Is The Mortgage Interest Deduction Capped Tax reform capped at 750 000 the amount of mortgage and home equity debt for which you can deduct interest For many housing markets that s still a lot of money And since the standard deduction has nearly doubled do you really need to worry about the cap Here are some things to consider

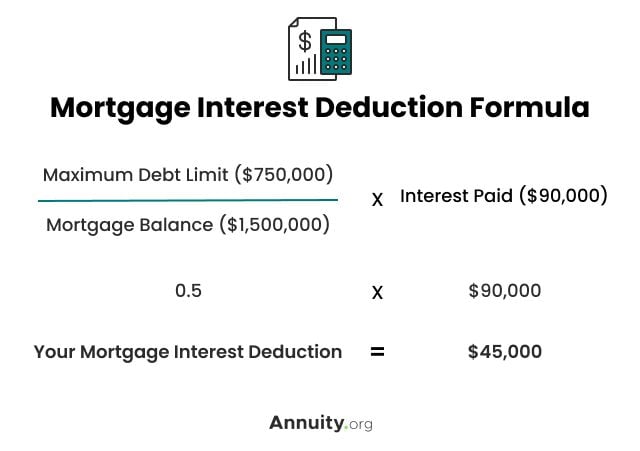

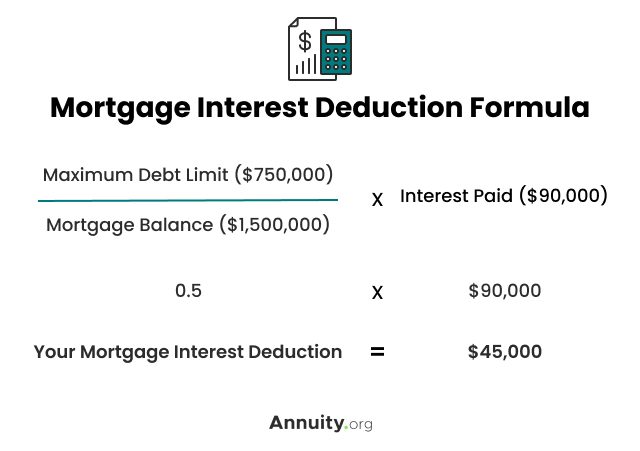

The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025 If you bought your home after December 15 2017 though your deduction is capped for interest on the first 750 000 of mortgage debt In a nutshell yes If you have a home loan the mortgage interest deduction allows you to reduce your taxable income by the amount of interest paid on the loan during the year along with

