Is The Nys 2024 Homeowner Tax Rebate Taxable You are the one that paid real property taxes on the property fully or partially How much is the credit The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayer s qualified gross income QGI and a specified rate based on the taxpayer s QGI

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two ways STAR credit If you are registered for the STAR credit the Tax Department will issue your STAR benefit via check or direct Peter Butler Dec 22 2023 4 30 p m PT 8 min read Mortgage interest is the most common tax deduction for homeowners but there are many more potential tax breaks Mykyta Dolmatov Getty

Is The Nys 2024 Homeowner Tax Rebate Taxable

Is The Nys 2024 Homeowner Tax Rebate Taxable

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-600x503.png

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1920&h=1080&crop=1

NYS Homeowner Tax Rebate Credit Checks Being Mailed Out

https://townsquare.media/site/497/files/2022/06/attachment-RS28849_ThinkstockPhotos-623211702-scr.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

However fewer middle income homeowners itemize for New York State income tax purposes because their deductible expenses on state tax returns same as federal but excluding state income taxes more often do not exceed the state standard deduction of 15 000 Therefore for most homeowners the rebate will effectively be taxable by the feds New York homeowners should watch their mailboxes this month for a one time property tax credit thanks to a 2 2 billion tax relief program approved in New York s budget The Homeowner

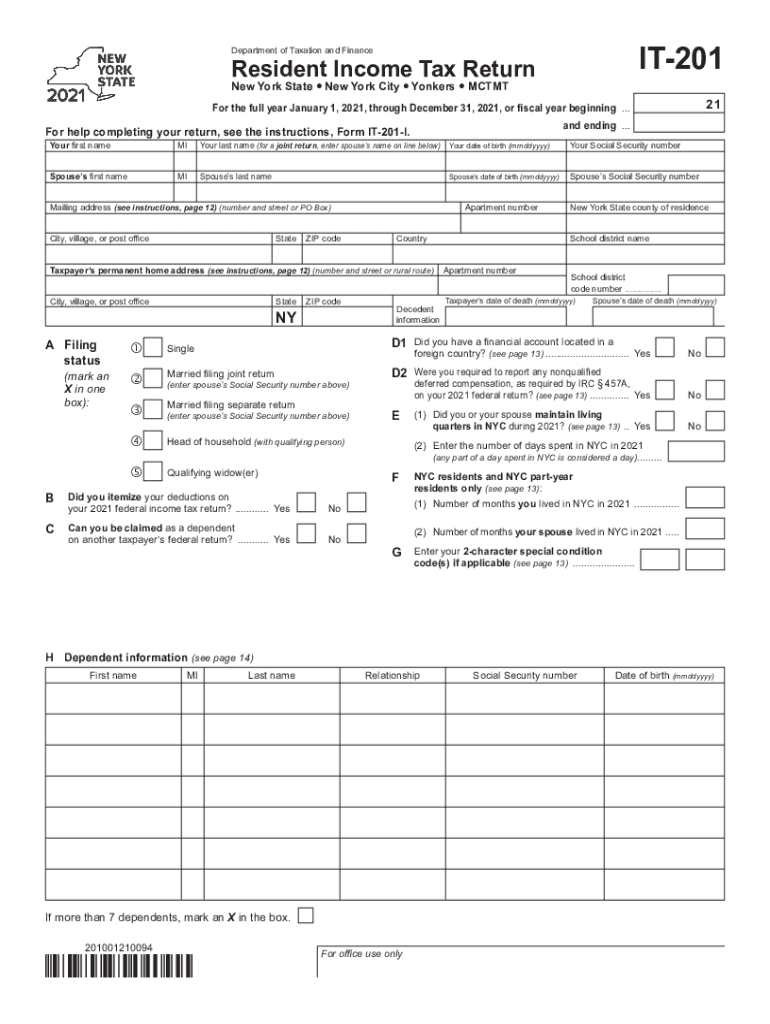

Providing a tax rebate on income taxes owed it allowed a credit of up to 10 of the purchase price on a principal residence to a maximum of 8 000 The IRS defined a first time home buyer as We recently began mailing nearly three million checks for the 2022 homeowner tax rebate credit HTRC to eligible New Yorkers The credit provides direct property tax relief in the form of checks to eligible homeowners The amount of the credit will depend on your home s location your income and

Download Is The Nys 2024 Homeowner Tax Rebate Taxable

More picture related to Is The Nys 2024 Homeowner Tax Rebate Taxable

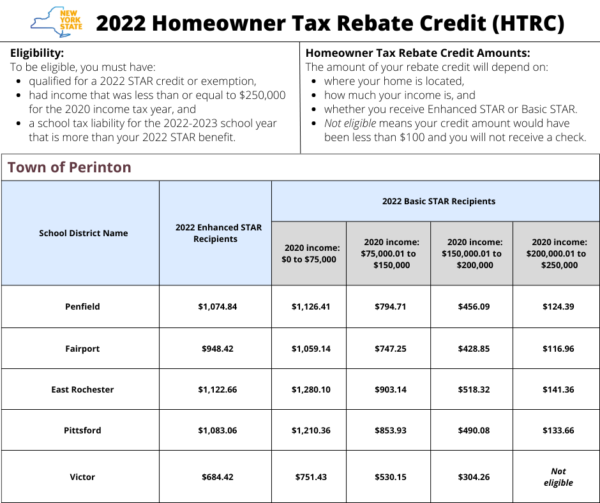

2023 Nys Tax Form Printable Forms Free Online

https://www.pdffiller.com/preview/584/982/584982095/large.png

NYS Homeowner Tax Credit Talks Lyons Main Street

https://static.wixstatic.com/media/0e0fa1_815d22e1cacf4551823c50c8085bfdde~mv2.jpg/v1/fill/w_1545,h_1530,al_c,q_90/0e0fa1_815d22e1cacf4551823c50c8085bfdde~mv2.jpg

