off your federal income taxes equal to 30 percent

Download Is The Federal Solar Tax Credit Refundable

More picture related to Is The Federal Solar Tax Credit Refundable

How To Claim Solar Tax Credit A Step by Step Guide

https://www.gov-relations.com/wp-content/uploads/2023/06/How-To-Claim-Solar-Tax-Credit.jpg

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

https://www.altestore.com/blog/wp-content/uploads/2021/12/form-5695-example.png

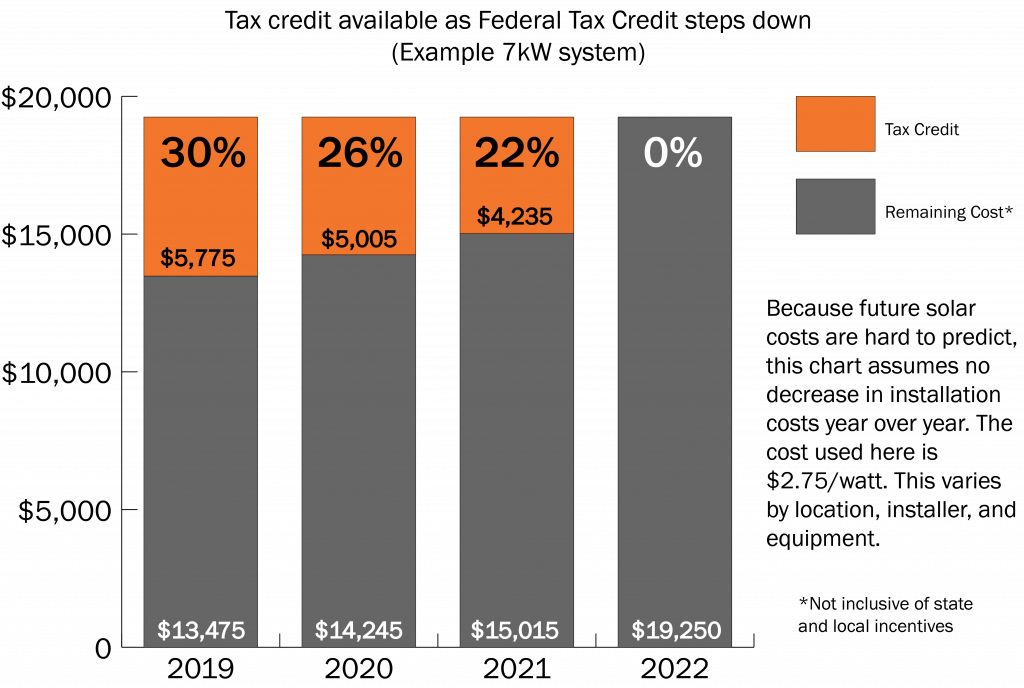

Go Solar In 2019 To Take Full Advantage Of The Federal Solar Tax Credit

https://www.solarunitedneighbors.org/wp-content/uploads/2018/12/Solar-tax-credit-graph-without-header-1024x688.png

When you purchase solar equipment for your home and have tax liability you generally can claim a solar tax credit to lower your tax bill The Residential Clean Energy Credit is non refundable meaning that it can offset your income tax liability dollar for dollar but any excess credit won t be refunded The solar tax credit is a non refundable credit worth 30 of the gross system cost of your solar project That means that if the gross system cost is 20 000 your tax credit would be 6 000 20 000 x 30 6 000

The Federal Solar Tax Credit officially called the Residential Clean Energy Credit allows eligible homeowners to deduct up to 30 of the cost of their solar energy system from their federal taxes for the year of installation and The federal solar tax credit is not the same thing as a tax deduction it s a dollar for dollar reduction in your federal income tax liability In 2024 the federal solar tax credit is equal to 30 of solar installation costs

Federal Solar Tax Credit Resources Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Federal-Solar-Tax-Credit-Resources.png?itok=GmU0gJL6

When Does Solar Tax Credit End SolarProGuide 2022

https://www.solarproguide.com/wp-content/uploads/when-does-the-federal-solar-tax-credit-expire.png

https://www.irs.gov/credits-deductions/residential...

The credit is nonrefundable so the credit amount you receive can t exceed the amount you owe in tax You can carry forward any excess unused credit though and apply it to reduce the tax you owe in future years

https://www.energy.gov/eere/solar/homeowners-guide...

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Federal Solar Tax Credit Guide Atlantic Key Energy

Federal Solar Tax Credit Resources Department Of Energy

26 Federal Solar Tax Credit Extended SolarTech

What You Should Know About The Federal Solar Tax Credit Aztec Solar

Texas Solar Incentives Tax Credits Rebates More In 2023

The Federal Solar Tax Credit Extension Can We Win If We Lose

The Federal Solar Tax Credit Extension Can We Win If We Lose

How The Solar Tax Credit Works 2022 Federal Solar Tax Credit

Federal Investment Solar Tax Credit Guide Learn How To Claim The

The 30 Solar Tax Credit Has Been Extended Through 2032

Is The Federal Solar Tax Credit Refundable - The Residential Clean Energy Credit is a dollar for dollar tax credit worth 30 of the total cost of solar and or battery storage expenditures As a non refundable tax credit it lowers your tax liability on your federal tax return