Is The Mortgage Interest Deduction Capped

Is The Mortgage Interest Deduction Capped

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-8.jpg

Mortgage Interest Tax Relief Calculator DermotHilary

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

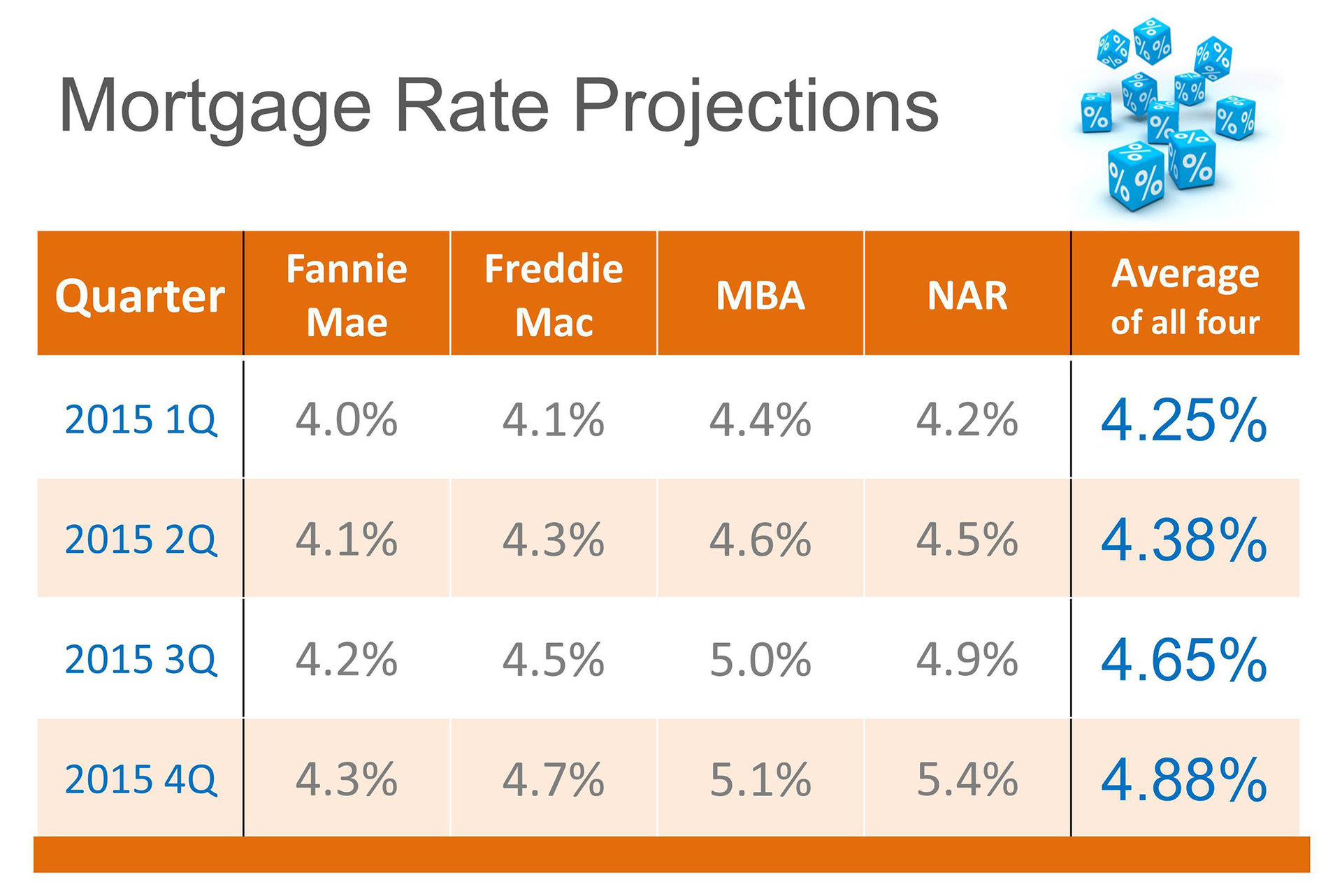

Wendy Jimenez Where Will Mortgage Rates Be Headed In 2015

http://www.keepingcurrentmatters.com/wp-content/uploads/2015/01/Interest-Rates-2015.jpg

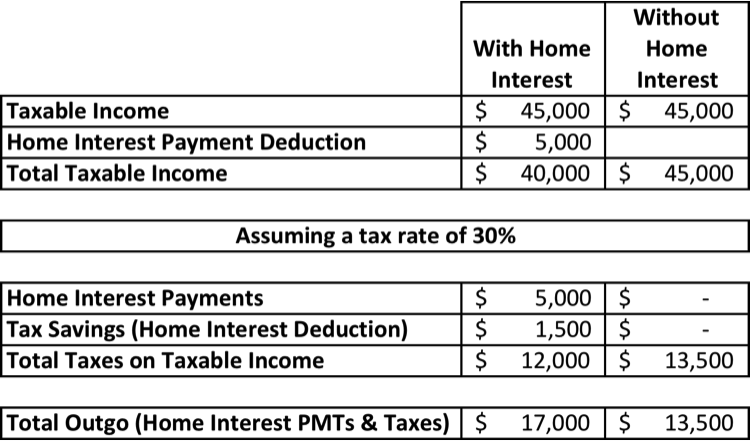

If you are single or married and filing jointly and you re itemizing your tax deductions you can deduct the interest on mortgage debt up to 750 000 If you are married and filing separately If your yearly salary is 120 000 you can use the mortgage interest you paid to reduce your taxable income to 100 000 This means you ll only pay taxes on 100 000 of your income not 120 000