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check CNYcentral

https://chittenango.com/wp-content/uploads/2022/08/bb776db9-9697-43c3-882f-8577bedc9e89-large16x9_tax_rebate.PNG

Eligibility for the Homeowner Tax Rebate Credit Qualified for a 2022 STAR credit or exemption Income less than or equal to 250 000 for the 2020 income tax year A school tax liability May 3 2023 Albany NY Governor Hochul Announces Support for Homeowners Tenants and Public Housing Residents as Part of FY 2024 Budget Adds 391 Million for New York s Emergency Rental Assistance Program to Support Thousands More Tenants and Families Including New York City Housing Authority Residents and Section 8 Voucher Recipients

The checks are part of a one year 2 2 billion program included in the state budget in April New York has begun mailing out this year s homeowner tax rebate checks Accelerates a 1 2 Billion Dollar Middle Class Tax Cut and Provides a Homeowner Tax Rebate Credit for Almost 2 5 Million New Yorkers Provides Up to 250 Million in Tax Credits and Relief for Small Businesses COVID 19 Related Expenses and Exempts 15 Percent in Eligible Small Business Income from Taxation Through a Tax Relief Program

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

https://i.ytimg.com/vi/ZN9k_nErOQE/maxresdefault.jpg

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

https://media.wgrz.com/assets/WGRZ/images/1045202f-604f-4386-8a31-35efff450899/1045202f-604f-4386-8a31-35efff450899_1920x1080.jpg

https://www.tax.ny.gov/pit/credits/real-property-tax-relief-credit.htm

You are the one that paid real property taxes on the property fully or partially How much is the credit The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayer s qualified gross income QGI and a specified rate based on the taxpayer s QGI

https://www.tax.ny.gov/star/

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two ways STAR credit If you are registered for the STAR credit the Tax Department will issue your STAR benefit via check or direct

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In NYS 2023 Budget WRGB

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

Nys School Tax Relief Checks Printable Rebate Form

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Nys Star Tax Rebate Checks 2022 StarRebate

Nys Star Tax Rebate Checks 2022 StarRebate

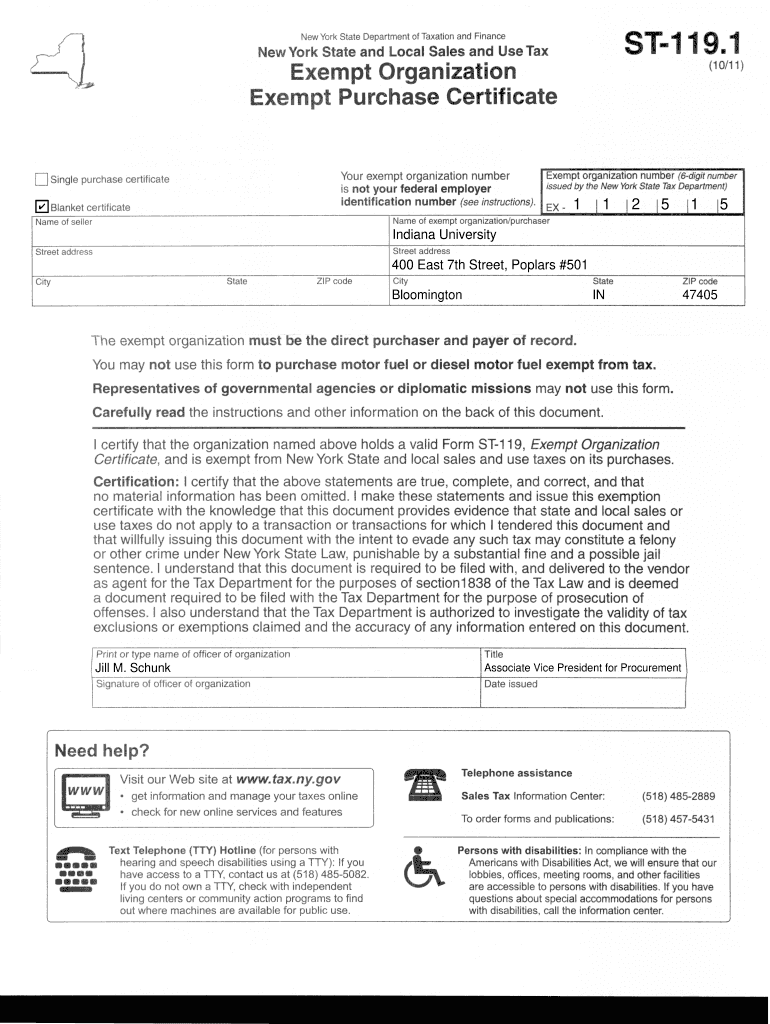

Nys Sales Tax Exempt Form 119 1 ExemptForm

Nys Rebate Check For Property Tax Tax Rebate

Nys Withholding Tax Forms 2022 WithholdingForm

Is The Nys 2024 Homeowner Tax Rebate Taxable - We recently began mailing nearly three million checks for the 2022 homeowner tax rebate credit HTRC to eligible New Yorkers The credit provides direct property tax relief in the form of checks to eligible homeowners The amount of the credit will depend on your home s location your income and