Is The Health Insurance Rebate Taxable Income Because it appears that you deducted the premium payments on Schedule A of your 2020 Form 1040 the MLR rebate that you received in 2021 is taxable to the extent that you received a tax benefit from the deduction whether the rebate is received as a cash payment or applied as a reduction in the amount of premiums due for 2021

Different thresholds apply depending on whether you have a single income or a family income When you lodge your tax return we calculate your income for surcharge purposes and determine your rebate entitlement Your entitlement is also based on the age of the oldest person covered by the policy Rebates are required when insurers percentages are out of line with this rule The average health insurance rebate is about 150 but how do you know if you will have to pay tax on that amount

Is The Health Insurance Rebate Taxable Income

Is The Health Insurance Rebate Taxable Income

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/income-property-tax-rebate-payments-going-out-chronicle-media-40.jpg

What Is Taxable Income And How Does It Affect Health Insurance Under

https://mbhealth.com/wp-content/uploads/2022/04/What-Is-Taxable-Income-and-How-Does-It-Affect-Health-Insurance-Under-the-ACA_-1024x683.jpg

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

If your employer provides a health FSA that qualifies as an accident or health plan the amount of your salary reduction and reimbursements of your medical care expenses in most cases aren t included in your income For individual market consumers who purchased their coverage with after tax dollars a rebate is not taxable income However if an individual deducted the prior year s premium payments on their Form 1040 Schedule A then their MLR rebate is subject to federal income tax

In the case of health insurance rebates there are different scenarios for when the rebates are taxable and when they are not These include If no itemized deduction was claimed for the premiums the rebate is not taxable If an itemized deduction was claimed for the premiums the rebate to the extent the deduction produced a tax benefit What s a modified adjusted gross income MAGI The figure used to determine eligibility for premium tax credits and other savings for Marketplace health insurance plans and for Medicaid and the Children s Health Insurance Program CHIP

Download Is The Health Insurance Rebate Taxable Income

More picture related to Is The Health Insurance Rebate Taxable Income

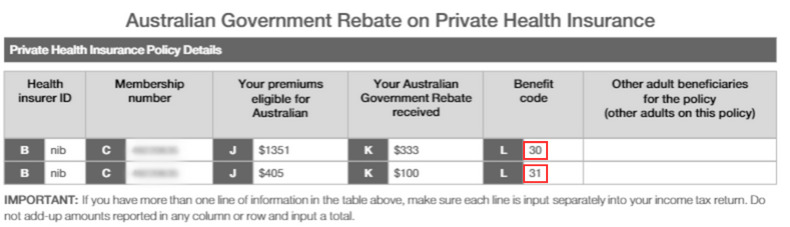

Find Understand Your Private Health Insurance Benefit Code Health Deal

https://healthdeal.com.au/wp-content/uploads/2023/03/Private-Health-Insurance-Benefit-Code.png

Cherish Childhood Memories Quotes

https://www.coursehero.com/qa/attachment/19096866/

Review Of What Is Health Insurance Marketplace 2023 Tanaka Novel

https://i2.wp.com/www.quote.com/media/2017-market-share-of-leading-u-s-health-insurance-companies-2.png

Are rebates taxable In general rebates are taxable if you pay health insurance premiums with pre tax dollars or you received tax benefits by deducting premiums you paid on your tax return Talk with your tax preparer to determine if you need to report your rebate as income when you file your next tax return How is MLR calculated Under the Affordable Care Act health insurers that fail to meet minimum medical loss ratios MLR must provide annual rebates to policyholders beginning in 2012 These rebates can be paid

[desc-10] [desc-11]

Tax Return 2022FY Private Health Insurance Rebate And Offset

https://static.wixstatic.com/media/d1b86a_81fda48d8cfb4ce3a4f155f725b64f42~mv2.png/v1/fill/w_888,h_350,al_c,q_85,enc_auto/d1b86a_81fda48d8cfb4ce3a4f155f725b64f42~mv2.png

Difference Between Income Tax Deductions Exemptions And Rebate Plan

https://www.planyourfinances.in/wp-content/uploads/2019/11/Difference-Between-Income-Tax-Deductions-Exemptions-and-Rebate.jpg

https://ttlc.intuit.com › community › taxes › discussion › ...