The near doubling of the standard deduction and caps on eligible mortgages mean that many fewer taxpayers are taking the mortgage interest deduction Photo Tammy Lian The number of Key Findings Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750 000 worth of principal on either their first or second residence This limitation was introduced by the Tax Cuts and Jobs Act TCJA and will revert to 1 million after 2025

Download Is The Mortgage Interest Deduction Capped

More picture related to Is The Mortgage Interest Deduction Capped

Mortgage Interest Deduction

https://activerain-store.s3.amazonaws.com/blog_entries/674/5152674/original/mortgage_interest_deduction.jpg?1514442284

Mortgage Payment For 300k Loan By Decade Mortgage Payment

https://i.pinimg.com/originals/93/aa/8a/93aa8a1fa62dc355158a5508a8be0293.jpg

Understanding The Mortgage Interest Deduction The Official Blog Of

https://www.taxslayer.com/blog/wp-content/uploads/2022/05/Mortgage-Interest-Deduction-8-1594x2048.png

The mortgage interest deduction helps homeowners lower the amount of tax owed These deductions are reported on Form 1098 and Schedule A or Schedule E depending on the type of deduction The Tax Before the TCJA the mortgage interest deduction limit was on loans up to 1 million Now the loan limit is 750 000 That means for the 2022 tax year married couples filing jointly single filers and heads of households could deduct the interest on mortgages up to 750 000

The name says it all The mortgage interest deduction allows you to deduct only the interest not the principal you pay on your mortgage Let s say your monthly mortgage payment is 1 500 Post TCJA the SALT deduction is capped at 10 000 for income sales and property taxes unless they were related to business activity The cap made the tax code more progressive by broadening the tax base and it helped partially fund reductions in statutory tax rates

/cdn.vox-cdn.com/uploads/chorus_image/image/55861629/shutterstock_682627057.0.jpg)

Mortgage Interest Tax Break Has no Effect On Homeownership Says

https://cdn.vox-cdn.com/thumbor/s4C2xr05hiB_N5_4aic14iPNvXc=/0x0:5760x3292/1820x1213/filters:focal(2420x1186:3340x2106)/cdn.vox-cdn.com/uploads/chorus_image/image/55861629/shutterstock_682627057.0.jpg

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

https://www.jamescolincampbell.com/wp-content/uploads/2021/02/mortgage-interest-deduction.jpg

https://www.creditkarma.com/tax/i/mortgage-interest-deduction-cap

Tax reform capped at 750 000 the amount of mortgage and home equity debt for which you can deduct interest For many housing markets that s still a lot of money And since the standard deduction has nearly doubled do you really need to worry about the cap Here are some things to consider

https://smartasset.com/mortgage/all-about-the...

The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025 If you bought your home after December 15 2017 though your deduction is capped for interest on the first 750 000 of mortgage debt

GOP Tax Plan Where The Loss Of The Second Home Mortgage Deduction

/cdn.vox-cdn.com/uploads/chorus_image/image/55861629/shutterstock_682627057.0.jpg)

Mortgage Interest Tax Break Has no Effect On Homeownership Says

Mortgage Interest Deduction 1 The Official Blog Of TaxSlayer

Is The Mortgage Interest Deduction In Play B Logics

How To Qualify For Mortgage Interest Deduction For 2024 Forbes Advisor

Mortgage Interest Tax Deduction YouTube

Mortgage Interest Tax Deduction YouTube

The Mortgage Interest Deduction Its Geographic Distribution And Policy

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

Can I Claim The Mortgage Interest Deduction Mortgage Interest Tax

Is The Mortgage Interest Deduction Capped - In 2022 the standard deduction is 25 900 for married couples filing jointly and 12 950 for individuals The standard deduction is 19 400 for those filing as head of household The