Because it appears that you deducted the premium payments on Schedule A of your 2020 Form 1040 the MLR rebate that you received in 2021 is taxable to the extent that you received a tax benefit from the deduction whether the rebate is received as a cash payment or applied as a reduction in the amount of premiums due for 2021

https://www.ato.gov.au › individuals-and-families › ...

Different thresholds apply depending on whether you have a single income or a family income When you lodge your tax return we calculate your income for surcharge purposes and determine your rebate entitlement Your entitlement is also based on the age of the oldest person covered by the policy

Ask The Medical Specialist Aaron Zolbrod 1 9 20 The Health

Tax Return 2022FY Private Health Insurance Rebate And Offset

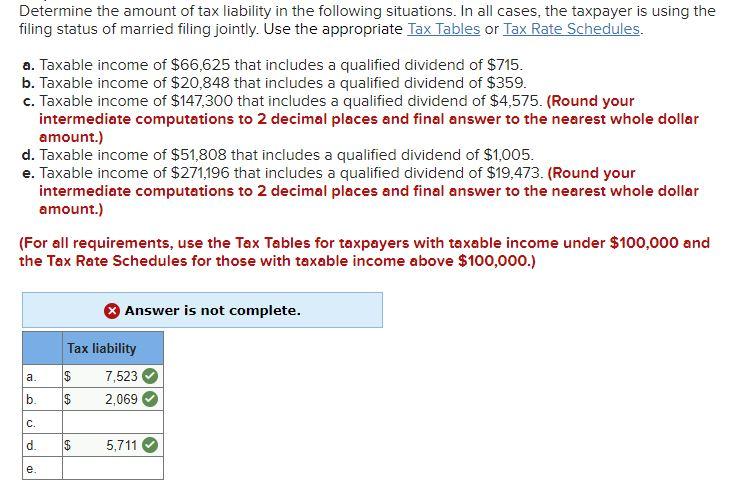

Solved Determine The Amount Of Tax Liability In The Chegg

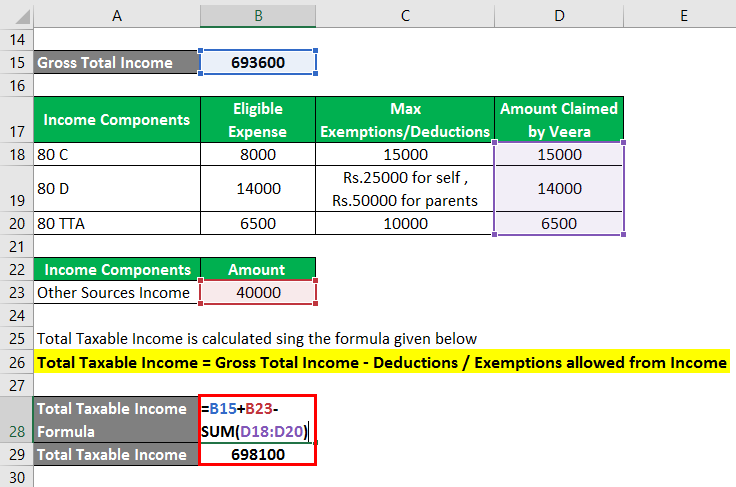

How To Calculate Gross Income Tax Haiper

Unraveling The Health Insurance A Comprehensive Dive Into Protection

Ehealthinsurance Is The Oldest And Most Well Known Of The Health

Ehealthinsurance Is The Oldest And Most Well Known Of The Health

What is taxable income Financial Wellness Starts Here

Health Insurance For Expatriates In The UAE Cost And Comparisons

I m Single 32 Healthy And Uninsured My Income Is High Enough That

Is The Health Insurance Rebate Taxable Income - For individual market consumers who purchased their coverage with after tax dollars a rebate is not taxable income However if an individual deducted the prior year s premium payments on their Form 1040 Schedule A then their MLR rebate is subject to federal income tax